| __timestamp | Automatic Data Processing, Inc. | CSX Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 11832800000 | 12669000000 |

| Thursday, January 1, 2015 | 10560800000 | 11811000000 |

| Friday, January 1, 2016 | 11290500000 | 11069000000 |

| Sunday, January 1, 2017 | 11982400000 | 11408000000 |

| Monday, January 1, 2018 | 12859300000 | 12250000000 |

| Tuesday, January 1, 2019 | 13613300000 | 11937000000 |

| Wednesday, January 1, 2020 | 14589800000 | 10583000000 |

| Friday, January 1, 2021 | 15005400000 | 12522000000 |

| Saturday, January 1, 2022 | 16498300000 | 14853000000 |

| Sunday, January 1, 2023 | 18012200000 | 14657000000 |

| Monday, January 1, 2024 | 19202600000 |

Data in motion

In the ever-evolving landscape of American business, Automatic Data Processing, Inc. (ADP) and CSX Corporation stand as titans in their respective industries. Over the past decade, ADP has demonstrated a robust growth trajectory, with its revenue surging by approximately 63% from 2014 to 2023. This growth reflects ADP's strategic expansion and innovation in human capital management solutions. Meanwhile, CSX Corporation, a leader in the transportation sector, has shown a more modest revenue increase of about 16% over the same period, highlighting the steady demand for freight rail services.

The data for 2024 is incomplete, indicating potential shifts in these trends.

Who Generates More Revenue? Automatic Data Processing, Inc. or FedEx Corporation

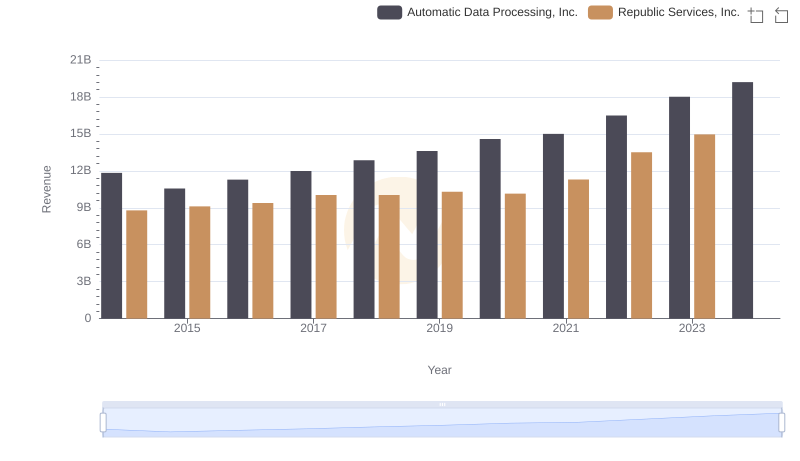

Automatic Data Processing, Inc. vs Republic Services, Inc.: Annual Revenue Growth Compared

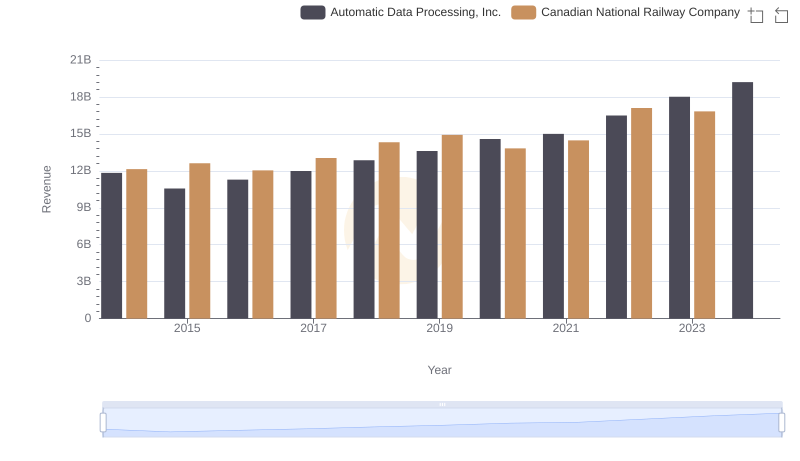

Automatic Data Processing, Inc. vs Canadian National Railway Company: Examining Key Revenue Metrics

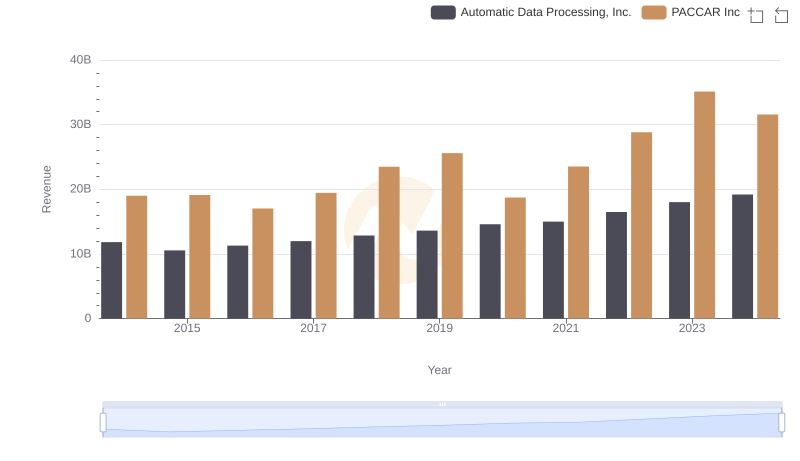

Automatic Data Processing, Inc. or PACCAR Inc: Who Leads in Yearly Revenue?

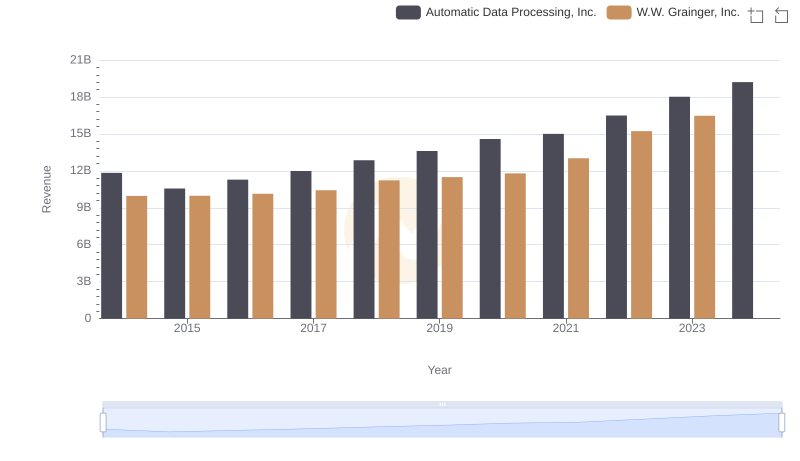

Annual Revenue Comparison: Automatic Data Processing, Inc. vs W.W. Grainger, Inc.

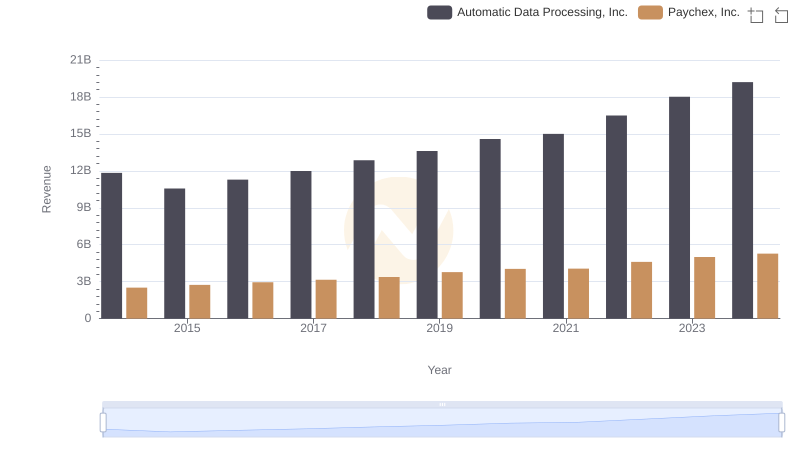

Automatic Data Processing, Inc. or Paychex, Inc.: Who Leads in Yearly Revenue?

Cost Insights: Breaking Down Automatic Data Processing, Inc. and CSX Corporation's Expenses

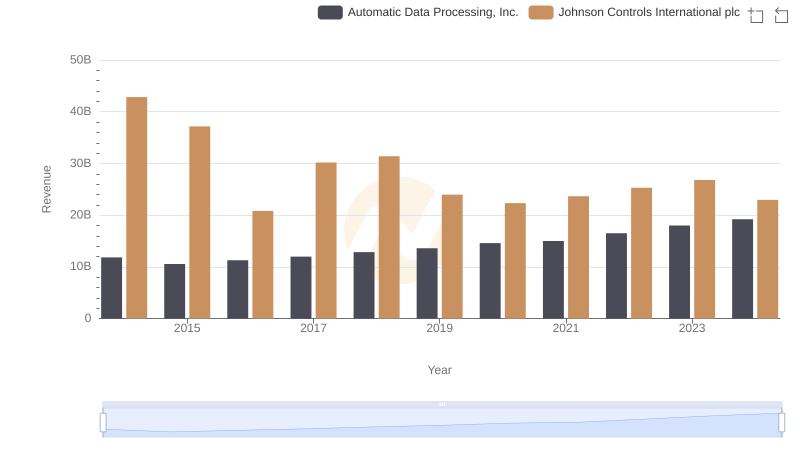

Automatic Data Processing, Inc. and Johnson Controls International plc: A Comprehensive Revenue Analysis

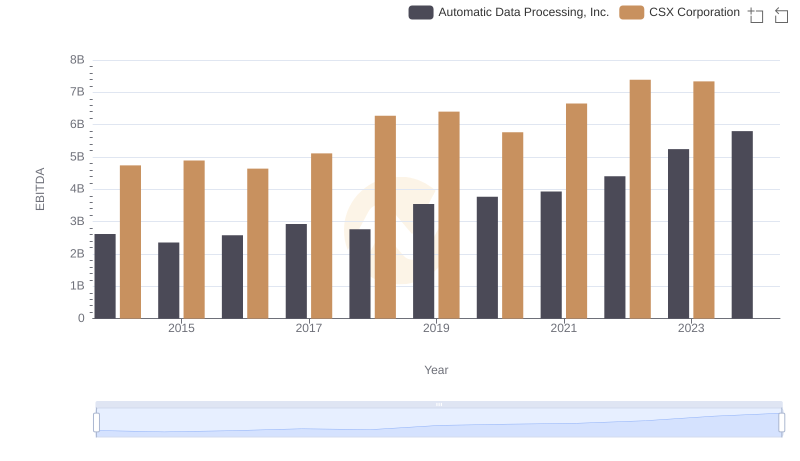

A Side-by-Side Analysis of EBITDA: Automatic Data Processing, Inc. and CSX Corporation