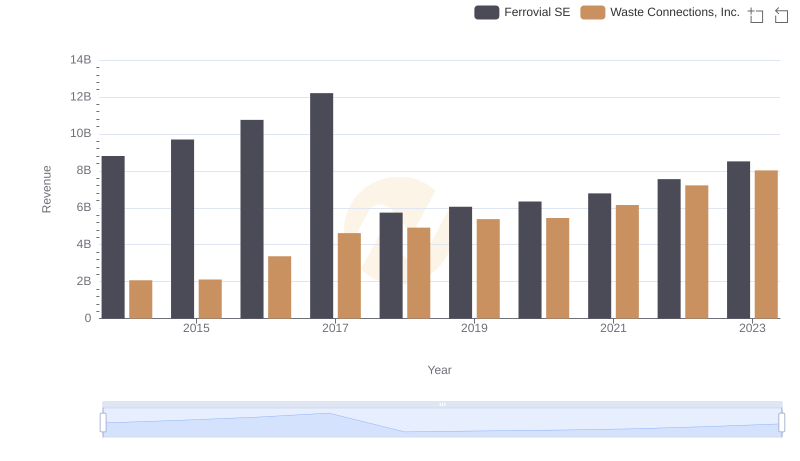

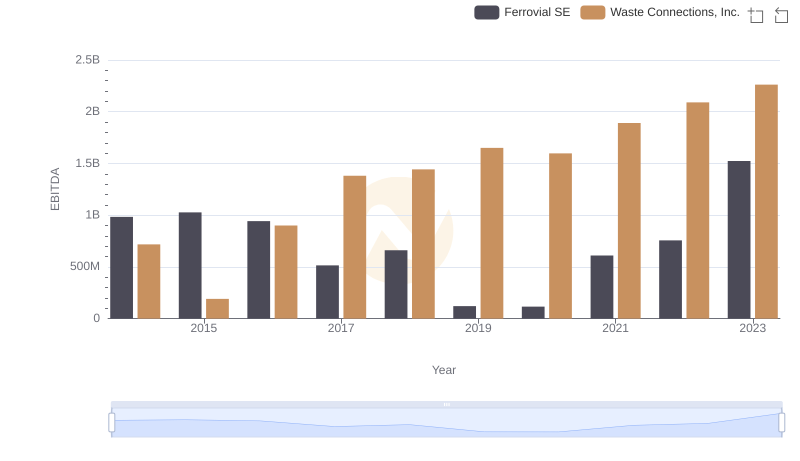

| __timestamp | Ferrovial SE | Waste Connections, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 7671000000 | 940778000 |

| Thursday, January 1, 2015 | 8556000000 | 939878000 |

| Friday, January 1, 2016 | 9491000000 | 1418151000 |

| Sunday, January 1, 2017 | 10864000000 | 1925713000 |

| Monday, January 1, 2018 | 4752000000 | 2057237000 |

| Tuesday, January 1, 2019 | 5105000000 | 2189922000 |

| Wednesday, January 1, 2020 | 5336000000 | 2169182000 |

| Friday, January 1, 2021 | 5701000000 | 2497287000 |

| Saturday, January 1, 2022 | 6354000000 | 2875847000 |

| Sunday, January 1, 2023 | 7385000000 | 3277438000 |

| Monday, January 1, 2024 | 3727885000 |

Unleashing the power of data

In the world of waste management and infrastructure, Waste Connections, Inc. and Ferrovial SE stand as titans. Over the past decade, these companies have showcased contrasting trajectories in gross profit performance. From 2014 to 2023, Ferrovial SE's gross profit saw a decline of approximately 4% from its peak in 2017, while Waste Connections, Inc. experienced a robust growth of around 248% during the same period.

These trends highlight the dynamic nature of the industry and the strategic maneuvers by each company to maintain their market positions.

Revenue Showdown: Waste Connections, Inc. vs Ferrovial SE

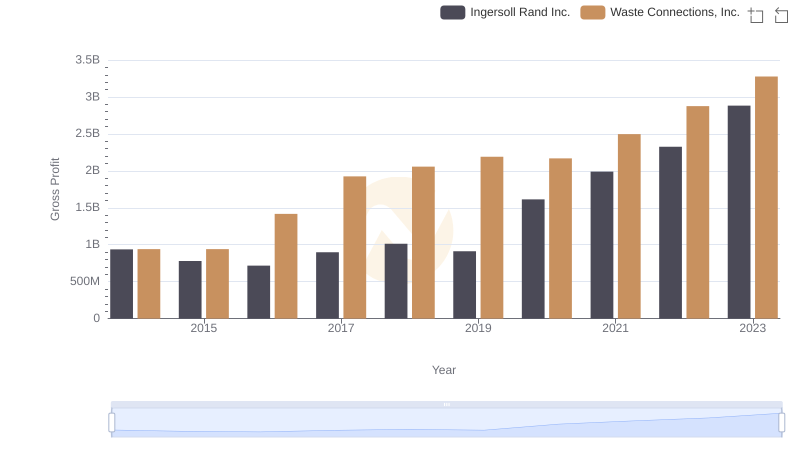

Waste Connections, Inc. vs Ingersoll Rand Inc.: A Gross Profit Performance Breakdown

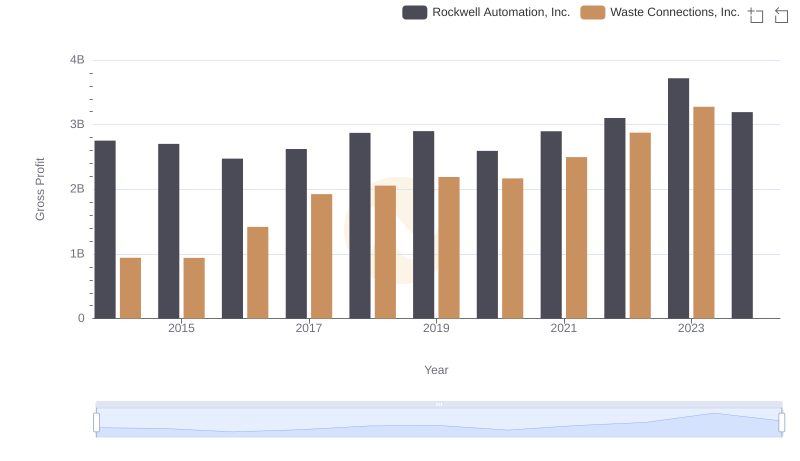

Waste Connections, Inc. and Rockwell Automation, Inc.: A Detailed Gross Profit Analysis

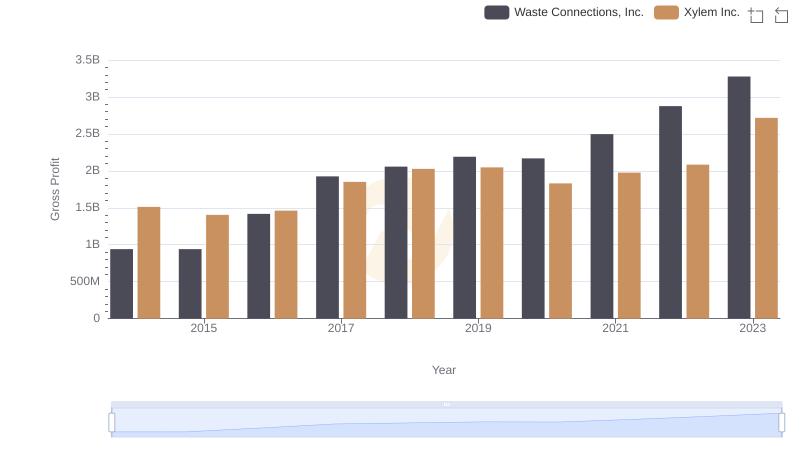

Waste Connections, Inc. vs Xylem Inc.: A Gross Profit Performance Breakdown

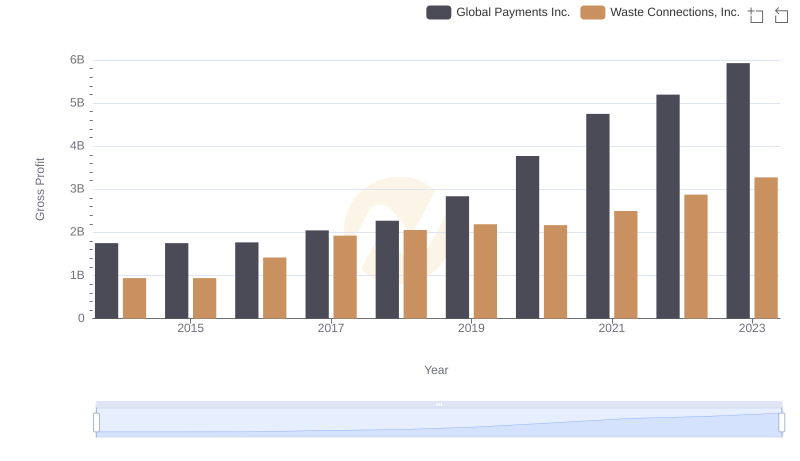

Gross Profit Trends Compared: Waste Connections, Inc. vs Global Payments Inc.

EBITDA Performance Review: Waste Connections, Inc. vs Ferrovial SE

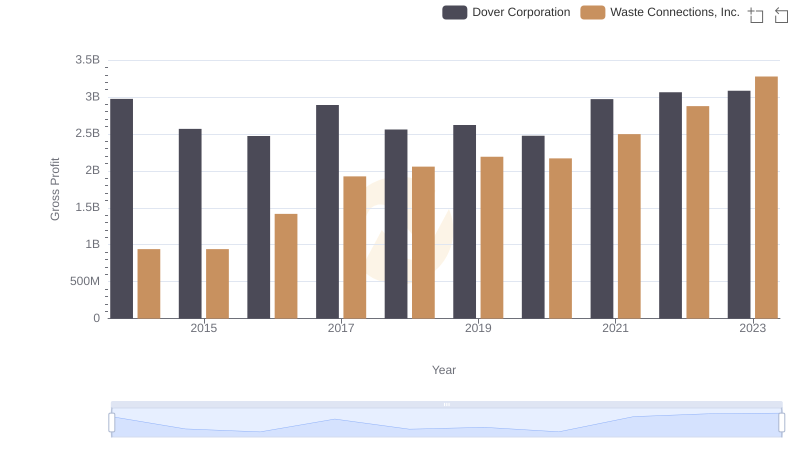

Waste Connections, Inc. and Dover Corporation: A Detailed Gross Profit Analysis

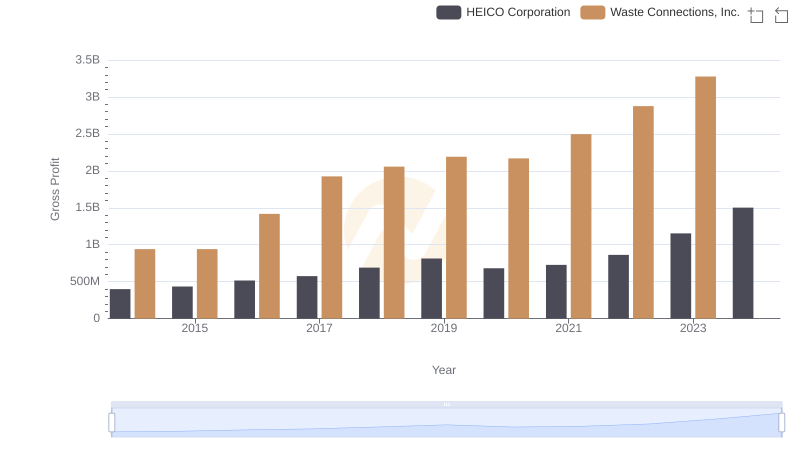

Gross Profit Analysis: Comparing Waste Connections, Inc. and HEICO Corporation