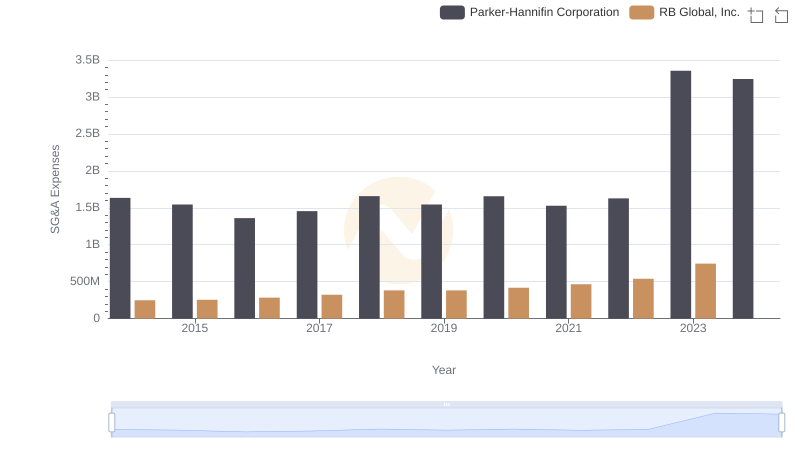

| __timestamp | Parker-Hannifin Corporation | ZTO Express (Cayman) Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1633992000 | 534537000 |

| Thursday, January 1, 2015 | 1544746000 | 591738000 |

| Friday, January 1, 2016 | 1359360000 | 705995000 |

| Sunday, January 1, 2017 | 1453935000 | 780517000 |

| Monday, January 1, 2018 | 1657152000 | 1210717000 |

| Tuesday, January 1, 2019 | 1543939000 | 1546227000 |

| Wednesday, January 1, 2020 | 1656553000 | 1663712000 |

| Friday, January 1, 2021 | 1527302000 | 1875869000 |

| Saturday, January 1, 2022 | 1627116000 | 2077372000 |

| Sunday, January 1, 2023 | 3354103000 | 2425253000 |

| Monday, January 1, 2024 | 3315177000 |

Unleashing insights

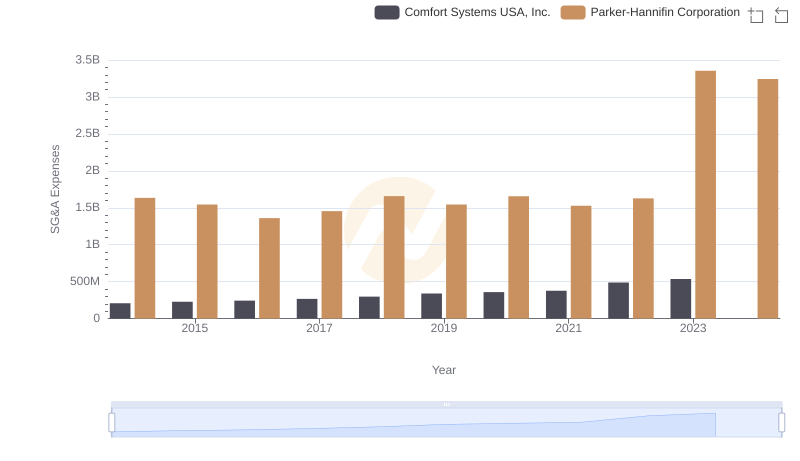

In the ever-evolving landscape of global business, understanding the efficiency of Selling, General, and Administrative (SG&A) expenses is crucial. Parker-Hannifin Corporation, a leader in motion and control technologies, and ZTO Express, a major player in the logistics sector, offer a fascinating comparison. From 2014 to 2023, Parker-Hannifin's SG&A expenses grew by approximately 105%, peaking in 2023. Meanwhile, ZTO Express saw a staggering 354% increase, reflecting its rapid expansion in the logistics industry. Notably, in 2020, ZTO's SG&A expenses surpassed Parker-Hannifin's for the first time, highlighting its aggressive growth strategy. However, data for 2024 is incomplete, leaving room for speculation on future trends. This analysis underscores the dynamic nature of SG&A efficiency and its impact on corporate strategy.

Revenue Insights: Parker-Hannifin Corporation and ZTO Express (Cayman) Inc. Performance Compared

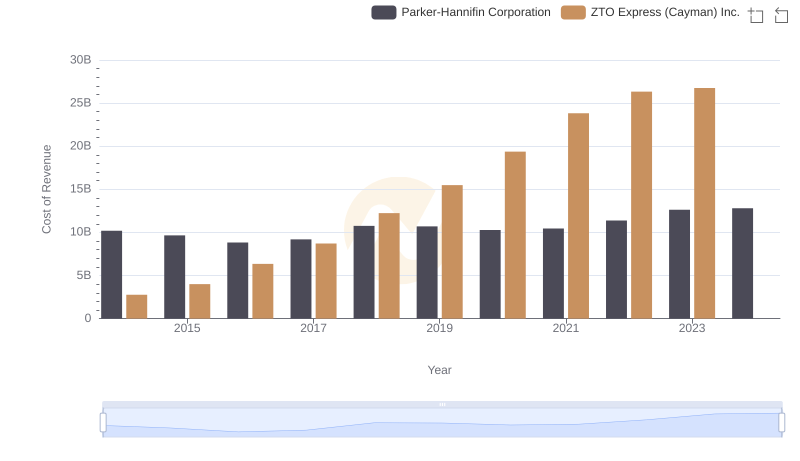

Cost of Revenue Trends: Parker-Hannifin Corporation vs ZTO Express (Cayman) Inc.

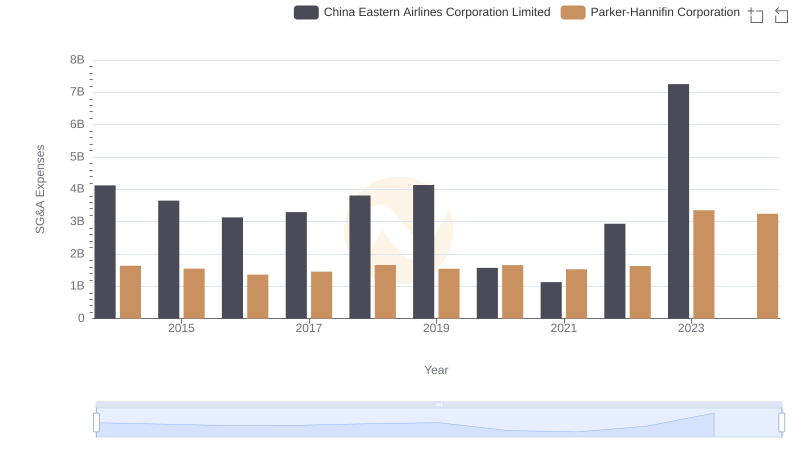

Parker-Hannifin Corporation vs China Eastern Airlines Corporation Limited: SG&A Expense Trends

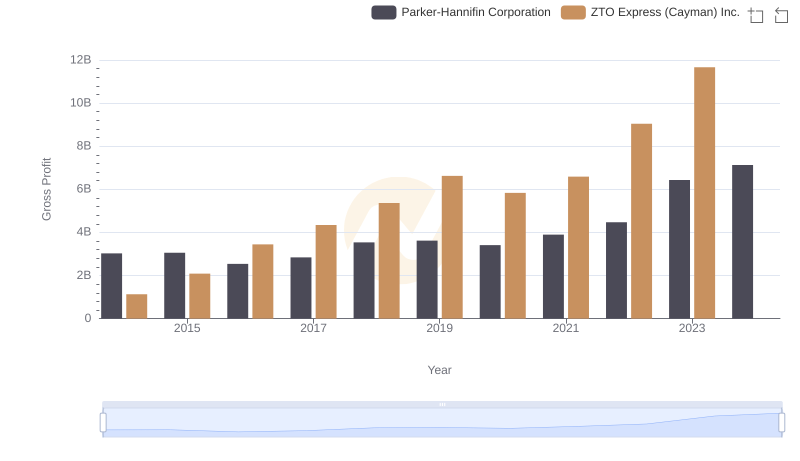

Who Generates Higher Gross Profit? Parker-Hannifin Corporation or ZTO Express (Cayman) Inc.

Breaking Down SG&A Expenses: Parker-Hannifin Corporation vs RB Global, Inc.

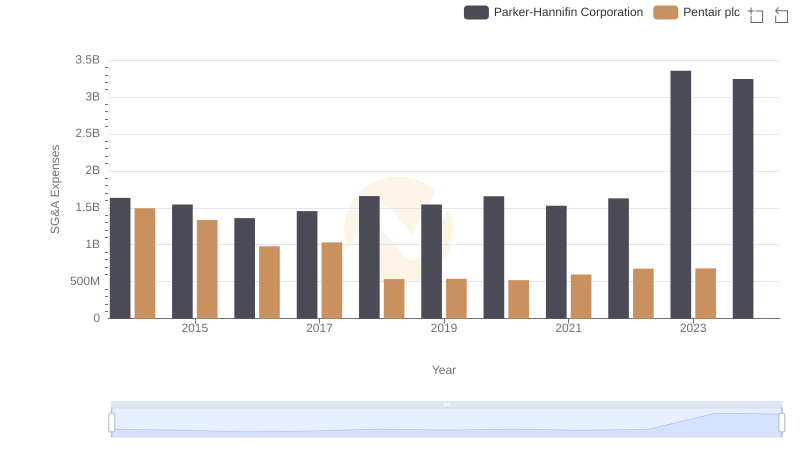

Who Optimizes SG&A Costs Better? Parker-Hannifin Corporation or Pentair plc

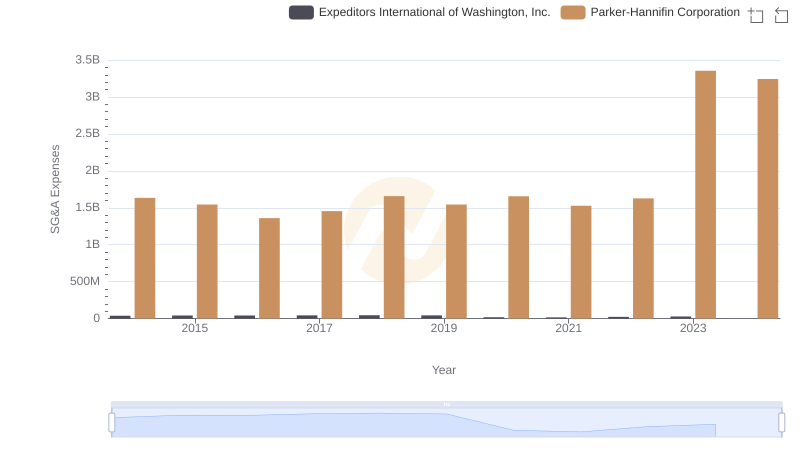

Who Optimizes SG&A Costs Better? Parker-Hannifin Corporation or Expeditors International of Washington, Inc.

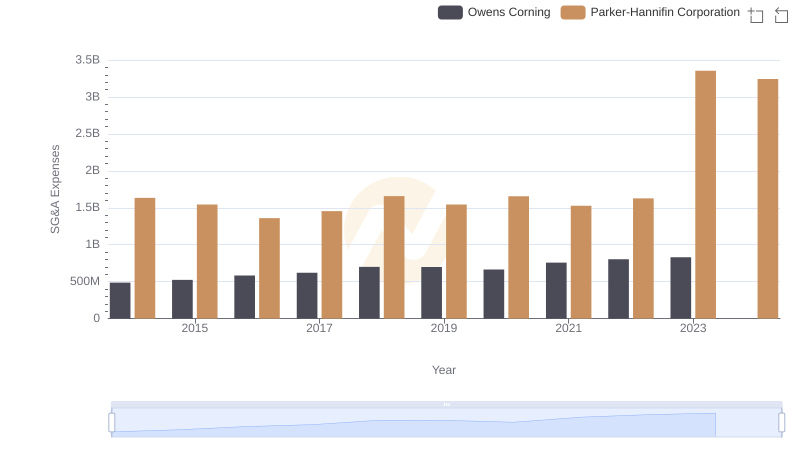

Operational Costs Compared: SG&A Analysis of Parker-Hannifin Corporation and Owens Corning

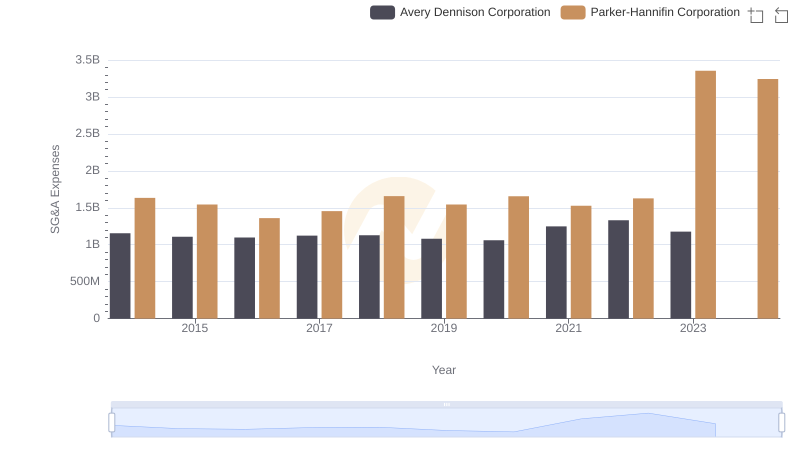

Parker-Hannifin Corporation and Avery Dennison Corporation: SG&A Spending Patterns Compared

Operational Costs Compared: SG&A Analysis of Parker-Hannifin Corporation and Comfort Systems USA, Inc.