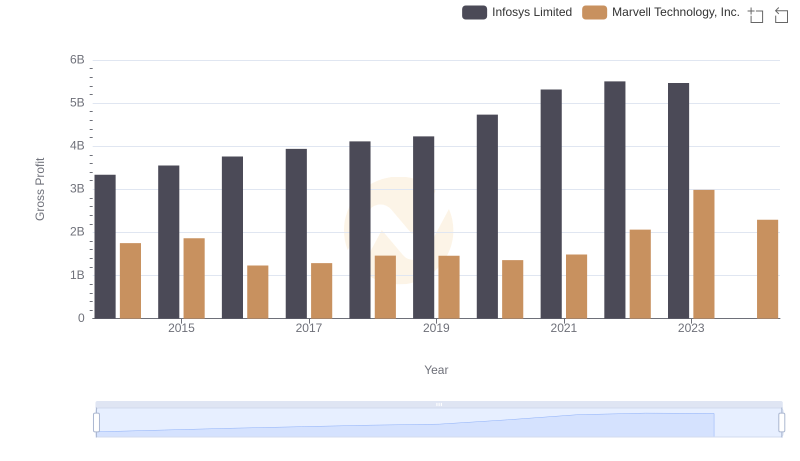

| __timestamp | Infosys Limited | MicroStrategy Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 3337000000 | 444620000 |

| Thursday, January 1, 2015 | 3551000000 | 428761000 |

| Friday, January 1, 2016 | 3762000000 | 419014000 |

| Sunday, January 1, 2017 | 3938000000 | 407894000 |

| Monday, January 1, 2018 | 4112000000 | 398139000 |

| Tuesday, January 1, 2019 | 4228000000 | 386353000 |

| Wednesday, January 1, 2020 | 4733000000 | 389680000 |

| Friday, January 1, 2021 | 5315000000 | 418853000 |

| Saturday, January 1, 2022 | 5503000000 | 396275000 |

| Sunday, January 1, 2023 | 5466000000 | 386317000 |

| Monday, January 1, 2024 | 333988000 |

Unleashing insights

In the ever-evolving landscape of global business, the ability to generate substantial gross profit is a testament to a company's operational efficiency and market prowess. Over the past decade, Infosys Limited, a titan in the IT services sector, has consistently outperformed MicroStrategy Incorporated, a leader in business intelligence software, in terms of gross profit. From 2014 to 2023, Infosys's gross profit surged by approximately 64%, peaking at over $5.5 billion in 2022. In contrast, MicroStrategy's gross profit remained relatively stable, with a slight decline of around 13% over the same period, reaching its highest point in 2014. This stark contrast highlights the divergent growth trajectories of these two companies, with Infosys capitalizing on the global demand for IT services, while MicroStrategy faces challenges in a competitive software market. As we look to the future, the question remains: can MicroStrategy pivot to regain its competitive edge?

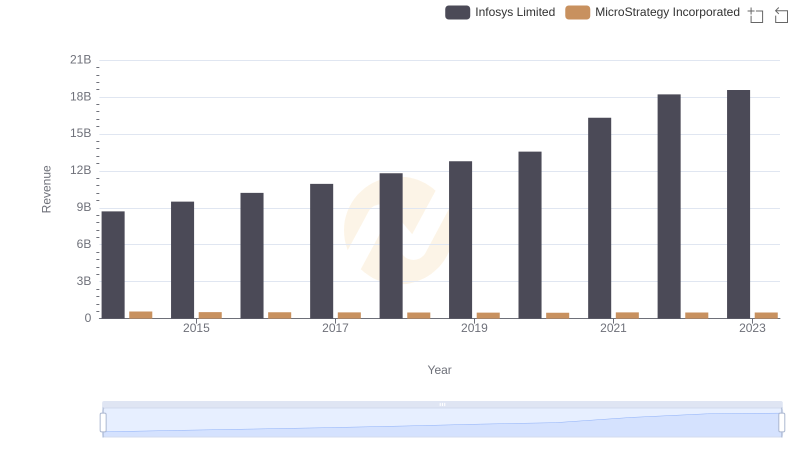

Infosys Limited or MicroStrategy Incorporated: Who Leads in Yearly Revenue?

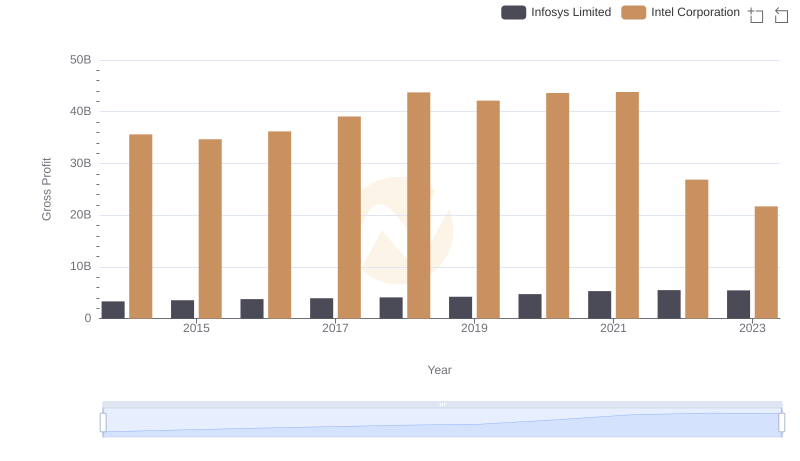

Gross Profit Analysis: Comparing Infosys Limited and Intel Corporation

Gross Profit Trends Compared: Infosys Limited vs Marvell Technology, Inc.

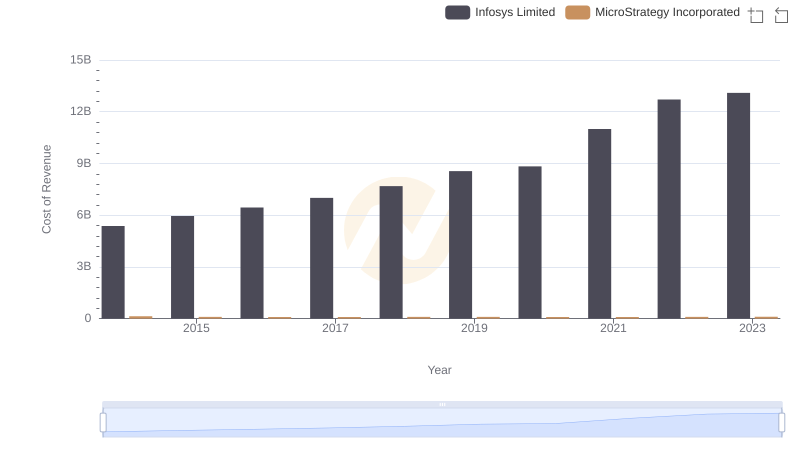

Cost of Revenue Comparison: Infosys Limited vs MicroStrategy Incorporated

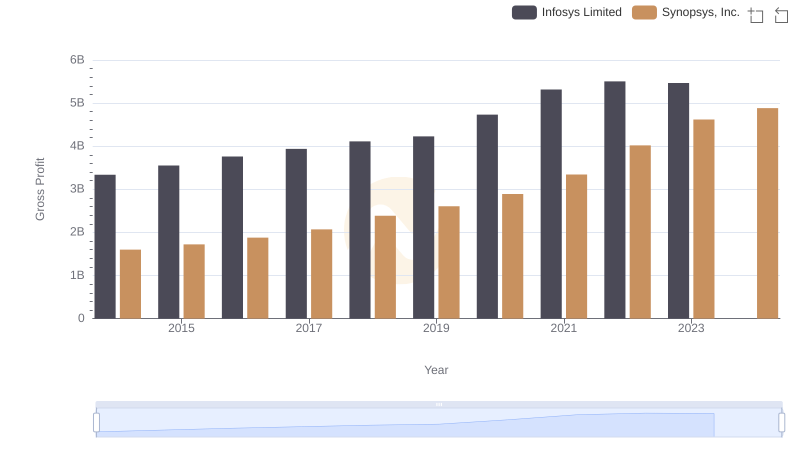

Gross Profit Analysis: Comparing Infosys Limited and Synopsys, Inc.

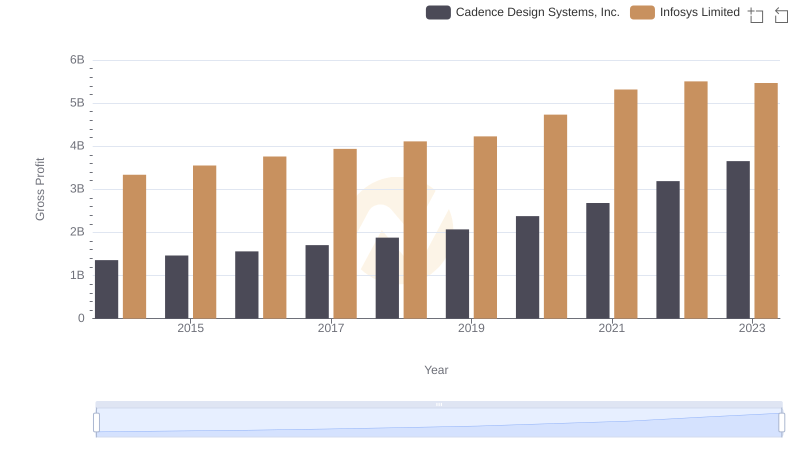

Infosys Limited and Cadence Design Systems, Inc.: A Detailed Gross Profit Analysis

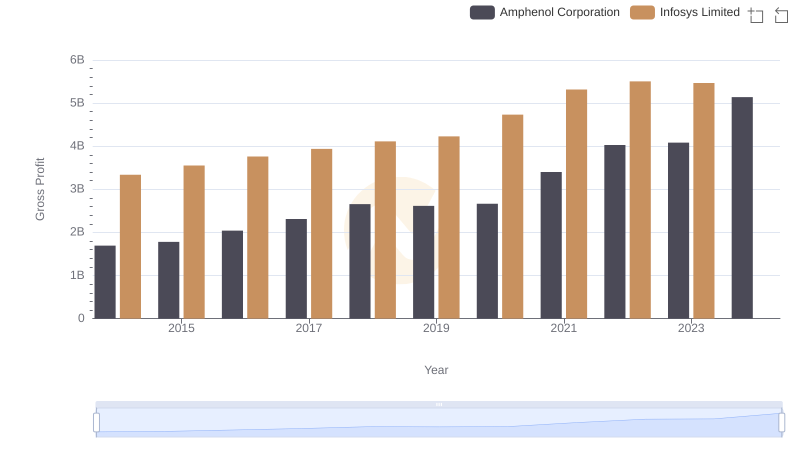

Infosys Limited vs Amphenol Corporation: A Gross Profit Performance Breakdown

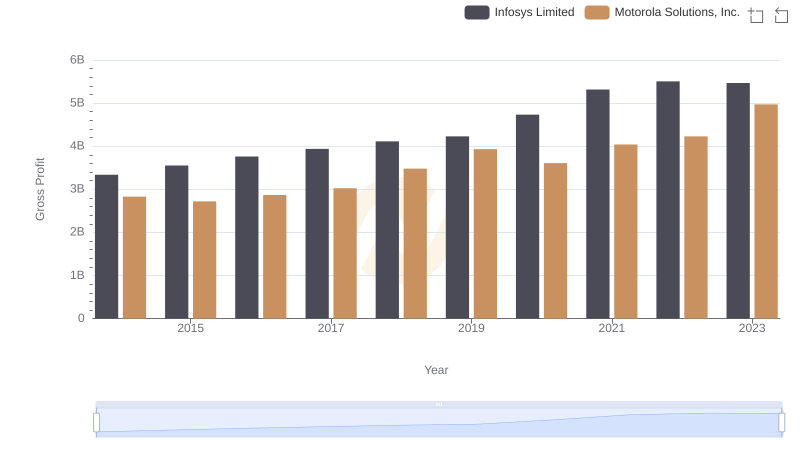

Who Generates Higher Gross Profit? Infosys Limited or Motorola Solutions, Inc.

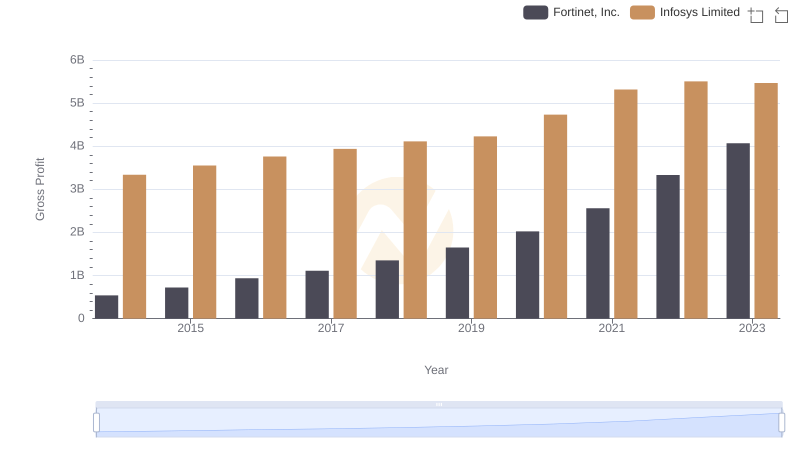

Infosys Limited vs Fortinet, Inc.: A Gross Profit Performance Breakdown

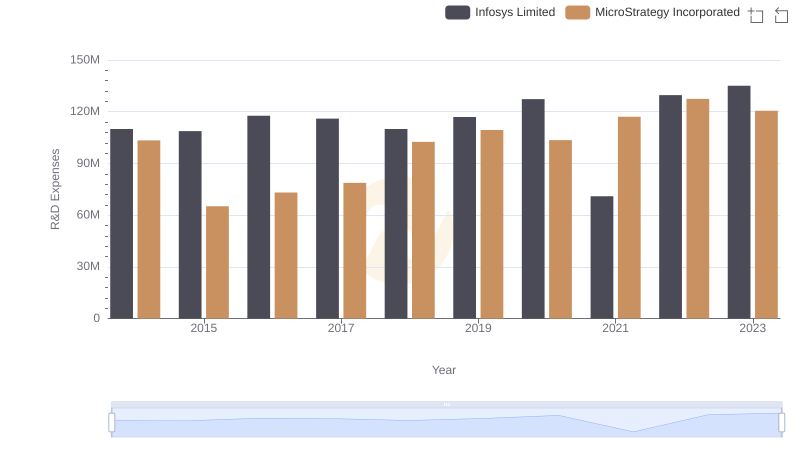

Analyzing R&D Budgets: Infosys Limited vs MicroStrategy Incorporated

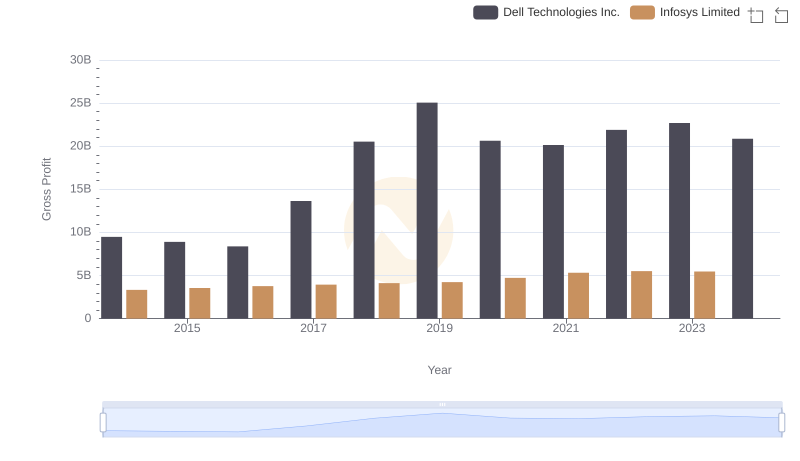

Gross Profit Trends Compared: Infosys Limited vs Dell Technologies Inc.

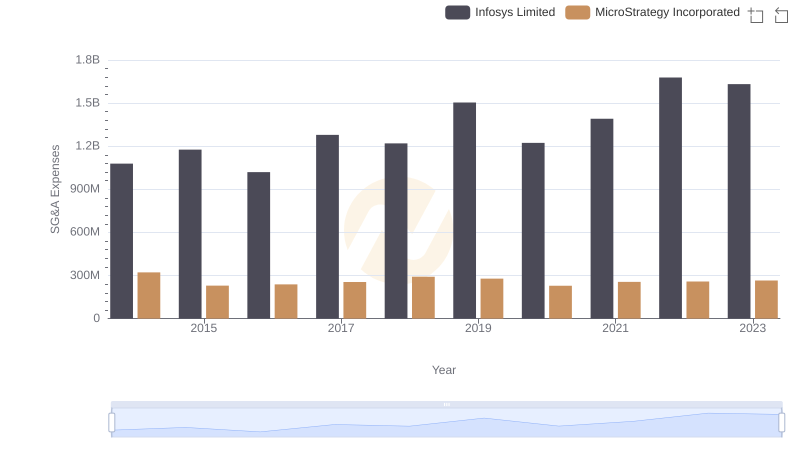

Breaking Down SG&A Expenses: Infosys Limited vs MicroStrategy Incorporated