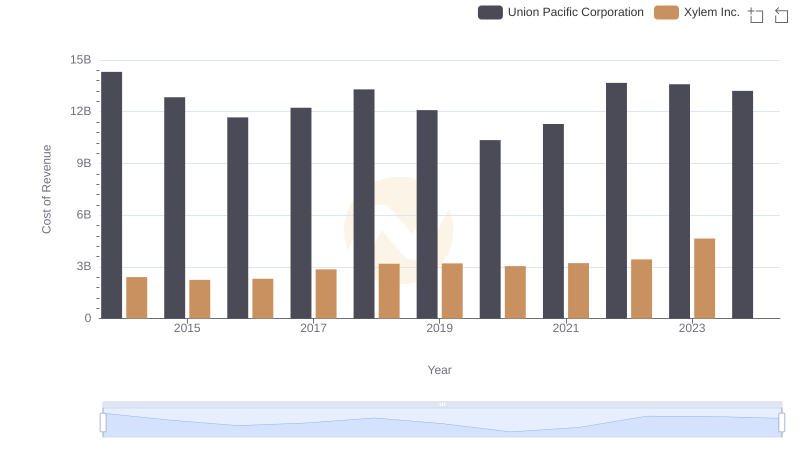

| __timestamp | Union Pacific Corporation | Xylem Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 10808000000 | 631000000 |

| Thursday, January 1, 2015 | 10290000000 | 588000000 |

| Friday, January 1, 2016 | 9502000000 | 637000000 |

| Sunday, January 1, 2017 | 10456000000 | 814000000 |

| Monday, January 1, 2018 | 10802000000 | 948000000 |

| Tuesday, January 1, 2019 | 11013000000 | 947000000 |

| Wednesday, January 1, 2020 | 10331000000 | 736000000 |

| Friday, January 1, 2021 | 11843000000 | 853000000 |

| Saturday, January 1, 2022 | 12636000000 | 755000000 |

| Sunday, January 1, 2023 | 11928000000 | 1150000000 |

| Monday, January 1, 2024 | 12461000000 |

Unveiling the hidden dimensions of data

In the world of industrial giants, Union Pacific Corporation and Xylem Inc. have carved distinct paths over the past decade. From 2014 to 2023, Union Pacific consistently outperformed Xylem in EBITDA, showcasing its robust financial health. Union Pacific's EBITDA grew by approximately 15% over this period, peaking in 2022 with a remarkable 1.26 times increase from its 2014 figures. In contrast, Xylem's EBITDA displayed a more volatile trajectory, with a notable surge in 2023, reaching its highest point at 1.15 times its 2014 value.

The data reveals Union Pacific's resilience, maintaining a steady upward trend despite economic fluctuations. Meanwhile, Xylem's performance, though less consistent, highlights its potential for growth. As we look to the future, these insights provide a compelling narrative of industrial evolution and financial strategy.

Cost of Revenue: Key Insights for Union Pacific Corporation and Xylem Inc.

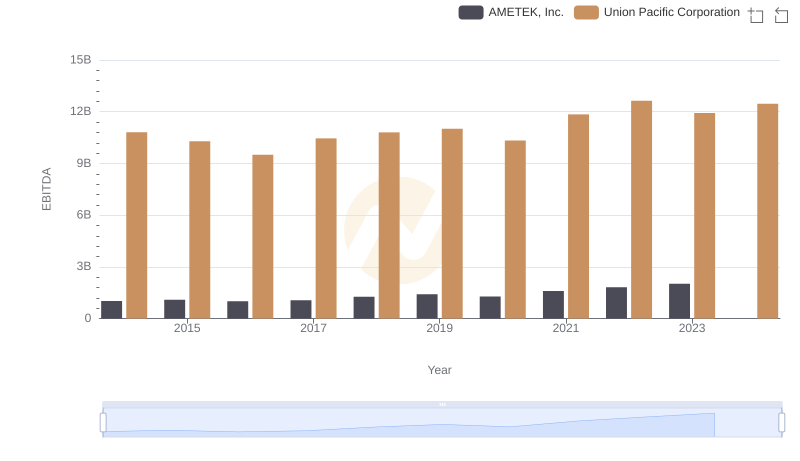

EBITDA Performance Review: Union Pacific Corporation vs AMETEK, Inc.

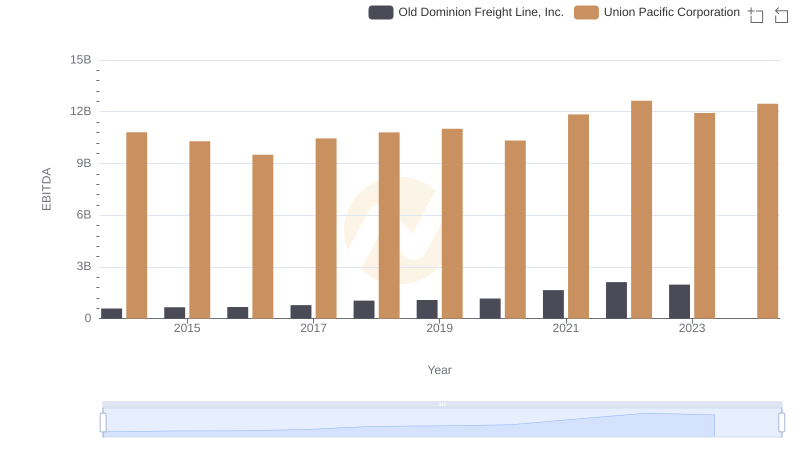

EBITDA Analysis: Evaluating Union Pacific Corporation Against Old Dominion Freight Line, Inc.

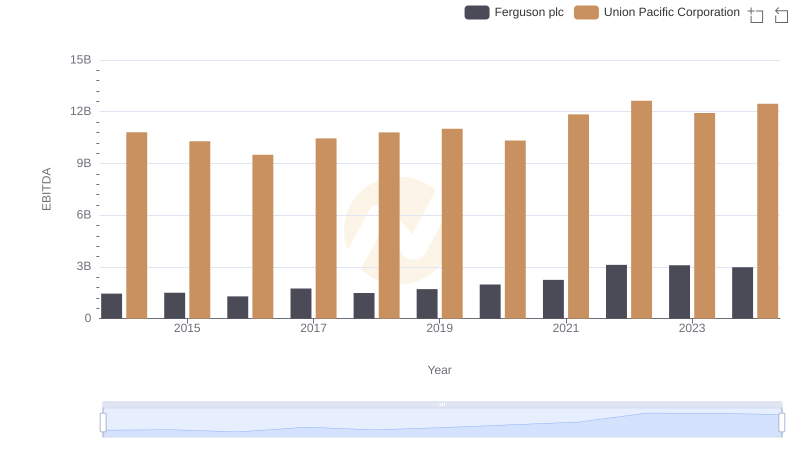

EBITDA Metrics Evaluated: Union Pacific Corporation vs Ferguson plc

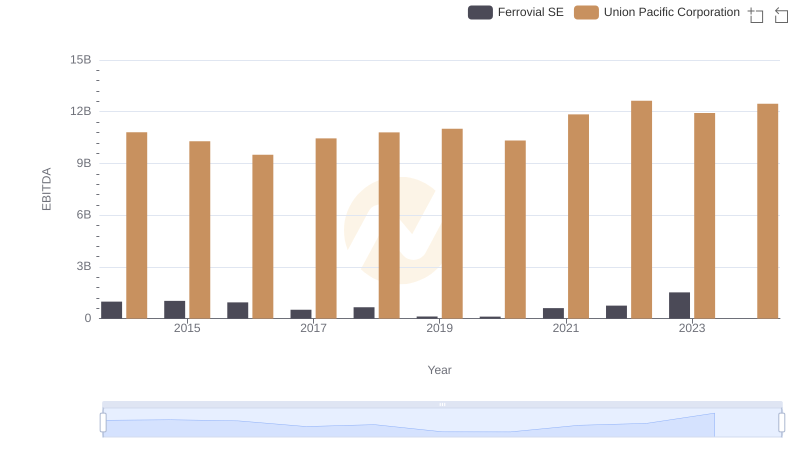

Union Pacific Corporation and Ferrovial SE: A Detailed Examination of EBITDA Performance

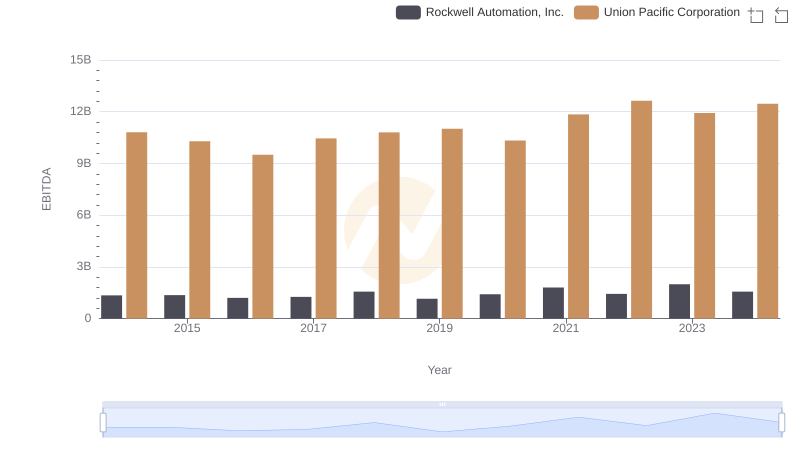

Union Pacific Corporation vs Rockwell Automation, Inc.: In-Depth EBITDA Performance Comparison