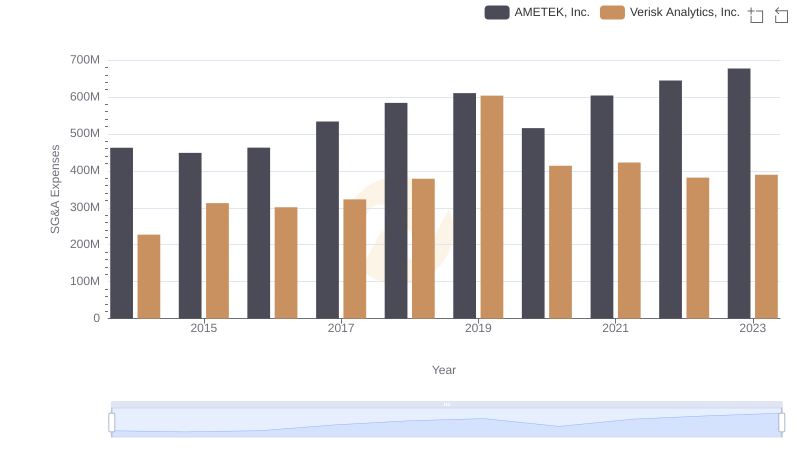

| __timestamp | AMETEK, Inc. | Old Dominion Freight Line, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 462637000 | 144817000 |

| Thursday, January 1, 2015 | 448592000 | 153589000 |

| Friday, January 1, 2016 | 462970000 | 152391000 |

| Sunday, January 1, 2017 | 533645000 | 177205000 |

| Monday, January 1, 2018 | 584022000 | 194368000 |

| Tuesday, January 1, 2019 | 610280000 | 206125000 |

| Wednesday, January 1, 2020 | 515630000 | 184185000 |

| Friday, January 1, 2021 | 603944000 | 223757000 |

| Saturday, January 1, 2022 | 644577000 | 258883000 |

| Sunday, January 1, 2023 | 677006000 | 281053000 |

| Monday, January 1, 2024 | 696905000 |

Data in motion

In the competitive landscape of corporate America, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. AMETEK, Inc. and Old Dominion Freight Line, Inc. have been navigating this financial terrain since 2014. Over the past decade, AMETEK has consistently maintained higher SG&A expenses, peaking at approximately $677 million in 2023. In contrast, Old Dominion's SG&A costs have grown more modestly, reaching around $281 million in the same year.

From 2014 to 2023, AMETEK's SG&A expenses increased by about 46%, while Old Dominion saw an impressive 94% rise. This suggests that Old Dominion is expanding its operations more aggressively, albeit from a smaller base. The data reveals a strategic divergence: AMETEK's focus on maintaining a steady growth trajectory versus Old Dominion's rapid expansion strategy. Understanding these trends offers valuable insights into how these companies optimize their operational costs.

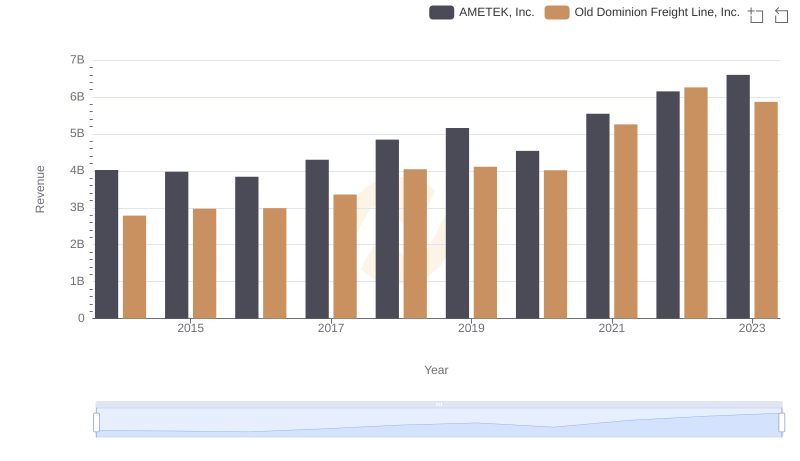

Revenue Insights: AMETEK, Inc. and Old Dominion Freight Line, Inc. Performance Compared

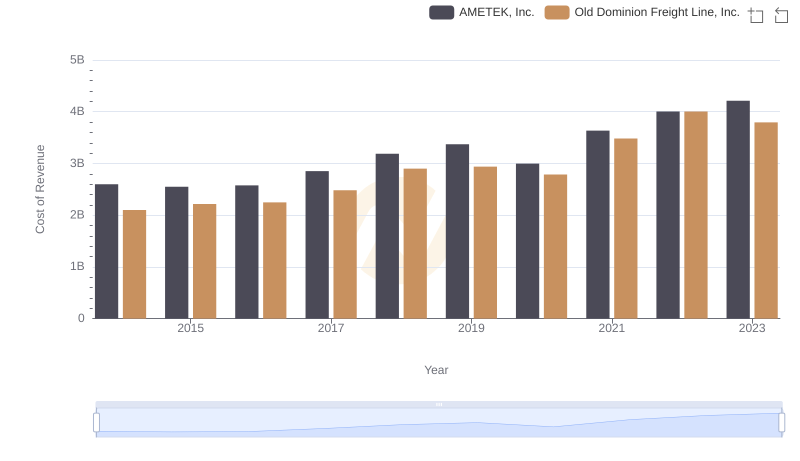

Cost of Revenue: Key Insights for AMETEK, Inc. and Old Dominion Freight Line, Inc.

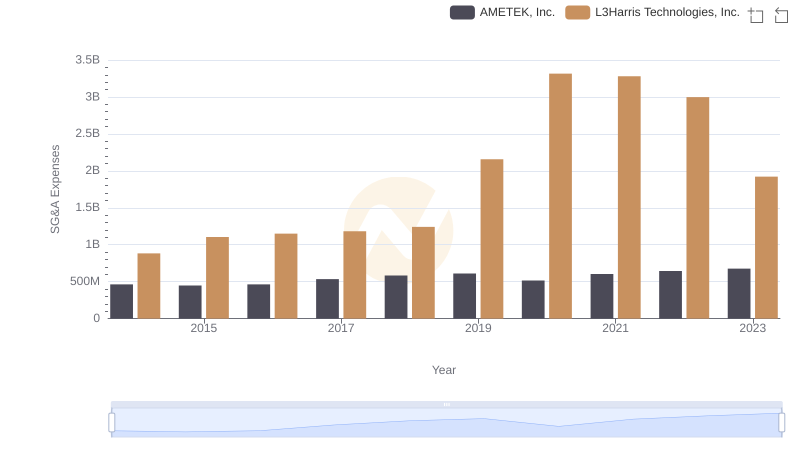

Operational Costs Compared: SG&A Analysis of AMETEK, Inc. and L3Harris Technologies, Inc.

Comparing SG&A Expenses: AMETEK, Inc. vs Verisk Analytics, Inc. Trends and Insights

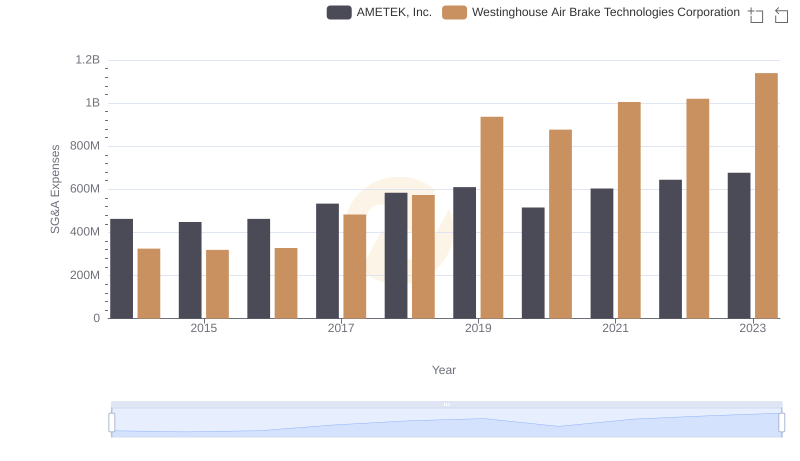

Selling, General, and Administrative Costs: AMETEK, Inc. vs Westinghouse Air Brake Technologies Corporation

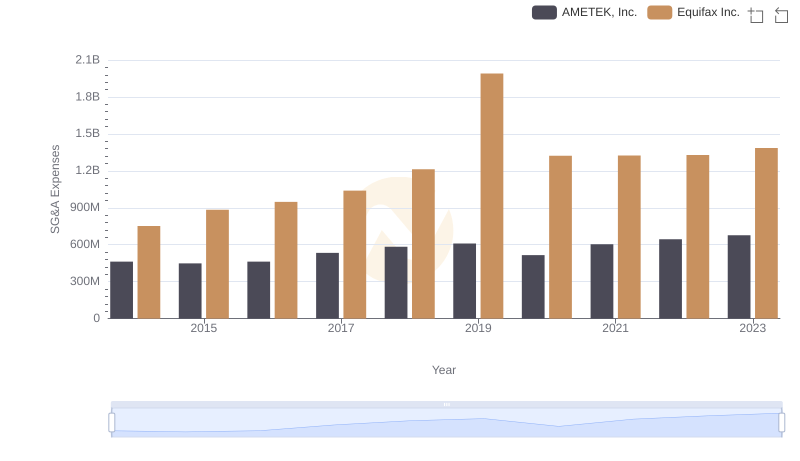

Cost Management Insights: SG&A Expenses for AMETEK, Inc. and Equifax Inc.

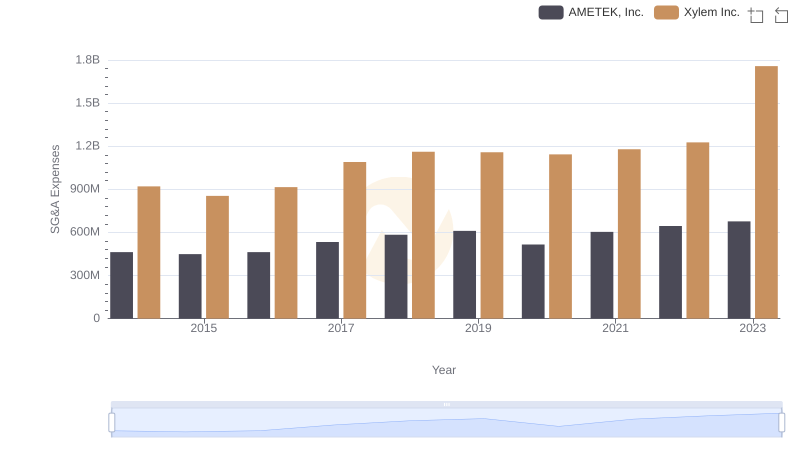

Comparing SG&A Expenses: AMETEK, Inc. vs Xylem Inc. Trends and Insights