| __timestamp | Roper Technologies, Inc. | Waste Management, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1102426000 | 1481000000 |

| Thursday, January 1, 2015 | 1136728000 | 1343000000 |

| Friday, January 1, 2016 | 1277847000 | 1410000000 |

| Sunday, January 1, 2017 | 1654552000 | 1468000000 |

| Monday, January 1, 2018 | 1883100000 | 1453000000 |

| Tuesday, January 1, 2019 | 1928700000 | 1631000000 |

| Wednesday, January 1, 2020 | 2111900000 | 1728000000 |

| Friday, January 1, 2021 | 2337700000 | 1864000000 |

| Saturday, January 1, 2022 | 2228300000 | 1938000000 |

| Sunday, January 1, 2023 | 1915900000 | 1926000000 |

| Monday, January 1, 2024 | 2881500000 | 2264000000 |

Unlocking the unknown

In the competitive landscape of corporate America, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Waste Management, Inc. and Roper Technologies, Inc. have been at the forefront of this financial discipline since 2014. Over the past decade, Roper Technologies has seen a 74% increase in SG&A expenses, peaking in 2021. Meanwhile, Waste Management's SG&A costs rose by 30% during the same period, with a notable dip in 2018.

Roper's strategic investments in technology and innovation have driven its higher SG&A, reflecting its growth ambitions. Conversely, Waste Management's steady cost control aligns with its operational efficiency focus. As of 2023, both companies report similar SG&A expenses, highlighting their distinct yet effective approaches. This comparison underscores the diverse strategies companies employ to optimize costs while pursuing growth.

Revenue Showdown: Waste Management, Inc. vs Roper Technologies, Inc.

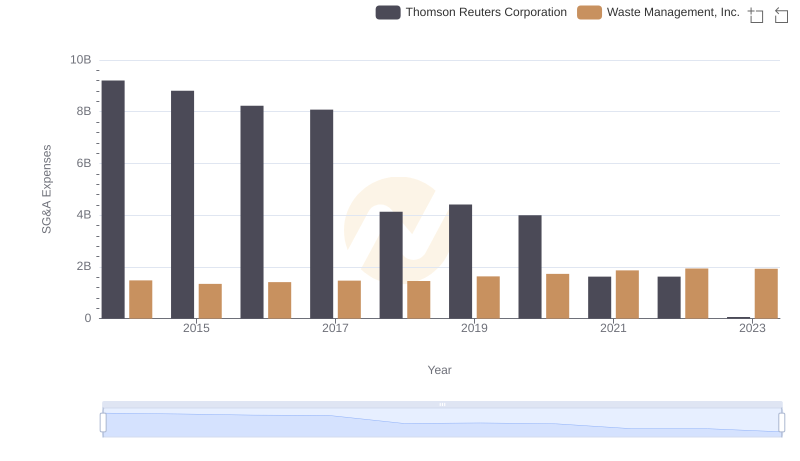

Waste Management, Inc. and Thomson Reuters Corporation: SG&A Spending Patterns Compared

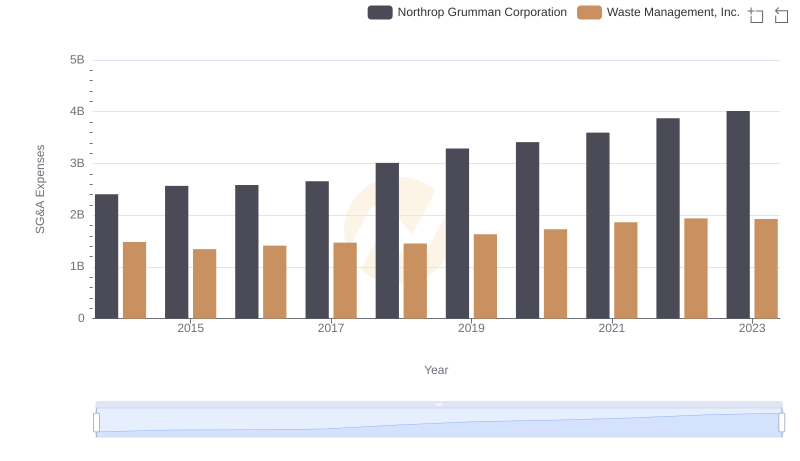

Waste Management, Inc. vs Northrop Grumman Corporation: SG&A Expense Trends

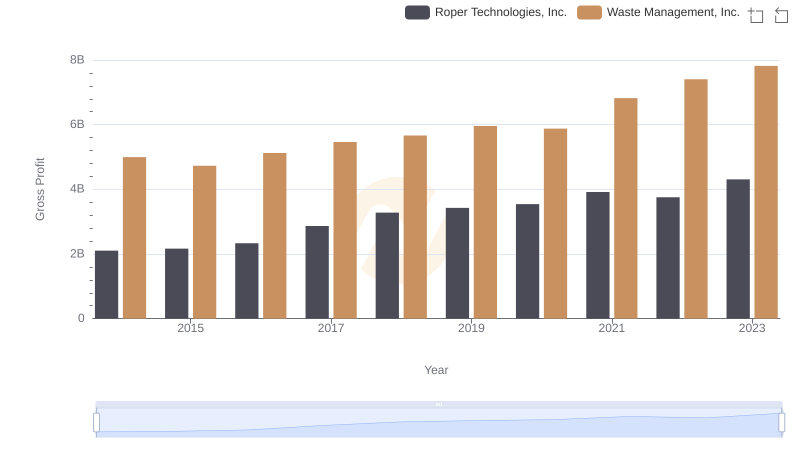

Who Generates Higher Gross Profit? Waste Management, Inc. or Roper Technologies, Inc.

Breaking Down SG&A Expenses: Waste Management, Inc. vs Republic Services, Inc.

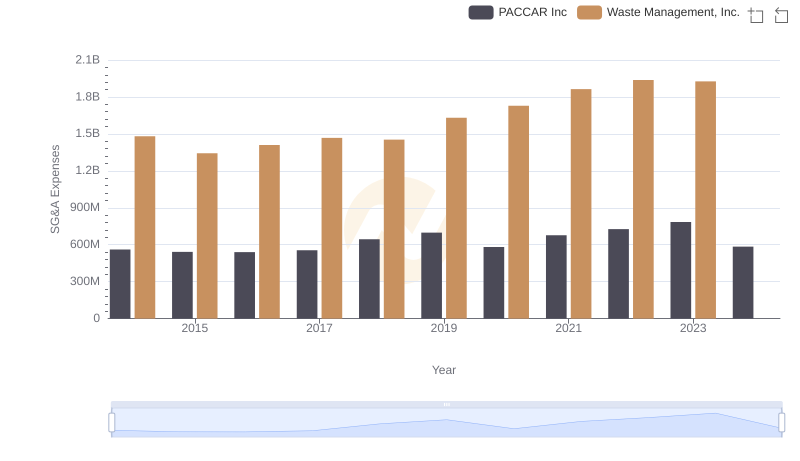

Waste Management, Inc. and PACCAR Inc: SG&A Spending Patterns Compared

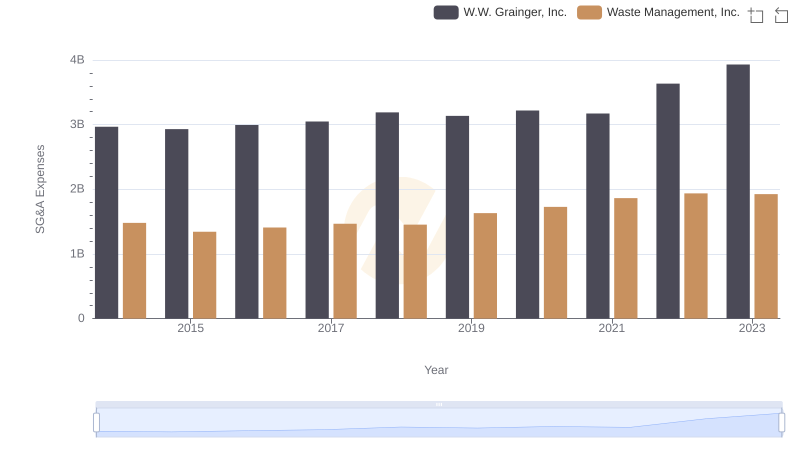

Waste Management, Inc. and W.W. Grainger, Inc.: SG&A Spending Patterns Compared

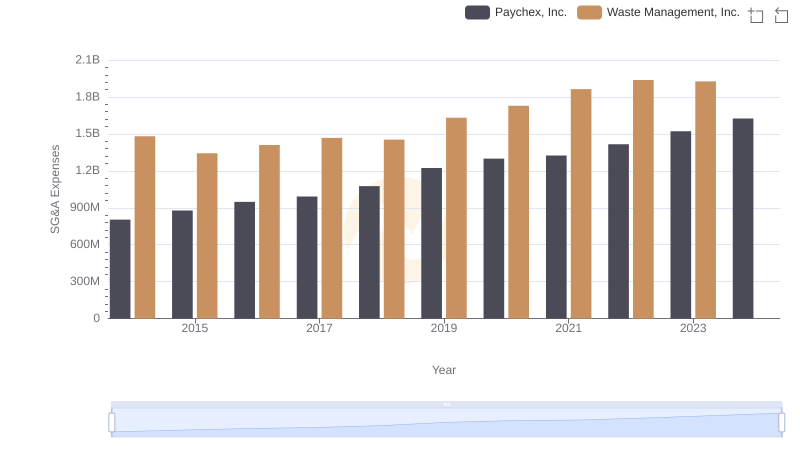

Waste Management, Inc. or Paychex, Inc.: Who Manages SG&A Costs Better?

Professional EBITDA Benchmarking: Waste Management, Inc. vs Roper Technologies, Inc.