| __timestamp | China Eastern Airlines Corporation Limited | Eaton Corporation plc |

|---|---|---|

| Wednesday, January 1, 2014 | 4120000000 | 3810000000 |

| Thursday, January 1, 2015 | 3651000000 | 3596000000 |

| Friday, January 1, 2016 | 3133000000 | 3505000000 |

| Sunday, January 1, 2017 | 3294000000 | 3565000000 |

| Monday, January 1, 2018 | 3807000000 | 3548000000 |

| Tuesday, January 1, 2019 | 4134000000 | 3583000000 |

| Wednesday, January 1, 2020 | 1570000000 | 3075000000 |

| Friday, January 1, 2021 | 1128000000 | 3256000000 |

| Saturday, January 1, 2022 | 2933000000 | 3227000000 |

| Sunday, January 1, 2023 | 7254000000 | 3795000000 |

| Monday, January 1, 2024 | 4077000000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of global business, the Selling, General, and Administrative (SG&A) expenses of companies offer a window into their operational strategies. From 2014 to 2023, Eaton Corporation plc and China Eastern Airlines Corporation Limited have showcased contrasting trends in their SG&A expenses. Eaton Corporation, a leader in power management, maintained a relatively stable SG&A expense, averaging around $3.5 billion annually. This consistency reflects its strategic focus on efficiency and cost management.

Conversely, China Eastern Airlines experienced significant fluctuations, with a notable dip in 2020 and 2021, likely due to the global pandemic's impact on the aviation industry. However, by 2023, their SG&A expenses surged by over 150% compared to 2021, indicating a robust recovery and expansion strategy. These trends highlight the dynamic nature of corporate financial management in response to global challenges and opportunities.

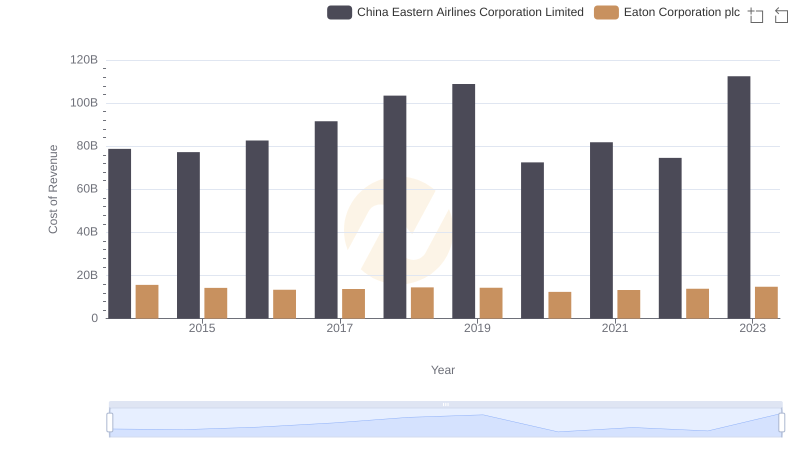

Comparing Cost of Revenue Efficiency: Eaton Corporation plc vs China Eastern Airlines Corporation Limited

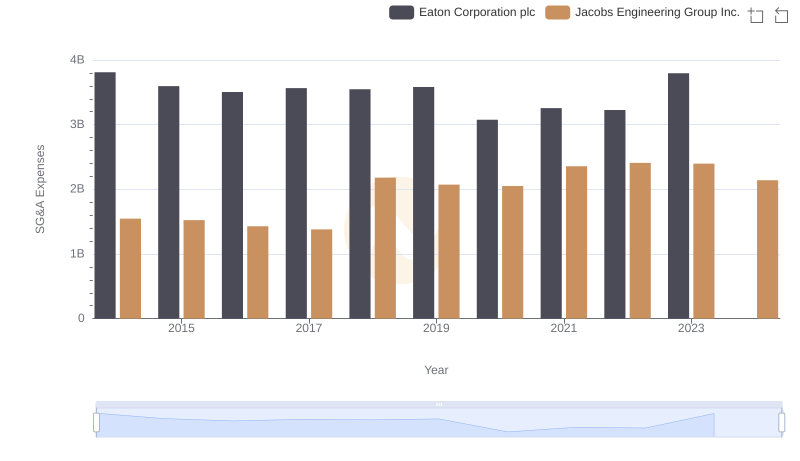

Eaton Corporation plc vs Jacobs Engineering Group Inc.: SG&A Expense Trends

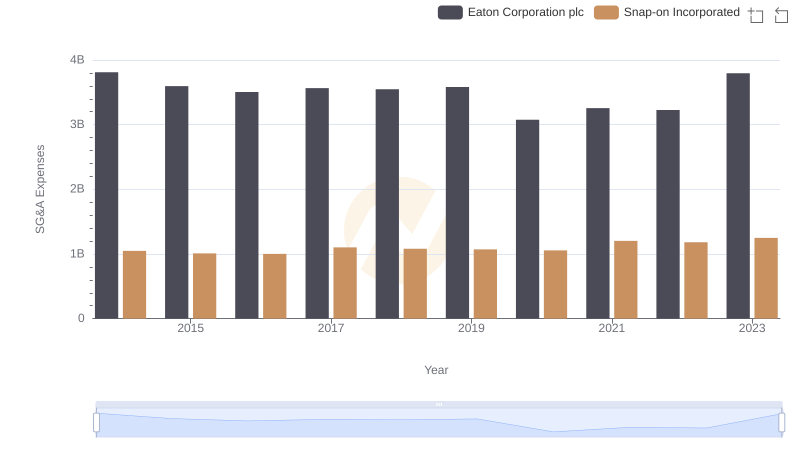

SG&A Efficiency Analysis: Comparing Eaton Corporation plc and Snap-on Incorporated

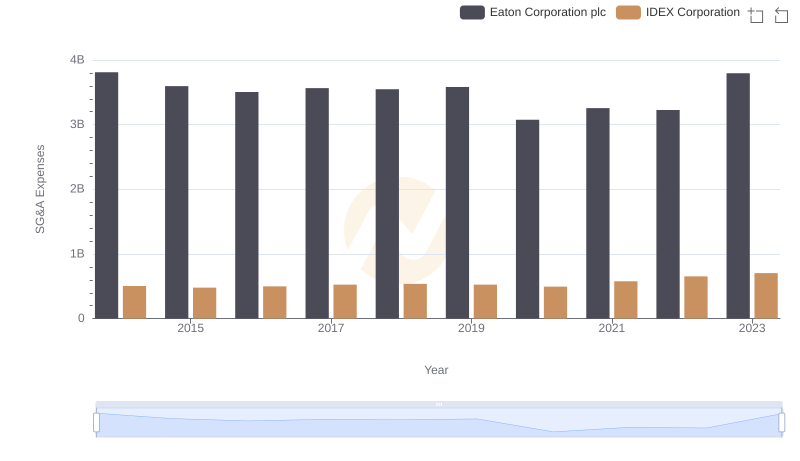

Selling, General, and Administrative Costs: Eaton Corporation plc vs IDEX Corporation

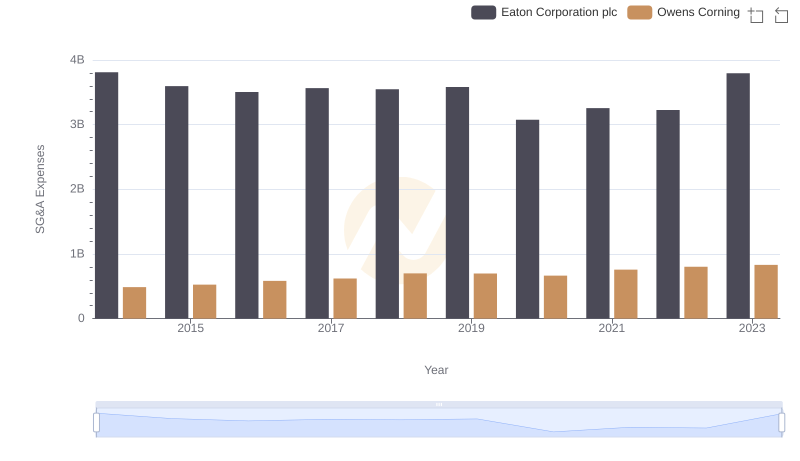

Eaton Corporation plc and Owens Corning: SG&A Spending Patterns Compared

Eaton Corporation plc vs ZTO Express (Cayman) Inc.: SG&A Expense Trends