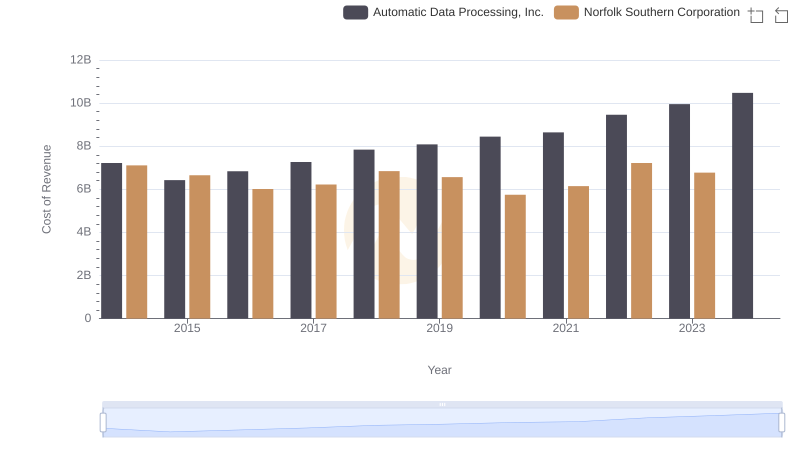

| __timestamp | Automatic Data Processing, Inc. | Norfolk Southern Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 2616900000 | 4531000000 |

| Thursday, January 1, 2015 | 2355100000 | 3943000000 |

| Friday, January 1, 2016 | 2579500000 | 4212000000 |

| Sunday, January 1, 2017 | 2927200000 | 4733000000 |

| Monday, January 1, 2018 | 2762900000 | 5128000000 |

| Tuesday, January 1, 2019 | 3544500000 | 5233000000 |

| Wednesday, January 1, 2020 | 3769700000 | 4632000000 |

| Friday, January 1, 2021 | 3931600000 | 5705000000 |

| Saturday, January 1, 2022 | 4405500000 | 6043000000 |

| Sunday, January 1, 2023 | 5244600000 | 4340000000 |

| Monday, January 1, 2024 | 5800000000 | 4071000000 |

Data in motion

In the ever-evolving landscape of American business, Automatic Data Processing, Inc. (ADP) and Norfolk Southern Corporation have showcased intriguing financial trajectories over the past decade. From 2014 to 2023, ADP's EBITDA has surged by approximately 122%, reflecting its robust growth in the payroll and human resources sector. In contrast, Norfolk Southern, a titan in the rail transportation industry, experienced a more modest 4% increase in EBITDA over the same period.

ADP's EBITDA growth highlights its strategic adaptability and market expansion, especially notable in 2023 with a 19% jump from the previous year. Meanwhile, Norfolk Southern's performance, peaking in 2022, underscores the challenges faced by traditional industries in adapting to modern economic shifts. The absence of data for Norfolk Southern in 2024 suggests potential reporting delays or strategic pivots. This comparative analysis offers a window into the dynamic interplay between technology-driven and traditional sectors in the U.S. economy.

Cost of Revenue Trends: Automatic Data Processing, Inc. vs Norfolk Southern Corporation

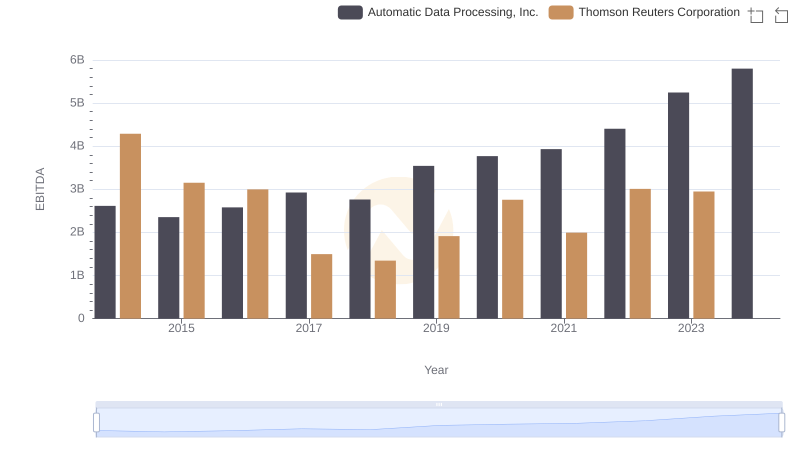

EBITDA Analysis: Evaluating Automatic Data Processing, Inc. Against Thomson Reuters Corporation

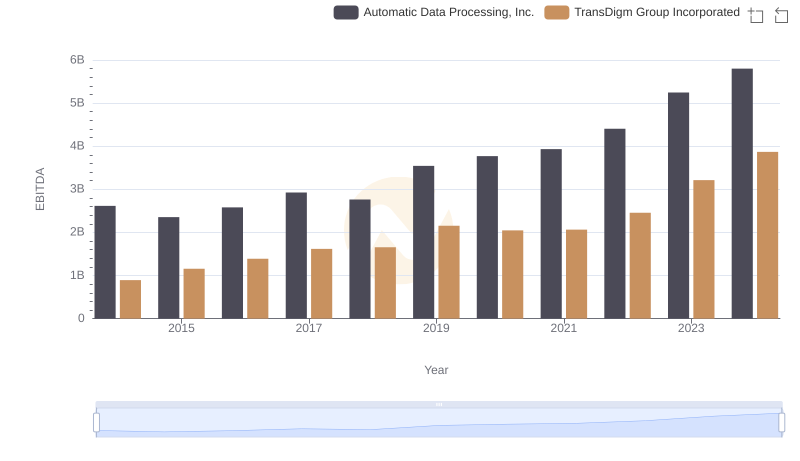

Professional EBITDA Benchmarking: Automatic Data Processing, Inc. vs TransDigm Group Incorporated

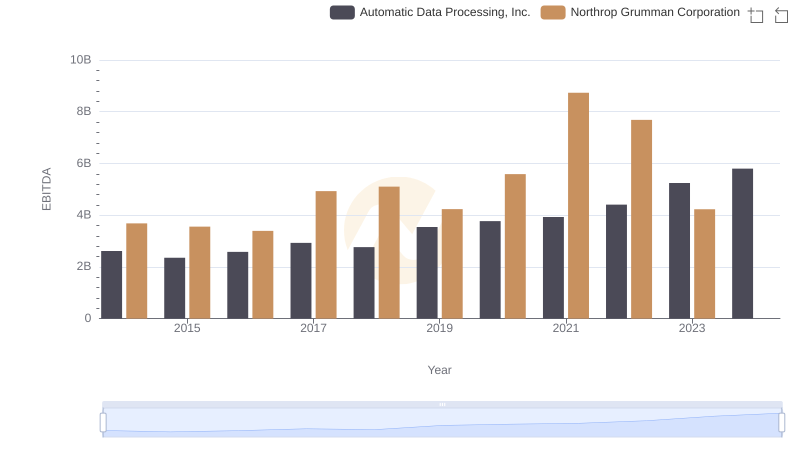

A Professional Review of EBITDA: Automatic Data Processing, Inc. Compared to Northrop Grumman Corporation

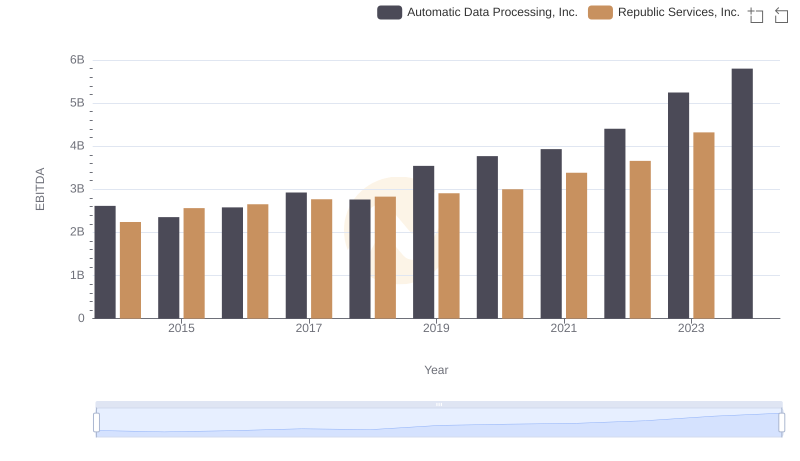

A Side-by-Side Analysis of EBITDA: Automatic Data Processing, Inc. and Republic Services, Inc.

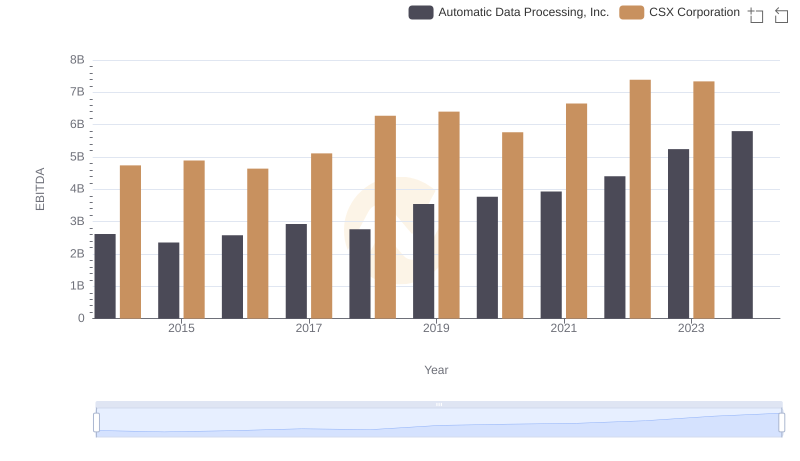

A Side-by-Side Analysis of EBITDA: Automatic Data Processing, Inc. and CSX Corporation

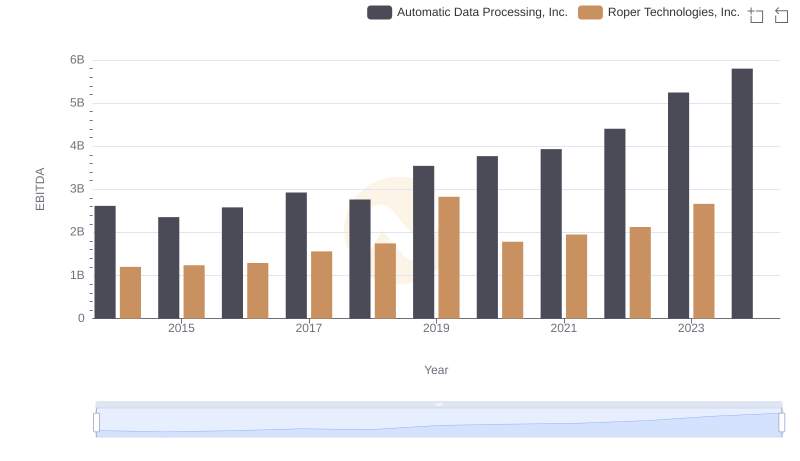

Professional EBITDA Benchmarking: Automatic Data Processing, Inc. vs Roper Technologies, Inc.