| __timestamp | EMCOR Group, Inc. | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 907246000 | 913534000 |

| Thursday, January 1, 2015 | 944479000 | 1026153000 |

| Friday, January 1, 2016 | 1037862000 | 901541000 |

| Sunday, January 1, 2017 | 1147012000 | 1040597000 |

| Monday, January 1, 2018 | 1205453000 | 1211731000 |

| Tuesday, January 1, 2019 | 1355868000 | 2077600000 |

| Wednesday, January 1, 2020 | 1395382000 | 1898700000 |

| Friday, January 1, 2021 | 1501737000 | 2135000000 |

| Saturday, January 1, 2022 | 1603594000 | 2292000000 |

| Sunday, January 1, 2023 | 2089339000 | 2944000000 |

| Monday, January 1, 2024 | 3366000000 |

Infusing magic into the data realm

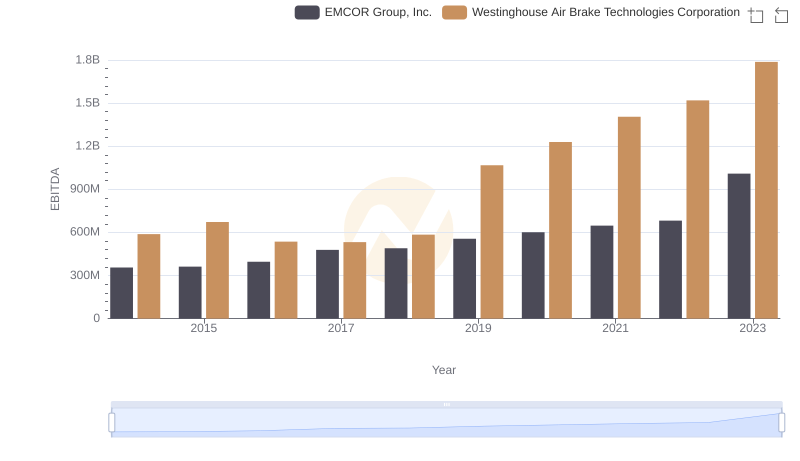

In the competitive landscape of industrial services, two titans stand out: Westinghouse Air Brake Technologies Corporation and EMCOR Group, Inc. Over the past decade, these companies have vied for supremacy in gross profit generation. From 2014 to 2023, Westinghouse consistently outperformed EMCOR, with a notable peak in 2023 where it achieved a gross profit nearly 41% higher than EMCOR. This trend highlights Westinghouse's strategic prowess in optimizing operational efficiencies and market positioning.

While EMCOR showed steady growth, increasing its gross profit by approximately 130% from 2014 to 2023, Westinghouse's growth was even more impressive, with a 222% increase over the same period. This data underscores the dynamic nature of the industrial sector and the importance of strategic innovation. As we look to the future, these insights provide a roadmap for understanding market dynamics and potential investment opportunities.

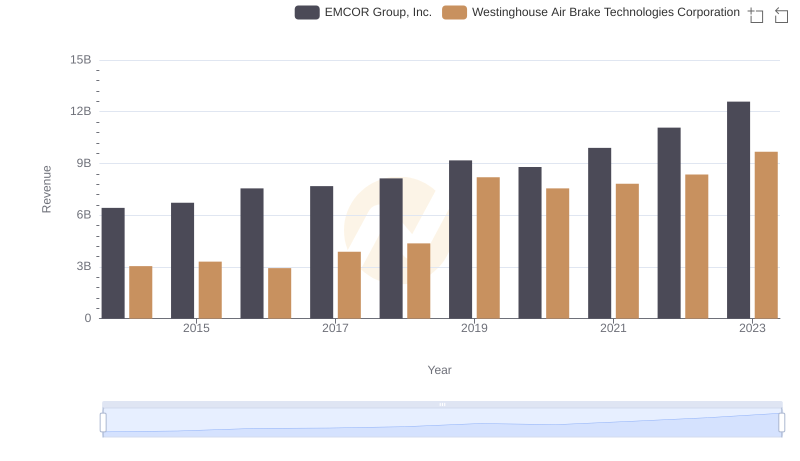

Westinghouse Air Brake Technologies Corporation and EMCOR Group, Inc.: A Comprehensive Revenue Analysis

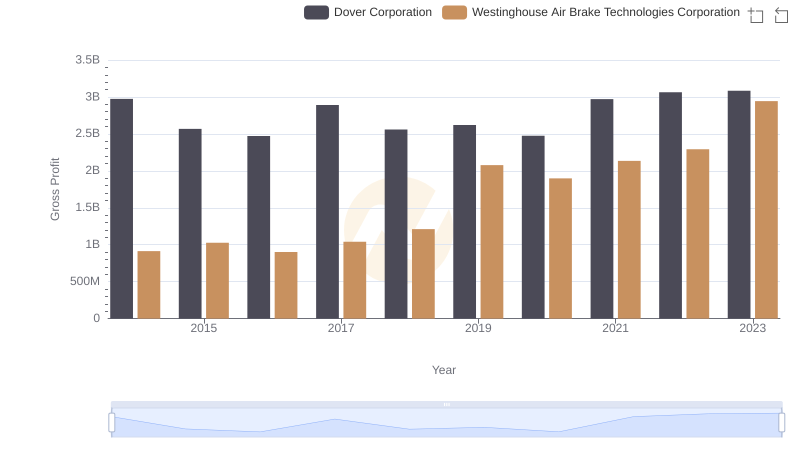

Gross Profit Comparison: Westinghouse Air Brake Technologies Corporation and Dover Corporation Trends

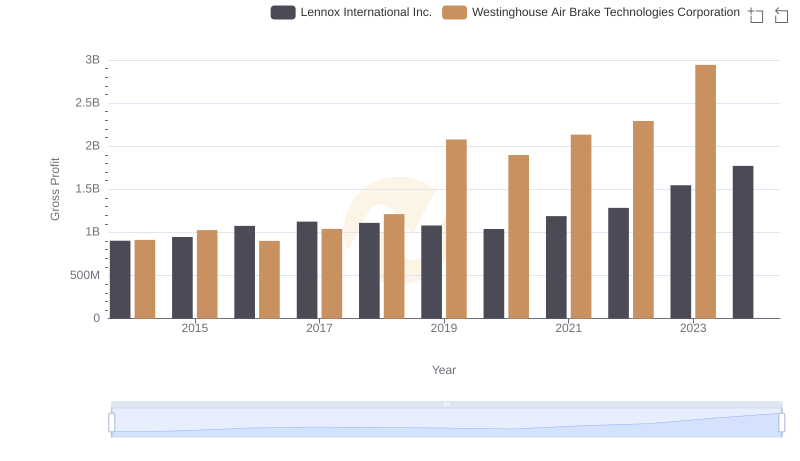

Gross Profit Comparison: Westinghouse Air Brake Technologies Corporation and Lennox International Inc. Trends

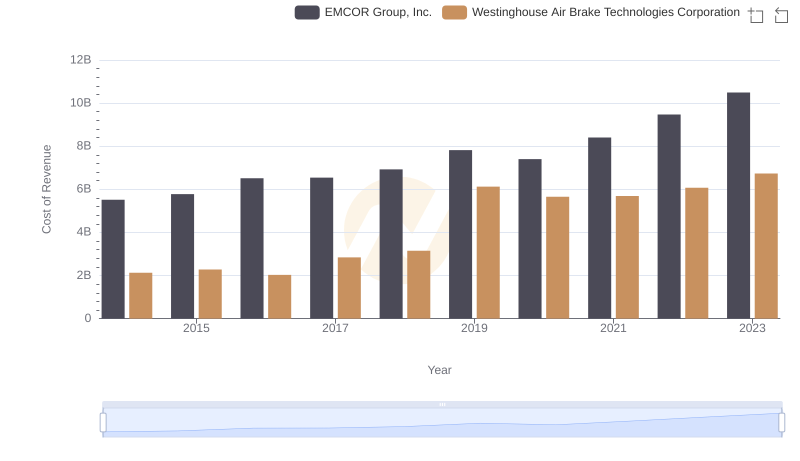

Cost of Revenue Trends: Westinghouse Air Brake Technologies Corporation vs EMCOR Group, Inc.

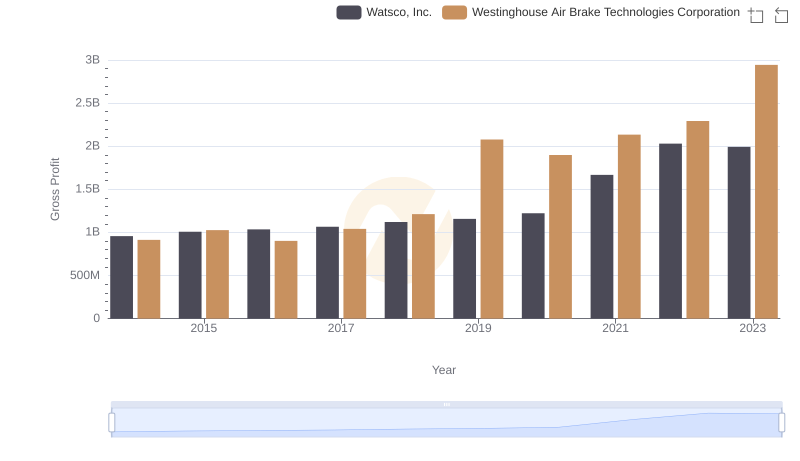

Gross Profit Trends Compared: Westinghouse Air Brake Technologies Corporation vs Watsco, Inc.

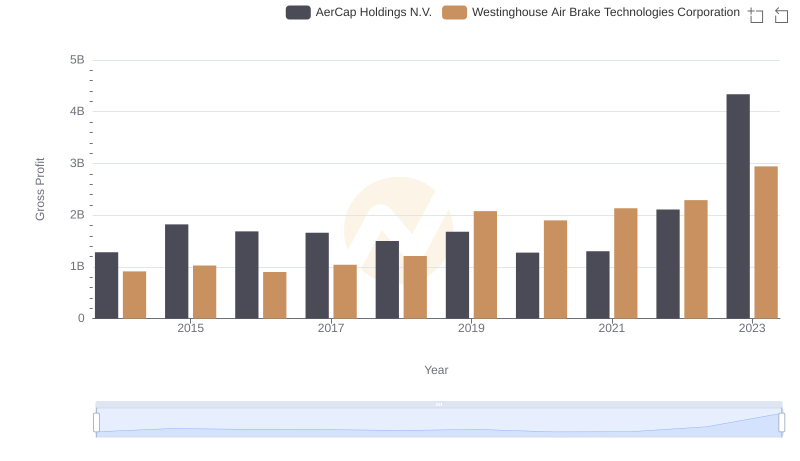

Westinghouse Air Brake Technologies Corporation vs AerCap Holdings N.V.: A Gross Profit Performance Breakdown

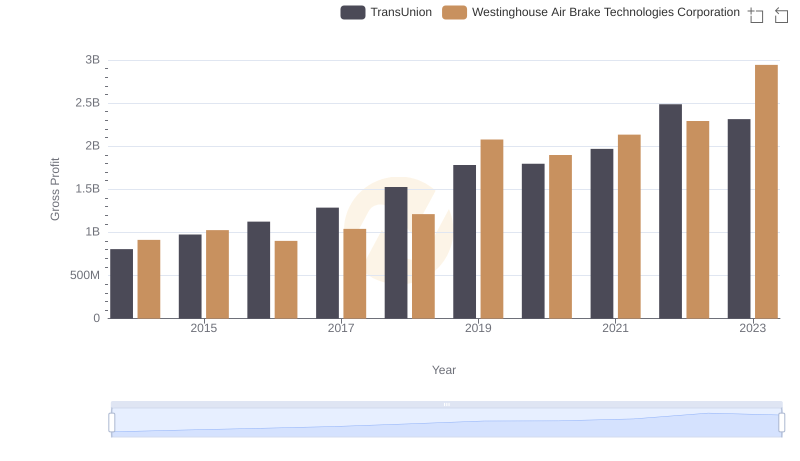

Gross Profit Trends Compared: Westinghouse Air Brake Technologies Corporation vs TransUnion

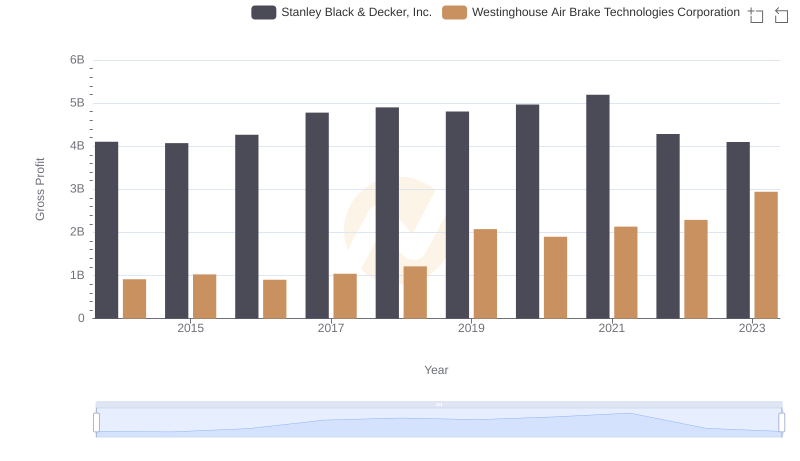

Who Generates Higher Gross Profit? Westinghouse Air Brake Technologies Corporation or Stanley Black & Decker, Inc.

Professional EBITDA Benchmarking: Westinghouse Air Brake Technologies Corporation vs EMCOR Group, Inc.