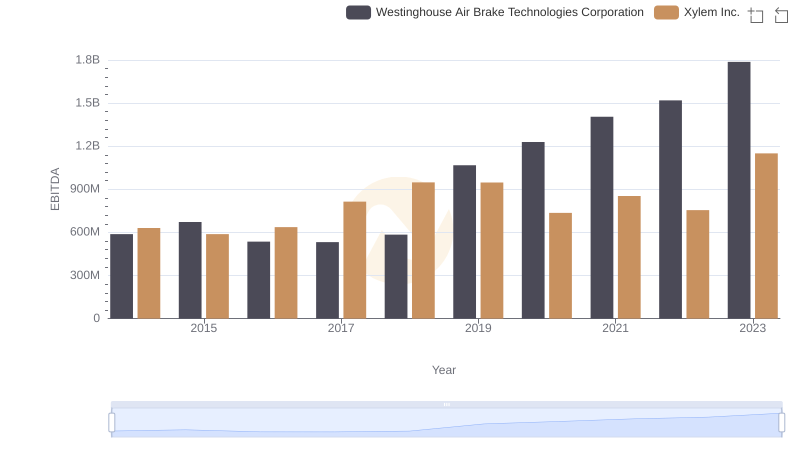

| __timestamp | Westinghouse Air Brake Technologies Corporation | Xylem Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 324539000 | 920000000 |

| Thursday, January 1, 2015 | 319173000 | 854000000 |

| Friday, January 1, 2016 | 327505000 | 915000000 |

| Sunday, January 1, 2017 | 482852000 | 1090000000 |

| Monday, January 1, 2018 | 573644000 | 1161000000 |

| Tuesday, January 1, 2019 | 936600000 | 1158000000 |

| Wednesday, January 1, 2020 | 877100000 | 1143000000 |

| Friday, January 1, 2021 | 1005000000 | 1179000000 |

| Saturday, January 1, 2022 | 1020000000 | 1227000000 |

| Sunday, January 1, 2023 | 1139000000 | 1757000000 |

| Monday, January 1, 2024 | 1248000000 |

Infusing magic into the data realm

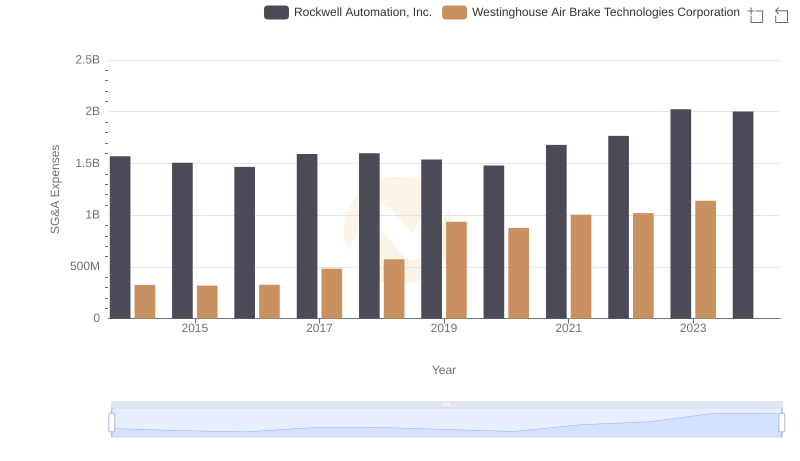

In the competitive landscape of industrial technology, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Westinghouse Air Brake Technologies Corporation and Xylem Inc. have been at the forefront of this challenge since 2014. Over the past decade, Xylem Inc. has consistently reported higher SG&A expenses, peaking at $1.76 billion in 2023, a 91% increase from 2014. In contrast, Westinghouse's SG&A expenses grew by 251% over the same period, reaching $1.14 billion in 2023. This data suggests that while Xylem Inc. has maintained a steady growth trajectory, Westinghouse has experienced a more volatile increase. The strategic management of these costs is pivotal, as it reflects each company's operational efficiency and adaptability in a rapidly evolving market. As investors and analysts scrutinize these figures, the ability to optimize SG&A expenses remains a key indicator of financial health and competitive advantage.

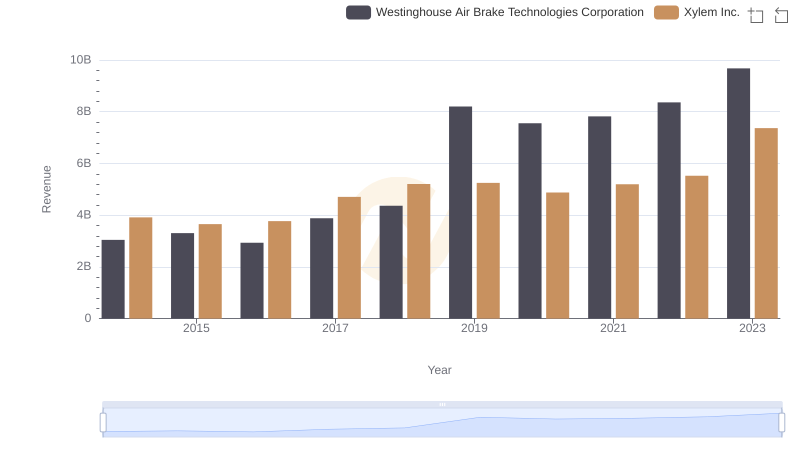

Who Generates More Revenue? Westinghouse Air Brake Technologies Corporation or Xylem Inc.

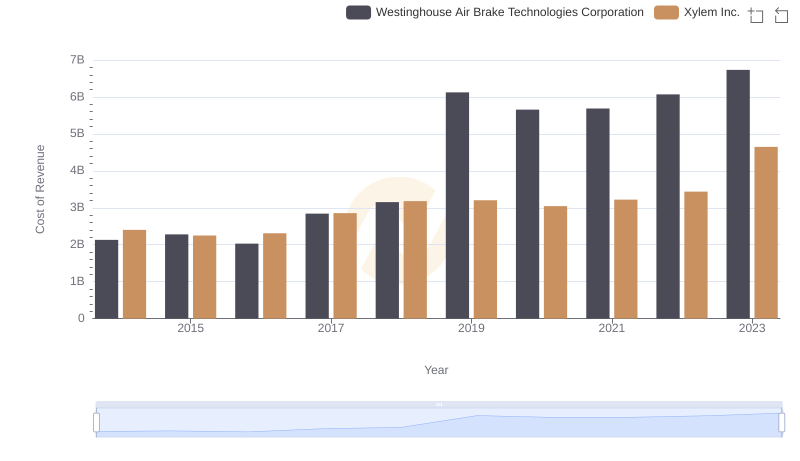

Cost Insights: Breaking Down Westinghouse Air Brake Technologies Corporation and Xylem Inc.'s Expenses

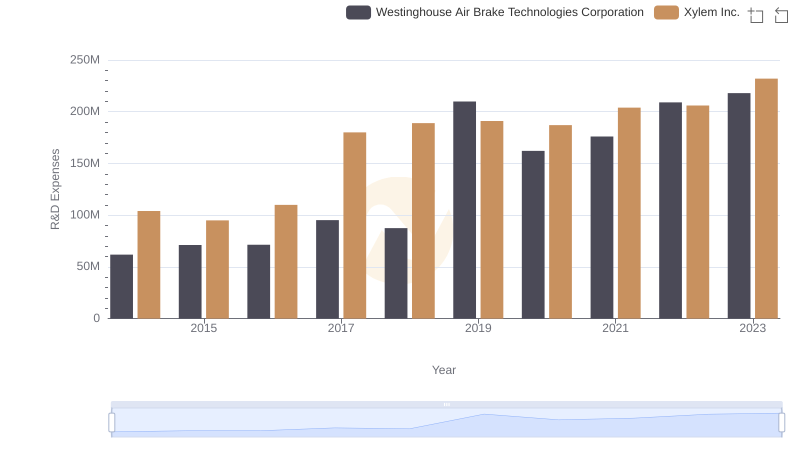

Westinghouse Air Brake Technologies Corporation or Xylem Inc.: Who Invests More in Innovation?

Westinghouse Air Brake Technologies Corporation and Rockwell Automation, Inc.: SG&A Spending Patterns Compared

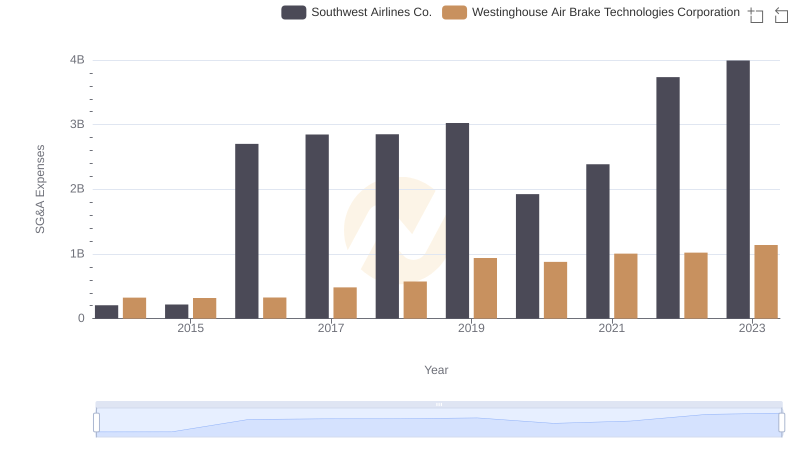

Cost Management Insights: SG&A Expenses for Westinghouse Air Brake Technologies Corporation and Southwest Airlines Co.

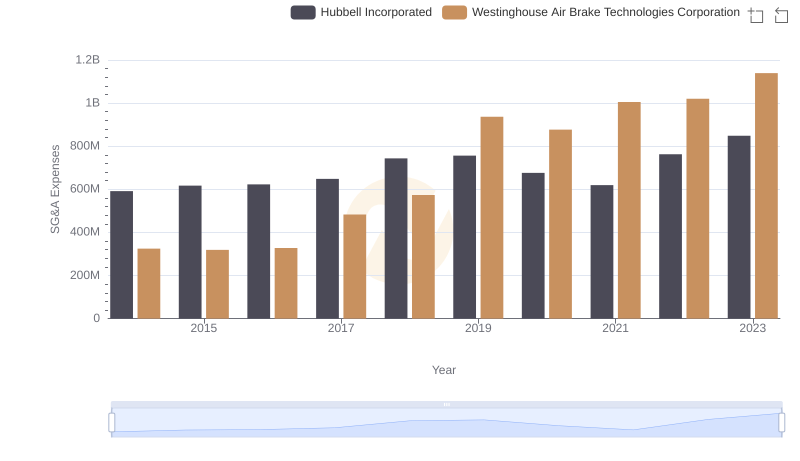

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Hubbell Incorporated

A Professional Review of EBITDA: Westinghouse Air Brake Technologies Corporation Compared to Xylem Inc.