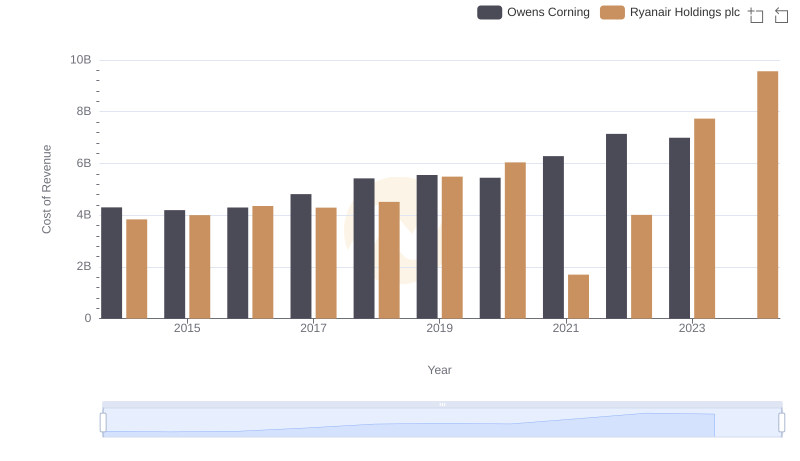

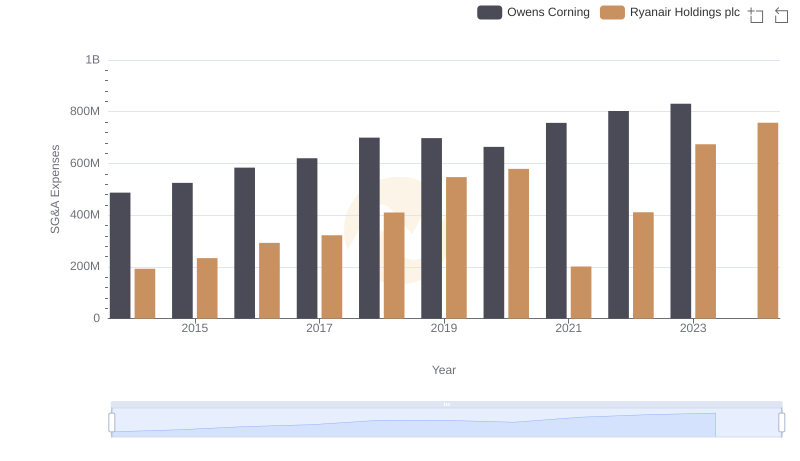

| __timestamp | Owens Corning | Ryanair Holdings plc |

|---|---|---|

| Wednesday, January 1, 2014 | 5276000000 | 5036700000 |

| Thursday, January 1, 2015 | 5350000000 | 5654000000 |

| Friday, January 1, 2016 | 5677000000 | 6535800000 |

| Sunday, January 1, 2017 | 6384000000 | 6647800000 |

| Monday, January 1, 2018 | 7057000000 | 7151000000 |

| Tuesday, January 1, 2019 | 7160000000 | 7697400000 |

| Wednesday, January 1, 2020 | 7055000000 | 8494799999 |

| Friday, January 1, 2021 | 8498000000 | 1635800000 |

| Saturday, January 1, 2022 | 9761000000 | 4800900000 |

| Sunday, January 1, 2023 | 9677000000 | 10775200000 |

| Monday, January 1, 2024 | 13443800000 |

In pursuit of knowledge

In the ever-evolving landscape of global business, Ryanair Holdings plc and Owens Corning have emerged as formidable players in their respective industries. Over the past decade, these companies have demonstrated resilience and adaptability, with their revenue trajectories offering a fascinating glimpse into their strategic maneuvers.

From 2014 to 2023, Owens Corning's revenue grew by approximately 83%, reflecting its robust market position in the building materials sector. Meanwhile, Ryanair Holdings plc, a leader in the airline industry, experienced a more volatile journey. Despite a significant dip in 2021, where revenue plummeted to just 24% of its 2020 peak, Ryanair rebounded impressively by 2023, achieving a revenue surge of 180% from its 2021 low.

As we look to the future, the data suggests a promising trajectory for both companies. However, the missing data for Owens Corning in 2024 leaves room for speculation. Will Owens Corning continue its upward trend, or will Ryanair's aggressive recovery strategy outpace its growth? Only time will tell.

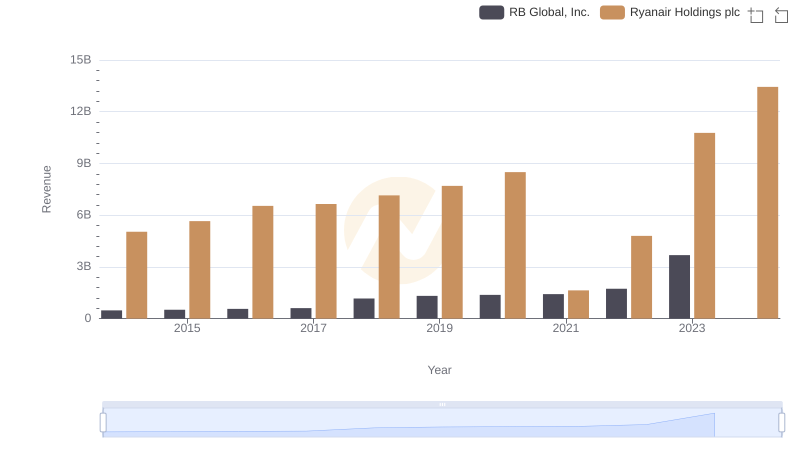

Comparing Revenue Performance: Ryanair Holdings plc or RB Global, Inc.?

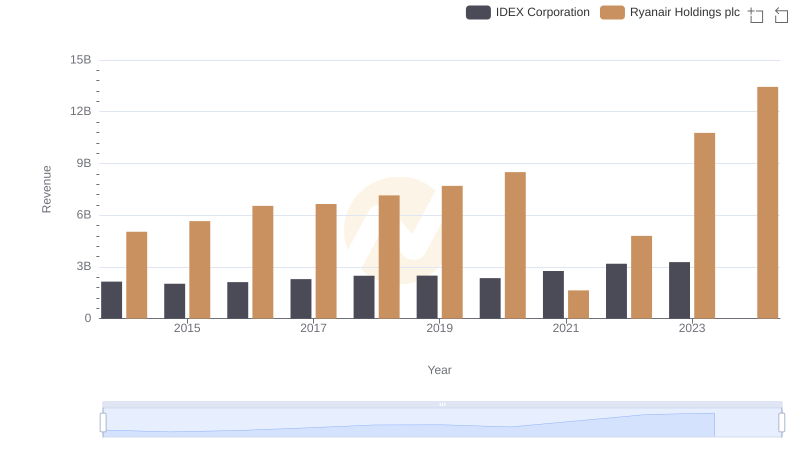

Annual Revenue Comparison: Ryanair Holdings plc vs IDEX Corporation

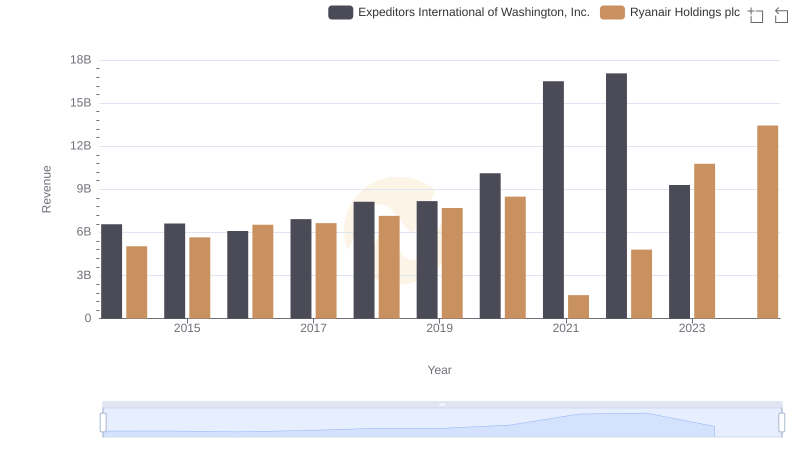

Revenue Insights: Ryanair Holdings plc and Expeditors International of Washington, Inc. Performance Compared

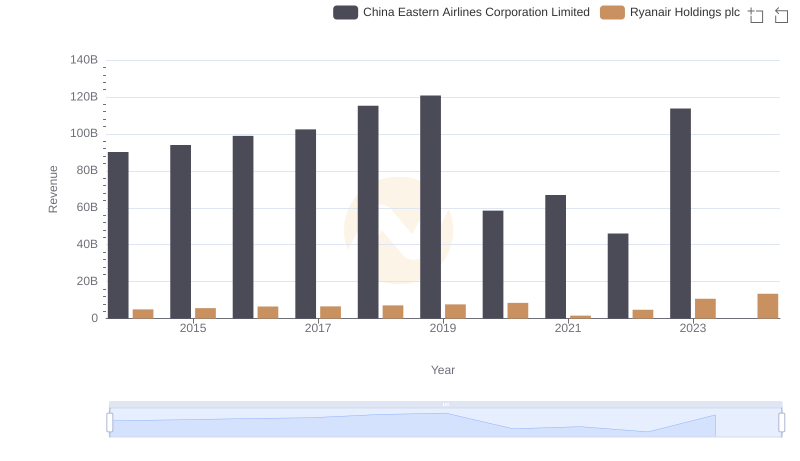

Ryanair Holdings plc vs China Eastern Airlines Corporation Limited: Examining Key Revenue Metrics

Ryanair Holdings plc vs Owens Corning: Efficiency in Cost of Revenue Explored

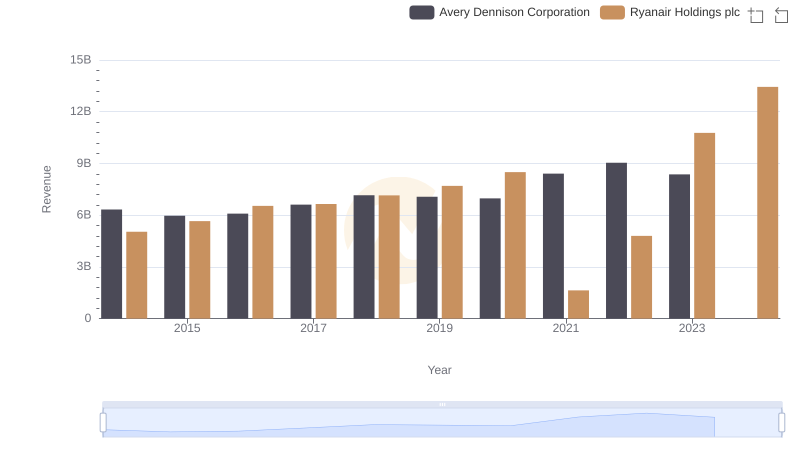

Breaking Down Revenue Trends: Ryanair Holdings plc vs Avery Dennison Corporation

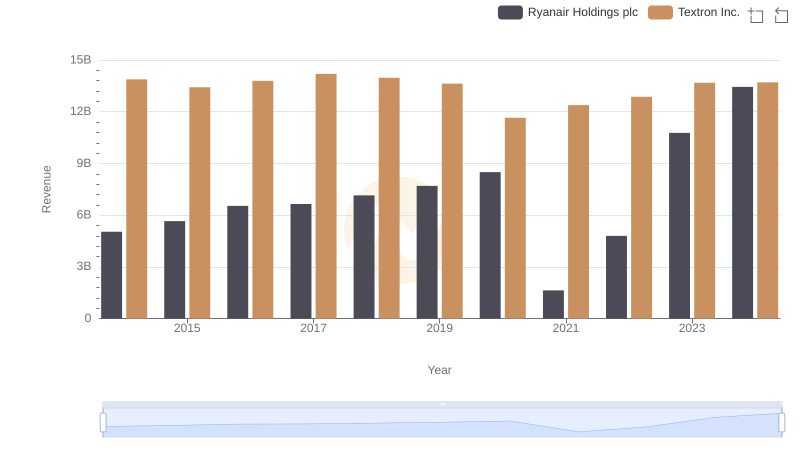

Ryanair Holdings plc and Textron Inc.: A Comprehensive Revenue Analysis

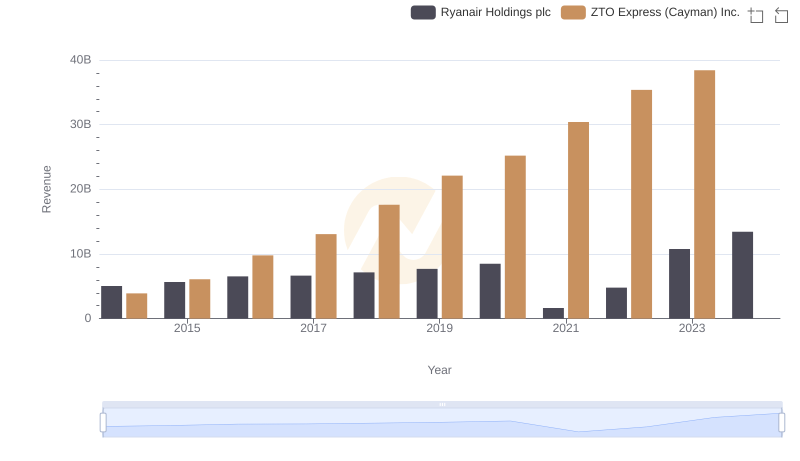

Who Generates More Revenue? Ryanair Holdings plc or ZTO Express (Cayman) Inc.

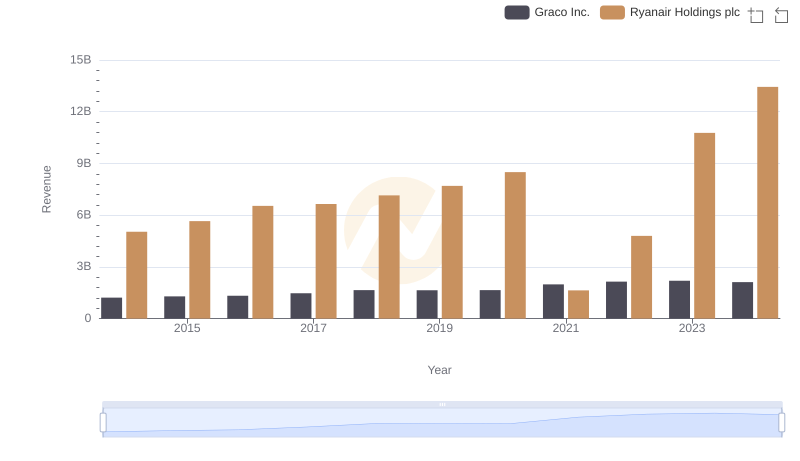

Ryanair Holdings plc and Graco Inc.: A Comprehensive Revenue Analysis

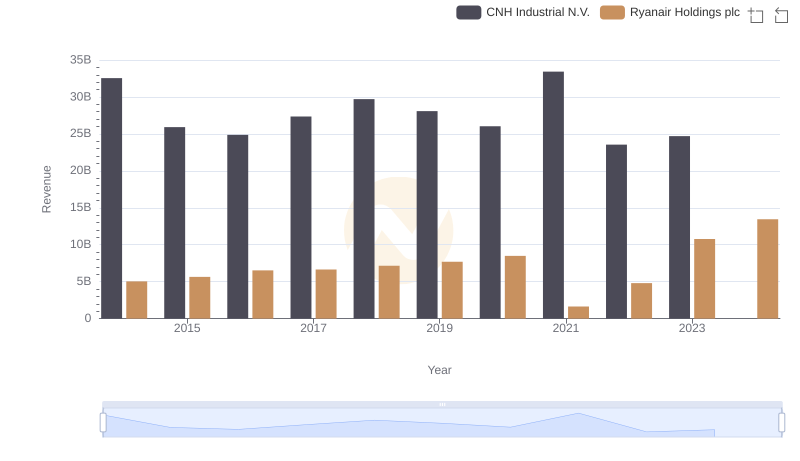

Breaking Down Revenue Trends: Ryanair Holdings plc vs CNH Industrial N.V.

Comparing SG&A Expenses: Ryanair Holdings plc vs Owens Corning Trends and Insights