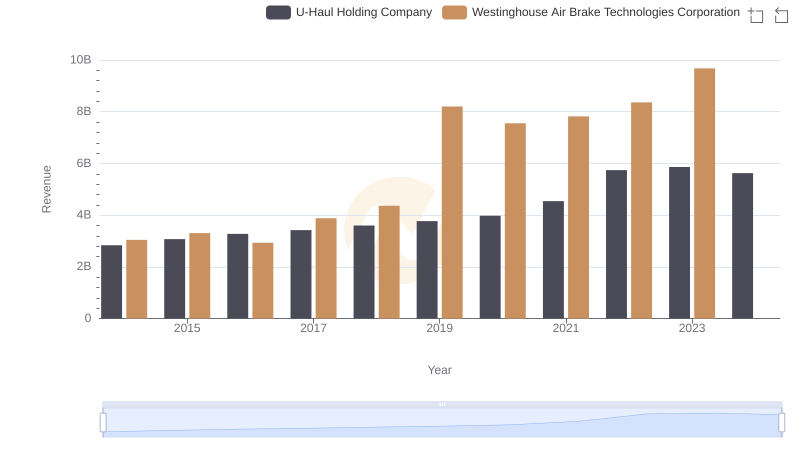

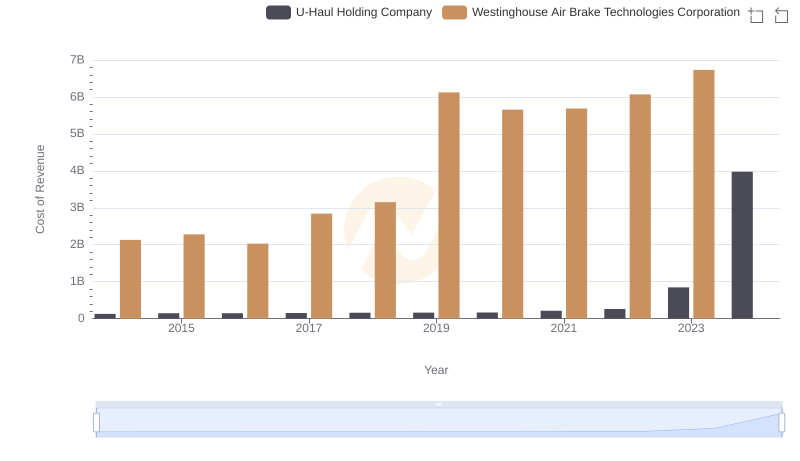

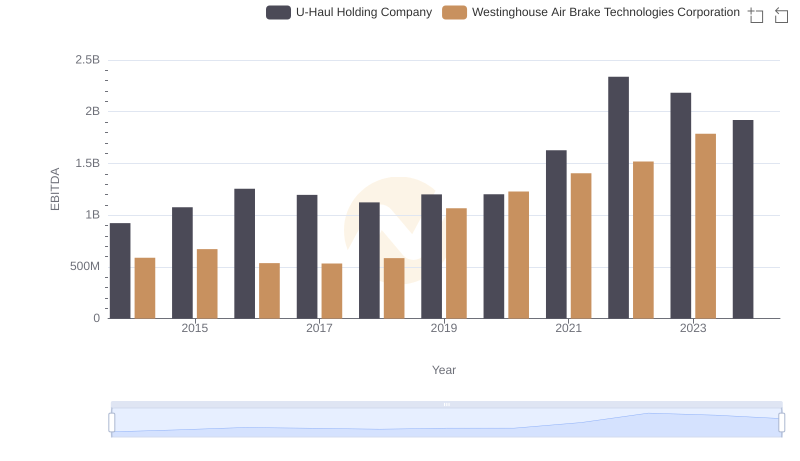

| __timestamp | U-Haul Holding Company | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 2707982000 | 913534000 |

| Thursday, January 1, 2015 | 2928459000 | 1026153000 |

| Friday, January 1, 2016 | 3130666000 | 901541000 |

| Sunday, January 1, 2017 | 3269282000 | 1040597000 |

| Monday, January 1, 2018 | 3440625000 | 1211731000 |

| Tuesday, January 1, 2019 | 3606565000 | 2077600000 |

| Wednesday, January 1, 2020 | 3814850000 | 1898700000 |

| Friday, January 1, 2021 | 4327926000 | 2135000000 |

| Saturday, January 1, 2022 | 5480162000 | 2292000000 |

| Sunday, January 1, 2023 | 5019797000 | 2944000000 |

| Monday, January 1, 2024 | 1649634000 | 3366000000 |

Unveiling the hidden dimensions of data

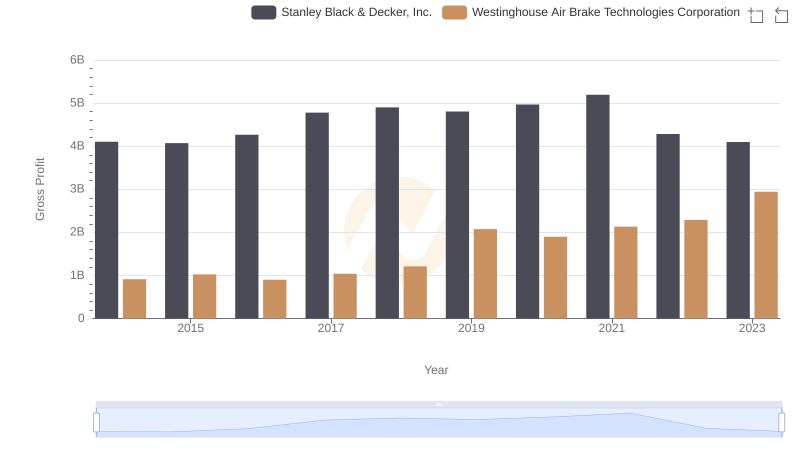

In the ever-evolving landscape of American industry, the financial performance of companies like U-Haul Holding Company and Westinghouse Air Brake Technologies Corporation offers a fascinating glimpse into their strategic maneuvers. Over the past decade, U-Haul has consistently outperformed its counterpart, with gross profits soaring by approximately 85% from 2014 to 2023. This growth trajectory underscores U-Haul's robust market positioning and operational efficiency. In contrast, Westinghouse Air Brake Technologies Corporation, while showing a commendable 222% increase in gross profit from 2014 to 2023, experienced more volatility, reflecting the challenges in the transportation sector. Notably, 2024 data for Westinghouse is missing, hinting at potential reporting delays or strategic shifts. As these companies navigate the complexities of their respective industries, their financial narratives provide valuable insights into broader economic trends.

Westinghouse Air Brake Technologies Corporation vs U-Haul Holding Company: Annual Revenue Growth Compared

Who Generates Higher Gross Profit? Westinghouse Air Brake Technologies Corporation or Stanley Black & Decker, Inc.

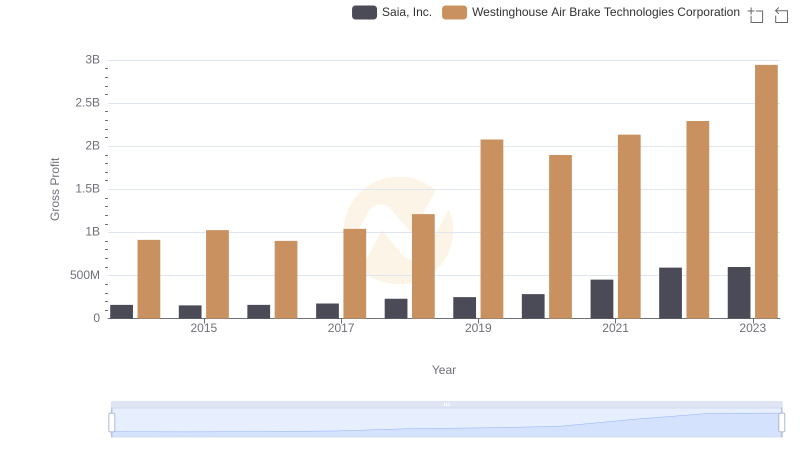

Gross Profit Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Saia, Inc.

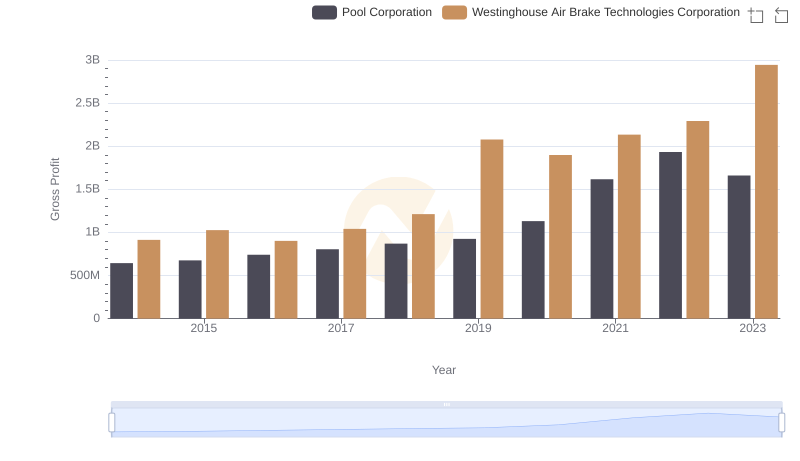

Gross Profit Comparison: Westinghouse Air Brake Technologies Corporation and Pool Corporation Trends

Cost Insights: Breaking Down Westinghouse Air Brake Technologies Corporation and U-Haul Holding Company's Expenses

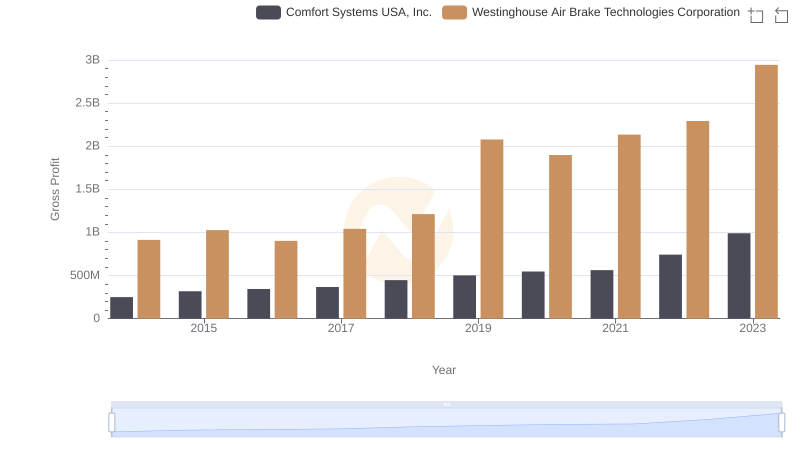

Westinghouse Air Brake Technologies Corporation and Comfort Systems USA, Inc.: A Detailed Gross Profit Analysis

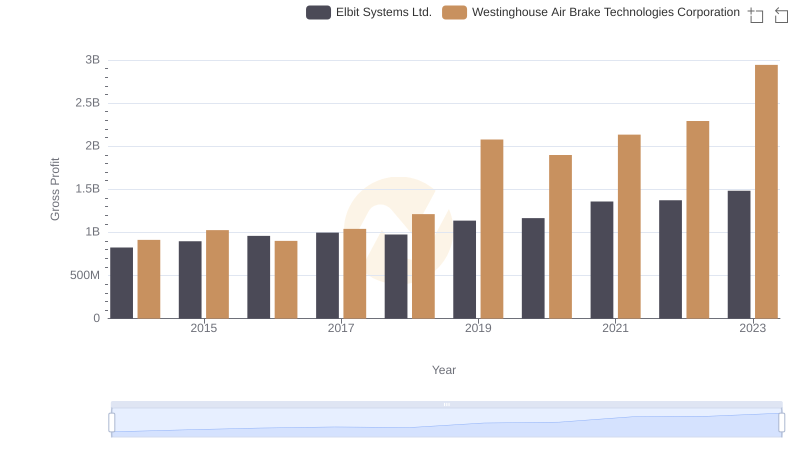

Westinghouse Air Brake Technologies Corporation and Elbit Systems Ltd.: A Detailed Gross Profit Analysis

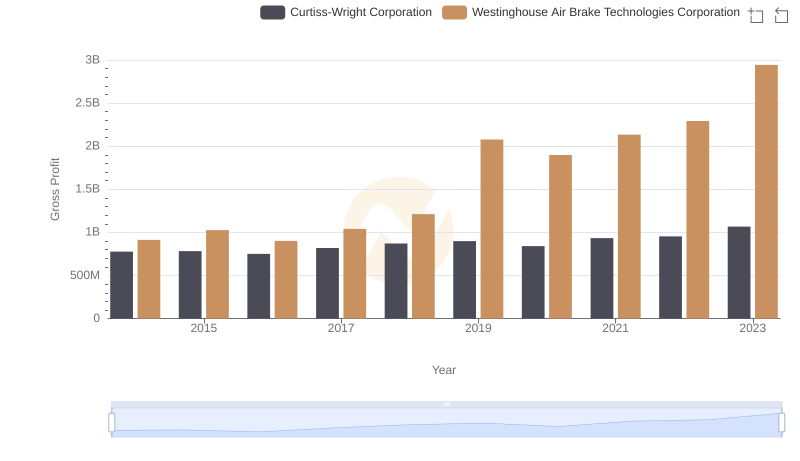

Westinghouse Air Brake Technologies Corporation vs Curtiss-Wright Corporation: A Gross Profit Performance Breakdown

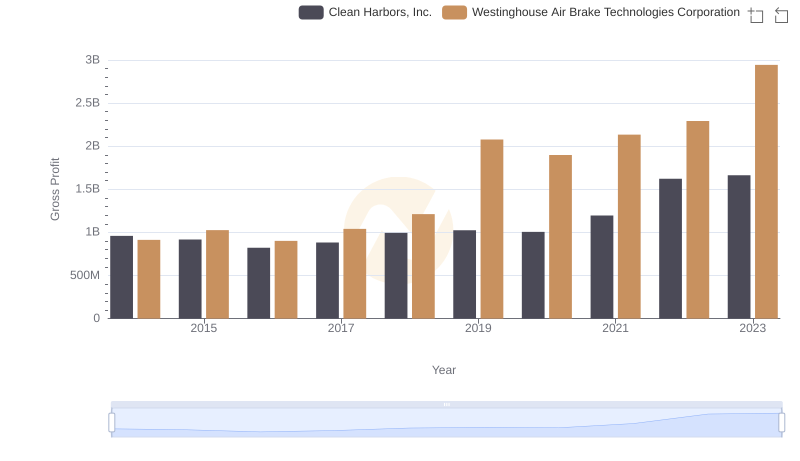

Key Insights on Gross Profit: Westinghouse Air Brake Technologies Corporation vs Clean Harbors, Inc.

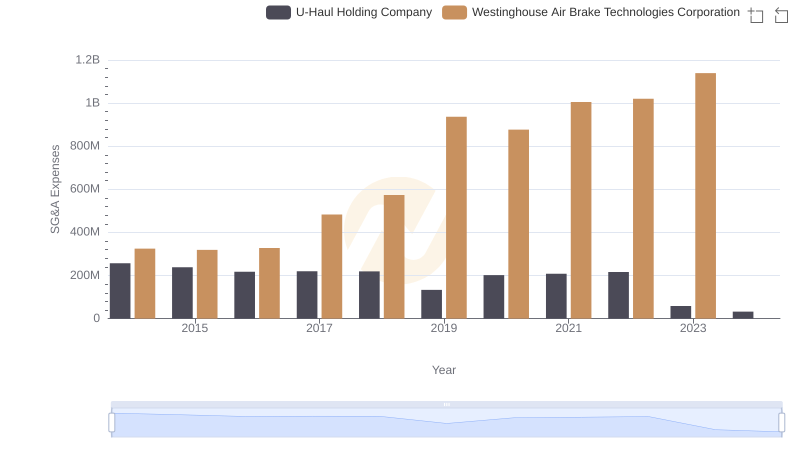

Selling, General, and Administrative Costs: Westinghouse Air Brake Technologies Corporation vs U-Haul Holding Company

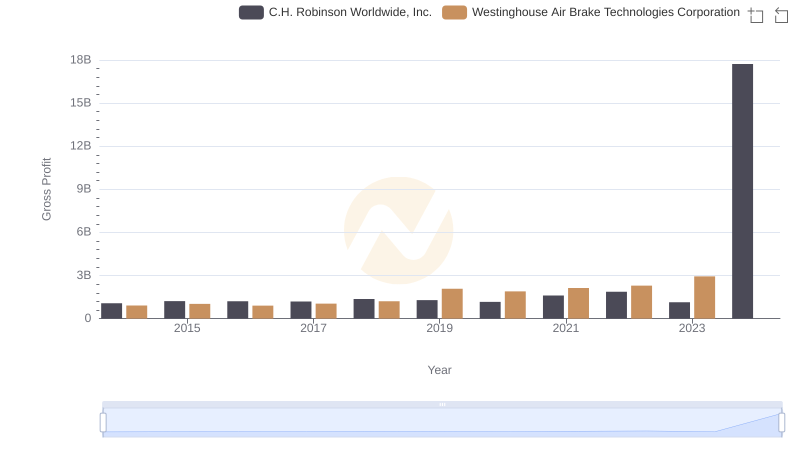

Westinghouse Air Brake Technologies Corporation and C.H. Robinson Worldwide, Inc.: A Detailed Gross Profit Analysis

A Side-by-Side Analysis of EBITDA: Westinghouse Air Brake Technologies Corporation and U-Haul Holding Company