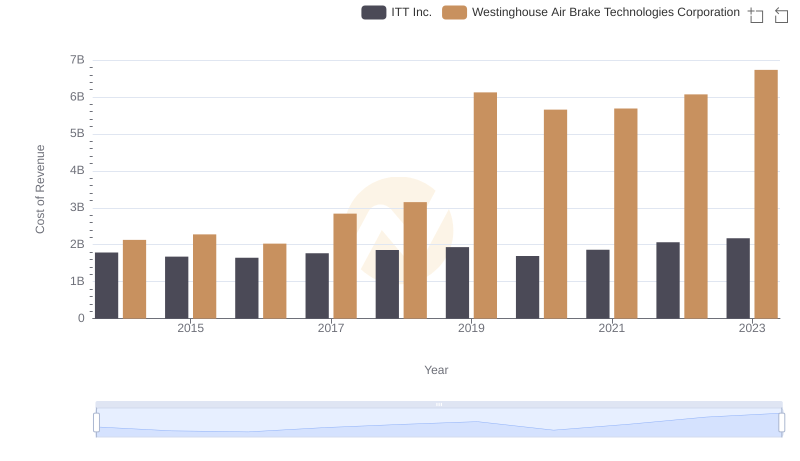

| __timestamp | ITT Inc. | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 866400000 | 913534000 |

| Thursday, January 1, 2015 | 809100000 | 1026153000 |

| Friday, January 1, 2016 | 758200000 | 901541000 |

| Sunday, January 1, 2017 | 817200000 | 1040597000 |

| Monday, January 1, 2018 | 887200000 | 1211731000 |

| Tuesday, January 1, 2019 | 910100000 | 2077600000 |

| Wednesday, January 1, 2020 | 782200000 | 1898700000 |

| Friday, January 1, 2021 | 899500000 | 2135000000 |

| Saturday, January 1, 2022 | 922300000 | 2292000000 |

| Sunday, January 1, 2023 | 1107300000 | 2944000000 |

| Monday, January 1, 2024 | 1247300000 | 3366000000 |

In pursuit of knowledge

In the competitive landscape of industrial manufacturing, Westinghouse Air Brake Technologies Corporation and ITT Inc. have showcased intriguing financial trajectories over the past decade. From 2014 to 2023, Westinghouse Air Brake Technologies Corporation consistently outperformed ITT Inc. in terms of gross profit, with a remarkable 78% increase from 2014 to 2023. In contrast, ITT Inc. experienced a more modest growth of approximately 28% during the same period.

Westinghouse's gross profit peaked in 2023, reaching nearly three times its 2014 value, while ITT Inc. saw its highest gross profit in 2023, marking a 28% rise from its 2014 figures. This data highlights Westinghouse's robust growth strategy and market adaptability. As the industrial sector evolves, these trends offer valuable insights into the financial health and strategic direction of these two industry leaders.

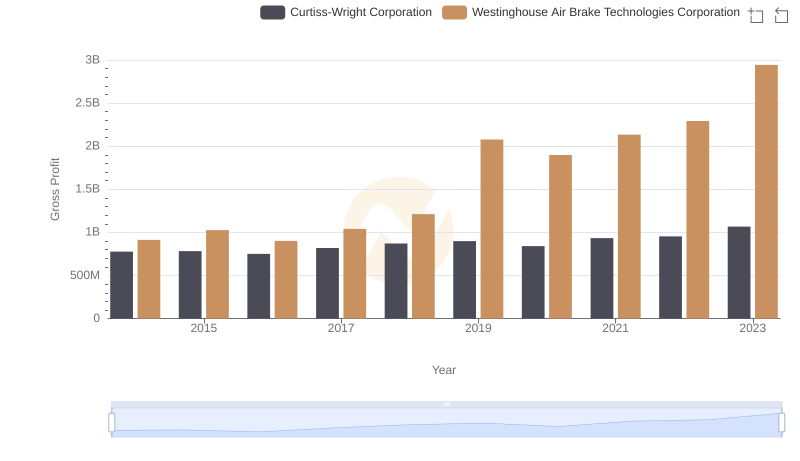

Westinghouse Air Brake Technologies Corporation vs Curtiss-Wright Corporation: A Gross Profit Performance Breakdown

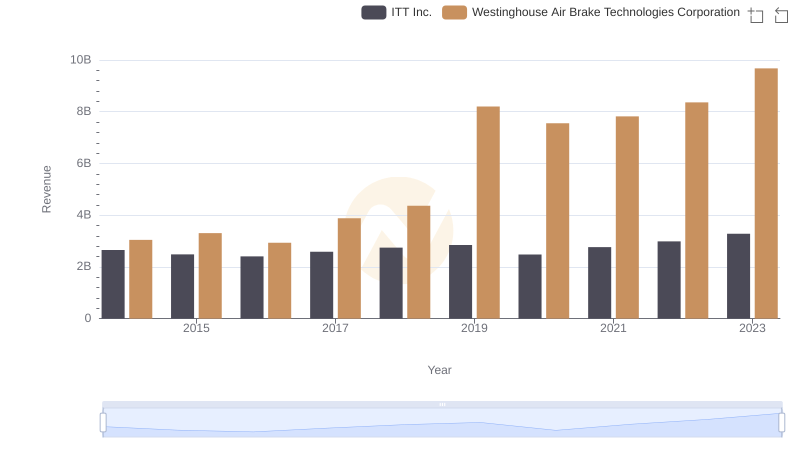

Westinghouse Air Brake Technologies Corporation vs ITT Inc.: Annual Revenue Growth Compared

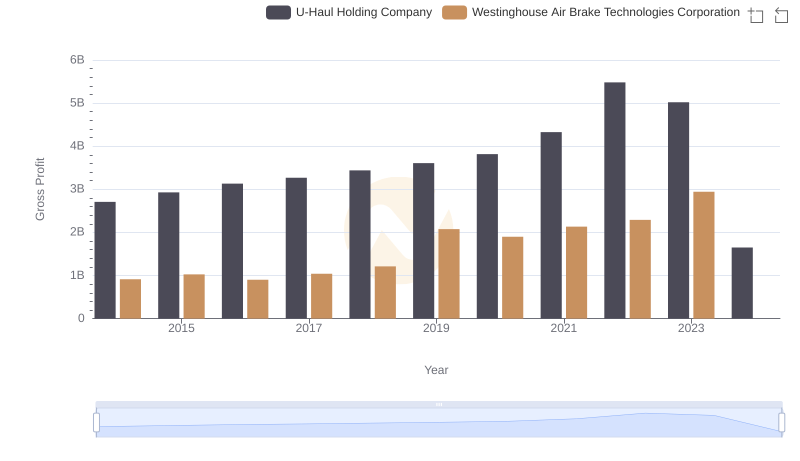

Gross Profit Analysis: Comparing Westinghouse Air Brake Technologies Corporation and U-Haul Holding Company

Cost of Revenue: Key Insights for Westinghouse Air Brake Technologies Corporation and ITT Inc.

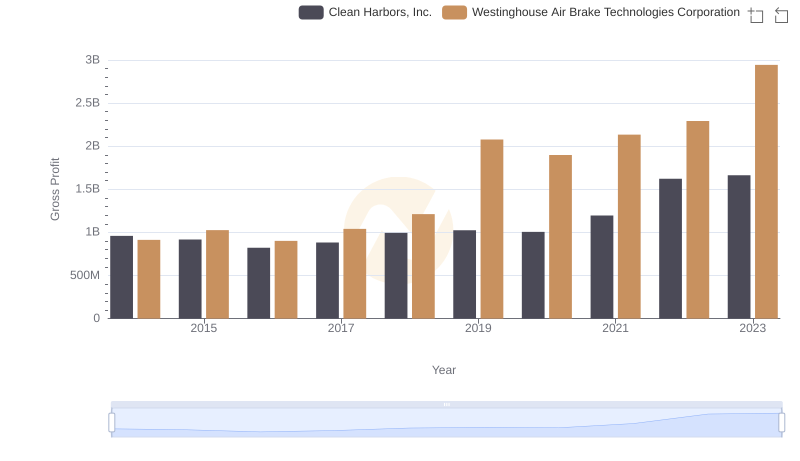

Key Insights on Gross Profit: Westinghouse Air Brake Technologies Corporation vs Clean Harbors, Inc.

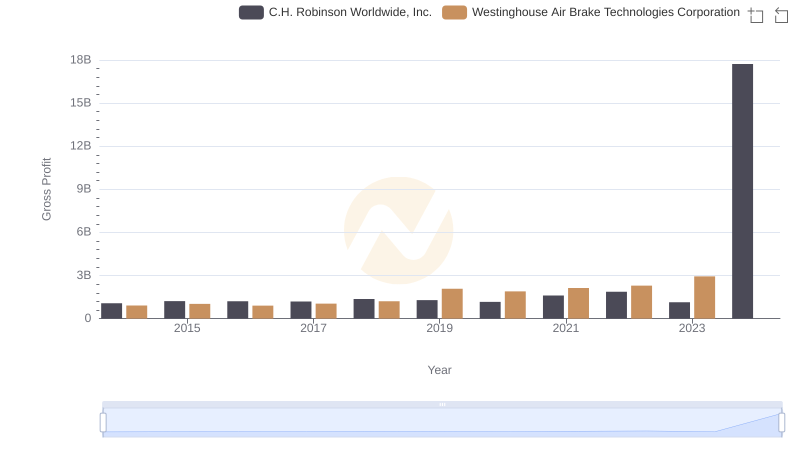

Westinghouse Air Brake Technologies Corporation and C.H. Robinson Worldwide, Inc.: A Detailed Gross Profit Analysis

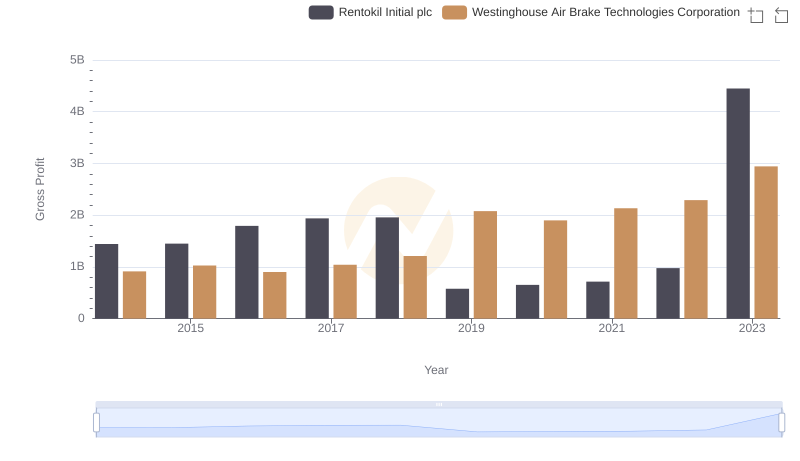

Who Generates Higher Gross Profit? Westinghouse Air Brake Technologies Corporation or Rentokil Initial plc

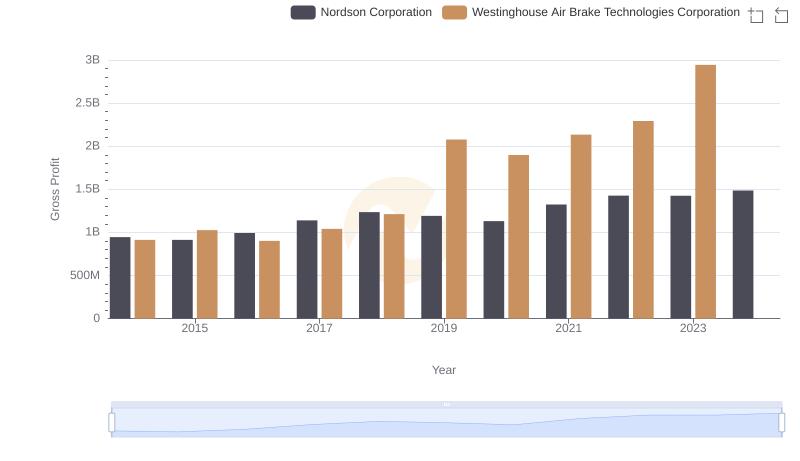

Westinghouse Air Brake Technologies Corporation vs Nordson Corporation: A Gross Profit Performance Breakdown

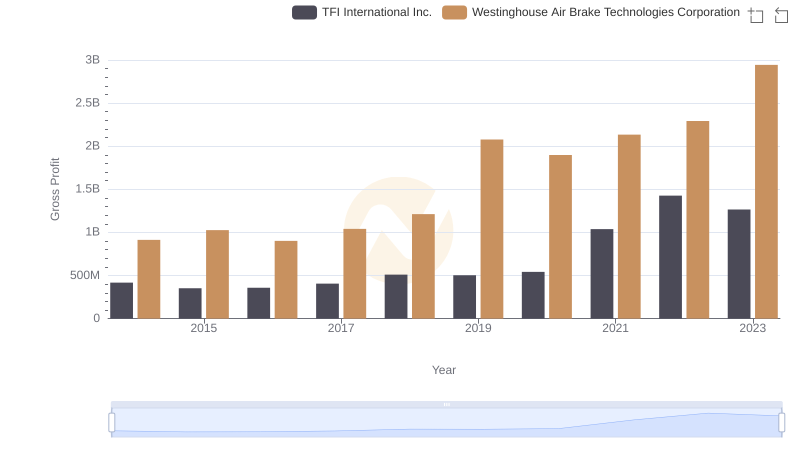

Gross Profit Comparison: Westinghouse Air Brake Technologies Corporation and TFI International Inc. Trends

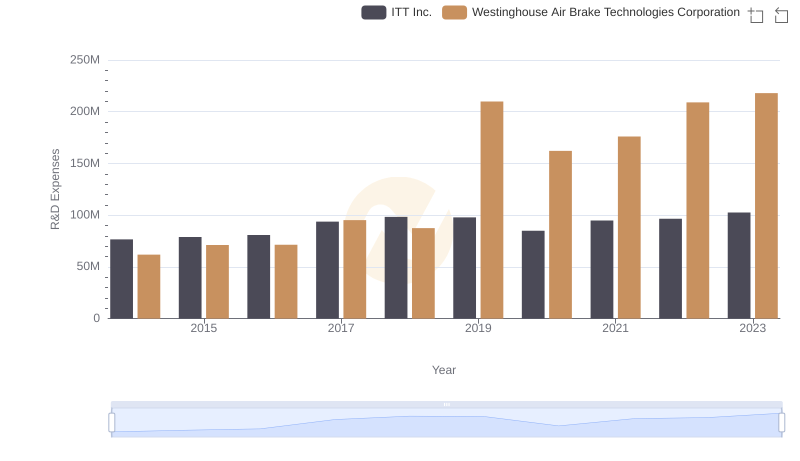

R&D Insights: How Westinghouse Air Brake Technologies Corporation and ITT Inc. Allocate Funds