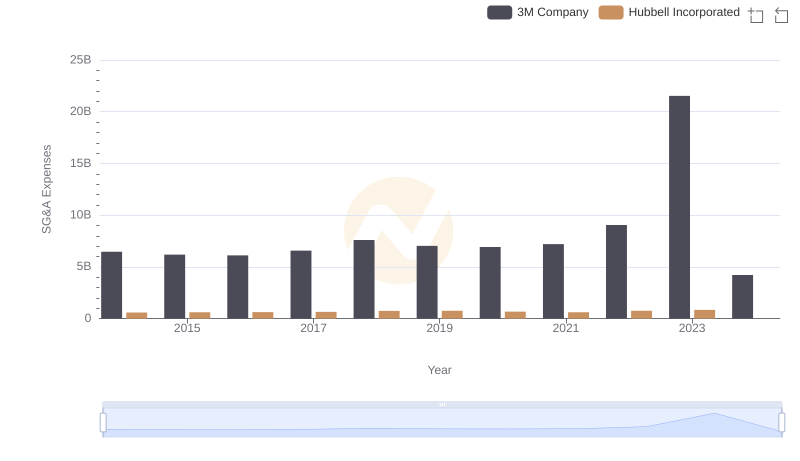

| __timestamp | 3M Company | TransUnion |

|---|---|---|

| Wednesday, January 1, 2014 | 6469000000 | 436000000 |

| Thursday, January 1, 2015 | 6182000000 | 499700000 |

| Friday, January 1, 2016 | 6111000000 | 560100000 |

| Sunday, January 1, 2017 | 6572000000 | 585400000 |

| Monday, January 1, 2018 | 7602000000 | 707700000 |

| Tuesday, January 1, 2019 | 7029000000 | 812100000 |

| Wednesday, January 1, 2020 | 6929000000 | 860300000 |

| Friday, January 1, 2021 | 7197000000 | 943900000 |

| Saturday, January 1, 2022 | 9049000000 | 1337400000 |

| Sunday, January 1, 2023 | 21526000000 | 1171600000 |

| Monday, January 1, 2024 | 4221000000 | 1239300000 |

Unlocking the unknown

In the ever-evolving landscape of corporate finance, understanding the trends in Selling, General, and Administrative (SG&A) expenses is crucial for investors and analysts alike. Over the past decade, 3M Company and TransUnion have showcased distinct trajectories in their SG&A expenditures. From 2014 to 2023, 3M's SG&A expenses have seen a significant increase, peaking in 2023 with a staggering 166% rise compared to 2014. This surge reflects strategic investments and possibly increased operational costs. In contrast, TransUnion's SG&A expenses have grown more modestly, with a 169% increase over the same period, indicating a steady expansion strategy. Notably, 2024 data for TransUnion is missing, leaving room for speculation on future trends. These insights provide a window into the financial strategies of these industry giants, offering valuable lessons in corporate management and growth.

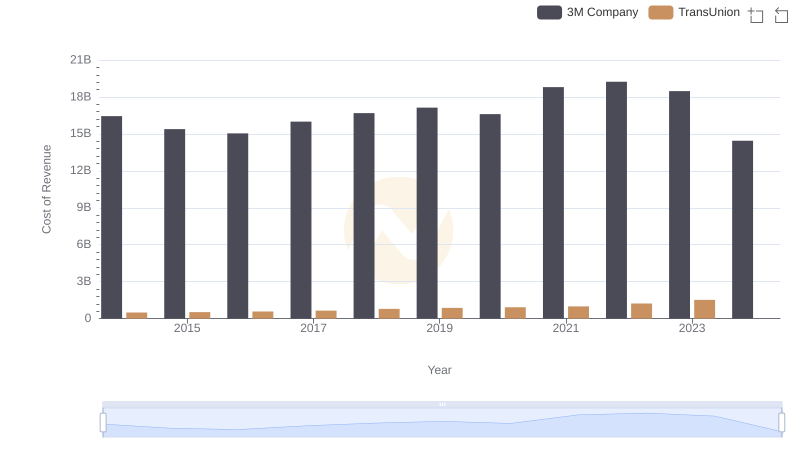

Analyzing Cost of Revenue: 3M Company and TransUnion

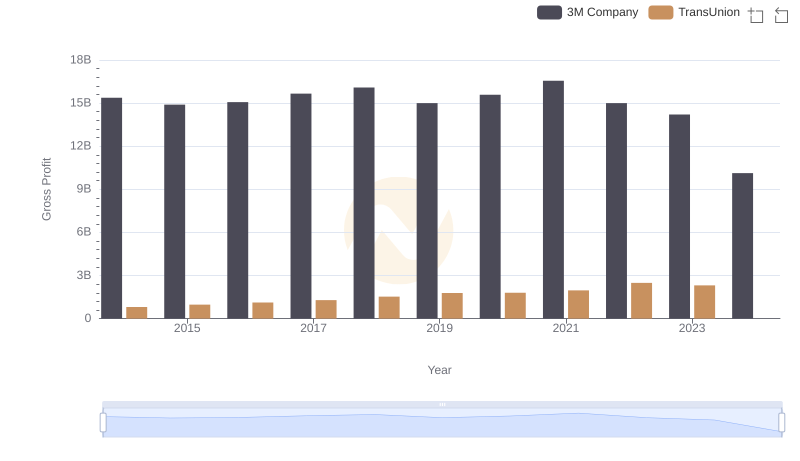

3M Company and TransUnion: A Detailed Gross Profit Analysis

SG&A Efficiency Analysis: Comparing 3M Company and Hubbell Incorporated

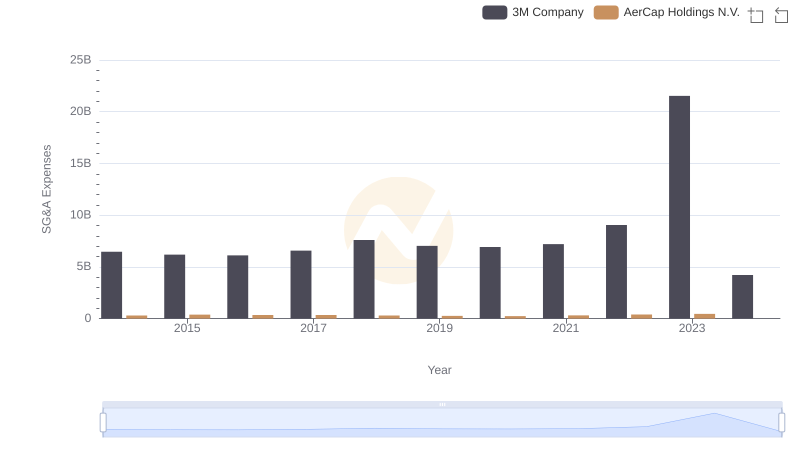

Who Optimizes SG&A Costs Better? 3M Company or AerCap Holdings N.V.

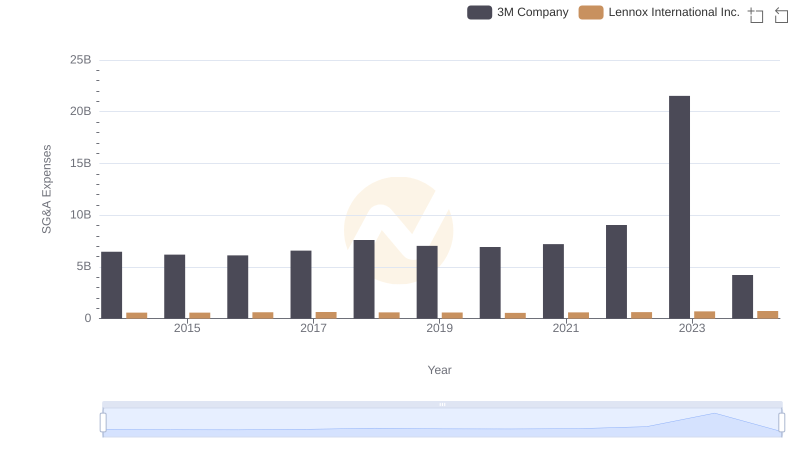

3M Company and Lennox International Inc.: SG&A Spending Patterns Compared

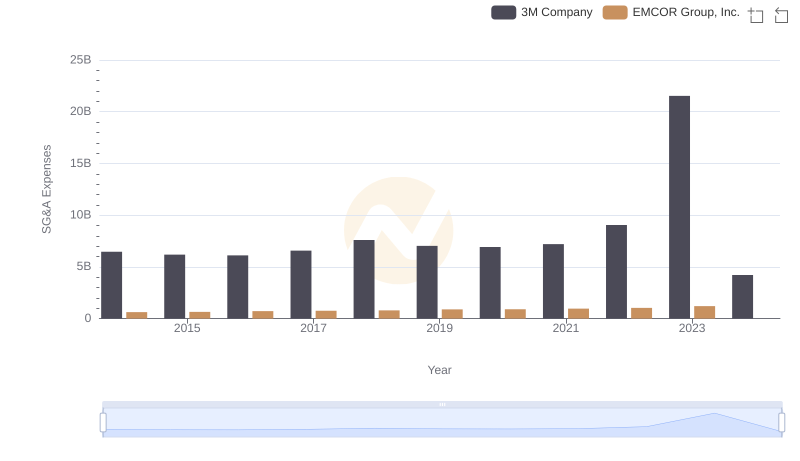

Who Optimizes SG&A Costs Better? 3M Company or EMCOR Group, Inc.