| __timestamp | Roper Technologies, Inc. | The Boeing Company |

|---|---|---|

| Wednesday, January 1, 2014 | 1102426000 | 3767000000 |

| Thursday, January 1, 2015 | 1136728000 | 3525000000 |

| Friday, January 1, 2016 | 1277847000 | 3616000000 |

| Sunday, January 1, 2017 | 1654552000 | 4094000000 |

| Monday, January 1, 2018 | 1883100000 | 4567000000 |

| Tuesday, January 1, 2019 | 1928700000 | 3909000000 |

| Wednesday, January 1, 2020 | 2111900000 | 4817000000 |

| Friday, January 1, 2021 | 2337700000 | 4157000000 |

| Saturday, January 1, 2022 | 2228300000 | 4187000000 |

| Sunday, January 1, 2023 | 1915900000 | 5168000000 |

| Monday, January 1, 2024 | 2881500000 | 5021000000 |

Igniting the spark of knowledge

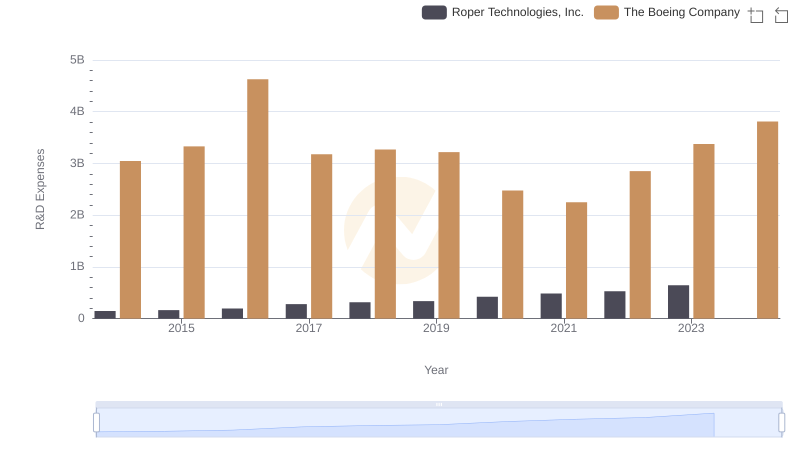

In the ever-evolving aerospace and technology sectors, effective cost management is crucial. Over the past decade, The Boeing Company and Roper Technologies, Inc. have demonstrated contrasting trends in their Selling, General, and Administrative (SG&A) expenses.

From 2014 to 2023, Boeing's SG&A expenses have soared by approximately 37%, peaking in 2023. This increase reflects the company's strategic investments and operational challenges, particularly in the wake of global disruptions.

Conversely, Roper Technologies has shown a more stable trajectory, with a 74% rise in SG&A expenses from 2014 to 2022, before a slight dip in 2023. This pattern underscores Roper's consistent growth strategy and adaptability in the tech industry.

As we look to the future, understanding these financial dynamics offers valuable insights into the strategic priorities of these industry leaders.

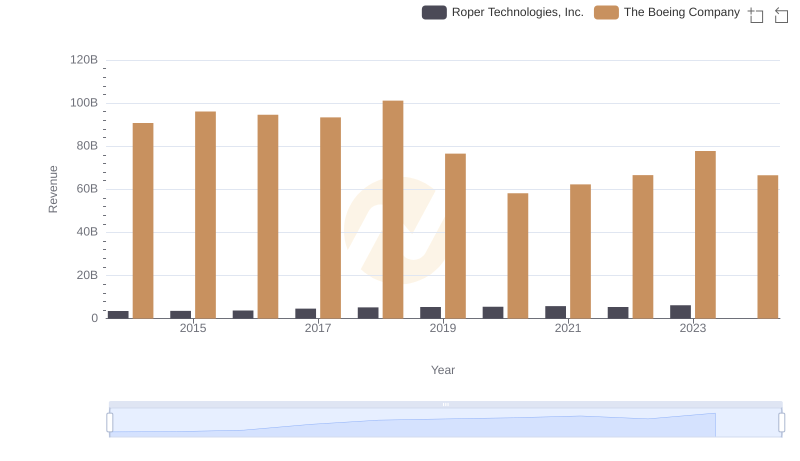

Revenue Insights: The Boeing Company and Roper Technologies, Inc. Performance Compared

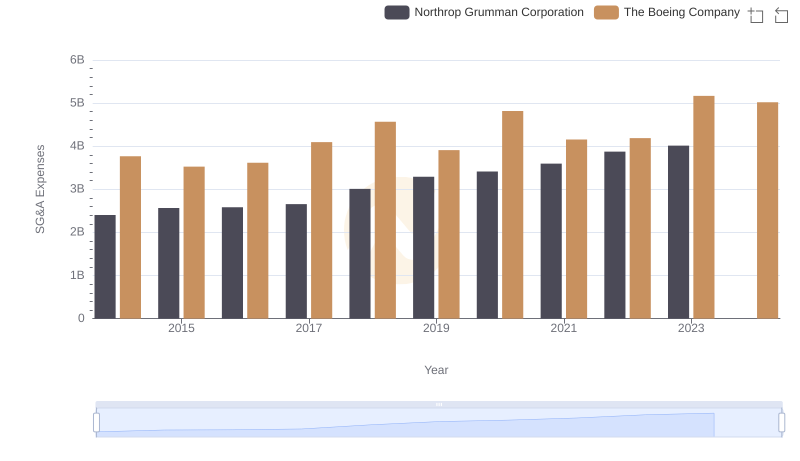

Operational Costs Compared: SG&A Analysis of The Boeing Company and Northrop Grumman Corporation

The Boeing Company or Roper Technologies, Inc.: Who Invests More in Innovation?

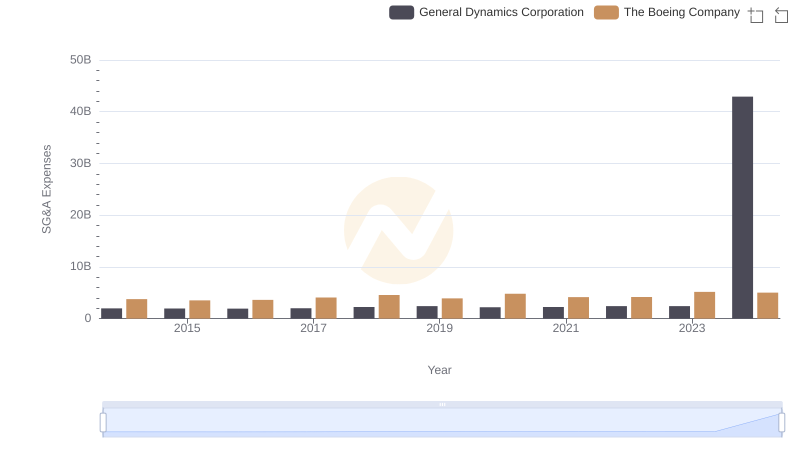

Operational Costs Compared: SG&A Analysis of The Boeing Company and General Dynamics Corporation

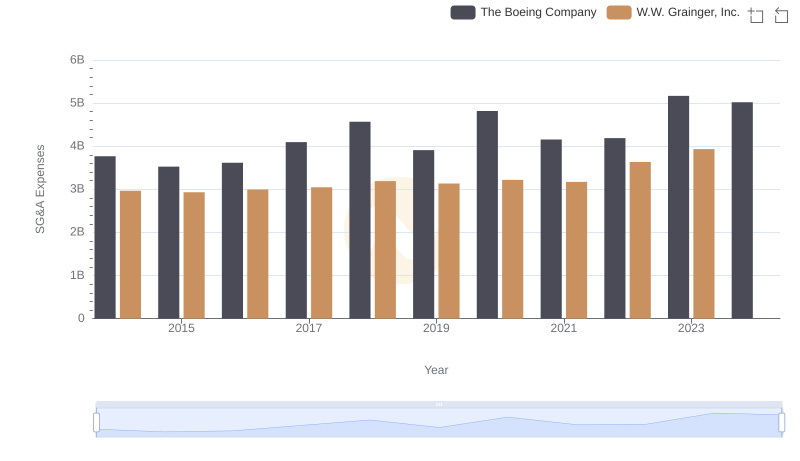

Selling, General, and Administrative Costs: The Boeing Company vs W.W. Grainger, Inc.

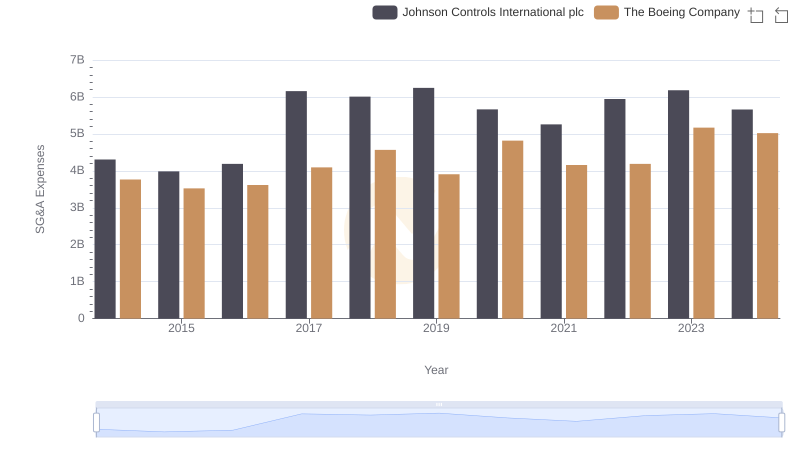

Operational Costs Compared: SG&A Analysis of The Boeing Company and Johnson Controls International plc

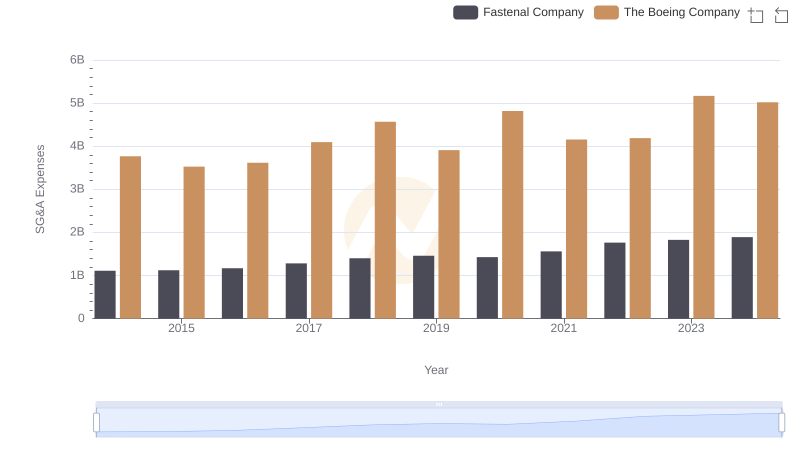

Who Optimizes SG&A Costs Better? The Boeing Company or Fastenal Company

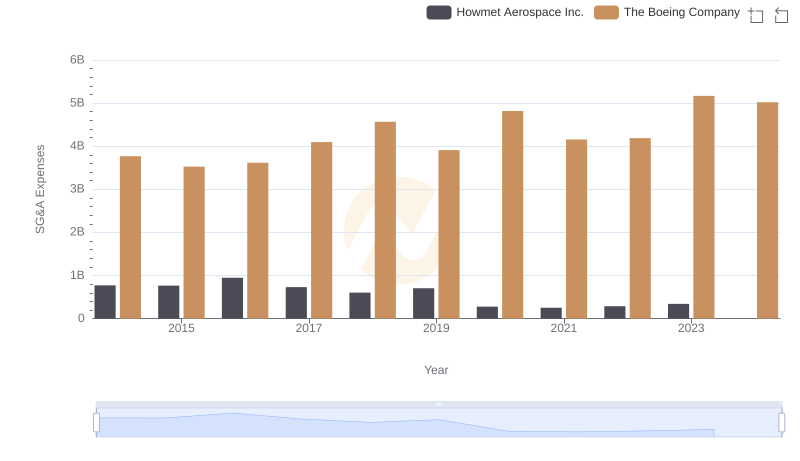

The Boeing Company or Howmet Aerospace Inc.: Who Manages SG&A Costs Better?