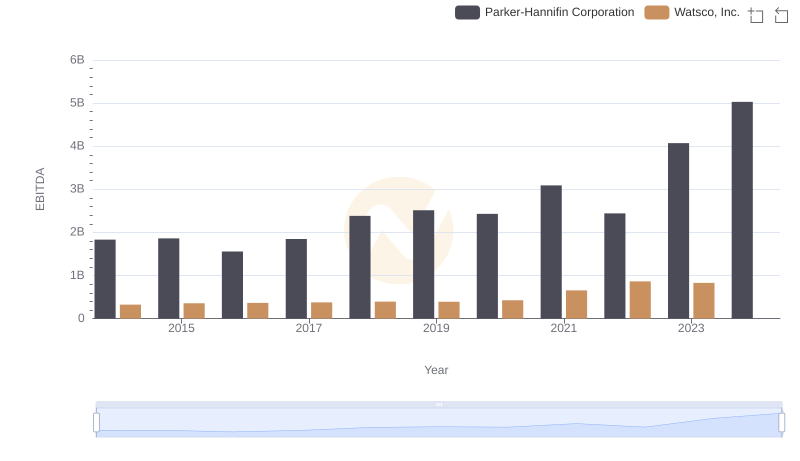

| __timestamp | Parker-Hannifin Corporation | Rockwell Automation, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1832903000 | 1346000000 |

| Thursday, January 1, 2015 | 1861551000 | 1359100000 |

| Friday, January 1, 2016 | 1558088000 | 1200700000 |

| Sunday, January 1, 2017 | 1846306000 | 1258400000 |

| Monday, January 1, 2018 | 2382235000 | 1568400000 |

| Tuesday, January 1, 2019 | 2513468000 | 1150200000 |

| Wednesday, January 1, 2020 | 2431500000 | 1410200000 |

| Friday, January 1, 2021 | 3092383000 | 1808300000 |

| Saturday, January 1, 2022 | 2441242000 | 1432100000 |

| Sunday, January 1, 2023 | 4071687000 | 1990700000 |

| Monday, January 1, 2024 | 5028229000 | 1567500000 |

Cracking the code

In the ever-evolving landscape of industrial automation, Parker-Hannifin Corporation and Rockwell Automation, Inc. have emerged as formidable players. Over the past decade, Parker-Hannifin has consistently outperformed Rockwell Automation in terms of EBITDA, showcasing a robust growth trajectory. From 2014 to 2024, Parker-Hannifin's EBITDA surged by approximately 175%, peaking in 2024, while Rockwell Automation experienced a more modest increase of around 16%.

This comparison underscores the dynamic nature of the industrial sector, where strategic investments and market adaptability play crucial roles in shaping financial outcomes.

Parker-Hannifin Corporation vs Rockwell Automation, Inc.: Strategic Focus on R&D Spending

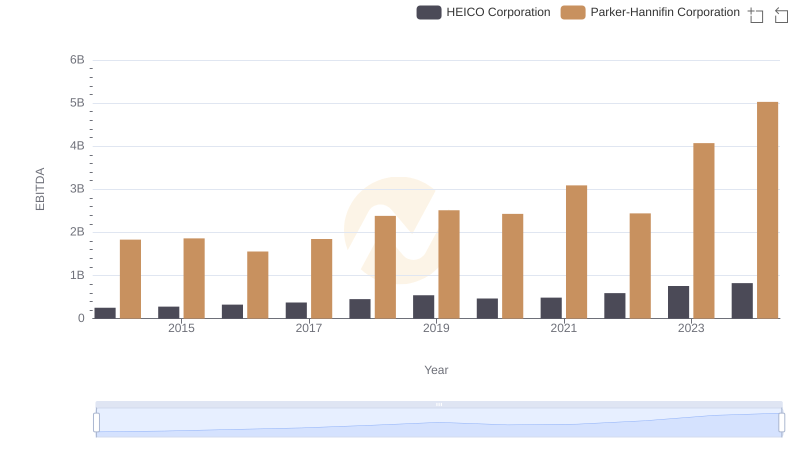

Comprehensive EBITDA Comparison: Parker-Hannifin Corporation vs HEICO Corporation

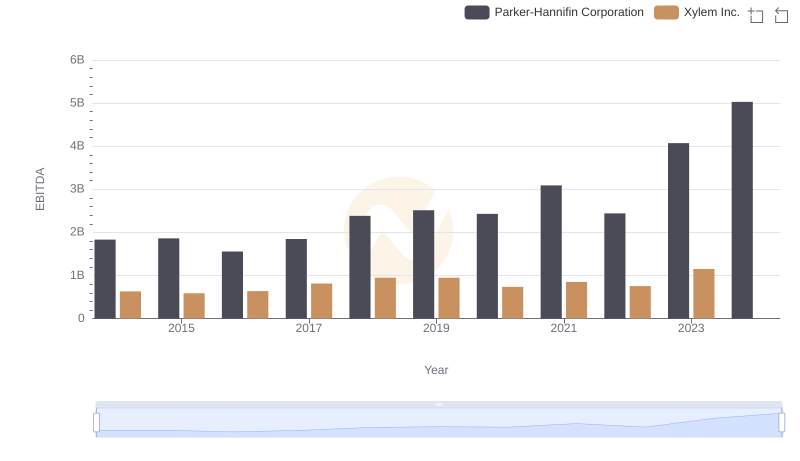

A Professional Review of EBITDA: Parker-Hannifin Corporation Compared to Xylem Inc.

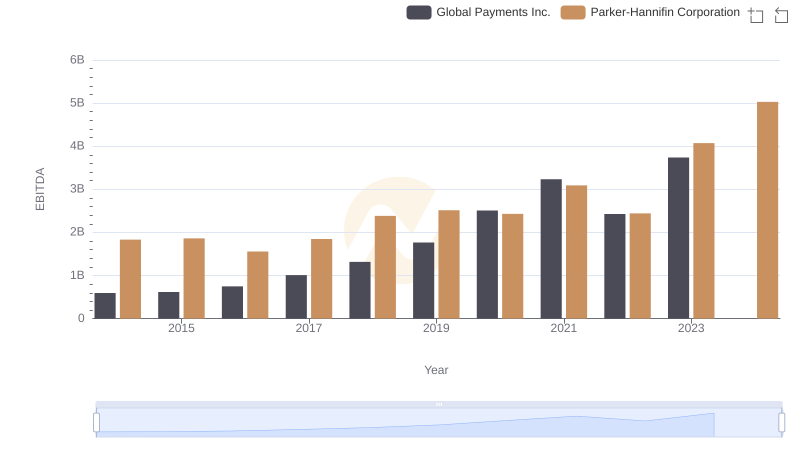

EBITDA Performance Review: Parker-Hannifin Corporation vs Global Payments Inc.

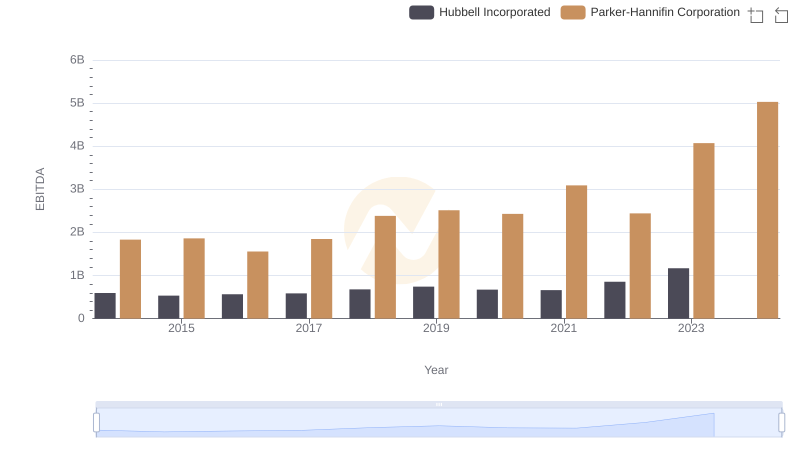

EBITDA Performance Review: Parker-Hannifin Corporation vs Hubbell Incorporated

EBITDA Analysis: Evaluating Parker-Hannifin Corporation Against Watsco, Inc.