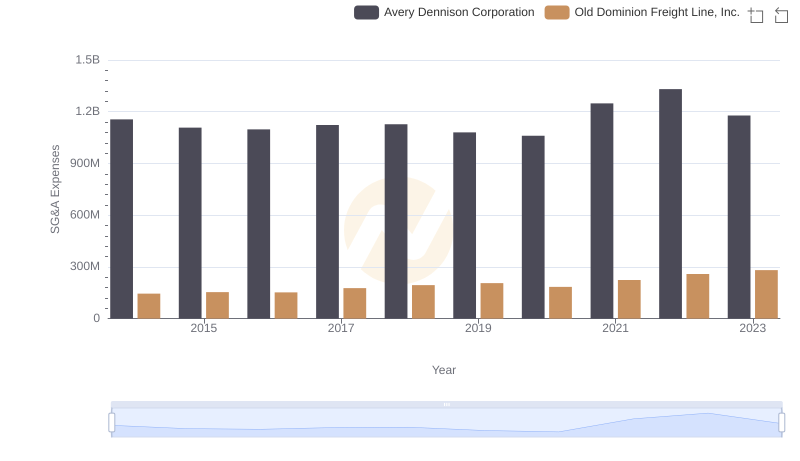

| __timestamp | CNH Industrial N.V. | Old Dominion Freight Line, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2925000000 | 144817000 |

| Thursday, January 1, 2015 | 2317000000 | 153589000 |

| Friday, January 1, 2016 | 2262000000 | 152391000 |

| Sunday, January 1, 2017 | 2330000000 | 177205000 |

| Monday, January 1, 2018 | 2351000000 | 194368000 |

| Tuesday, January 1, 2019 | 2216000000 | 206125000 |

| Wednesday, January 1, 2020 | 2155000000 | 184185000 |

| Friday, January 1, 2021 | 2443000000 | 223757000 |

| Saturday, January 1, 2022 | 1752000000 | 258883000 |

| Sunday, January 1, 2023 | 1863000000 | 281053000 |

Cracking the code

In the competitive world of logistics and industrial manufacturing, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Old Dominion Freight Line, Inc. and CNH Industrial N.V. have been at the forefront of this financial balancing act since 2014. Over the past decade, Old Dominion has demonstrated a remarkable ability to control its SG&A costs, maintaining an average of just 9% of CNH's expenses. This efficiency is evident as Old Dominion's SG&A expenses grew by approximately 94% from 2014 to 2023, while CNH Industrial saw a 36% decrease in the same period. The data reveals a strategic focus on cost optimization by both companies, albeit with different trajectories. As the industry evolves, these insights provide a window into the financial strategies that drive success in logistics and manufacturing.

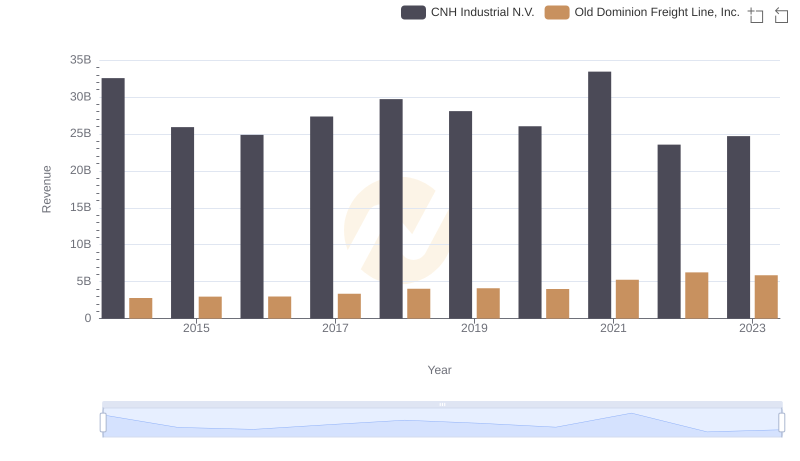

Comparing Revenue Performance: Old Dominion Freight Line, Inc. or CNH Industrial N.V.?

Cost Management Insights: SG&A Expenses for Old Dominion Freight Line, Inc. and Avery Dennison Corporation

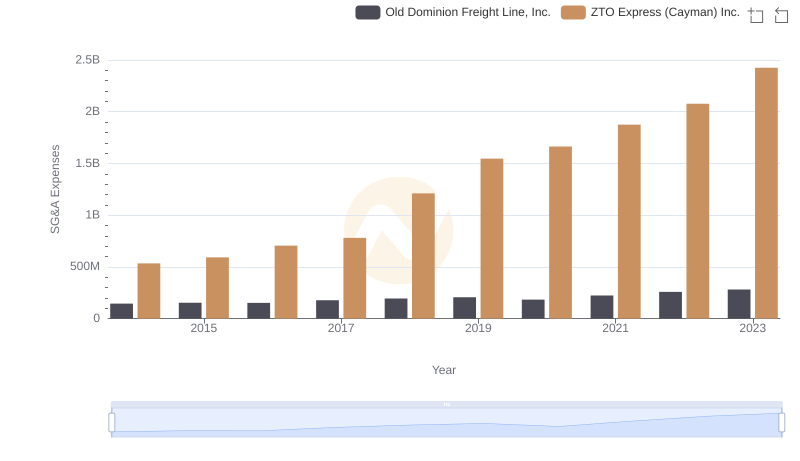

Comparing SG&A Expenses: Old Dominion Freight Line, Inc. vs ZTO Express (Cayman) Inc. Trends and Insights

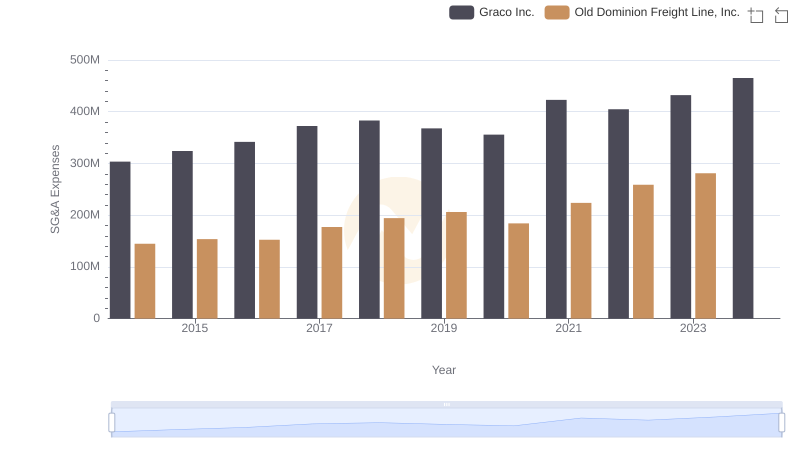

Old Dominion Freight Line, Inc. vs Graco Inc.: SG&A Expense Trends

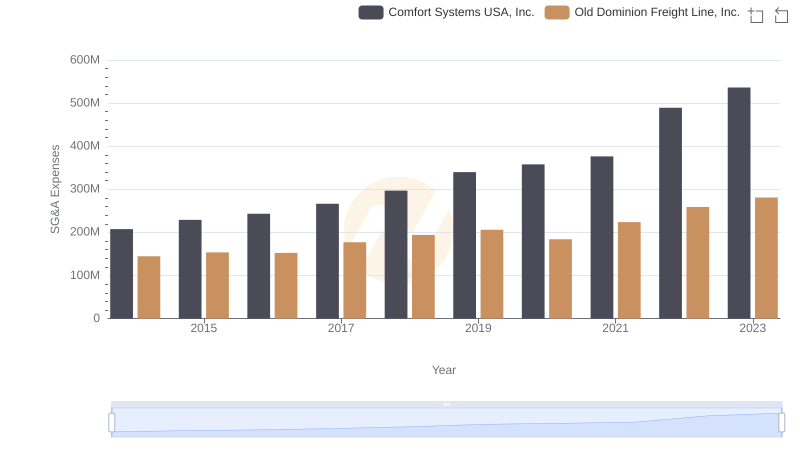

Comparing SG&A Expenses: Old Dominion Freight Line, Inc. vs Comfort Systems USA, Inc. Trends and Insights

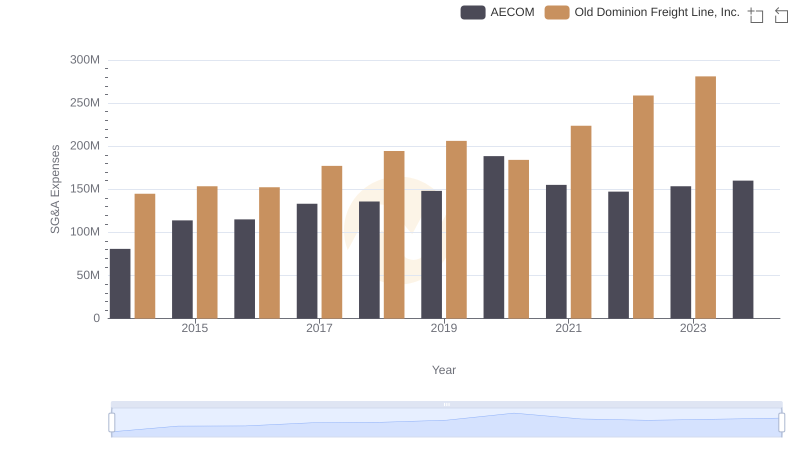

Comparing SG&A Expenses: Old Dominion Freight Line, Inc. vs AECOM Trends and Insights

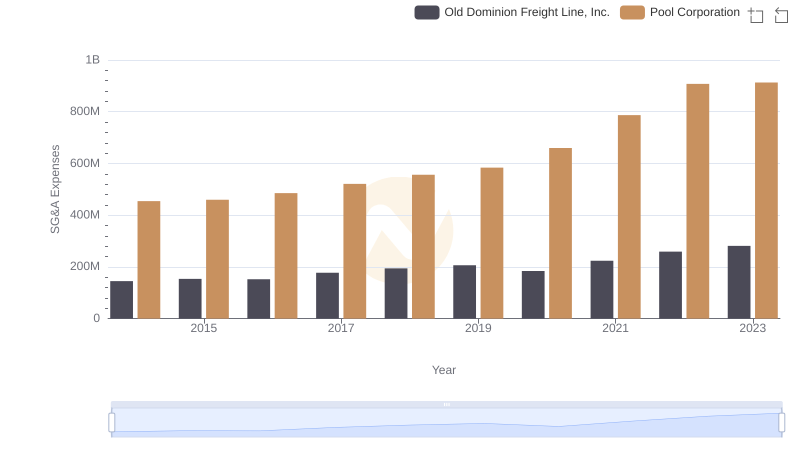

Operational Costs Compared: SG&A Analysis of Old Dominion Freight Line, Inc. and Pool Corporation

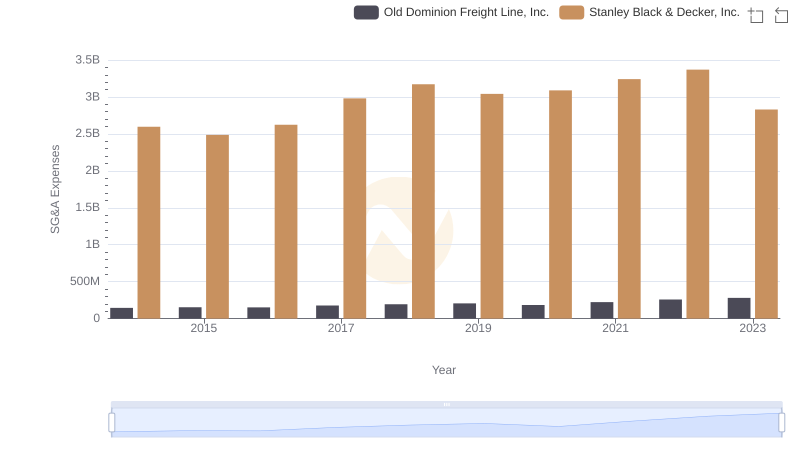

SG&A Efficiency Analysis: Comparing Old Dominion Freight Line, Inc. and Stanley Black & Decker, Inc.