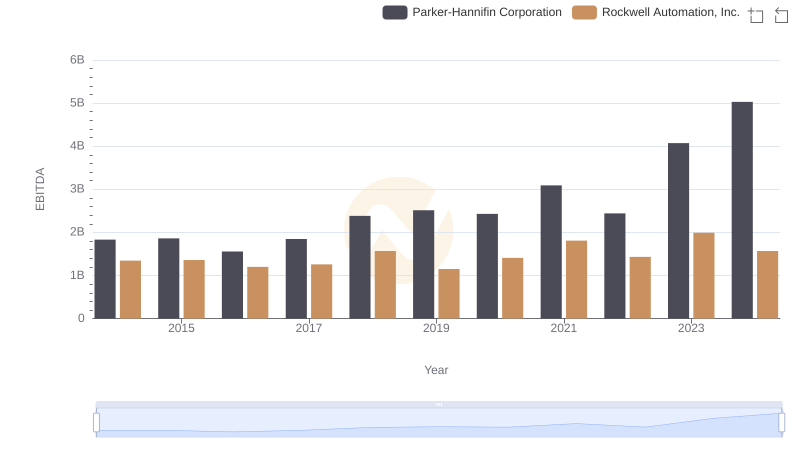

| __timestamp | Parker-Hannifin Corporation | Rockwell Automation, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 410132000 | 290100000 |

| Thursday, January 1, 2015 | 403085000 | 307300000 |

| Friday, January 1, 2016 | 359796000 | 319300000 |

| Sunday, January 1, 2017 | 336675000 | 348200000 |

| Monday, January 1, 2018 | 327877000 | 371800000 |

| Tuesday, January 1, 2019 | 294852000 | 378900000 |

| Wednesday, January 1, 2020 | 293837000 | 371500000 |

| Friday, January 1, 2021 | 259039000 | 422500000 |

| Saturday, January 1, 2022 | 191000000 | 440900000 |

| Sunday, January 1, 2023 | 258000000 | 529500000 |

| Monday, January 1, 2024 | 298000000 | 477300000 |

Data in motion

In the competitive landscape of industrial automation, Parker-Hannifin Corporation and Rockwell Automation, Inc. have long been at the forefront, driven by their strategic focus on research and development (R&D). Over the past decade, these two titans have demonstrated contrasting approaches to R&D spending, reflecting their unique strategic priorities.

From 2014 to 2024, Parker-Hannifin's R&D expenses have seen a notable decline, dropping by approximately 27% from their peak in 2014. This trend suggests a strategic shift, possibly towards optimizing existing technologies or reallocating resources to other growth areas. In contrast, Rockwell Automation has consistently increased its R&D investment, with a remarkable 82% growth over the same period, peaking in 2023. This aggressive investment underscores Rockwell's commitment to innovation and maintaining its competitive edge in the rapidly evolving automation sector.

These divergent strategies highlight the dynamic nature of the industry and the varied paths companies take to achieve technological leadership.

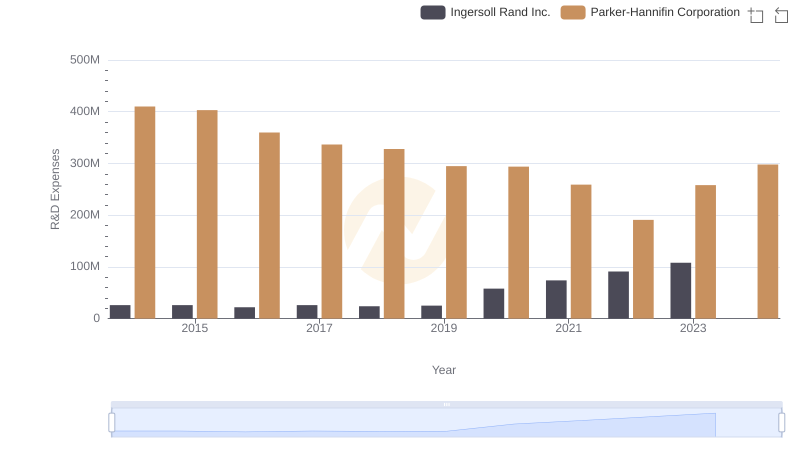

Research and Development: Comparing Key Metrics for Parker-Hannifin Corporation and Ingersoll Rand Inc.

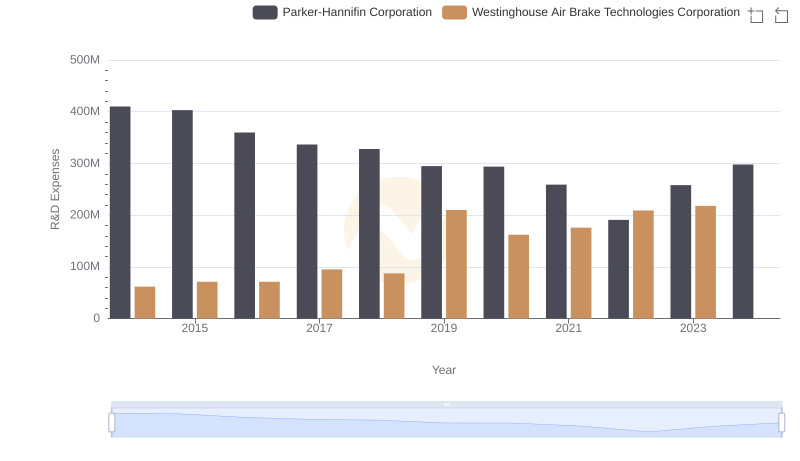

Parker-Hannifin Corporation vs Westinghouse Air Brake Technologies Corporation: Strategic Focus on R&D Spending

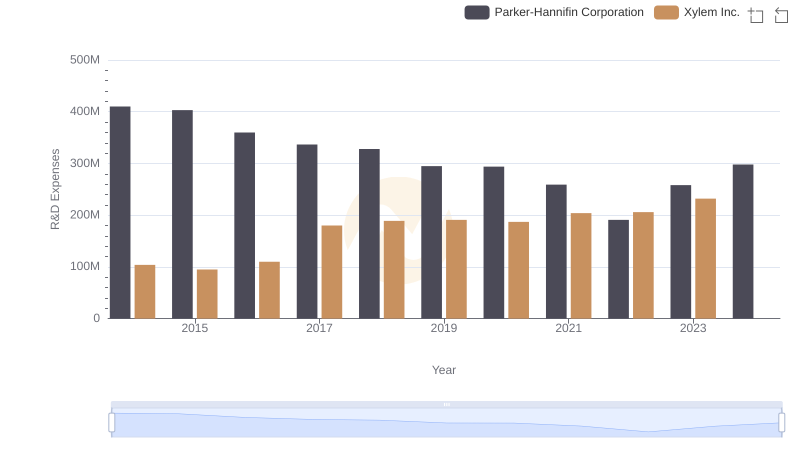

Research and Development Expenses Breakdown: Parker-Hannifin Corporation vs Xylem Inc.

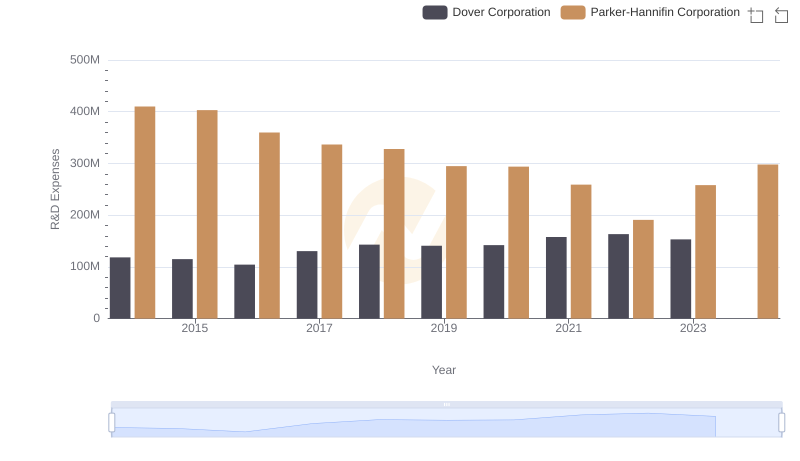

Research and Development: Comparing Key Metrics for Parker-Hannifin Corporation and Dover Corporation

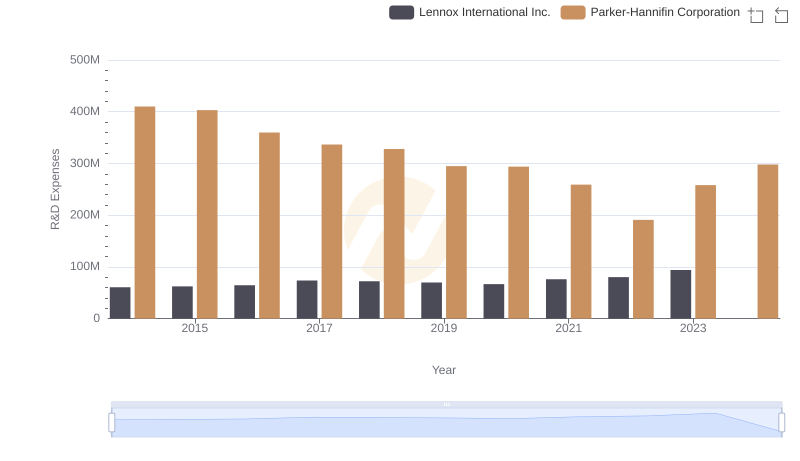

Research and Development: Comparing Key Metrics for Parker-Hannifin Corporation and Lennox International Inc.

Parker-Hannifin Corporation vs Rockwell Automation, Inc.: In-Depth EBITDA Performance Comparison

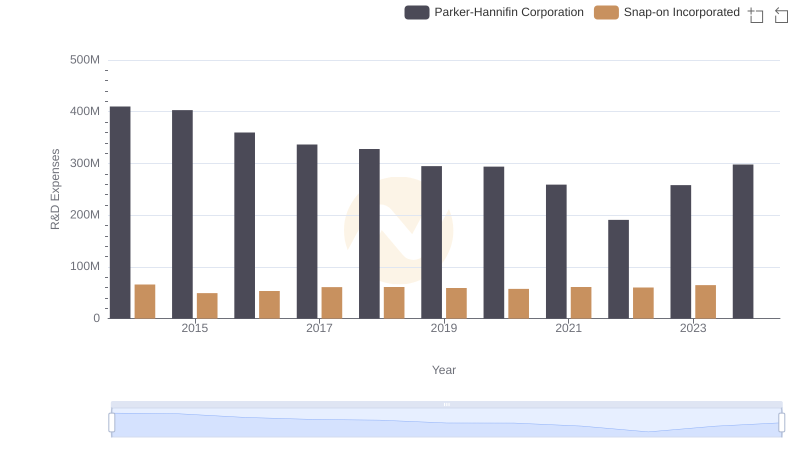

Research and Development Expenses Breakdown: Parker-Hannifin Corporation vs Snap-on Incorporated