| __timestamp | Booz Allen Hamilton Holding Corporation | Eaton Corporation plc |

|---|---|---|

| Wednesday, January 1, 2014 | 2229642000 | 3810000000 |

| Thursday, January 1, 2015 | 2159439000 | 3596000000 |

| Friday, January 1, 2016 | 2319592000 | 3505000000 |

| Sunday, January 1, 2017 | 2568511000 | 3565000000 |

| Monday, January 1, 2018 | 2719909000 | 3548000000 |

| Tuesday, January 1, 2019 | 2932602000 | 3583000000 |

| Wednesday, January 1, 2020 | 3334378000 | 3075000000 |

| Friday, January 1, 2021 | 3362722000 | 3256000000 |

| Saturday, January 1, 2022 | 3633150000 | 3227000000 |

| Sunday, January 1, 2023 | 4341769000 | 3795000000 |

| Monday, January 1, 2024 | 1281443000 | 4077000000 |

Unleashing the power of data

In the competitive landscape of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. This analysis compares Eaton Corporation plc and Booz Allen Hamilton Holding Corporation from 2014 to 2023. Eaton Corporation consistently maintained higher SG&A expenses, peaking at approximately $3.81 billion in 2014, while Booz Allen Hamilton's expenses rose by nearly 95% over the decade, reaching $4.34 billion in 2023. Despite Eaton's higher initial costs, Booz Allen Hamilton's rapid increase suggests a strategic shift or expansion. Notably, Eaton's expenses dipped in 2020, possibly reflecting cost-cutting measures during the pandemic. Missing data for Eaton in 2024 indicates potential reporting delays or strategic changes. Understanding these trends offers insights into each company's operational efficiency and strategic priorities, highlighting the importance of SG&A optimization in sustaining competitive advantage.

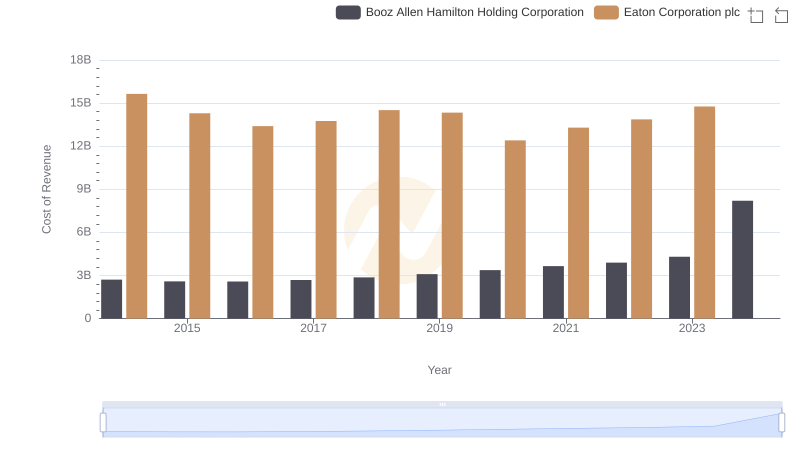

Comparing Revenue Performance: Eaton Corporation plc or Booz Allen Hamilton Holding Corporation?

Cost Insights: Breaking Down Eaton Corporation plc and Booz Allen Hamilton Holding Corporation's Expenses

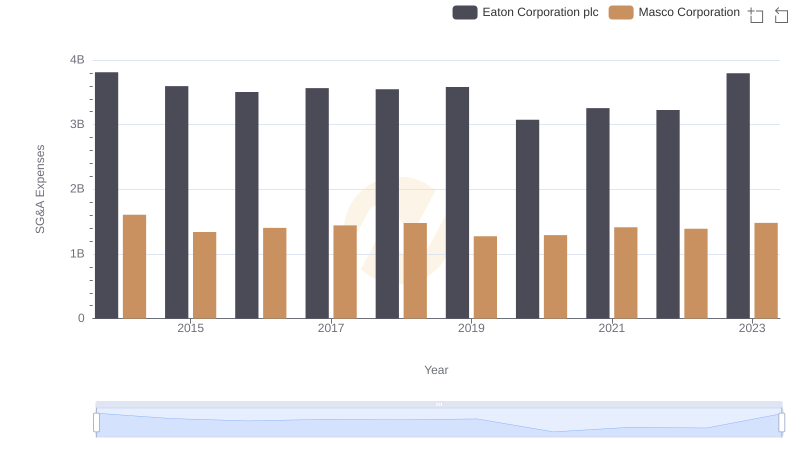

SG&A Efficiency Analysis: Comparing Eaton Corporation plc and Masco Corporation

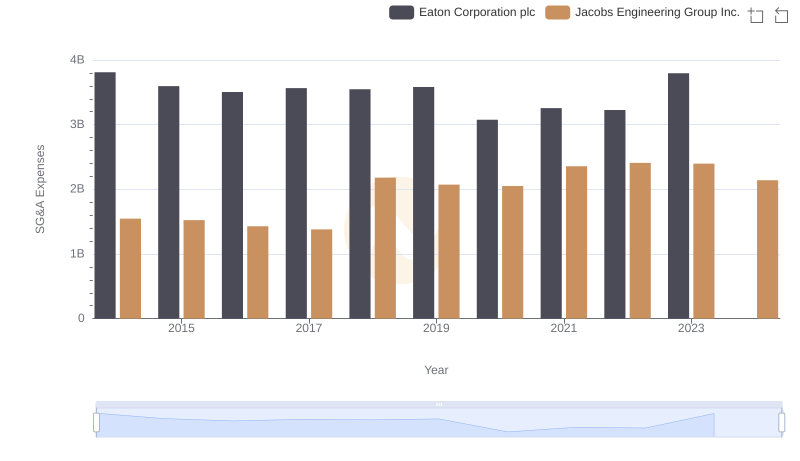

Eaton Corporation plc vs Jacobs Engineering Group Inc.: SG&A Expense Trends

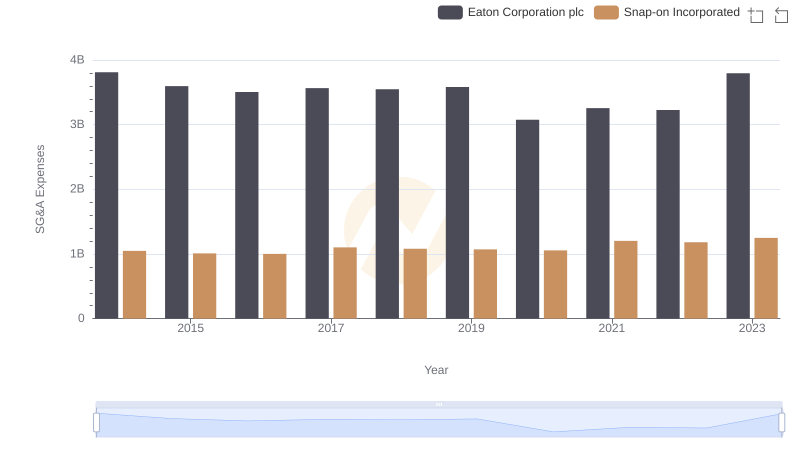

SG&A Efficiency Analysis: Comparing Eaton Corporation plc and Snap-on Incorporated