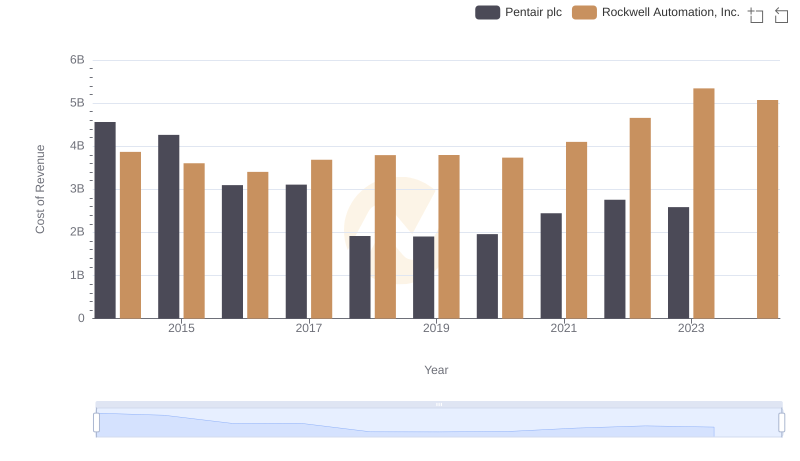

| __timestamp | Pentair plc | Rockwell Automation, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 7039000000 | 6623500000 |

| Thursday, January 1, 2015 | 6449000000 | 6307900000 |

| Friday, January 1, 2016 | 4890000000 | 5879500000 |

| Sunday, January 1, 2017 | 4936500000 | 6311300000 |

| Monday, January 1, 2018 | 2965100000 | 6666000000 |

| Tuesday, January 1, 2019 | 2957200000 | 6694800000 |

| Wednesday, January 1, 2020 | 3017800000 | 6329800000 |

| Friday, January 1, 2021 | 3764800000 | 6997400000 |

| Saturday, January 1, 2022 | 4121800000 | 7760400000 |

| Sunday, January 1, 2023 | 4104500000 | 9058000000 |

| Monday, January 1, 2024 | 4082800000 | 8264200000 |

Infusing magic into the data realm

In the ever-evolving landscape of industrial automation and water solutions, Rockwell Automation, Inc. and Pentair plc have been pivotal players. Over the past decade, these companies have showcased distinct revenue trajectories. Rockwell Automation, Inc. has consistently demonstrated robust growth, with a remarkable 37% increase in revenue from 2014 to 2023, peaking at approximately $9 billion in 2023. In contrast, Pentair plc experienced a more volatile journey, with revenues declining by nearly 42% from their 2014 high of $7 billion to around $4.1 billion in 2023.

The data highlights Rockwell's resilience and strategic positioning in the market, while Pentair's fluctuations suggest challenges in maintaining steady growth. Notably, the absence of data for Pentair in 2024 raises questions about its future trajectory. As these industry giants navigate the complexities of global markets, their financial performances offer valuable insights into their strategic directions.

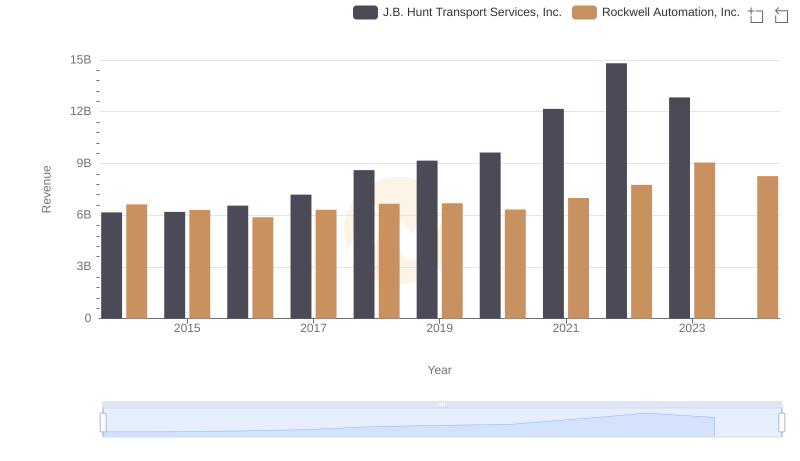

Rockwell Automation, Inc. vs J.B. Hunt Transport Services, Inc.: Annual Revenue Growth Compared

Breaking Down Revenue Trends: Rockwell Automation, Inc. vs Booz Allen Hamilton Holding Corporation

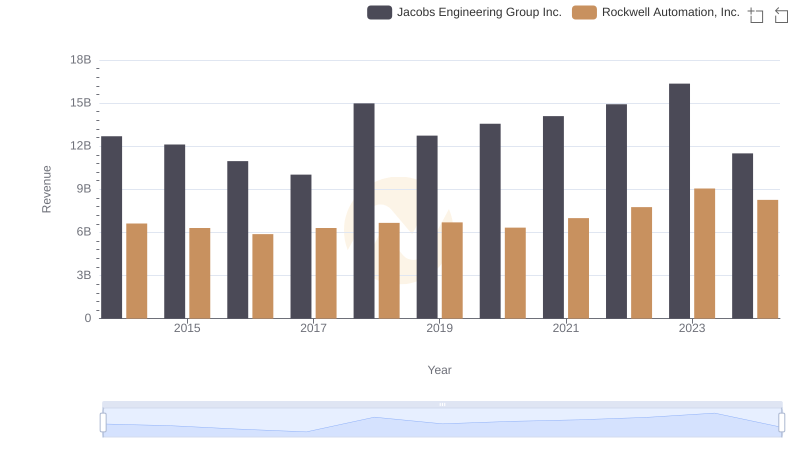

Rockwell Automation, Inc. vs Jacobs Engineering Group Inc.: Annual Revenue Growth Compared

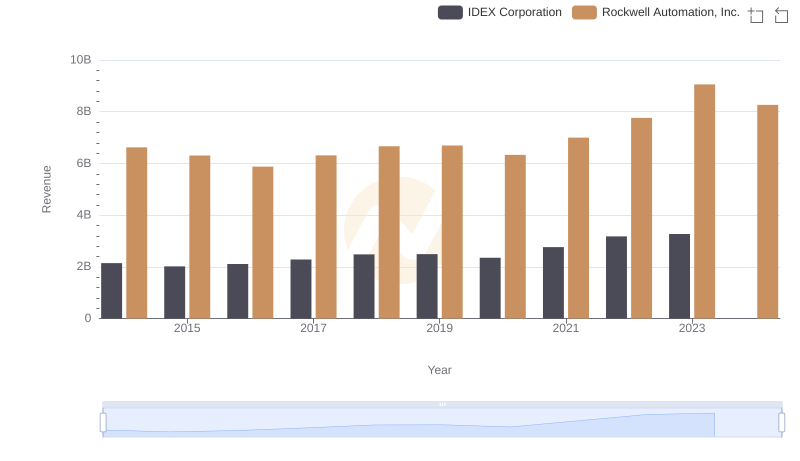

Comparing Revenue Performance: Rockwell Automation, Inc. or IDEX Corporation?

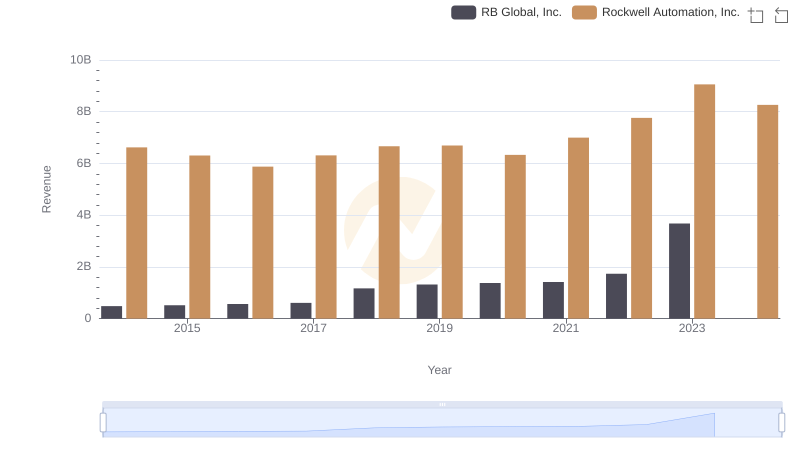

Rockwell Automation, Inc. and RB Global, Inc.: A Comprehensive Revenue Analysis

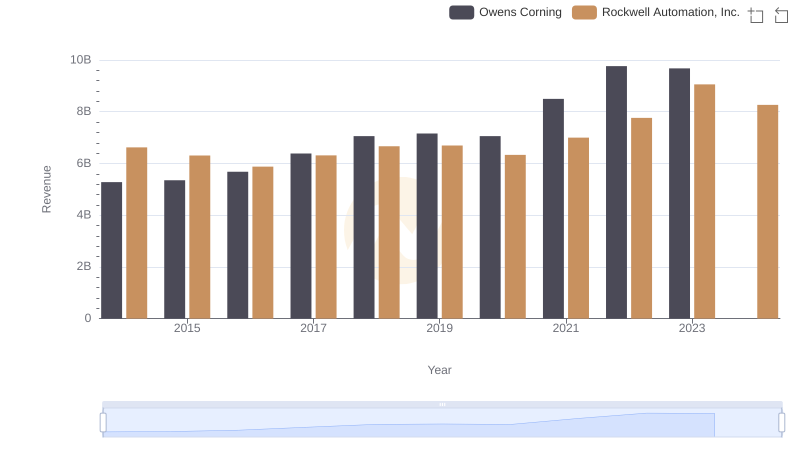

Who Generates More Revenue? Rockwell Automation, Inc. or Owens Corning

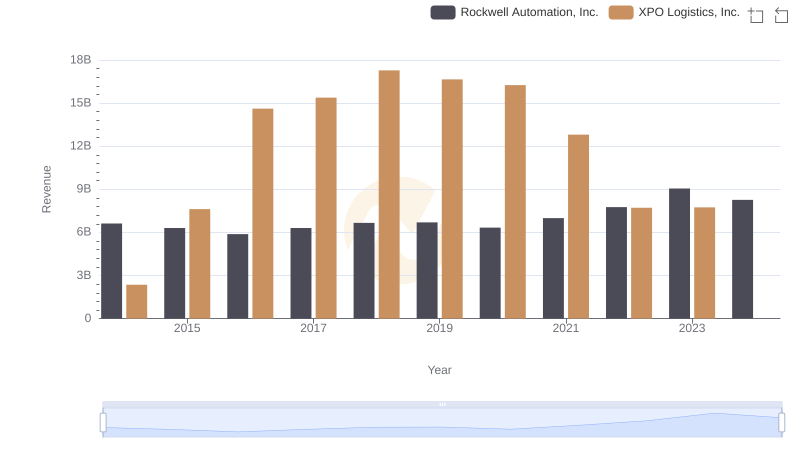

Revenue Showdown: Rockwell Automation, Inc. vs XPO Logistics, Inc.

Cost of Revenue Trends: Rockwell Automation, Inc. vs Pentair plc

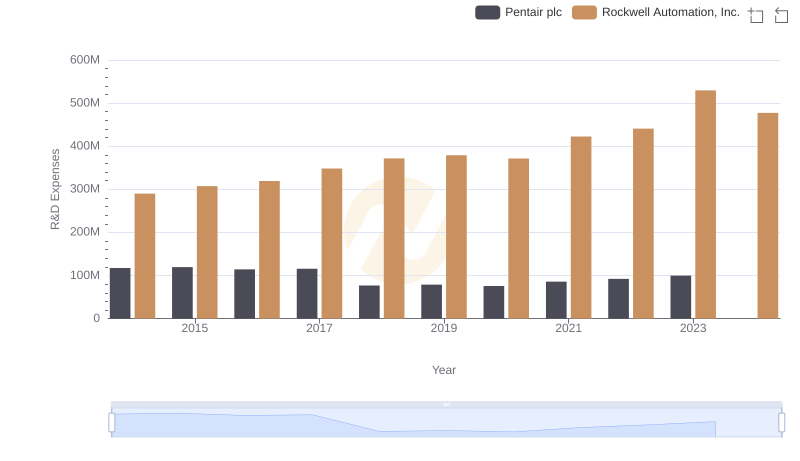

Research and Development: Comparing Key Metrics for Rockwell Automation, Inc. and Pentair plc

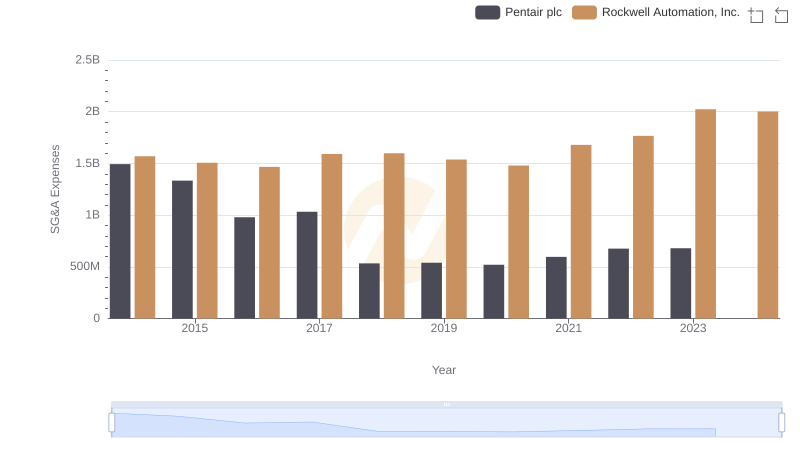

Rockwell Automation, Inc. vs Pentair plc: SG&A Expense Trends

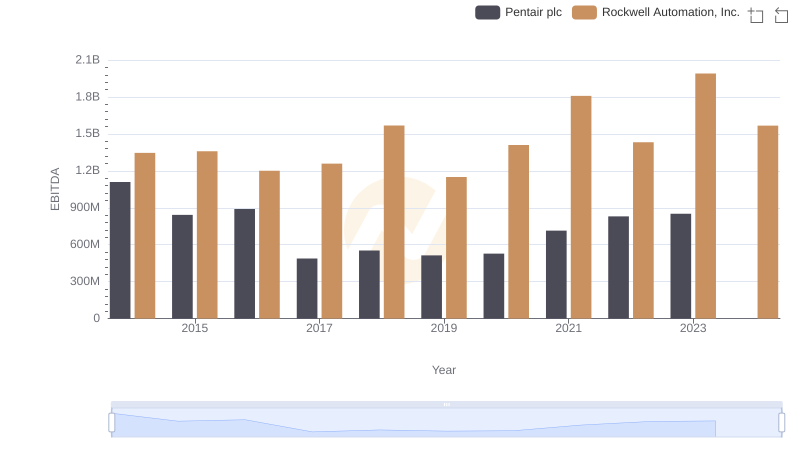

Comprehensive EBITDA Comparison: Rockwell Automation, Inc. vs Pentair plc