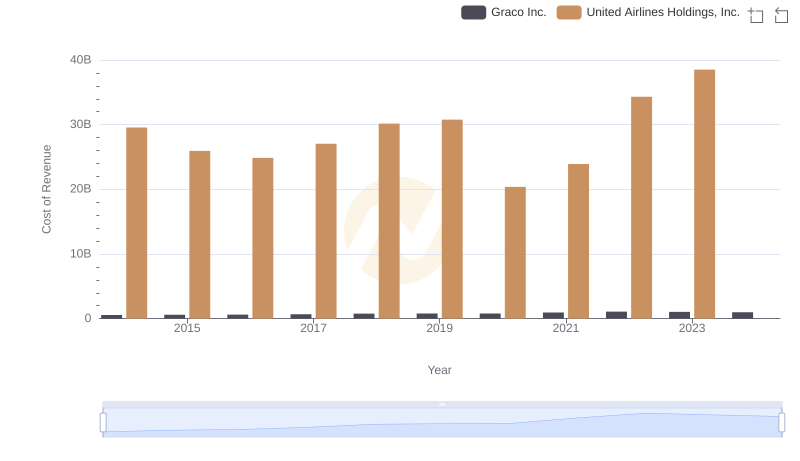

| __timestamp | Graco Inc. | United Airlines Holdings, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 303565000 | 1373000000 |

| Thursday, January 1, 2015 | 324016000 | 1342000000 |

| Friday, January 1, 2016 | 341734000 | 1303000000 |

| Sunday, January 1, 2017 | 372496000 | 1349000000 |

| Monday, January 1, 2018 | 382988000 | 1558000000 |

| Tuesday, January 1, 2019 | 367743000 | 1651000000 |

| Wednesday, January 1, 2020 | 355796000 | 459000000 |

| Friday, January 1, 2021 | 422975000 | 677000000 |

| Saturday, January 1, 2022 | 404731000 | 1535000000 |

| Sunday, January 1, 2023 | 432156000 | 1977000000 |

| Monday, January 1, 2024 | 465133000 | 2231000000 |

In pursuit of knowledge

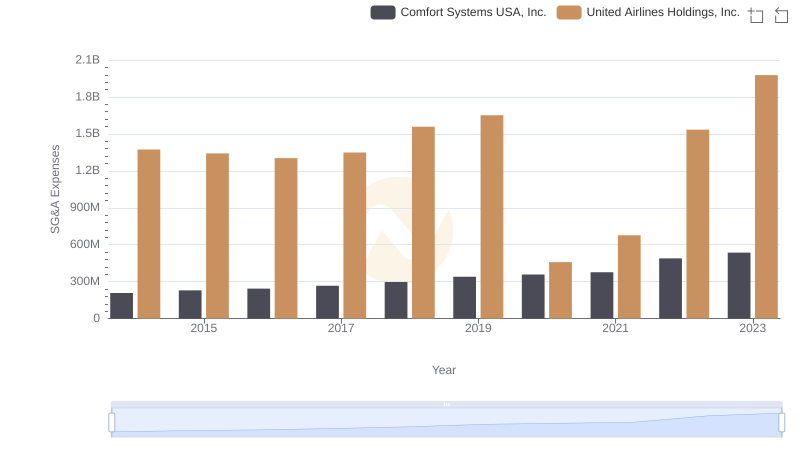

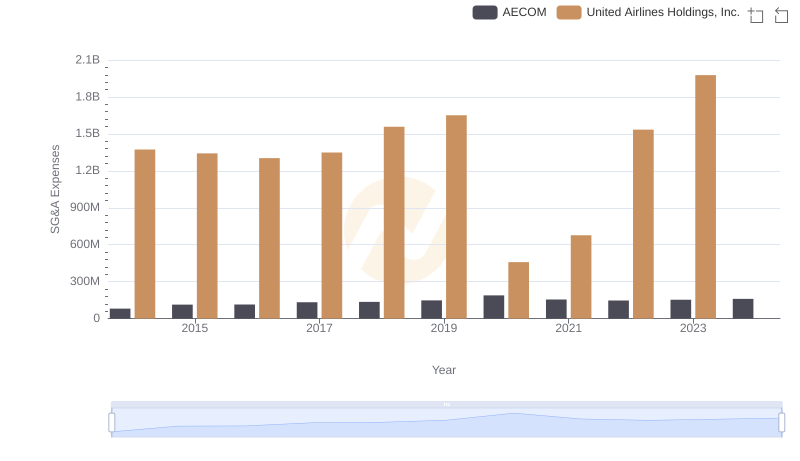

In the competitive world of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. From 2014 to 2023, Graco Inc. consistently demonstrated a more stable approach to SG&A costs, with an average annual expense of approximately $380 million. In contrast, United Airlines Holdings, Inc. faced more volatility, with expenses ranging from $459 million in 2020 to nearly $2 billion in 2023.

Graco's SG&A expenses grew by about 53% over the decade, reflecting a steady and controlled increase. Meanwhile, United Airlines experienced a dramatic 330% rise in SG&A costs, highlighting the challenges faced by the airline industry, especially during the pandemic years. This data underscores the importance of strategic cost management in different sectors, with Graco showcasing a more consistent approach compared to the fluctuating expenses of United Airlines.

Cost Insights: Breaking Down United Airlines Holdings, Inc. and Graco Inc.'s Expenses

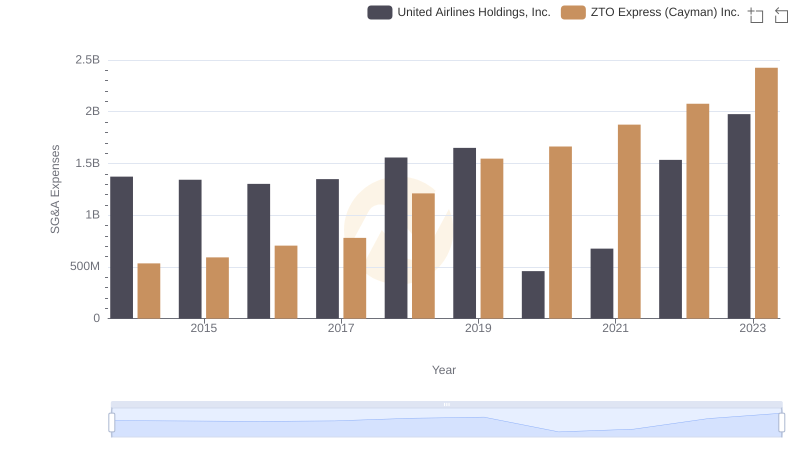

Selling, General, and Administrative Costs: United Airlines Holdings, Inc. vs ZTO Express (Cayman) Inc.

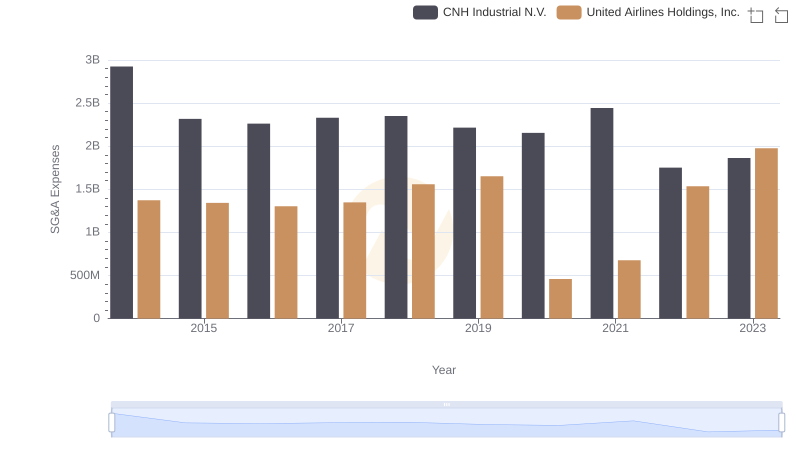

United Airlines Holdings, Inc. vs CNH Industrial N.V.: SG&A Expense Trends

Breaking Down SG&A Expenses: United Airlines Holdings, Inc. vs Comfort Systems USA, Inc.

Breaking Down SG&A Expenses: United Airlines Holdings, Inc. vs AECOM