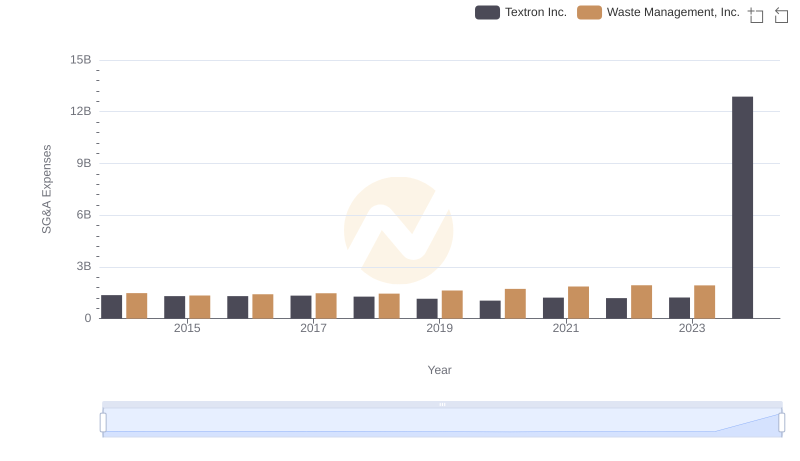

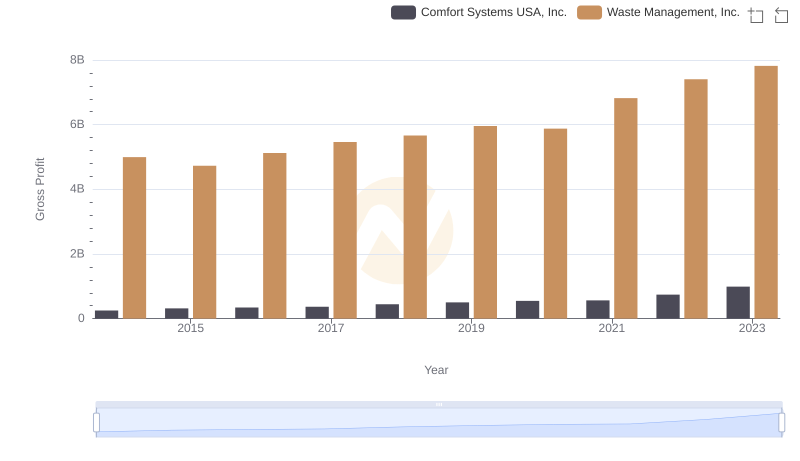

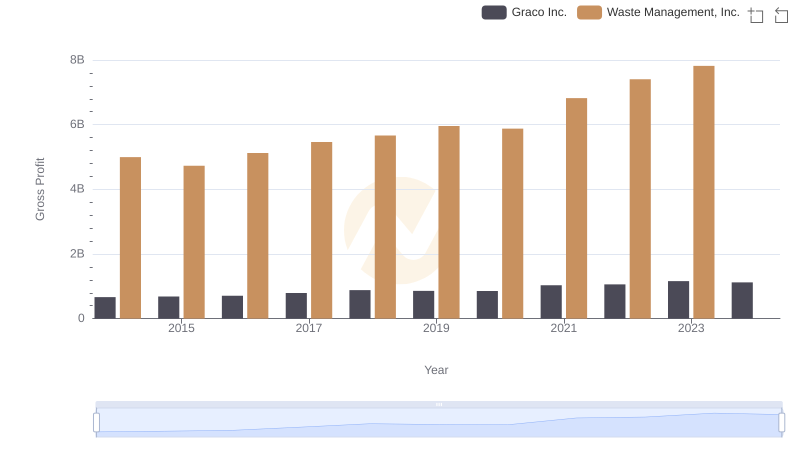

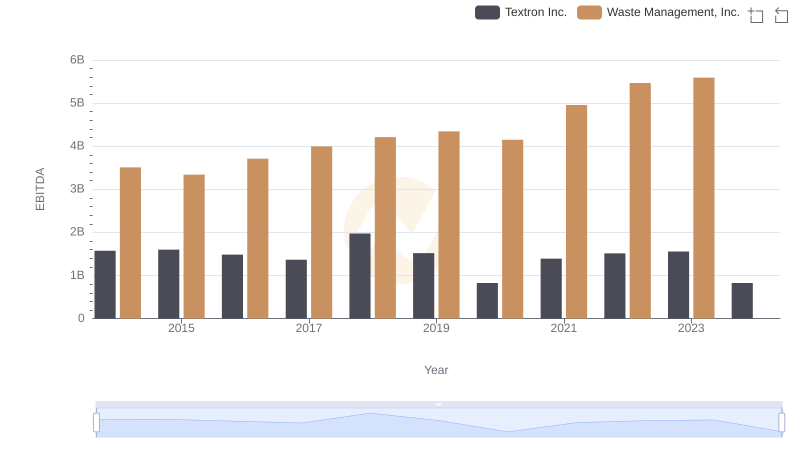

| __timestamp | Textron Inc. | Waste Management, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2457000000 | 4994000000 |

| Thursday, January 1, 2015 | 2444000000 | 4730000000 |

| Friday, January 1, 2016 | 2477000000 | 5123000000 |

| Sunday, January 1, 2017 | 2403000000 | 5464000000 |

| Monday, January 1, 2018 | 2378000000 | 5665000000 |

| Tuesday, January 1, 2019 | 2224000000 | 5959000000 |

| Wednesday, January 1, 2020 | 1557000000 | 5877000000 |

| Friday, January 1, 2021 | 2085000000 | 6820000000 |

| Saturday, January 1, 2022 | 2069000000 | 7404000000 |

| Sunday, January 1, 2023 | 2278000000 | 7820000000 |

| Monday, January 1, 2024 | 2502000000 | 8680000000 |

Igniting the spark of knowledge

In the ever-evolving landscape of American industry, Waste Management, Inc. and Textron Inc. stand as titans in their respective fields. Over the past decade, from 2014 to 2023, these companies have showcased distinct trajectories in gross profit growth. Waste Management, Inc. has consistently demonstrated robust growth, with a remarkable 57% increase in gross profit, peaking at $7.82 billion in 2023. This growth underscores the company's strategic prowess in capitalizing on the increasing demand for sustainable waste solutions.

Conversely, Textron Inc. experienced a more volatile journey, with gross profits fluctuating significantly. Despite a dip in 2020, Textron's gross profit surged by 550% in 2024, reaching an unprecedented $13.7 billion. This dramatic rise highlights Textron's resilience and adaptability in the face of economic challenges. However, data for Waste Management, Inc. in 2024 remains unavailable, leaving room for speculation on its future performance.

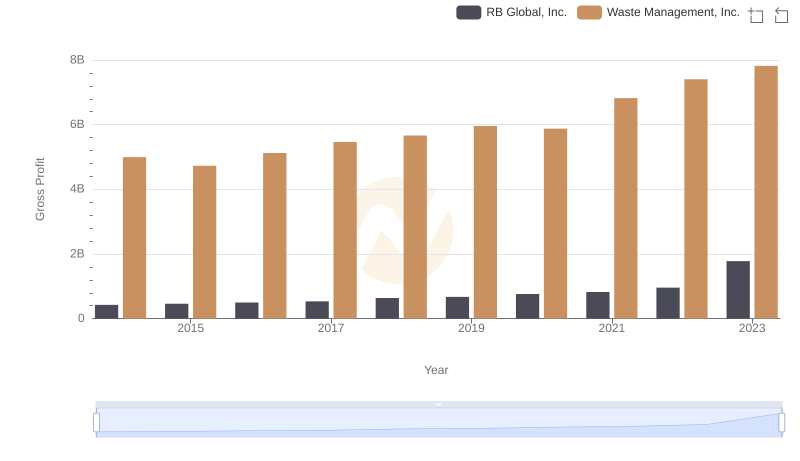

Gross Profit Comparison: Waste Management, Inc. and RB Global, Inc. Trends

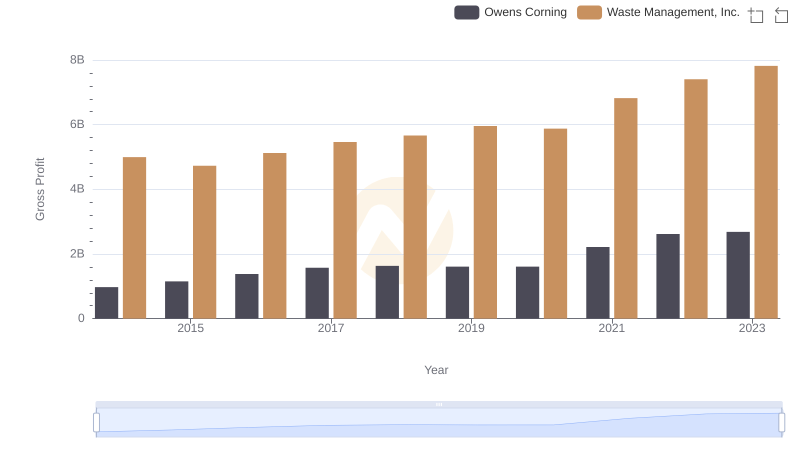

Key Insights on Gross Profit: Waste Management, Inc. vs Owens Corning

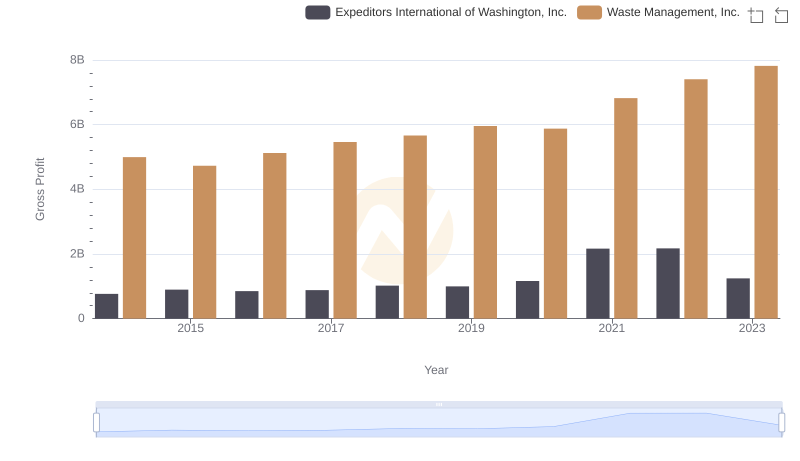

Who Generates Higher Gross Profit? Waste Management, Inc. or Expeditors International of Washington, Inc.

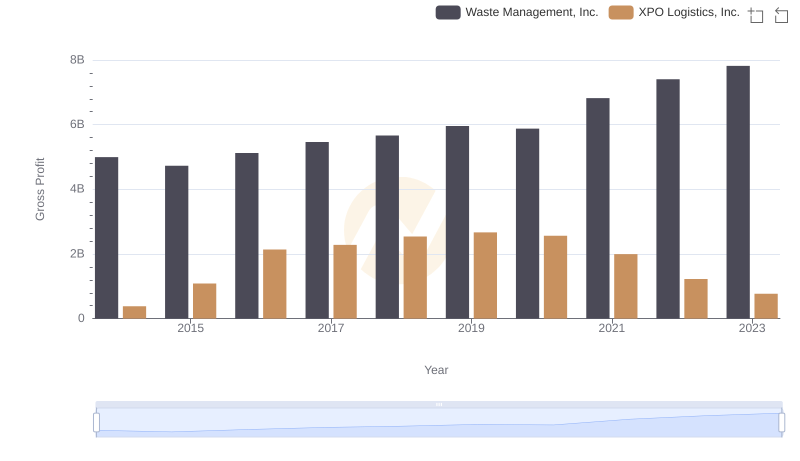

Gross Profit Analysis: Comparing Waste Management, Inc. and XPO Logistics, Inc.

Waste Management, Inc. vs Textron Inc.: Examining Key Revenue Metrics

Key Insights on Gross Profit: Waste Management, Inc. vs ZTO Express (Cayman) Inc.

Waste Management, Inc. vs Textron Inc.: SG&A Expense Trends

Who Generates Higher Gross Profit? Waste Management, Inc. or Comfort Systems USA, Inc.

Gross Profit Analysis: Comparing Waste Management, Inc. and Graco Inc.

Professional EBITDA Benchmarking: Waste Management, Inc. vs Textron Inc.