| __timestamp | United Airlines Holdings, Inc. | ZTO Express (Cayman) Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1373000000 | 534537000 |

| Thursday, January 1, 2015 | 1342000000 | 591738000 |

| Friday, January 1, 2016 | 1303000000 | 705995000 |

| Sunday, January 1, 2017 | 1349000000 | 780517000 |

| Monday, January 1, 2018 | 1558000000 | 1210717000 |

| Tuesday, January 1, 2019 | 1651000000 | 1546227000 |

| Wednesday, January 1, 2020 | 459000000 | 1663712000 |

| Friday, January 1, 2021 | 677000000 | 1875869000 |

| Saturday, January 1, 2022 | 1535000000 | 2077372000 |

| Sunday, January 1, 2023 | 1977000000 | 2425253000 |

| Monday, January 1, 2024 | 2231000000 |

Data in motion

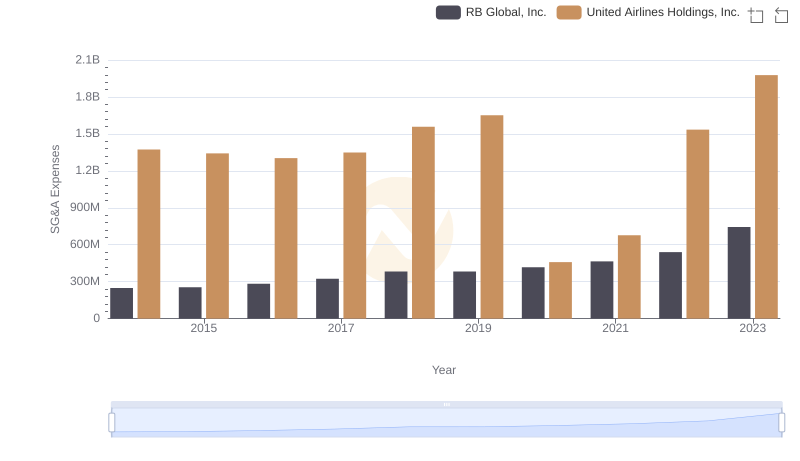

In the ever-evolving landscape of global business, the financial strategies of industry leaders like United Airlines Holdings, Inc. and ZTO Express (Cayman) Inc. offer a fascinating glimpse into their operational priorities. Over the past decade, these two giants have navigated the complexities of their respective industries with distinct approaches to Selling, General, and Administrative (SG&A) expenses.

From 2014 to 2023, United Airlines saw a steady increase in SG&A costs, peaking in 2023 with a 44% rise from 2014. This reflects their strategic investments in customer service and operational efficiency. In contrast, ZTO Express, a leader in logistics, experienced a staggering 354% increase in SG&A expenses over the same period, underscoring their aggressive expansion and technological advancements.

This comparison not only highlights the diverse challenges faced by these companies but also their commitment to growth and innovation in a competitive market.

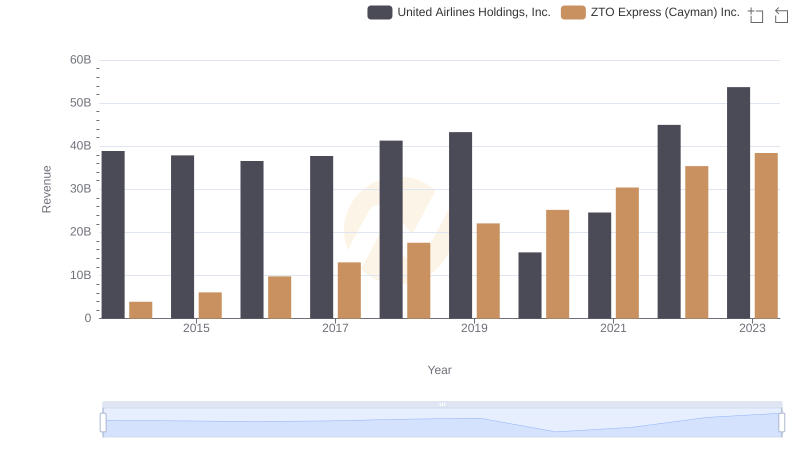

Revenue Showdown: United Airlines Holdings, Inc. vs ZTO Express (Cayman) Inc.

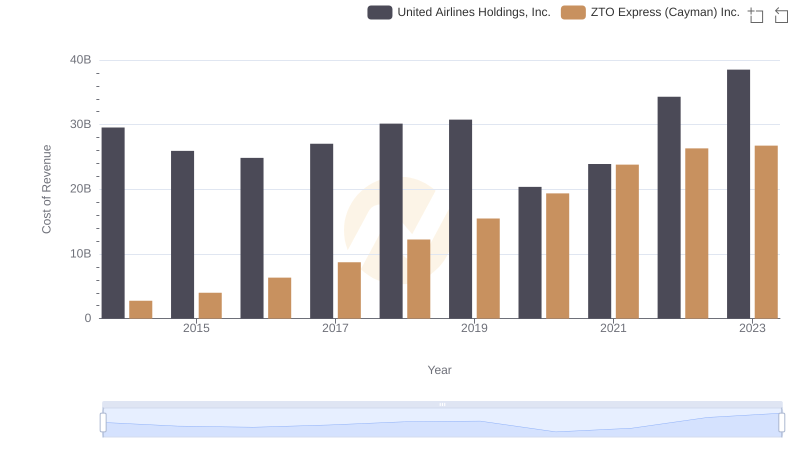

Cost Insights: Breaking Down United Airlines Holdings, Inc. and ZTO Express (Cayman) Inc.'s Expenses

United Airlines Holdings, Inc. vs RB Global, Inc.: SG&A Expense Trends

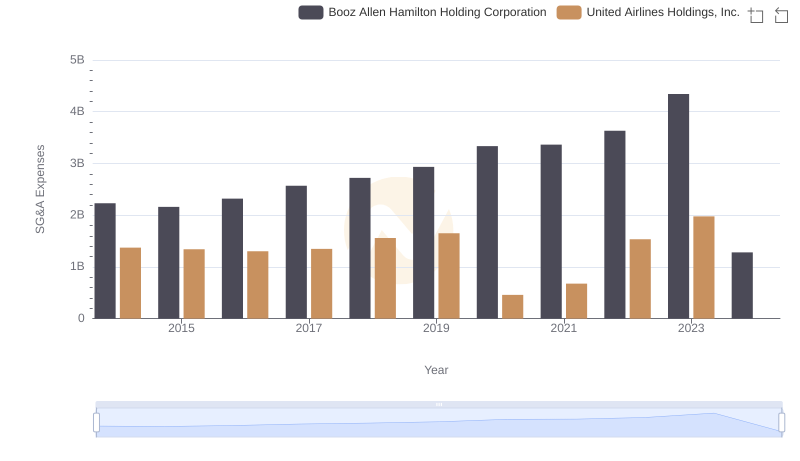

United Airlines Holdings, Inc. or Booz Allen Hamilton Holding Corporation: Who Manages SG&A Costs Better?