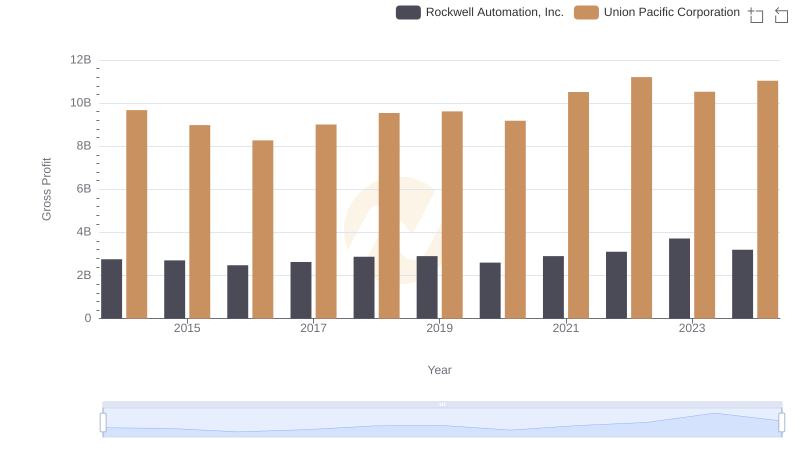

| __timestamp | Rockwell Automation, Inc. | Union Pacific Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1346000000 | 10808000000 |

| Thursday, January 1, 2015 | 1359100000 | 10290000000 |

| Friday, January 1, 2016 | 1200700000 | 9502000000 |

| Sunday, January 1, 2017 | 1258400000 | 10456000000 |

| Monday, January 1, 2018 | 1568400000 | 10802000000 |

| Tuesday, January 1, 2019 | 1150200000 | 11013000000 |

| Wednesday, January 1, 2020 | 1410200000 | 10331000000 |

| Friday, January 1, 2021 | 1808300000 | 11843000000 |

| Saturday, January 1, 2022 | 1432100000 | 12636000000 |

| Sunday, January 1, 2023 | 1990700000 | 11928000000 |

| Monday, January 1, 2024 | 1567500000 | 12461000000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of American industry, Union Pacific Corporation and Rockwell Automation, Inc. stand as giants in their respective fields. Over the past decade, from 2014 to 2024, these companies have showcased remarkable EBITDA performance, reflecting their resilience and strategic prowess.

Union Pacific, a leader in the transportation sector, has consistently demonstrated robust financial health. With an average annual EBITDA of approximately $11 billion, the company has seen a steady increase, peaking in 2022 with a 33% rise from its 2016 low.

Rockwell Automation, a key player in industrial automation, has experienced a more volatile trajectory. Despite fluctuations, the company achieved a significant milestone in 2023, with a 47% increase in EBITDA compared to 2016, underscoring its adaptability and innovation.

This comparison highlights the diverse strategies and market conditions influencing these industrial powerhouses.

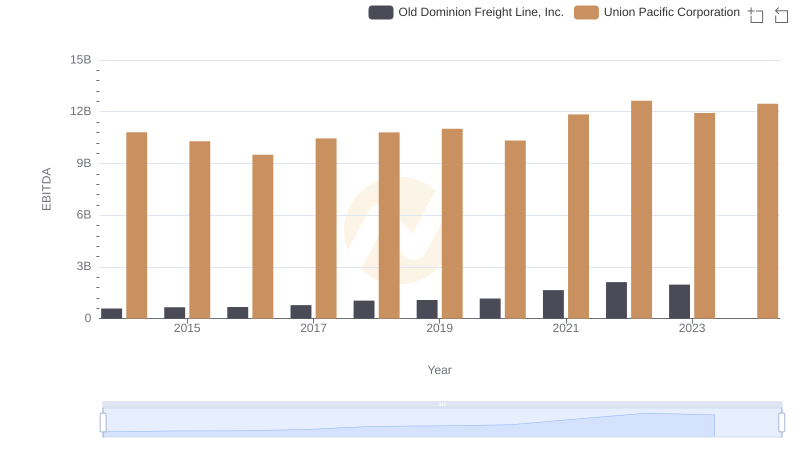

EBITDA Analysis: Evaluating Union Pacific Corporation Against Old Dominion Freight Line, Inc.

Gross Profit Analysis: Comparing Union Pacific Corporation and Rockwell Automation, Inc.

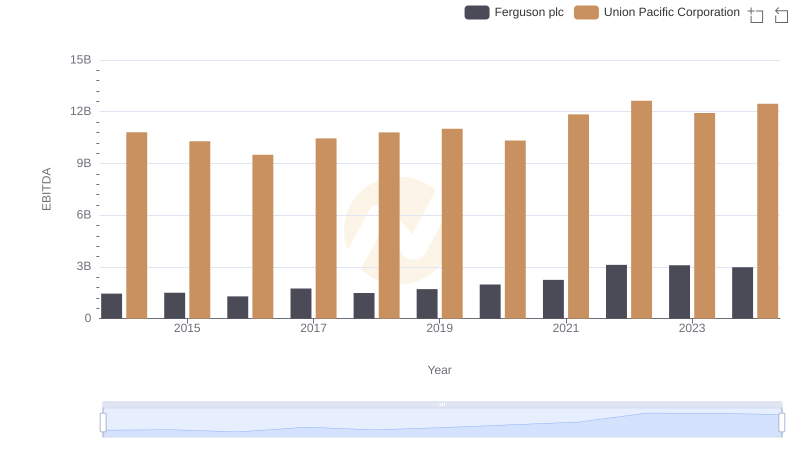

EBITDA Metrics Evaluated: Union Pacific Corporation vs Ferguson plc

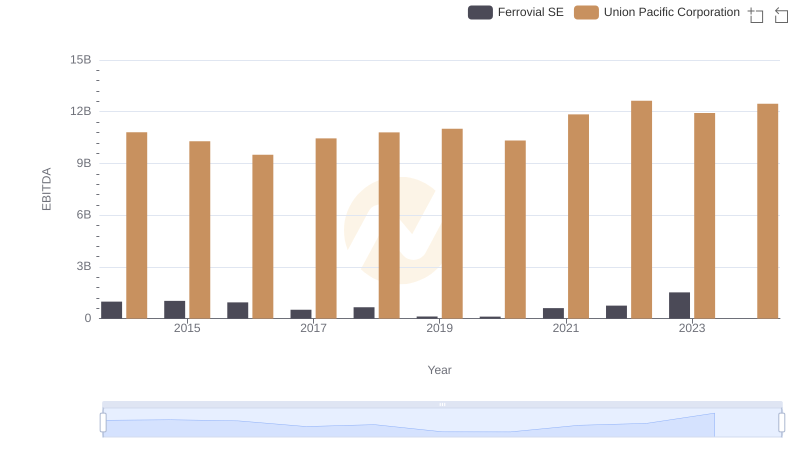

Union Pacific Corporation and Ferrovial SE: A Detailed Examination of EBITDA Performance

Union Pacific Corporation vs Xylem Inc.: In-Depth EBITDA Performance Comparison

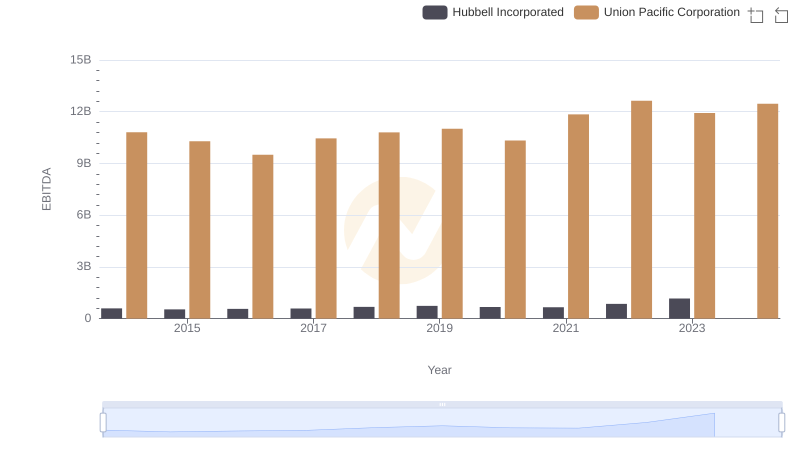

Union Pacific Corporation and Hubbell Incorporated: A Detailed Examination of EBITDA Performance