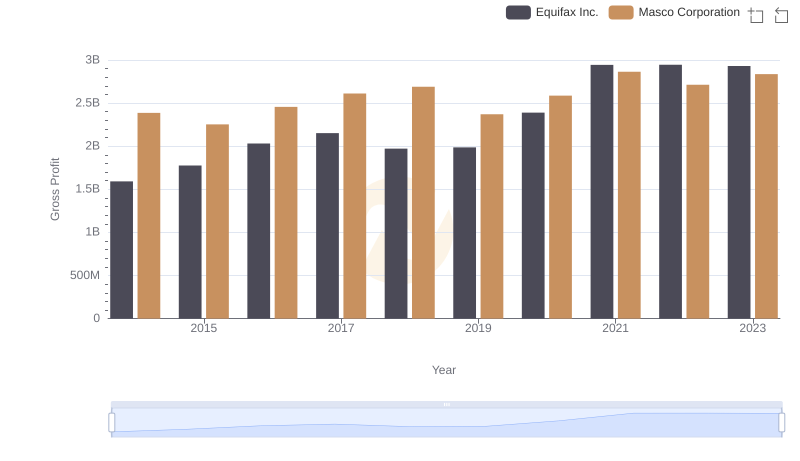

| __timestamp | Equifax Inc. | Masco Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 751700000 | 1607000000 |

| Thursday, January 1, 2015 | 884300000 | 1339000000 |

| Friday, January 1, 2016 | 948200000 | 1403000000 |

| Sunday, January 1, 2017 | 1039100000 | 1442000000 |

| Monday, January 1, 2018 | 1213300000 | 1478000000 |

| Tuesday, January 1, 2019 | 1990200000 | 1274000000 |

| Wednesday, January 1, 2020 | 1322500000 | 1292000000 |

| Friday, January 1, 2021 | 1324600000 | 1413000000 |

| Saturday, January 1, 2022 | 1328900000 | 1390000000 |

| Sunday, January 1, 2023 | 1385700000 | 1481000000 |

| Monday, January 1, 2024 | 1450500000 | 1468000000 |

Unleashing insights

In the competitive landscape of corporate America, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Equifax Inc. and Masco Corporation, two industry leaders, have shown contrasting strategies over the past decade. From 2014 to 2023, Equifax's SG&A expenses grew by approximately 84%, peaking in 2019. Meanwhile, Masco Corporation maintained a more stable trajectory, with a modest 8% increase over the same period. This suggests that while Equifax has been investing heavily in administrative functions, Masco has focused on cost efficiency. The year 2019 marked a significant divergence, with Equifax's expenses surging by 64% compared to the previous year, while Masco's expenses decreased by 14%. This data highlights the strategic choices each company makes in balancing growth and cost management, offering valuable insights for investors and industry analysts alike.

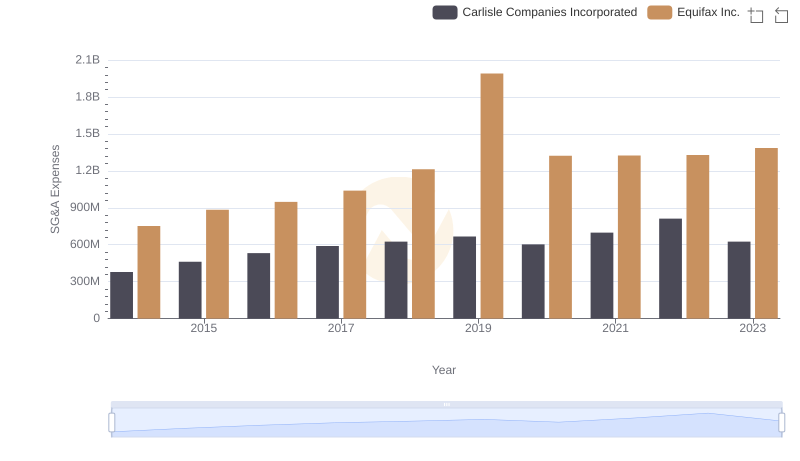

Selling, General, and Administrative Costs: Equifax Inc. vs Carlisle Companies Incorporated

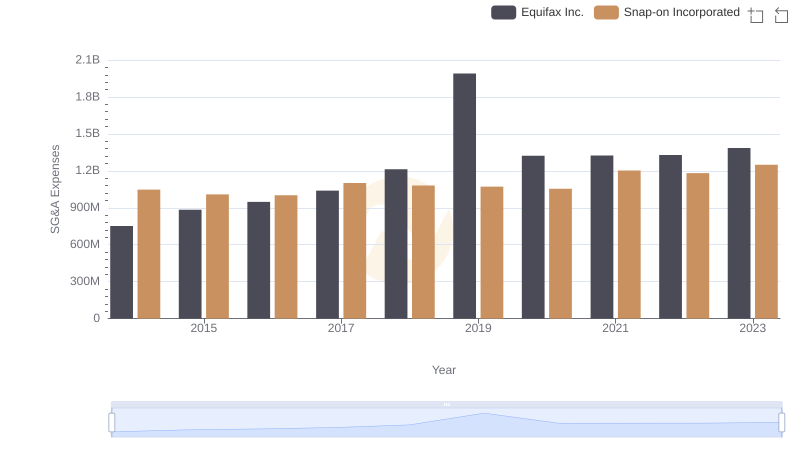

Breaking Down SG&A Expenses: Equifax Inc. vs Snap-on Incorporated

Key Insights on Gross Profit: Equifax Inc. vs Masco Corporation

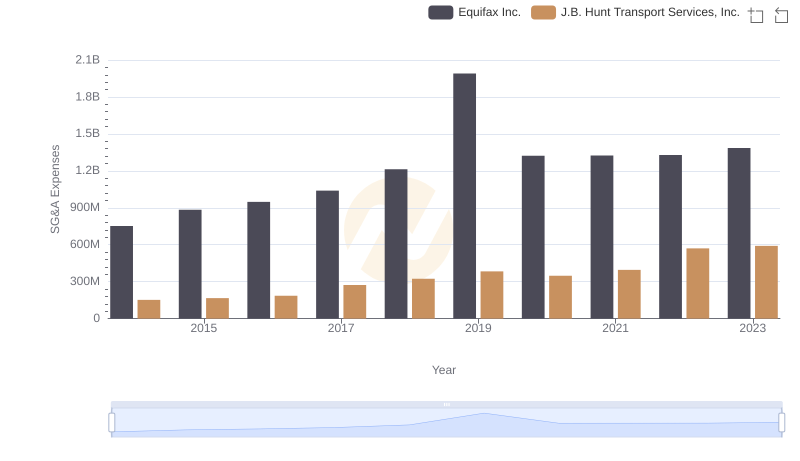

Breaking Down SG&A Expenses: Equifax Inc. vs J.B. Hunt Transport Services, Inc.

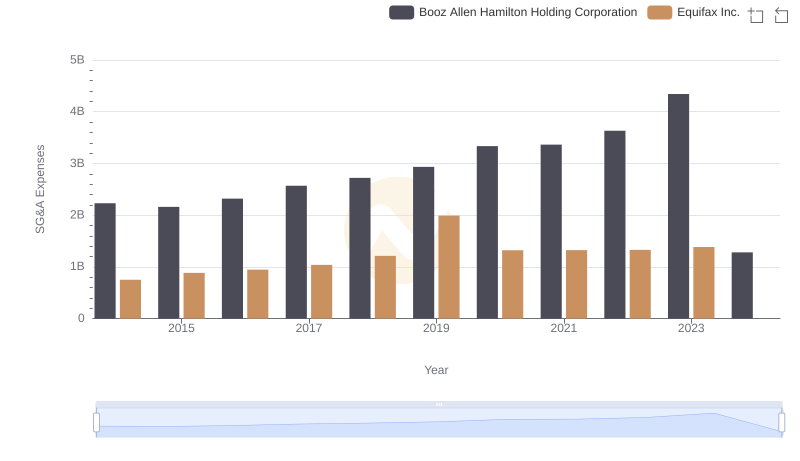

Equifax Inc. and Booz Allen Hamilton Holding Corporation: SG&A Spending Patterns Compared