| __timestamp | Eaton Corporation plc | Ryanair Holdings plc |

|---|---|---|

| Wednesday, January 1, 2014 | 3810000000 | 192800000 |

| Thursday, January 1, 2015 | 3596000000 | 233900000 |

| Friday, January 1, 2016 | 3505000000 | 292700000 |

| Sunday, January 1, 2017 | 3565000000 | 322300000 |

| Monday, January 1, 2018 | 3548000000 | 410400000 |

| Tuesday, January 1, 2019 | 3583000000 | 547300000 |

| Wednesday, January 1, 2020 | 3075000000 | 578800000 |

| Friday, January 1, 2021 | 3256000000 | 201500000 |

| Saturday, January 1, 2022 | 3227000000 | 411300000 |

| Sunday, January 1, 2023 | 3795000000 | 674400000 |

| Monday, January 1, 2024 | 4077000000 | 757200000 |

Unlocking the unknown

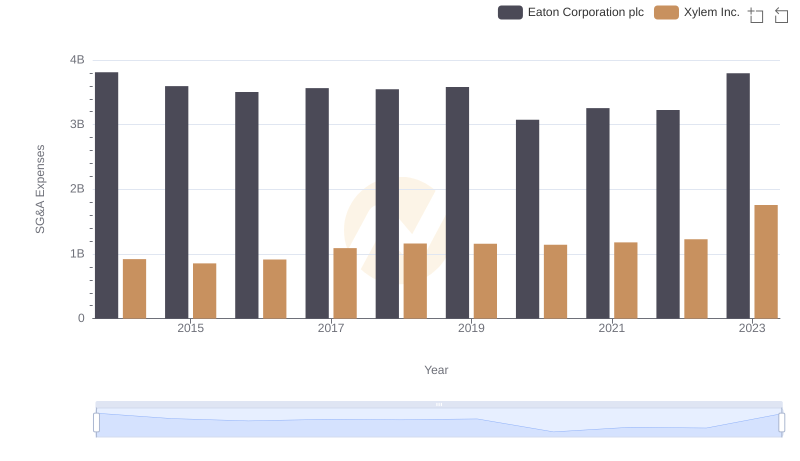

In the world of corporate finance, operational costs are a critical measure of efficiency and strategy. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of Eaton Corporation plc and Ryanair Holdings plc from 2014 to 2023. Eaton, a leader in power management, consistently reported higher SG&A expenses, peaking in 2014 with a 3% increase over the subsequent years. In contrast, Ryanair, Europe's budget airline, showcased a more dynamic trend, with a notable 250% rise in SG&A expenses from 2014 to 2023. This disparity highlights the contrasting business models: Eaton's steady industrial focus versus Ryanair's aggressive expansion in the competitive airline market. Notably, 2024 data for Eaton is missing, suggesting a potential shift or anomaly in reporting. As these companies navigate their respective industries, understanding their operational costs offers valuable insights into their strategic priorities.

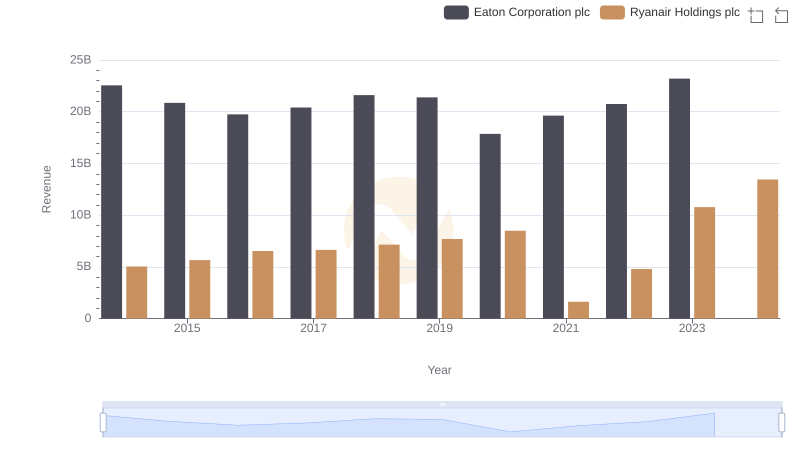

Breaking Down Revenue Trends: Eaton Corporation plc vs Ryanair Holdings plc

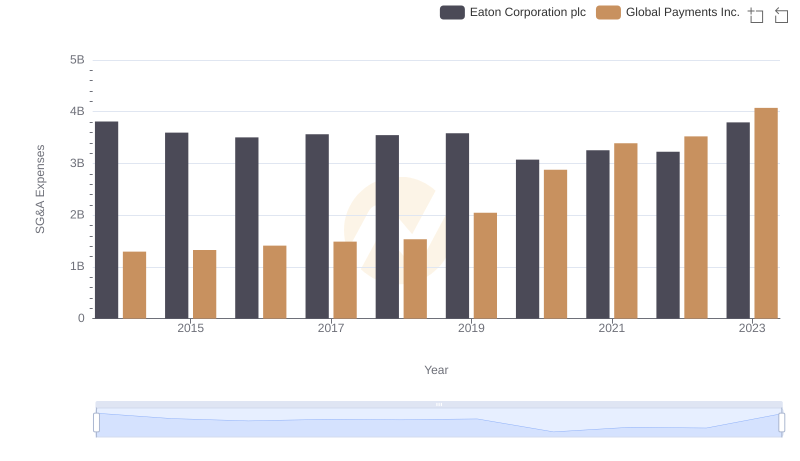

Cost Management Insights: SG&A Expenses for Eaton Corporation plc and Global Payments Inc.

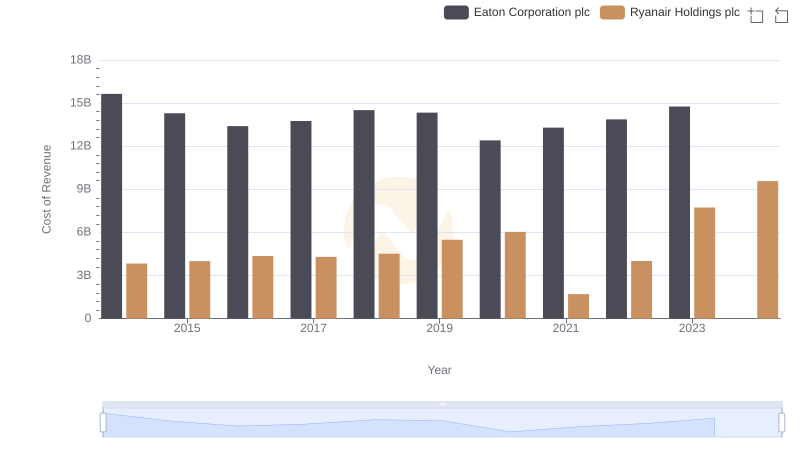

Analyzing Cost of Revenue: Eaton Corporation plc and Ryanair Holdings plc

Breaking Down SG&A Expenses: Eaton Corporation plc vs Xylem Inc.

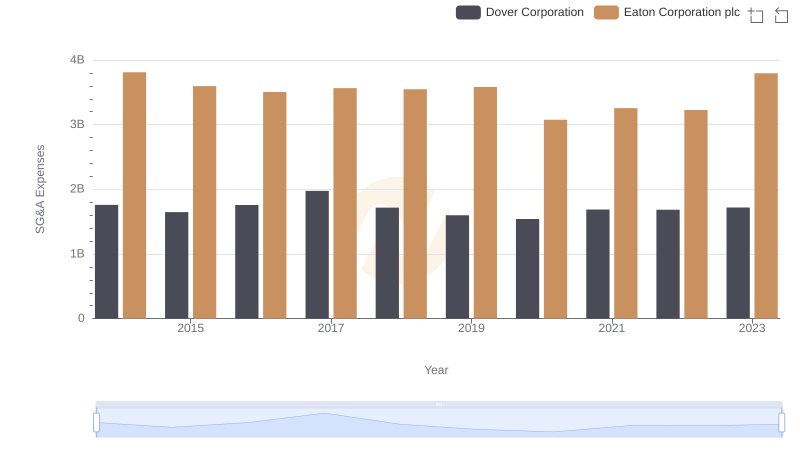

Comparing SG&A Expenses: Eaton Corporation plc vs Dover Corporation Trends and Insights

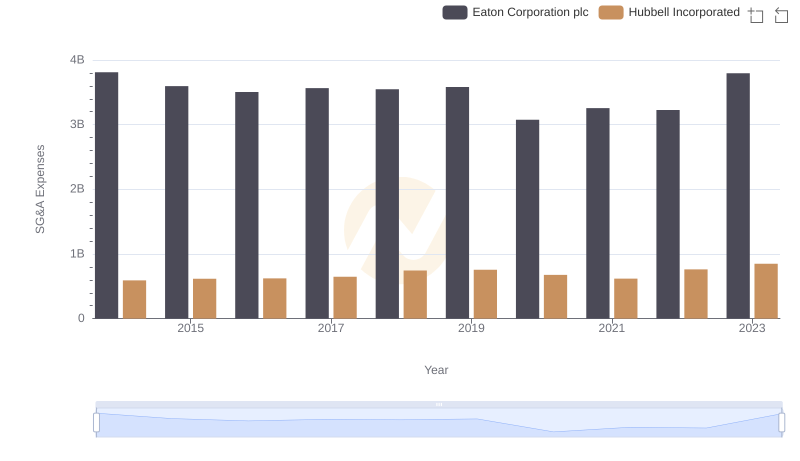

Operational Costs Compared: SG&A Analysis of Eaton Corporation plc and Hubbell Incorporated

Operational Costs Compared: SG&A Analysis of Eaton Corporation plc and Lennox International Inc.