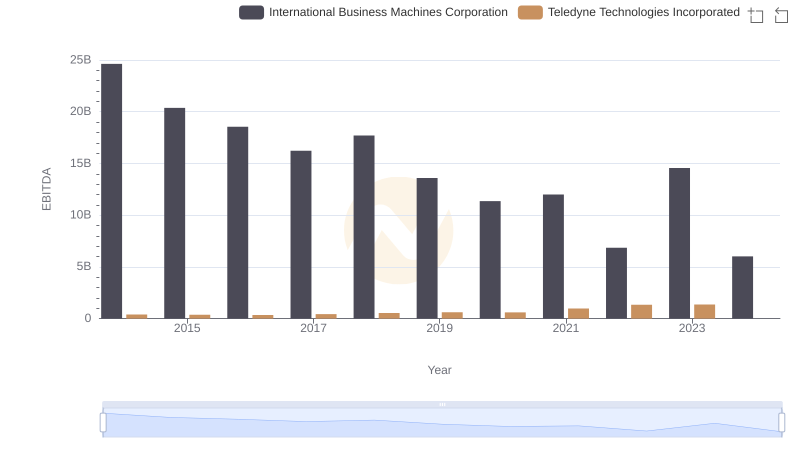

| __timestamp | International Business Machines Corporation | Teledyne Technologies Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 22472000000 | 612400000 |

| Thursday, January 1, 2015 | 19894000000 | 588600000 |

| Friday, January 1, 2016 | 20279000000 | 574100000 |

| Sunday, January 1, 2017 | 19680000000 | 656000000 |

| Monday, January 1, 2018 | 19366000000 | 694200000 |

| Tuesday, January 1, 2019 | 18724000000 | 751600000 |

| Wednesday, January 1, 2020 | 20561000000 | 700800000 |

| Friday, January 1, 2021 | 18745000000 | 1067800000 |

| Saturday, January 1, 2022 | 17483000000 | 1156600000 |

| Sunday, January 1, 2023 | 17997000000 | 1208300000 |

| Monday, January 1, 2024 | 29536000000 |

Unlocking the unknown

In the ever-evolving landscape of corporate finance, understanding the efficiency of Selling, General, and Administrative (SG&A) expenses is crucial. Over the past decade, International Business Machines Corporation (IBM) and Teledyne Technologies Incorporated have showcased contrasting trends in their SG&A expenditures.

From 2014 to 2023, IBM's SG&A expenses have seen a gradual decline, dropping approximately 20% from their peak in 2014. This reduction reflects IBM's strategic shift towards more efficient operations amidst a rapidly changing tech environment. In contrast, Teledyne Technologies has experienced a significant increase of nearly 97% in SG&A expenses over the same period, indicating aggressive expansion and investment in administrative capabilities.

These trends highlight the diverse strategies employed by these industry leaders. While IBM focuses on streamlining, Teledyne is investing in growth, each adapting to the unique challenges and opportunities of their respective markets.

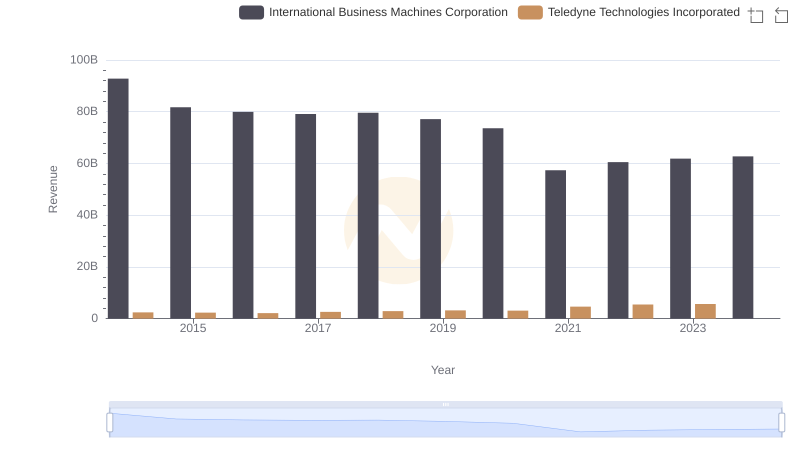

Revenue Insights: International Business Machines Corporation and Teledyne Technologies Incorporated Performance Compared

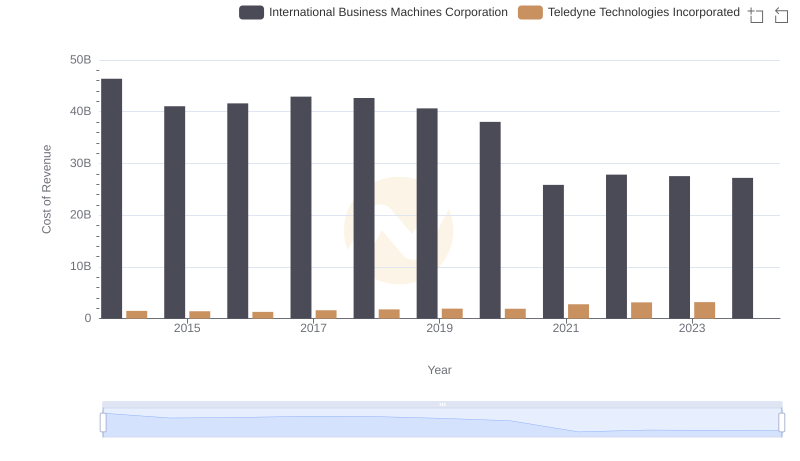

Cost Insights: Breaking Down International Business Machines Corporation and Teledyne Technologies Incorporated's Expenses

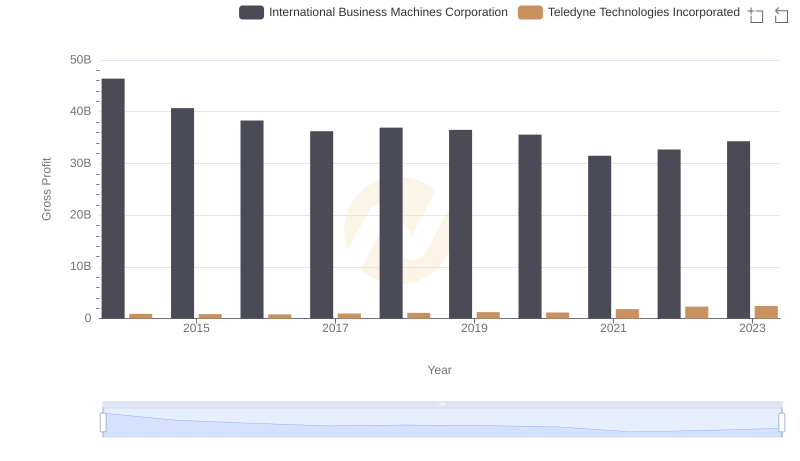

International Business Machines Corporation and Teledyne Technologies Incorporated: A Detailed Gross Profit Analysis

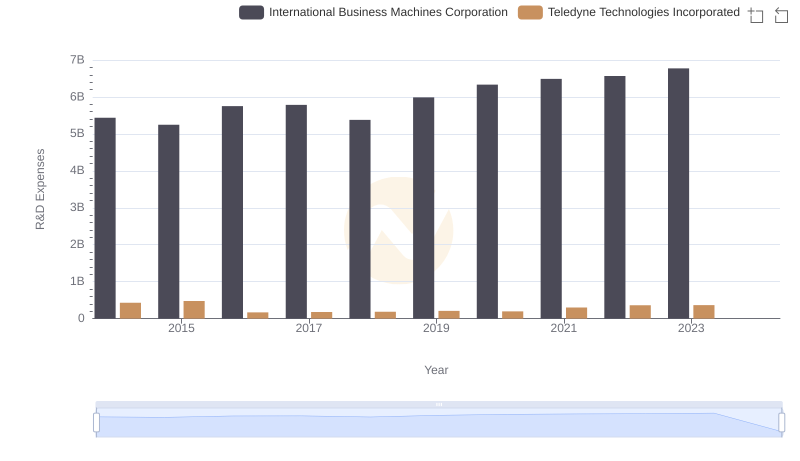

Analyzing R&D Budgets: International Business Machines Corporation vs Teledyne Technologies Incorporated

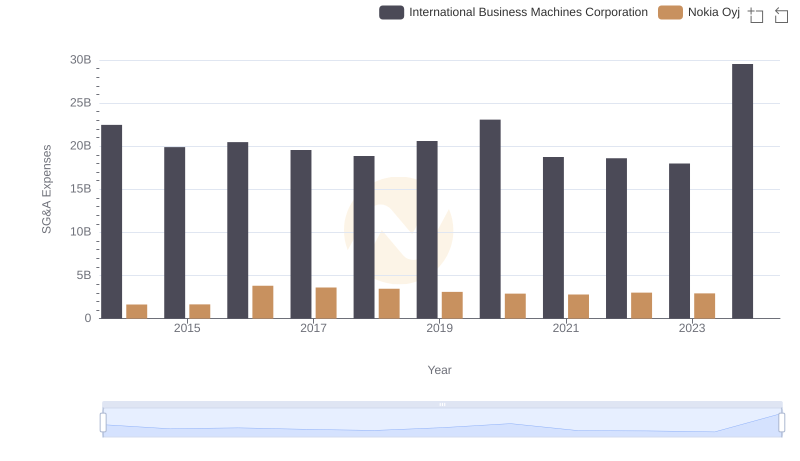

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and Nokia Oyj

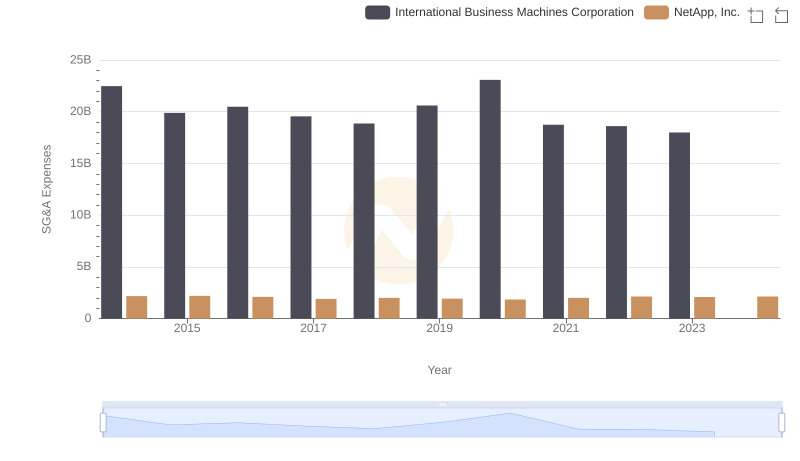

Who Optimizes SG&A Costs Better? International Business Machines Corporation or NetApp, Inc.

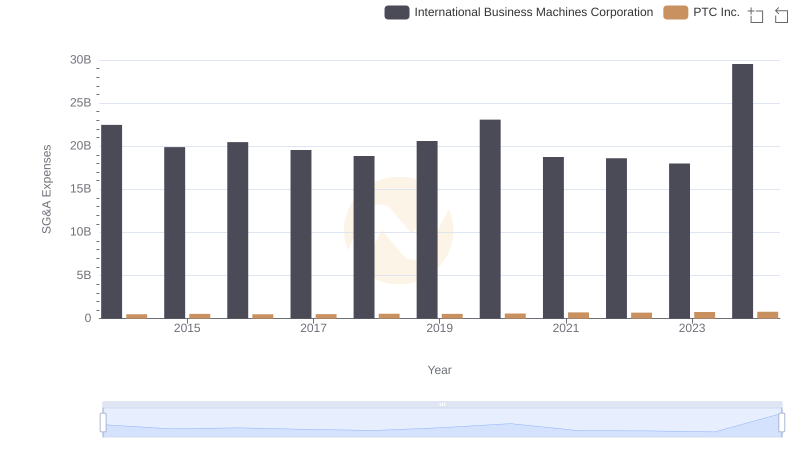

International Business Machines Corporation vs PTC Inc.: SG&A Expense Trends

Breaking Down SG&A Expenses: International Business Machines Corporation vs ON Semiconductor Corporation

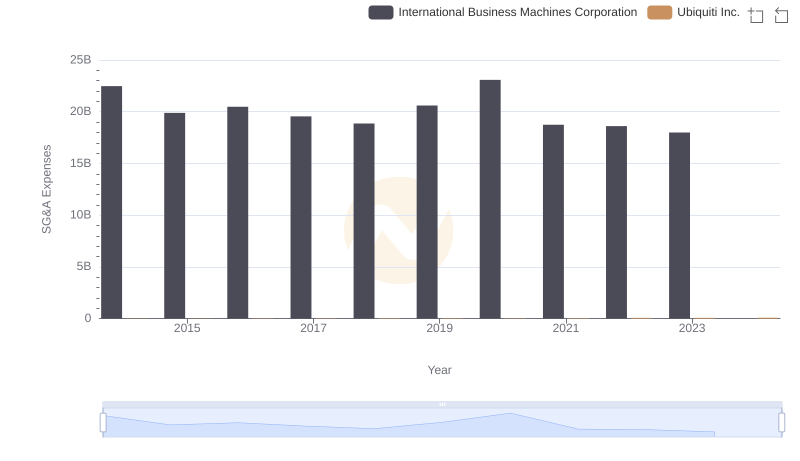

Breaking Down SG&A Expenses: International Business Machines Corporation vs Ubiquiti Inc.

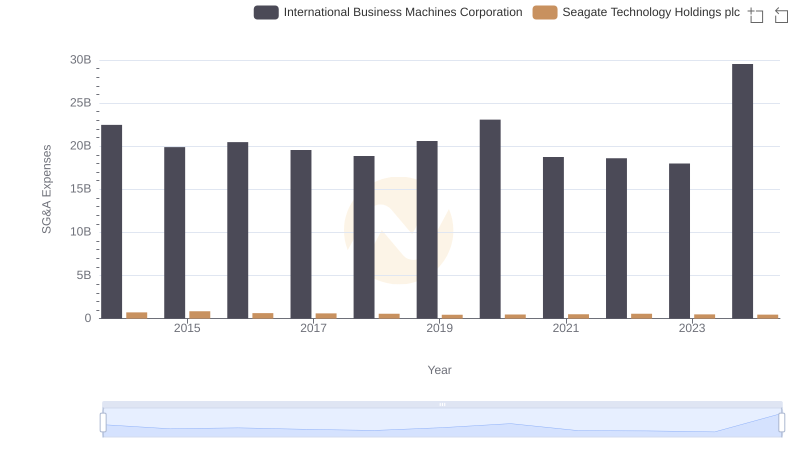

Cost Management Insights: SG&A Expenses for International Business Machines Corporation and Seagate Technology Holdings plc

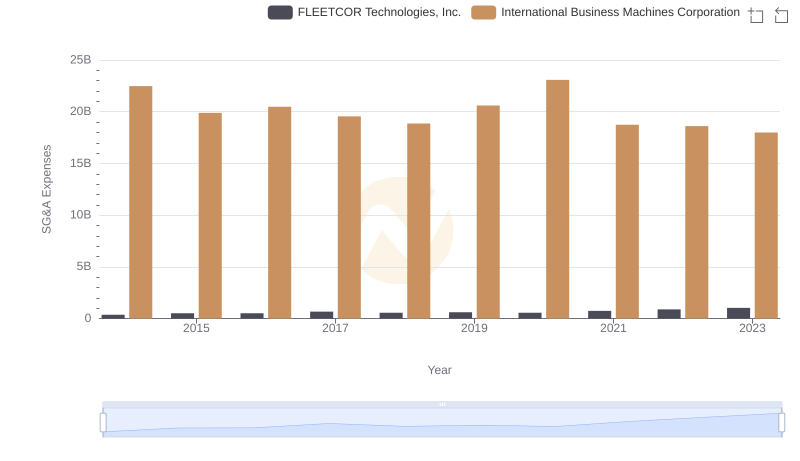

International Business Machines Corporation vs FLEETCOR Technologies, Inc.: SG&A Expense Trends

A Professional Review of EBITDA: International Business Machines Corporation Compared to Teledyne Technologies Incorporated