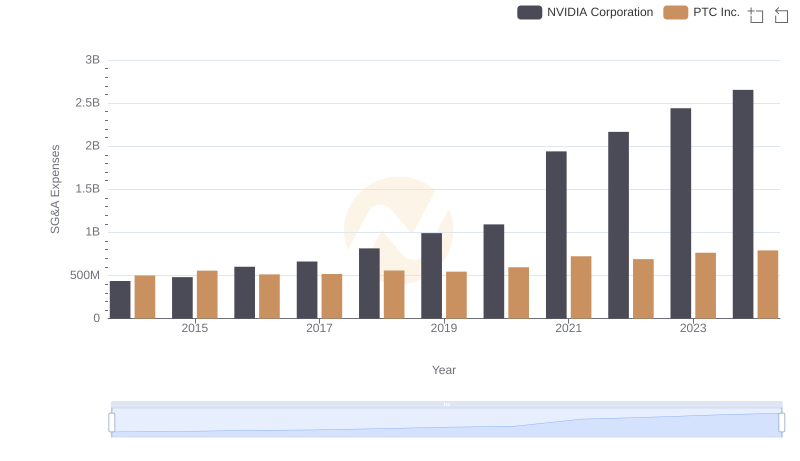

| __timestamp | PTC Inc. | TE Connectivity Ltd. |

|---|---|---|

| Wednesday, January 1, 2014 | 499679000 | 1882000000 |

| Thursday, January 1, 2015 | 557301000 | 1504000000 |

| Friday, January 1, 2016 | 513080000 | 1463000000 |

| Sunday, January 1, 2017 | 518013000 | 1591000000 |

| Monday, January 1, 2018 | 557505000 | 1594000000 |

| Tuesday, January 1, 2019 | 545368000 | 1490000000 |

| Wednesday, January 1, 2020 | 595277000 | 1392000000 |

| Friday, January 1, 2021 | 723785000 | 1512000000 |

| Saturday, January 1, 2022 | 689979000 | 1584000000 |

| Sunday, January 1, 2023 | 763641000 | 1670000000 |

| Monday, January 1, 2024 | 791331000 | 1732000000 |

Data in motion

In the competitive landscape of technology and connectivity, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Over the past decade, TE Connectivity Ltd. and PTC Inc. have shown distinct approaches to handling these costs. From 2014 to 2024, TE Connectivity consistently reported higher SG&A expenses, peaking at approximately $1.73 billion in 2024. In contrast, PTC Inc.'s expenses grew steadily, reaching around $791 million in the same year. Despite TE Connectivity's larger scale, PTC Inc. demonstrated a more controlled growth in SG&A costs, with an average annual increase of about 5%. This strategic management could indicate a more efficient cost structure, potentially offering a competitive edge. As businesses navigate economic uncertainties, understanding these financial strategies becomes essential for investors and stakeholders alike.

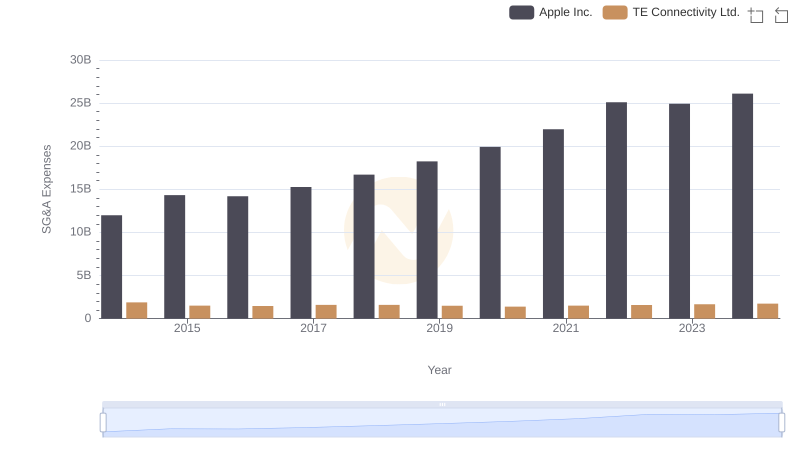

Apple Inc. or TE Connectivity Ltd.: Who Manages SG&A Costs Better?

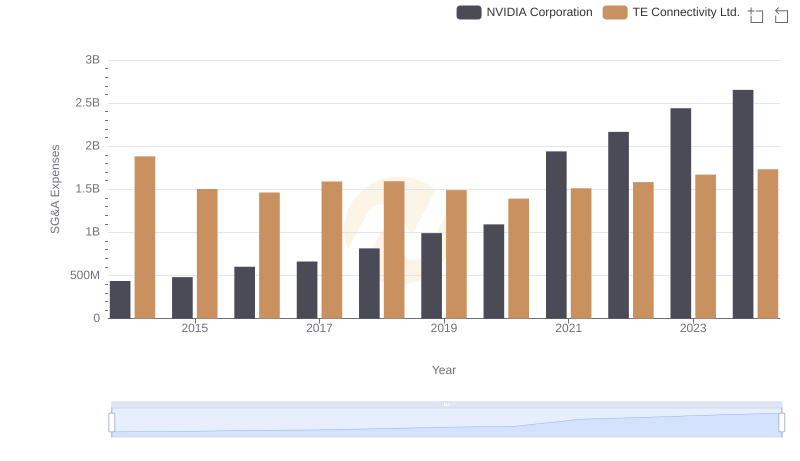

Comparing SG&A Expenses: NVIDIA Corporation vs TE Connectivity Ltd. Trends and Insights

NVIDIA Corporation or PTC Inc.: Who Manages SG&A Costs Better?

Taiwan Semiconductor Manufacturing Company Limited vs TE Connectivity Ltd.: SG&A Expense Trends

Comparing SG&A Expenses: Taiwan Semiconductor Manufacturing Company Limited vs PTC Inc. Trends and Insights

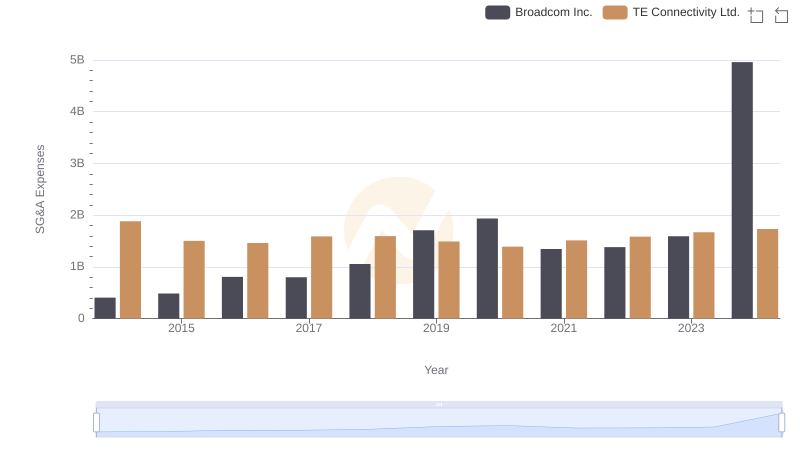

Breaking Down SG&A Expenses: Broadcom Inc. vs TE Connectivity Ltd.

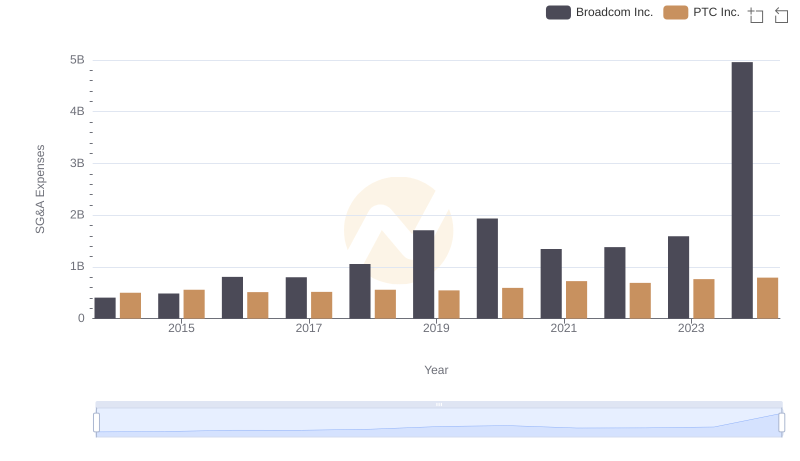

Who Optimizes SG&A Costs Better? Broadcom Inc. or PTC Inc.

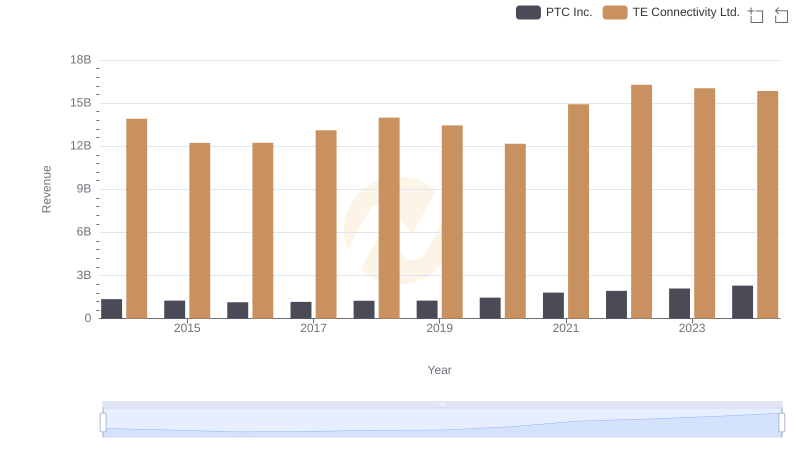

Revenue Showdown: TE Connectivity Ltd. vs PTC Inc.

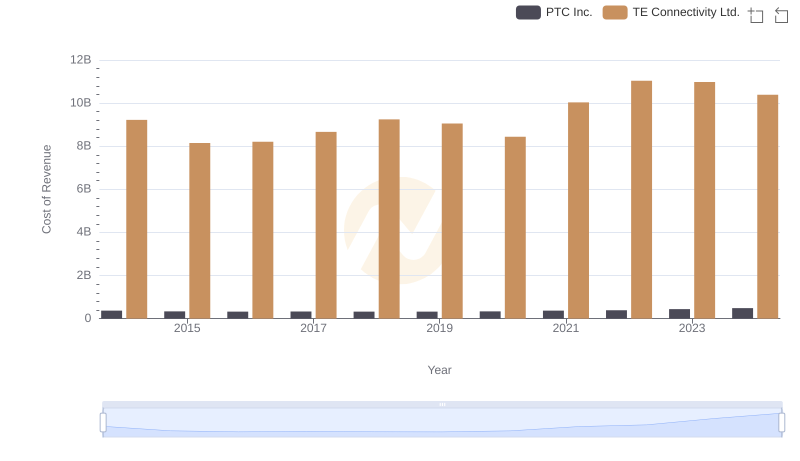

Cost of Revenue Trends: TE Connectivity Ltd. vs PTC Inc.

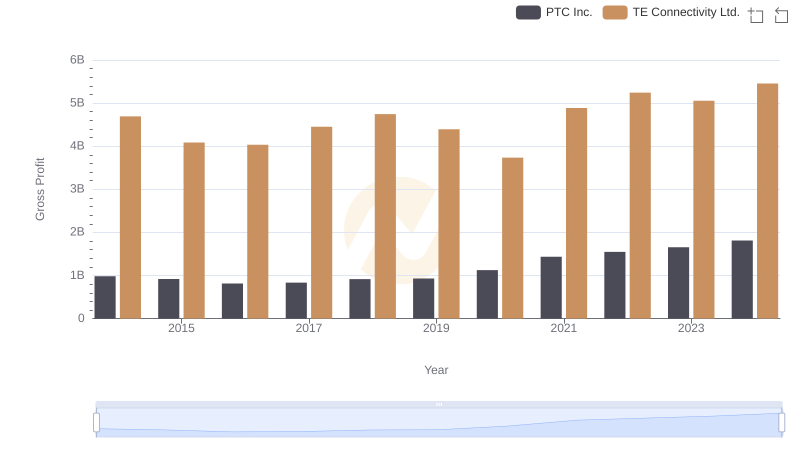

Gross Profit Comparison: TE Connectivity Ltd. and PTC Inc. Trends

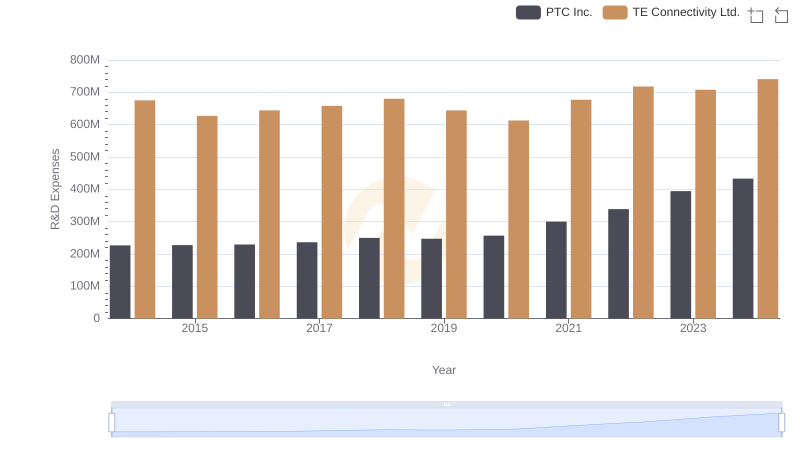

Analyzing R&D Budgets: TE Connectivity Ltd. vs PTC Inc.

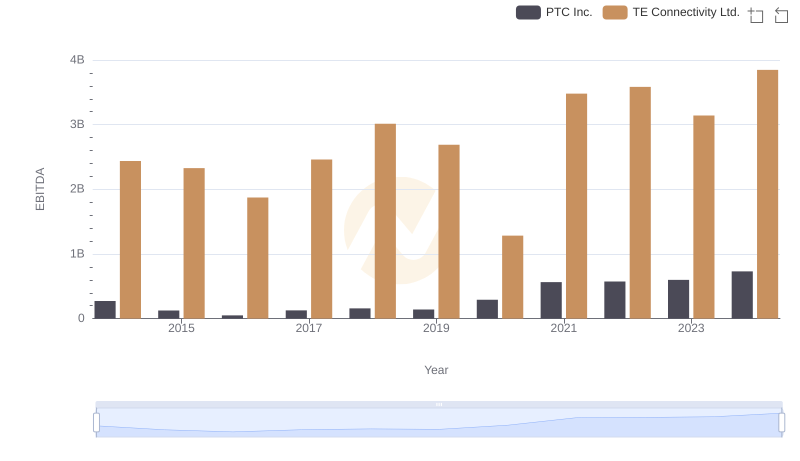

A Side-by-Side Analysis of EBITDA: TE Connectivity Ltd. and PTC Inc.