| __timestamp | Old Dominion Freight Line, Inc. | Pool Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 144817000 | 454470000 |

| Thursday, January 1, 2015 | 153589000 | 459422000 |

| Friday, January 1, 2016 | 152391000 | 485228000 |

| Sunday, January 1, 2017 | 177205000 | 520918000 |

| Monday, January 1, 2018 | 194368000 | 556284000 |

| Tuesday, January 1, 2019 | 206125000 | 583679000 |

| Wednesday, January 1, 2020 | 184185000 | 659931000 |

| Friday, January 1, 2021 | 223757000 | 786808000 |

| Saturday, January 1, 2022 | 258883000 | 907629000 |

| Sunday, January 1, 2023 | 281053000 | 912927000 |

Unleashing insights

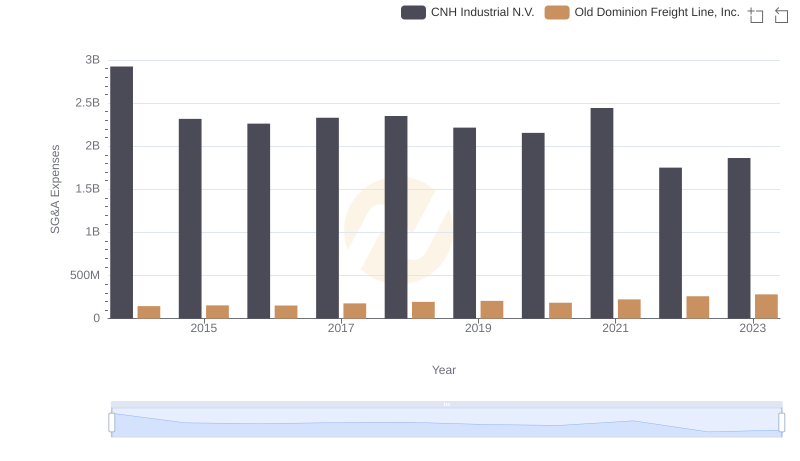

In the competitive landscape of logistics and distribution, understanding operational costs is crucial. Old Dominion Freight Line, Inc. and Pool Corporation, two industry giants, have shown distinct trends in their Selling, General, and Administrative (SG&A) expenses over the past decade.

From 2014 to 2023, Old Dominion Freight Line, Inc. saw a steady increase in SG&A expenses, rising by approximately 94% from 2014 to 2023. In contrast, Pool Corporation's expenses surged by about 101% during the same period. This indicates a robust expansion strategy, with Pool Corporation consistently outpacing Old Dominion in terms of SG&A growth.

These trends highlight the strategic priorities of each company. While Old Dominion focuses on operational efficiency, Pool Corporation's aggressive spending suggests a focus on market expansion. Investors and stakeholders should consider these dynamics when evaluating potential growth and profitability.

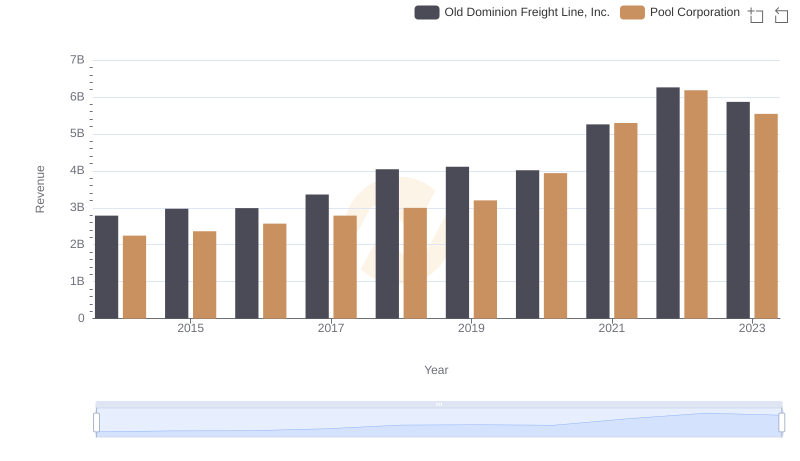

Breaking Down Revenue Trends: Old Dominion Freight Line, Inc. vs Pool Corporation

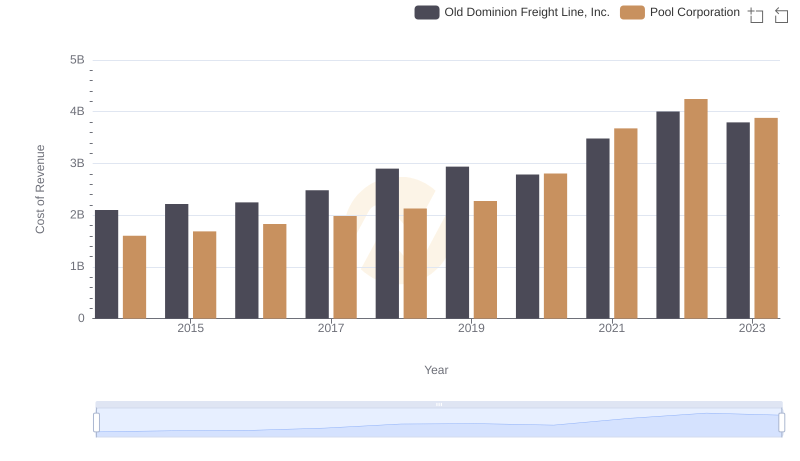

Cost of Revenue: Key Insights for Old Dominion Freight Line, Inc. and Pool Corporation

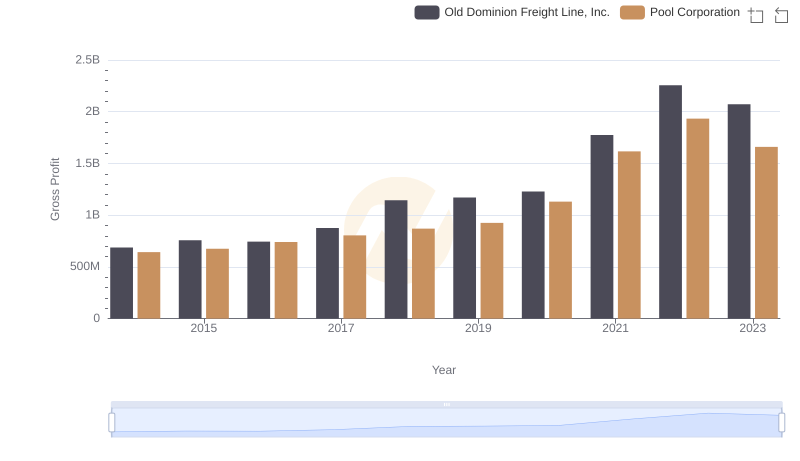

Old Dominion Freight Line, Inc. vs Pool Corporation: A Gross Profit Performance Breakdown

Who Optimizes SG&A Costs Better? Old Dominion Freight Line, Inc. or CNH Industrial N.V.

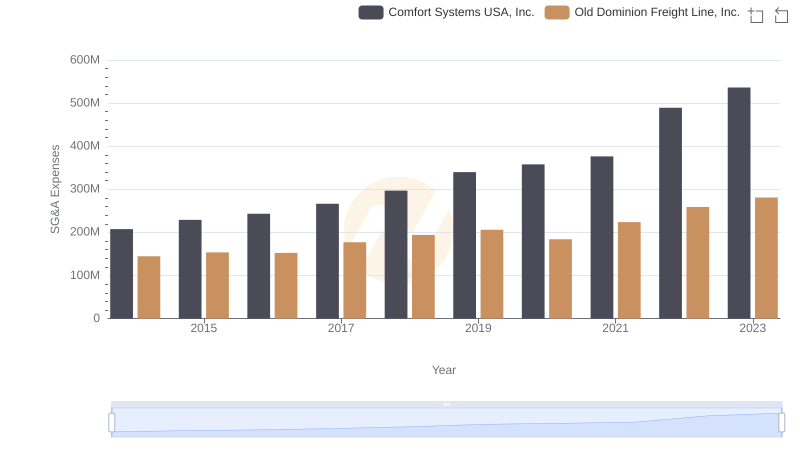

Comparing SG&A Expenses: Old Dominion Freight Line, Inc. vs Comfort Systems USA, Inc. Trends and Insights

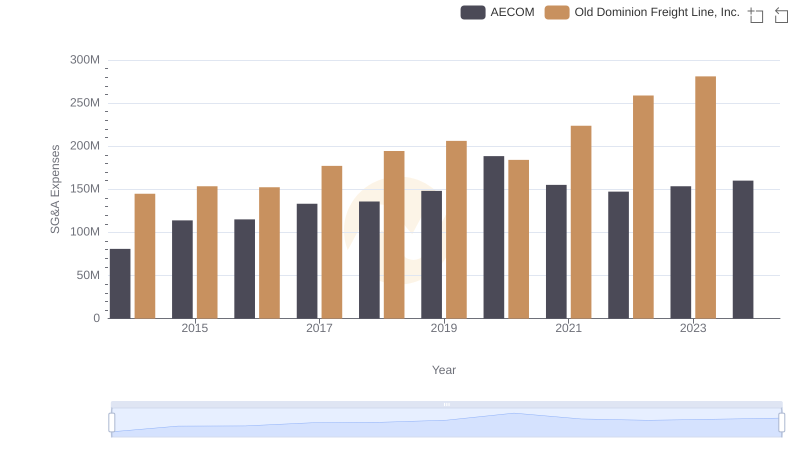

Comparing SG&A Expenses: Old Dominion Freight Line, Inc. vs AECOM Trends and Insights

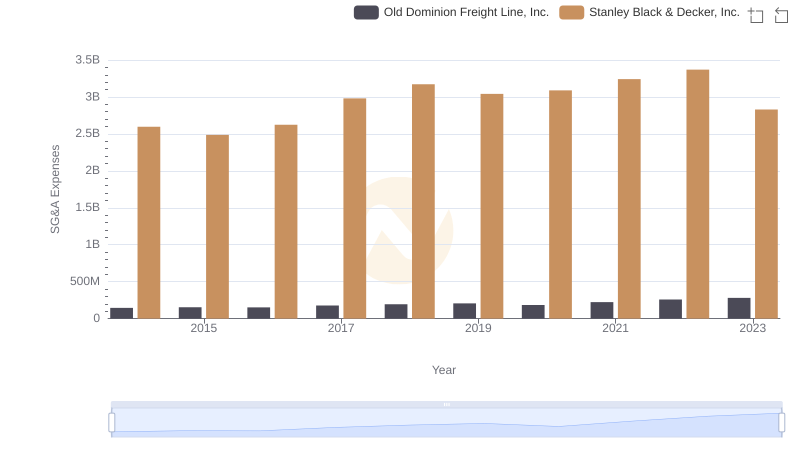

SG&A Efficiency Analysis: Comparing Old Dominion Freight Line, Inc. and Stanley Black & Decker, Inc.

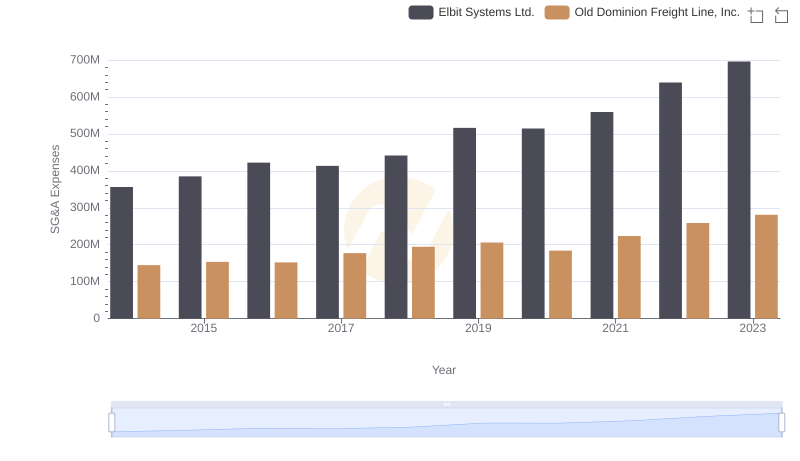

Cost Management Insights: SG&A Expenses for Old Dominion Freight Line, Inc. and Elbit Systems Ltd.

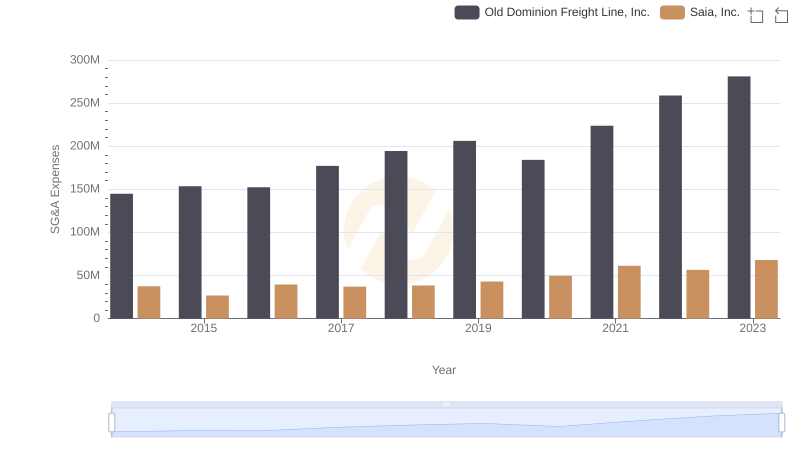

Breaking Down SG&A Expenses: Old Dominion Freight Line, Inc. vs Saia, Inc.

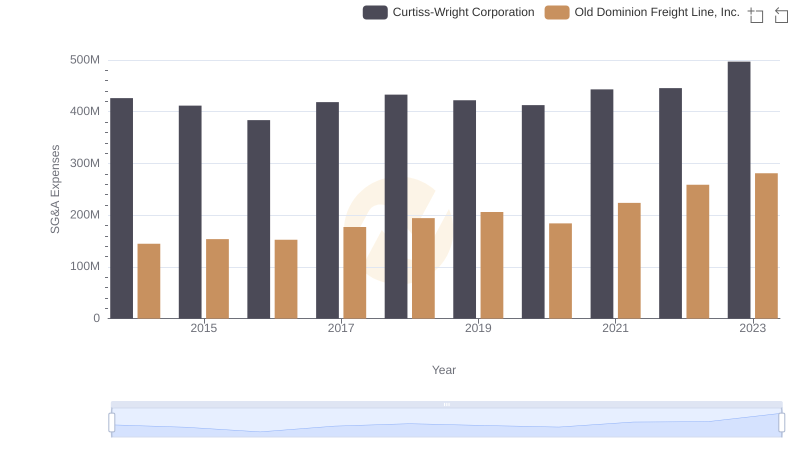

Cost Management Insights: SG&A Expenses for Old Dominion Freight Line, Inc. and Curtiss-Wright Corporation