| __timestamp | Hubbell Incorporated | Union Pacific Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 594700000 | 10808000000 |

| Thursday, January 1, 2015 | 533600000 | 10290000000 |

| Friday, January 1, 2016 | 564700000 | 9502000000 |

| Sunday, January 1, 2017 | 585600000 | 10456000000 |

| Monday, January 1, 2018 | 677500000 | 10802000000 |

| Tuesday, January 1, 2019 | 740900000 | 11013000000 |

| Wednesday, January 1, 2020 | 671400000 | 10331000000 |

| Friday, January 1, 2021 | 661000000 | 11843000000 |

| Saturday, January 1, 2022 | 854300000 | 12636000000 |

| Sunday, January 1, 2023 | 1169700000 | 11928000000 |

| Monday, January 1, 2024 | 1291200000 | 12461000000 |

Igniting the spark of knowledge

In the ever-evolving landscape of American industry, Union Pacific Corporation and Hubbell Incorporated stand as titans in their respective fields. From 2014 to 2023, these companies have showcased distinct trajectories in their EBITDA performance, a key indicator of financial health. Union Pacific, a leader in the transportation sector, consistently demonstrated robust growth, with EBITDA peaking at approximately $12.6 billion in 2022, marking a 33% increase from its 2016 low. Meanwhile, Hubbell, a stalwart in electrical products, saw a remarkable 118% surge in EBITDA from 2015 to 2023, reaching nearly $1.17 billion. This growth underscores Hubbell's strategic adaptability in a competitive market. Notably, 2024 data for Hubbell is absent, leaving room for speculation on its future performance. This analysis not only highlights the resilience of these corporations but also offers insights into broader economic trends.

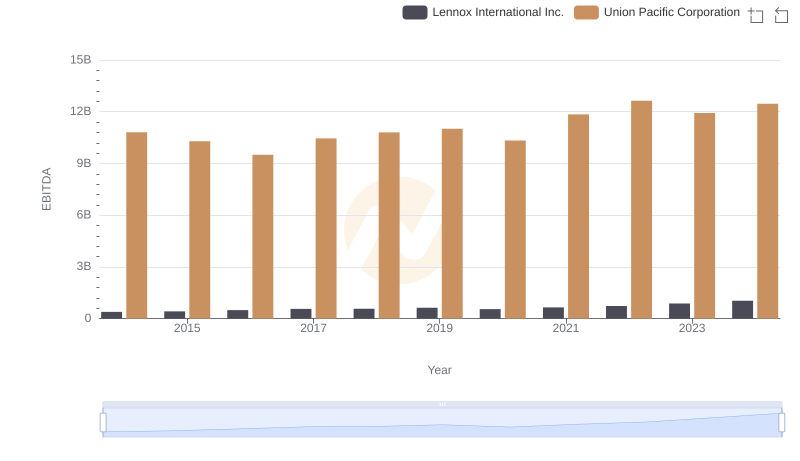

Union Pacific Corporation and Lennox International Inc.: A Detailed Examination of EBITDA Performance

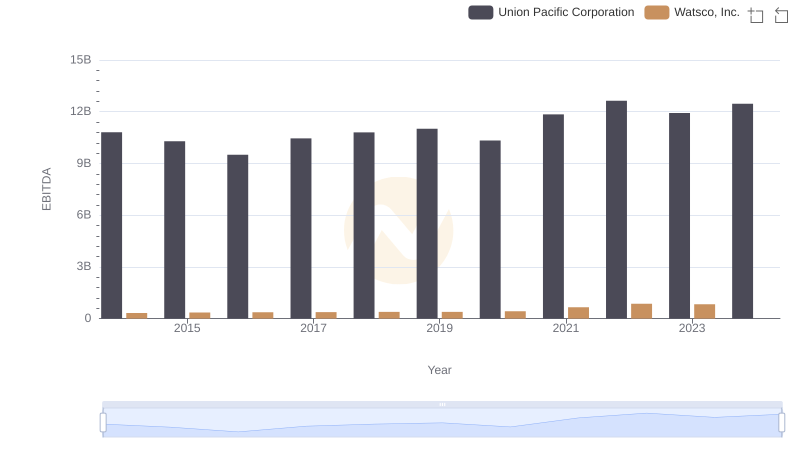

Comparative EBITDA Analysis: Union Pacific Corporation vs Watsco, Inc.

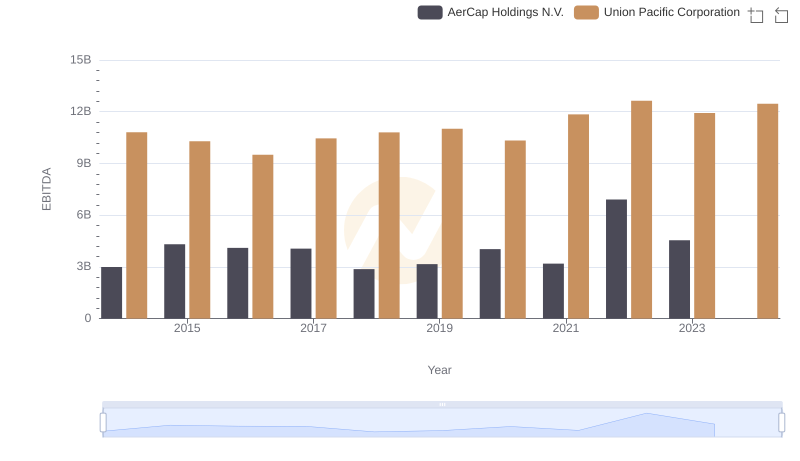

Comparative EBITDA Analysis: Union Pacific Corporation vs AerCap Holdings N.V.

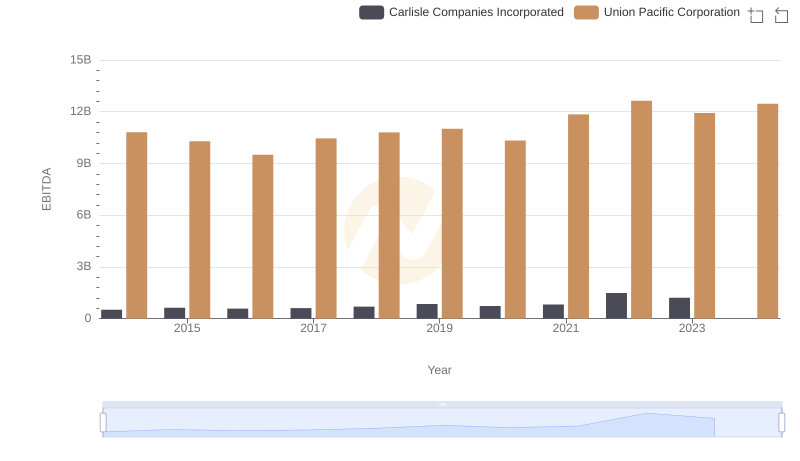

A Side-by-Side Analysis of EBITDA: Union Pacific Corporation and Carlisle Companies Incorporated