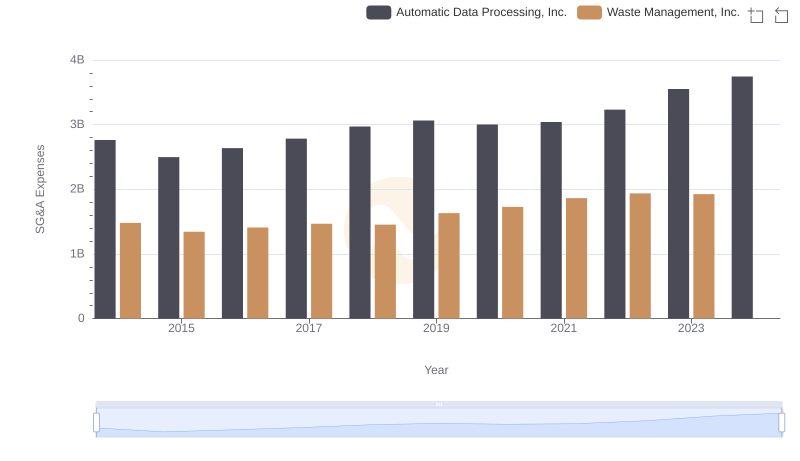

| __timestamp | Automatic Data Processing, Inc. | Parker-Hannifin Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 2762400000 | 1633992000 |

| Thursday, January 1, 2015 | 2496900000 | 1544746000 |

| Friday, January 1, 2016 | 2637000000 | 1359360000 |

| Sunday, January 1, 2017 | 2783200000 | 1453935000 |

| Monday, January 1, 2018 | 2971500000 | 1657152000 |

| Tuesday, January 1, 2019 | 3064200000 | 1543939000 |

| Wednesday, January 1, 2020 | 3003000000 | 1656553000 |

| Friday, January 1, 2021 | 3040500000 | 1527302000 |

| Saturday, January 1, 2022 | 3233200000 | 1627116000 |

| Sunday, January 1, 2023 | 3551400000 | 3354103000 |

| Monday, January 1, 2024 | 3778900000 | 3315177000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of corporate finance, understanding operational costs is crucial. Over the past decade, Automatic Data Processing, Inc. (ADP) and Parker-Hannifin Corporation have showcased distinct trends in their Selling, General, and Administrative (SG&A) expenses. From 2014 to 2024, ADP's SG&A expenses have surged by approximately 36%, reflecting its strategic investments in growth and innovation. In contrast, Parker-Hannifin's expenses remained relatively stable until a dramatic 105% increase in 2023, likely due to strategic acquisitions or expansions.

This analysis highlights the importance of SG&A management in maintaining competitive advantage. ADP's consistent growth in expenses aligns with its expansion strategy, while Parker-Hannifin's recent spike suggests a pivotal shift in its operational focus. As businesses navigate the complexities of the modern market, these insights underscore the critical role of financial agility and strategic foresight.

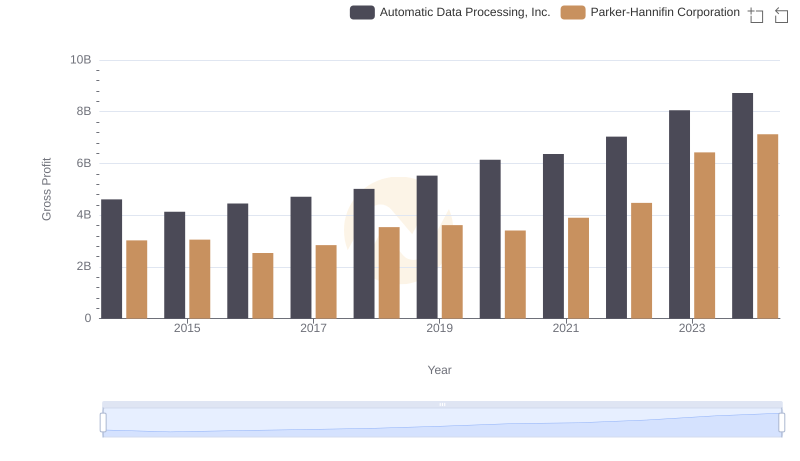

Gross Profit Trends Compared: Automatic Data Processing, Inc. vs Parker-Hannifin Corporation

SG&A Efficiency Analysis: Comparing Automatic Data Processing, Inc. and Waste Management, Inc.

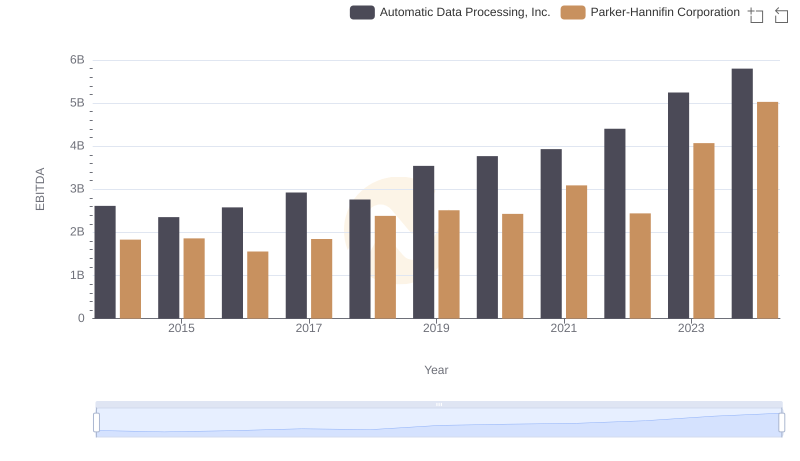

EBITDA Performance Review: Automatic Data Processing, Inc. vs Parker-Hannifin Corporation

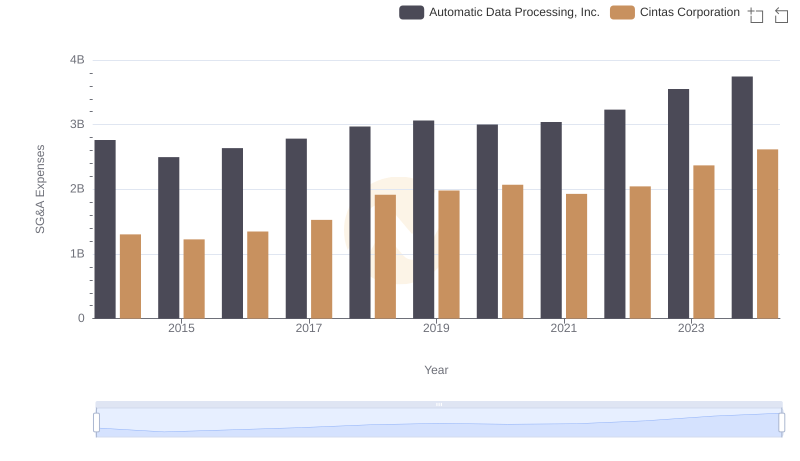

SG&A Efficiency Analysis: Comparing Automatic Data Processing, Inc. and Cintas Corporation

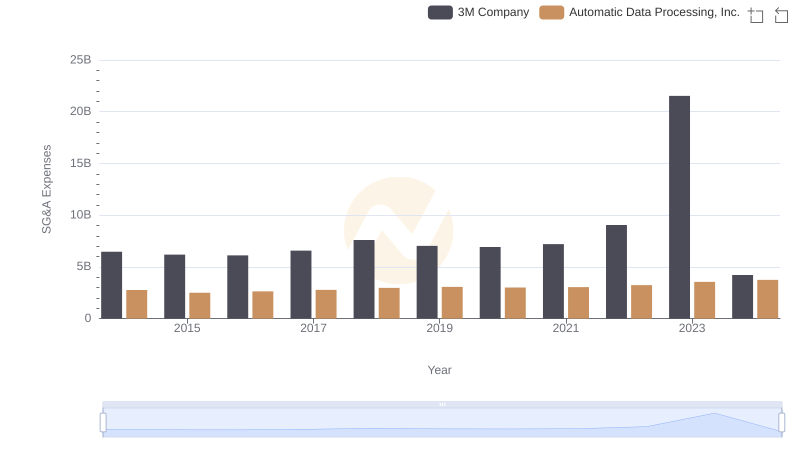

Automatic Data Processing, Inc. vs 3M Company: SG&A Expense Trends

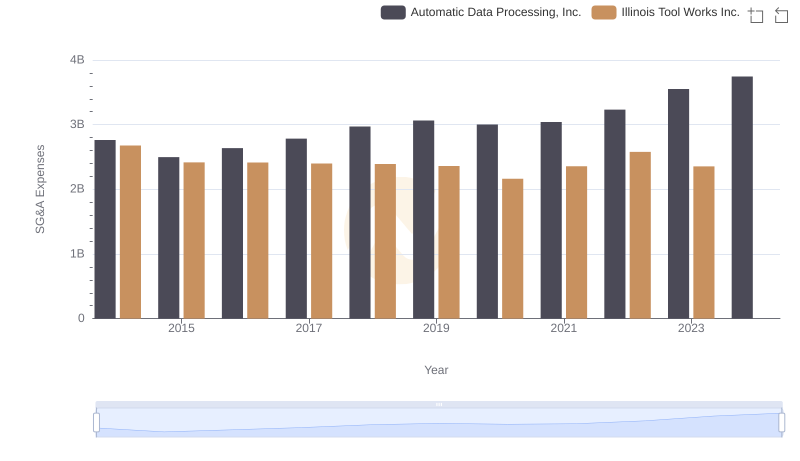

SG&A Efficiency Analysis: Comparing Automatic Data Processing, Inc. and Illinois Tool Works Inc.

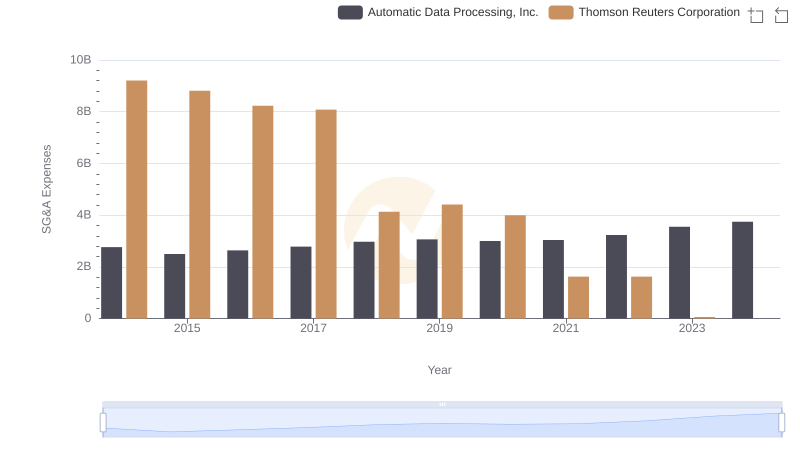

Breaking Down SG&A Expenses: Automatic Data Processing, Inc. vs Thomson Reuters Corporation

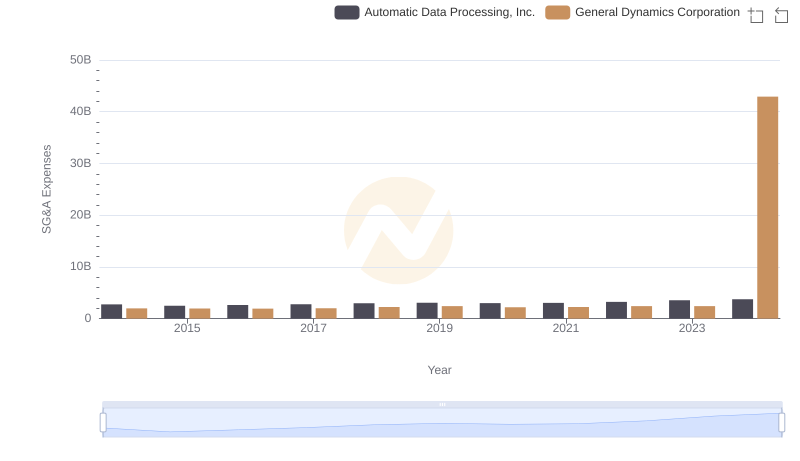

Automatic Data Processing, Inc. or General Dynamics Corporation: Who Manages SG&A Costs Better?

Cost Management Insights: SG&A Expenses for Automatic Data Processing, Inc. and Northrop Grumman Corporation