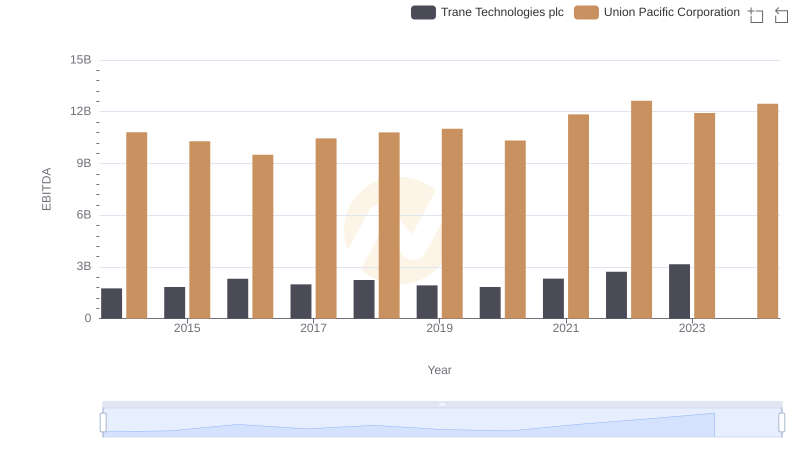

| __timestamp | Trane Technologies plc | Union Pacific Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 3908600000 | 9677000000 |

| Thursday, January 1, 2015 | 3999100000 | 8976000000 |

| Friday, January 1, 2016 | 4179600000 | 8269000000 |

| Sunday, January 1, 2017 | 4386000000 | 9009000000 |

| Monday, January 1, 2018 | 4820600000 | 9539000000 |

| Tuesday, January 1, 2019 | 5147400000 | 9614000000 |

| Wednesday, January 1, 2020 | 3803400000 | 9179000000 |

| Friday, January 1, 2021 | 4469600000 | 10514000000 |

| Saturday, January 1, 2022 | 4964800000 | 11205000000 |

| Sunday, January 1, 2023 | 5857200000 | 10529000000 |

| Monday, January 1, 2024 | 7080500000 | 11039000000 |

Cracking the code

In the world of industrial titans, Union Pacific Corporation and Trane Technologies plc have long been stalwarts of their respective sectors. Over the past decade, these companies have demonstrated remarkable resilience and growth in their gross profit margins. From 2014 to 2023, Union Pacific consistently outperformed Trane Technologies, with gross profits peaking at approximately $11.2 billion in 2022, a 16% increase from 2014. Meanwhile, Trane Technologies saw a significant rise in its gross profit, reaching nearly $5.9 billion in 2023, marking a 50% growth over the same period.

However, the data for 2024 reveals a gap for Trane Technologies, indicating a potential shift or anomaly in their financial reporting. This comparison not only highlights the robust performance of these industrial leaders but also underscores the dynamic nature of the market, where strategic decisions and market conditions can lead to varying financial outcomes.

Union Pacific Corporation vs Deere & Company: A Gross Profit Performance Breakdown

Cost Insights: Breaking Down Union Pacific Corporation and Trane Technologies plc's Expenses

Union Pacific Corporation vs Cintas Corporation: A Gross Profit Performance Breakdown

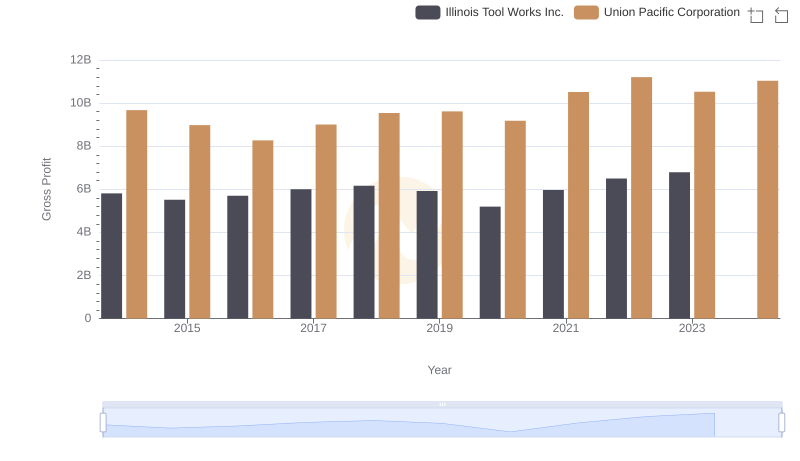

Union Pacific Corporation vs Illinois Tool Works Inc.: A Gross Profit Performance Breakdown

Comparative EBITDA Analysis: Union Pacific Corporation vs Trane Technologies plc