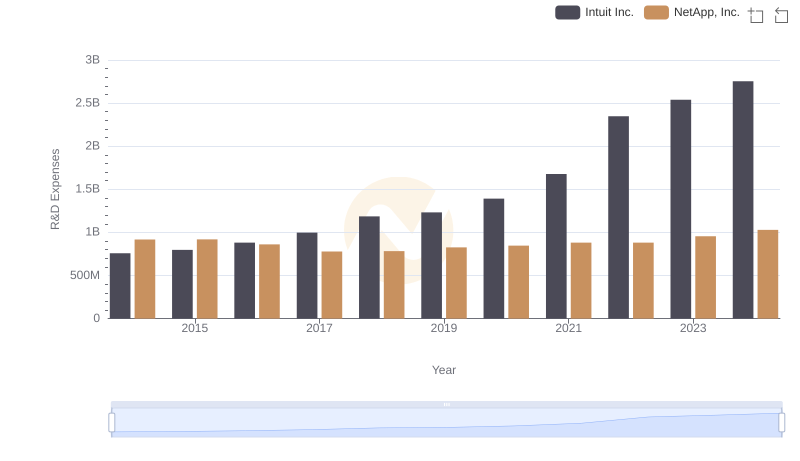

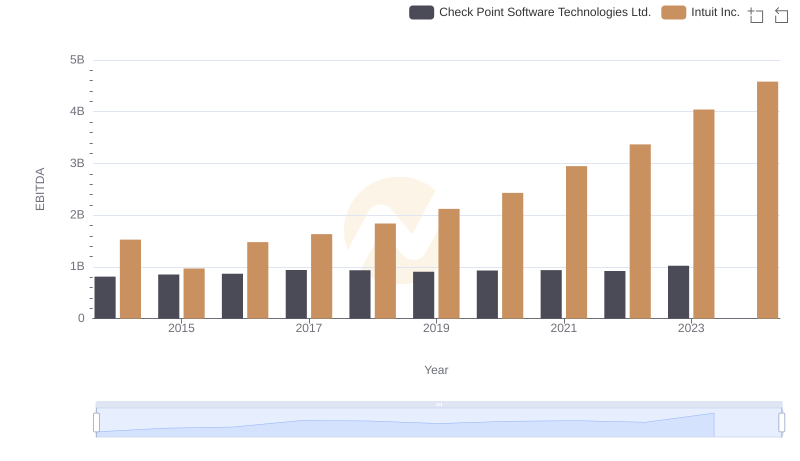

| __timestamp | Check Point Software Technologies Ltd. | Intuit Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 133300000 | 758000000 |

| Thursday, January 1, 2015 | 149279000 | 798000000 |

| Friday, January 1, 2016 | 178372000 | 881000000 |

| Sunday, January 1, 2017 | 192386000 | 998000000 |

| Monday, January 1, 2018 | 211523000 | 1186000000 |

| Tuesday, January 1, 2019 | 239200000 | 1233000000 |

| Wednesday, January 1, 2020 | 252800000 | 1392000000 |

| Friday, January 1, 2021 | 292700000 | 1678000000 |

| Saturday, January 1, 2022 | 349900000 | 2347000000 |

| Sunday, January 1, 2023 | 368900000 | 2539000000 |

| Monday, January 1, 2024 | 2754000000 |

Unlocking the unknown

In the ever-evolving tech landscape, research and development (R&D) spending is a critical indicator of a company's commitment to innovation. Over the past decade, Intuit Inc. and Check Point Software Technologies Ltd. have demonstrated contrasting trajectories in their R&D investments.

From 2014 to 2023, Intuit Inc. has consistently increased its R&D spending, growing by over 230%, from approximately $758 million to $2.54 billion. This surge underscores Intuit's aggressive push towards innovation, particularly in financial software solutions. In contrast, Check Point Software Technologies Ltd. has shown a more modest increase of around 177% in the same period, from $133 million to $369 million, reflecting a steady yet cautious approach in cybersecurity advancements.

While Intuit's R&D spending in 2024 is projected to reach $2.75 billion, Check Point's data for the same year remains unavailable, leaving room for speculation on its future innovation strategies.

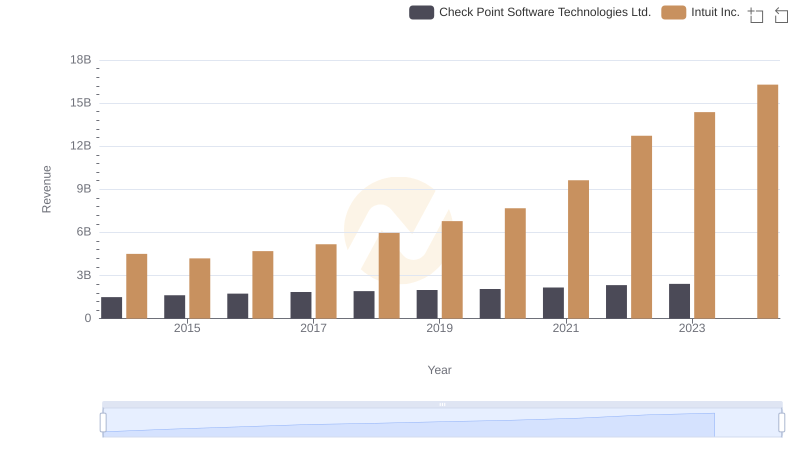

Intuit Inc. and Check Point Software Technologies Ltd.: A Comprehensive Revenue Analysis

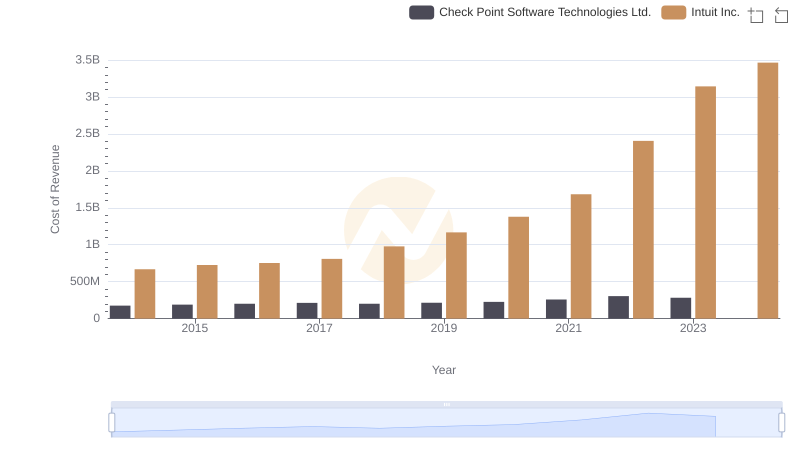

Comparing Cost of Revenue Efficiency: Intuit Inc. vs Check Point Software Technologies Ltd.

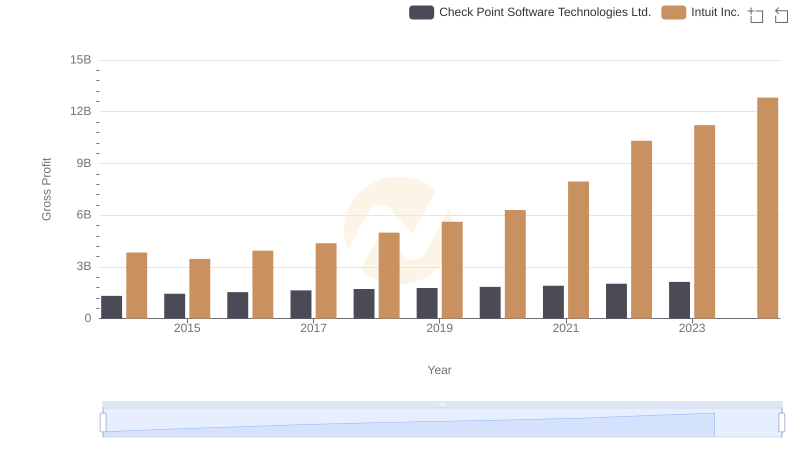

Who Generates Higher Gross Profit? Intuit Inc. or Check Point Software Technologies Ltd.

Research and Development Expenses Breakdown: Intuit Inc. vs ON Semiconductor Corporation

Analyzing R&D Budgets: Intuit Inc. vs Teledyne Technologies Incorporated

Analyzing R&D Budgets: Intuit Inc. vs NetApp, Inc.

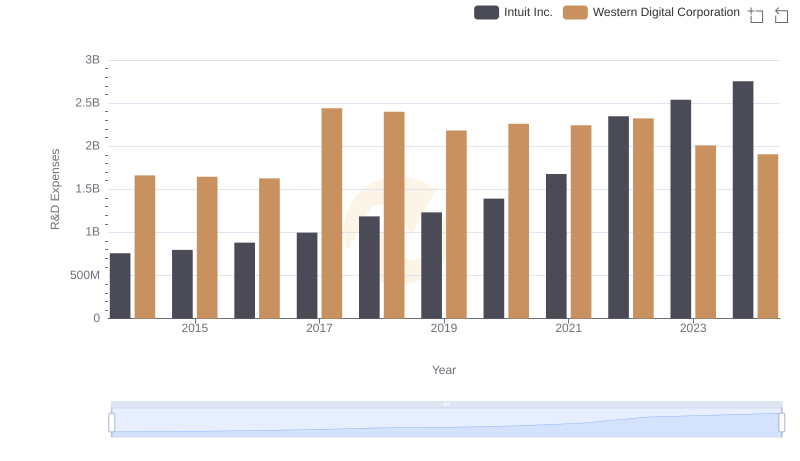

Who Prioritizes Innovation? R&D Spending Compared for Intuit Inc. and Western Digital Corporation

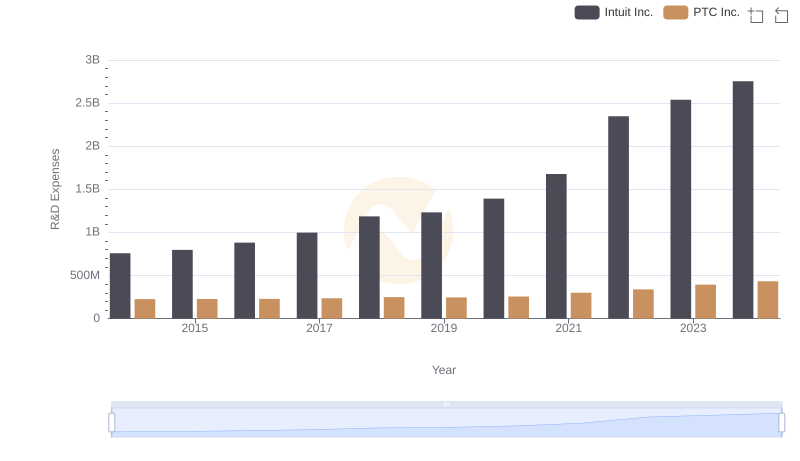

Who Prioritizes Innovation? R&D Spending Compared for Intuit Inc. and PTC Inc.

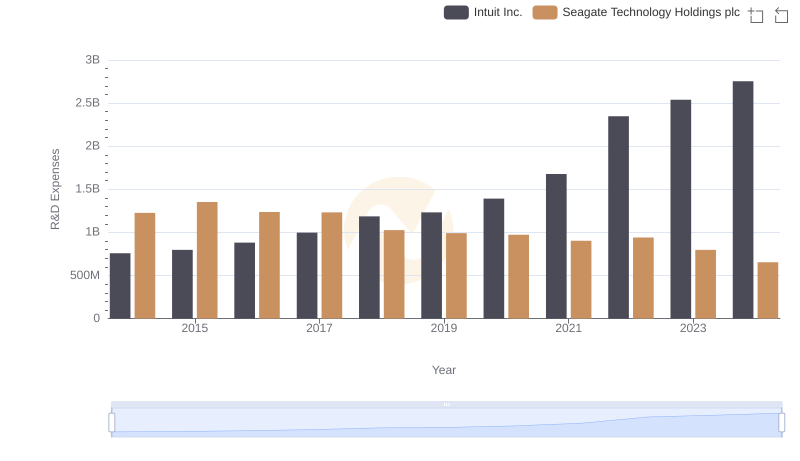

Research and Development Investment: Intuit Inc. vs Seagate Technology Holdings plc

Professional EBITDA Benchmarking: Intuit Inc. vs Check Point Software Technologies Ltd.