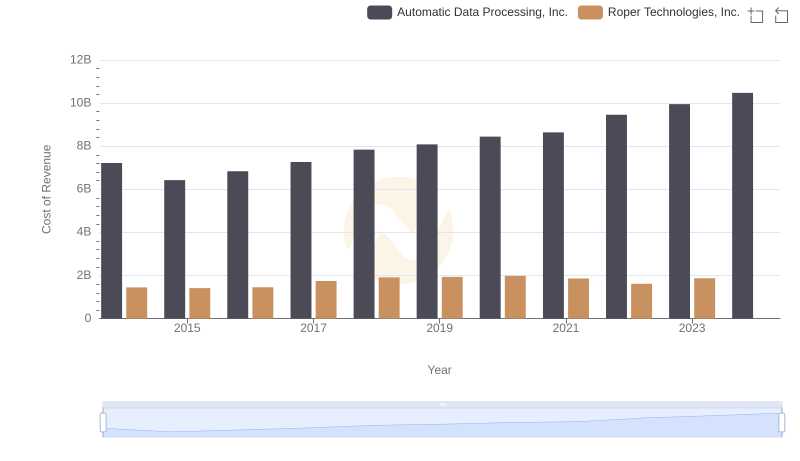

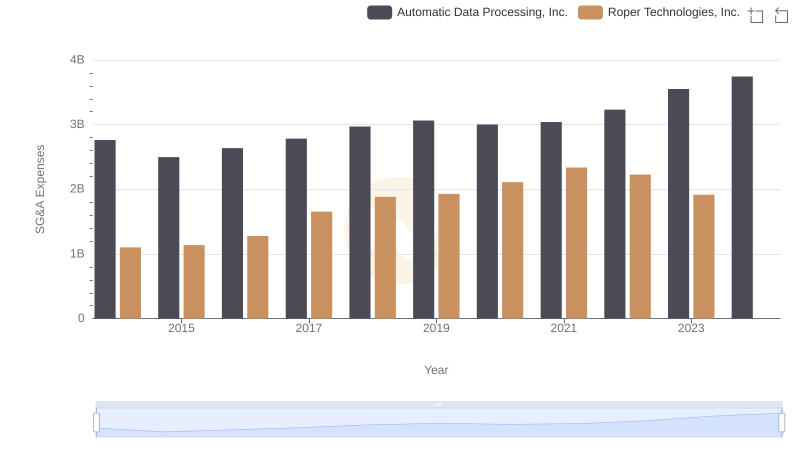

| __timestamp | Automatic Data Processing, Inc. | Roper Technologies, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2616900000 | 1199557000 |

| Thursday, January 1, 2015 | 2355100000 | 1238079000 |

| Friday, January 1, 2016 | 2579500000 | 1290510000 |

| Sunday, January 1, 2017 | 2927200000 | 1558802000 |

| Monday, January 1, 2018 | 2762900000 | 1746500000 |

| Tuesday, January 1, 2019 | 3544500000 | 2827900000 |

| Wednesday, January 1, 2020 | 3769700000 | 1782800000 |

| Friday, January 1, 2021 | 3931600000 | 1951500000 |

| Saturday, January 1, 2022 | 4405500000 | 2124500000 |

| Sunday, January 1, 2023 | 5244600000 | 2663000000 |

| Monday, January 1, 2024 | 5800000000 | 1996800000 |

Igniting the spark of knowledge

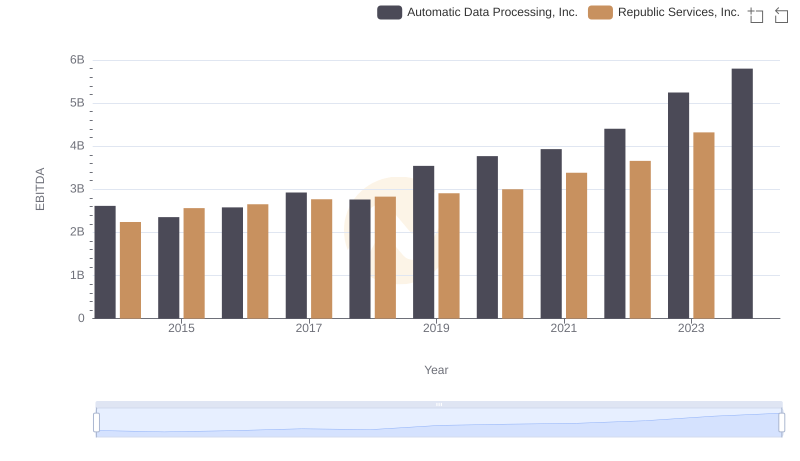

In the competitive landscape of business services and technology, Automatic Data Processing, Inc. (ADP) and Roper Technologies, Inc. have been key players. Over the past decade, ADP has consistently outperformed Roper in terms of EBITDA, showcasing a robust growth trajectory. From 2014 to 2023, ADP's EBITDA surged by approximately 122%, reflecting its strategic prowess and market adaptability. In contrast, Roper's EBITDA grew by about 122% until 2023, highlighting its steady, albeit slower, growth.

The data reveals that ADP's EBITDA peaked in 2024, while Roper's data for the same year remains unavailable, indicating potential reporting delays or strategic shifts. This financial journey underscores the dynamic nature of the industry, where adaptability and innovation are key. As we look to the future, these trends offer valuable insights into the evolving strategies of these industry titans.

Cost Insights: Breaking Down Automatic Data Processing, Inc. and Roper Technologies, Inc.'s Expenses

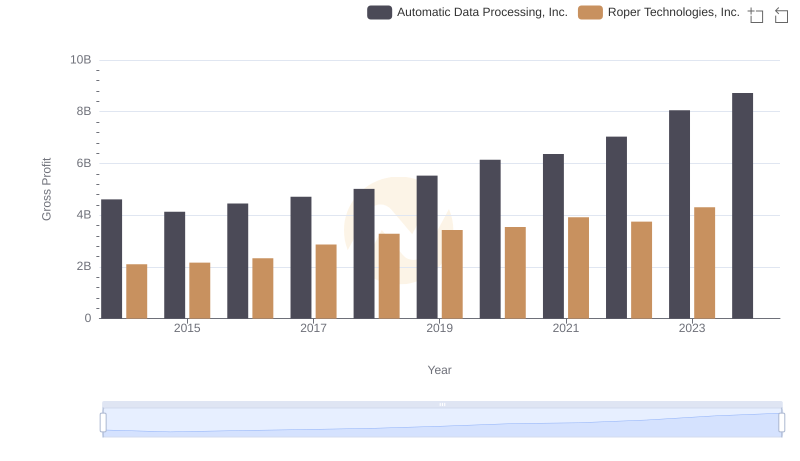

Automatic Data Processing, Inc. and Roper Technologies, Inc.: A Detailed Gross Profit Analysis

A Side-by-Side Analysis of EBITDA: Automatic Data Processing, Inc. and Republic Services, Inc.

SG&A Efficiency Analysis: Comparing Automatic Data Processing, Inc. and Roper Technologies, Inc.

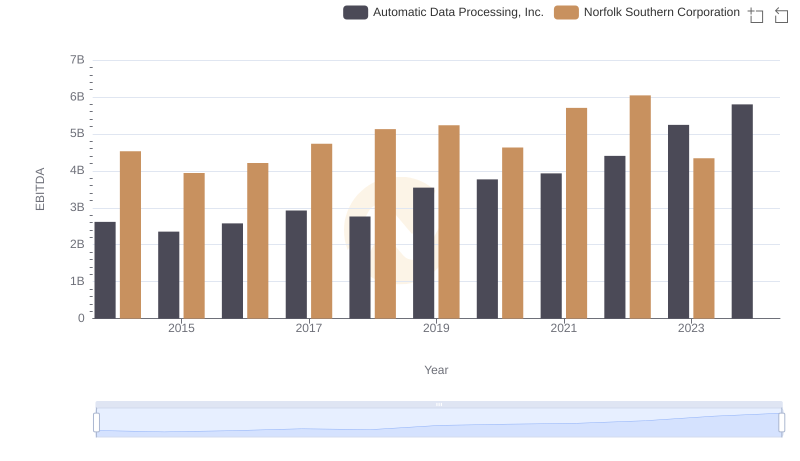

Comparative EBITDA Analysis: Automatic Data Processing, Inc. vs Norfolk Southern Corporation

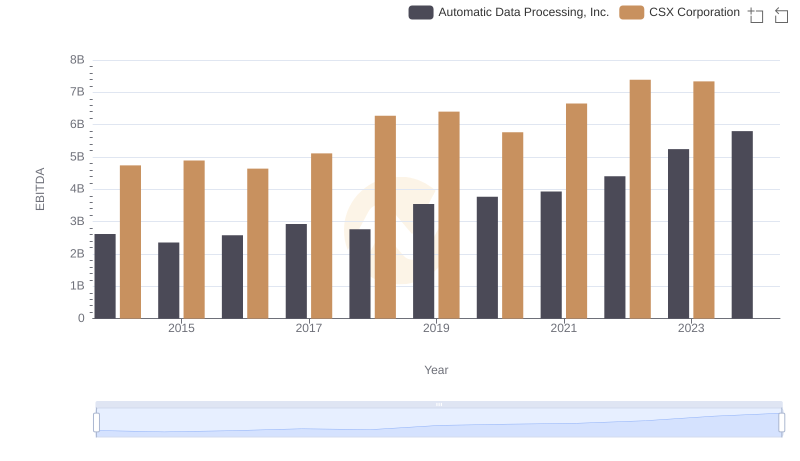

A Side-by-Side Analysis of EBITDA: Automatic Data Processing, Inc. and CSX Corporation

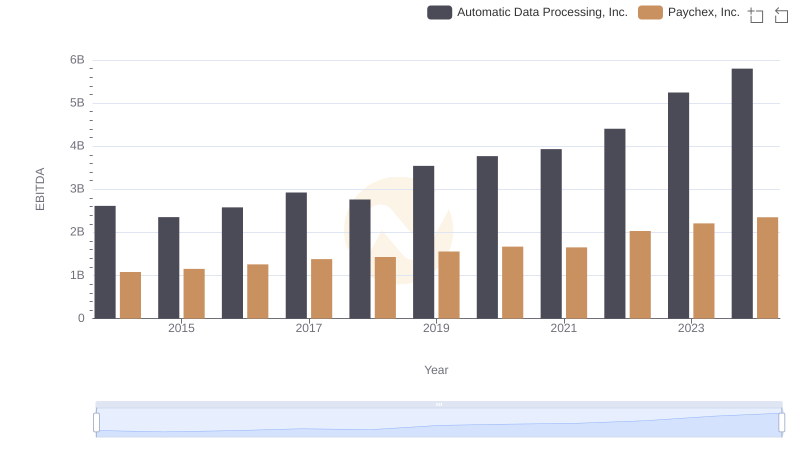

Comprehensive EBITDA Comparison: Automatic Data Processing, Inc. vs Paychex, Inc.