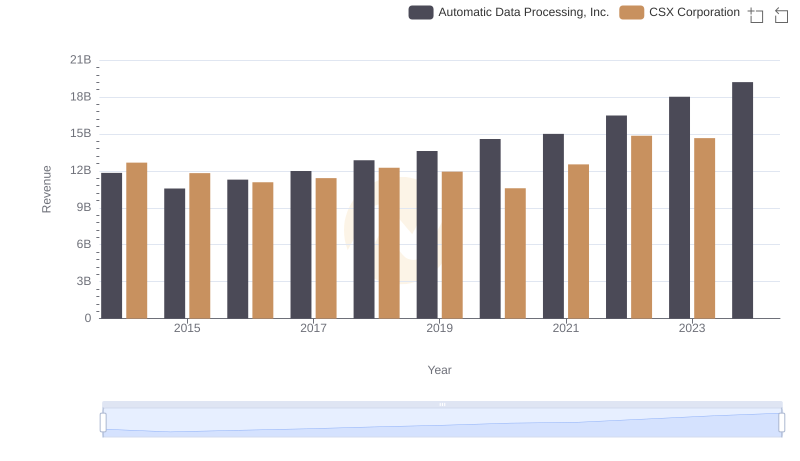

| __timestamp | Automatic Data Processing, Inc. | CSX Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 2616900000 | 4740000000 |

| Thursday, January 1, 2015 | 2355100000 | 4890000000 |

| Friday, January 1, 2016 | 2579500000 | 4640000000 |

| Sunday, January 1, 2017 | 2927200000 | 5113000000 |

| Monday, January 1, 2018 | 2762900000 | 6274000000 |

| Tuesday, January 1, 2019 | 3544500000 | 6402000000 |

| Wednesday, January 1, 2020 | 3769700000 | 5764000000 |

| Friday, January 1, 2021 | 3931600000 | 6653000000 |

| Saturday, January 1, 2022 | 4405500000 | 7390000000 |

| Sunday, January 1, 2023 | 5244600000 | 7340000000 |

| Monday, January 1, 2024 | 5800000000 |

Cracking the code

In the ever-evolving landscape of American business, understanding the financial health of industry giants is crucial. This analysis delves into the EBITDA performance of Automatic Data Processing, Inc. (ADP) and CSX Corporation from 2014 to 2023. Over this decade, ADP's EBITDA surged by approximately 122%, reflecting its robust growth and adaptability in the tech-driven HR solutions sector. Meanwhile, CSX Corporation, a leader in the transportation industry, saw a 55% increase in EBITDA, underscoring its resilience amidst economic fluctuations.

Notably, ADP's EBITDA growth outpaced CSX's, particularly in the latter half of the decade, with a remarkable 31% increase from 2022 to 2023 alone. This trend highlights ADP's strategic advancements and market positioning. However, CSX maintained a higher EBITDA throughout most of the period, showcasing its stronghold in the logistics domain. The data for 2024 remains incomplete, leaving room for speculation on future trajectories.

Breaking Down Revenue Trends: Automatic Data Processing, Inc. vs CSX Corporation

Cost Insights: Breaking Down Automatic Data Processing, Inc. and CSX Corporation's Expenses

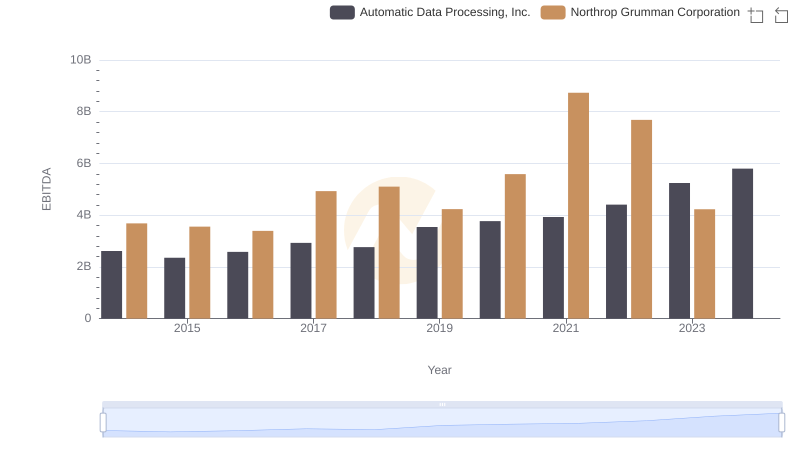

A Professional Review of EBITDA: Automatic Data Processing, Inc. Compared to Northrop Grumman Corporation

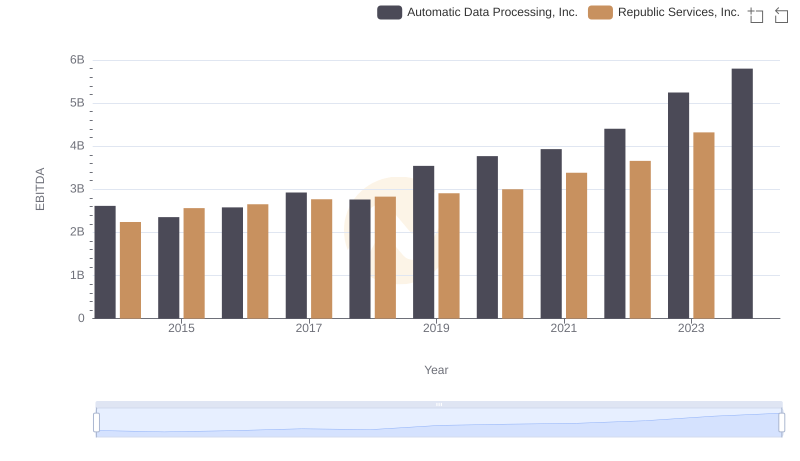

A Side-by-Side Analysis of EBITDA: Automatic Data Processing, Inc. and Republic Services, Inc.

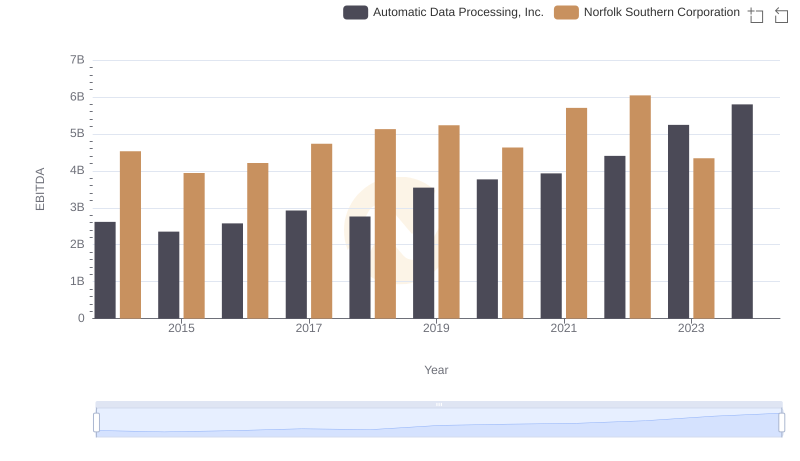

Comparative EBITDA Analysis: Automatic Data Processing, Inc. vs Norfolk Southern Corporation

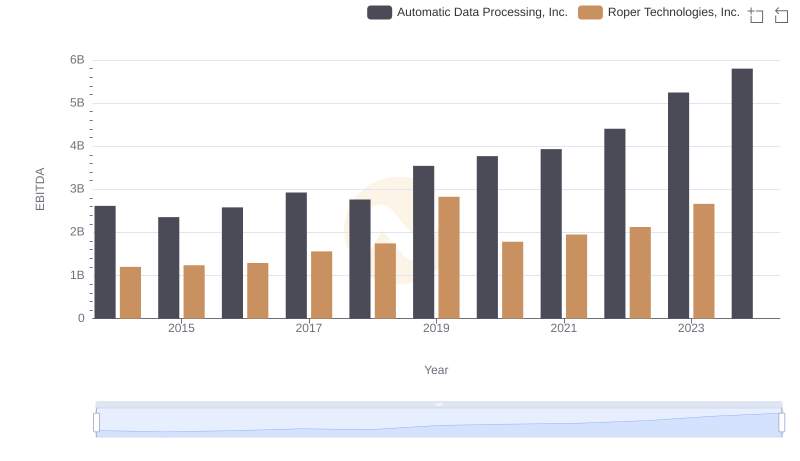

Professional EBITDA Benchmarking: Automatic Data Processing, Inc. vs Roper Technologies, Inc.

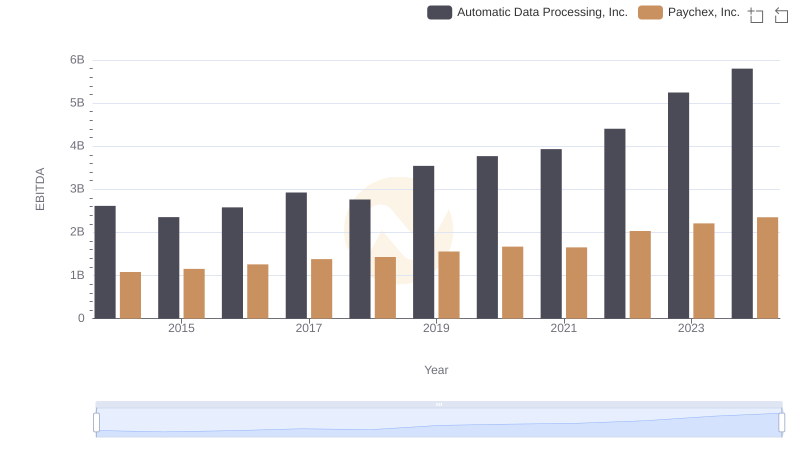

Comprehensive EBITDA Comparison: Automatic Data Processing, Inc. vs Paychex, Inc.