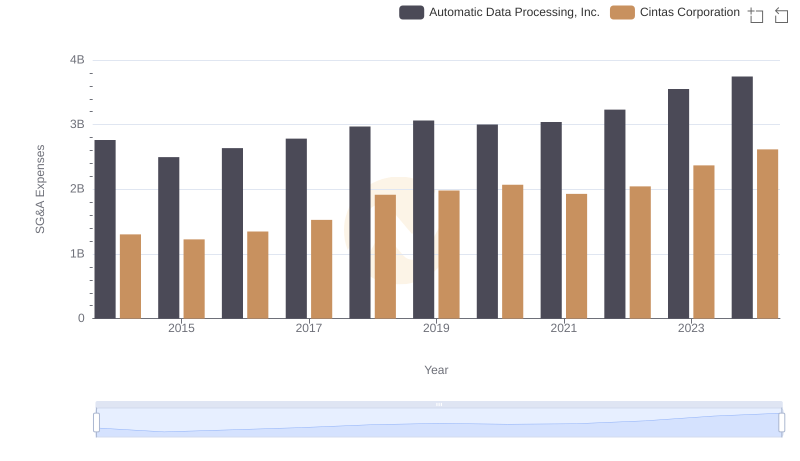

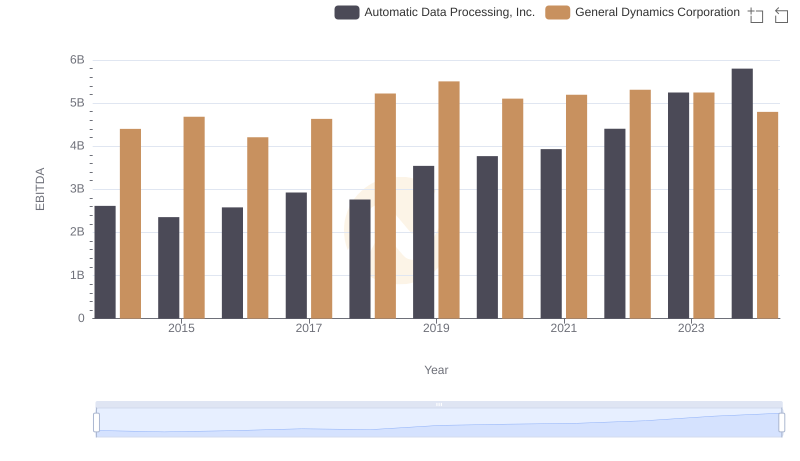

| __timestamp | Automatic Data Processing, Inc. | General Dynamics Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 2762400000 | 1984000000 |

| Thursday, January 1, 2015 | 2496900000 | 1952000000 |

| Friday, January 1, 2016 | 2637000000 | 1940000000 |

| Sunday, January 1, 2017 | 2783200000 | 2010000000 |

| Monday, January 1, 2018 | 2971500000 | 2258000000 |

| Tuesday, January 1, 2019 | 3064200000 | 2411000000 |

| Wednesday, January 1, 2020 | 3003000000 | 2192000000 |

| Friday, January 1, 2021 | 3040500000 | 2245000000 |

| Saturday, January 1, 2022 | 3233200000 | 2411000000 |

| Sunday, January 1, 2023 | 3551400000 | 2427000000 |

| Monday, January 1, 2024 | 3778900000 | 2568000000 |

Data in motion

In the competitive landscape of corporate America, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Automatic Data Processing, Inc. (ADP) and General Dynamics Corporation (GD) have been at the forefront of this financial balancing act since 2014. Over the past decade, ADP has consistently maintained its SG&A expenses around 3 billion dollars annually, showcasing a steady growth of approximately 28% from 2014 to 2023. In contrast, General Dynamics has kept its SG&A costs relatively stable, with a notable spike in 2024, reaching an unprecedented 42.9 billion dollars. This sudden increase could indicate strategic investments or restructuring. As businesses navigate economic uncertainties, understanding how these industry leaders manage their operational costs provides valuable insights into effective financial strategies.

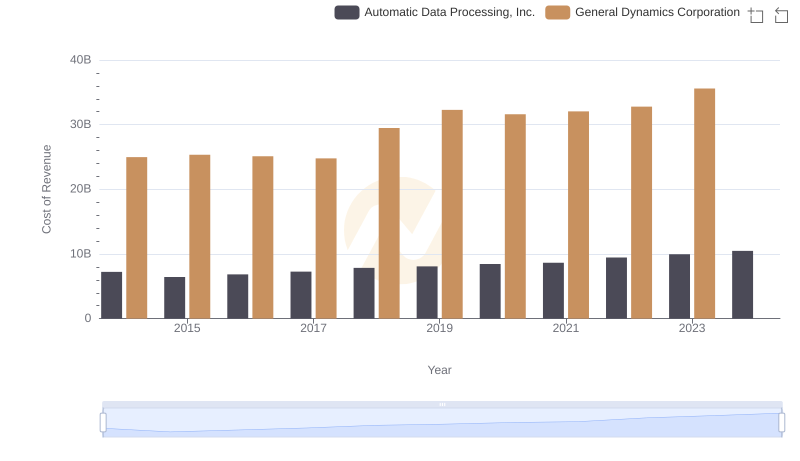

Cost of Revenue Trends: Automatic Data Processing, Inc. vs General Dynamics Corporation

SG&A Efficiency Analysis: Comparing Automatic Data Processing, Inc. and Cintas Corporation

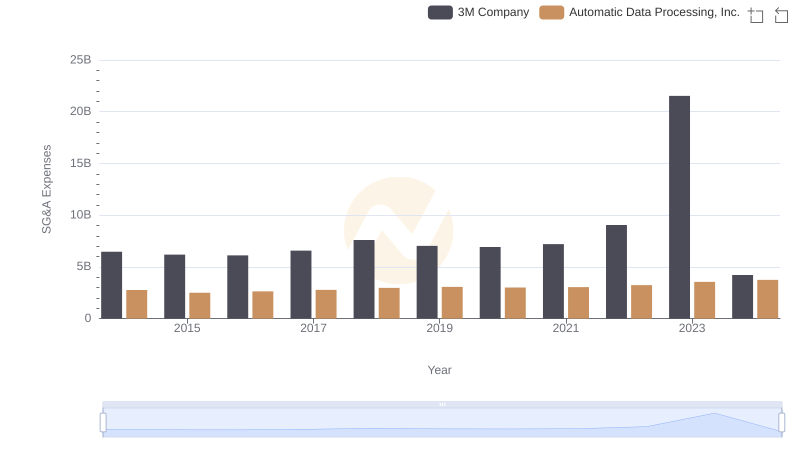

Automatic Data Processing, Inc. vs 3M Company: SG&A Expense Trends

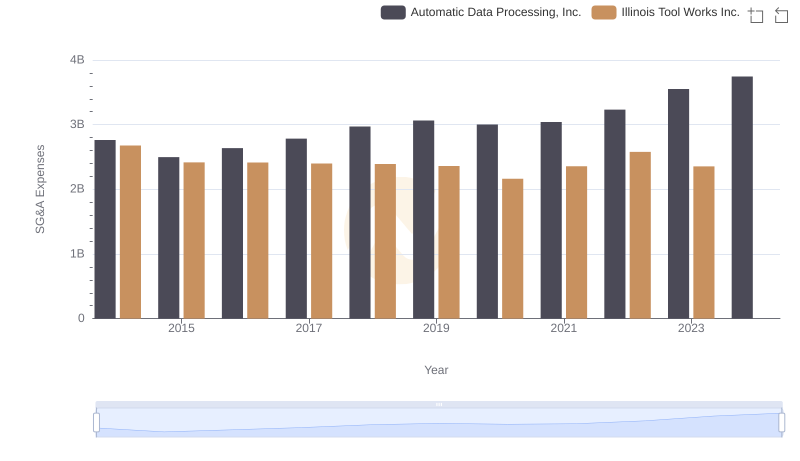

SG&A Efficiency Analysis: Comparing Automatic Data Processing, Inc. and Illinois Tool Works Inc.

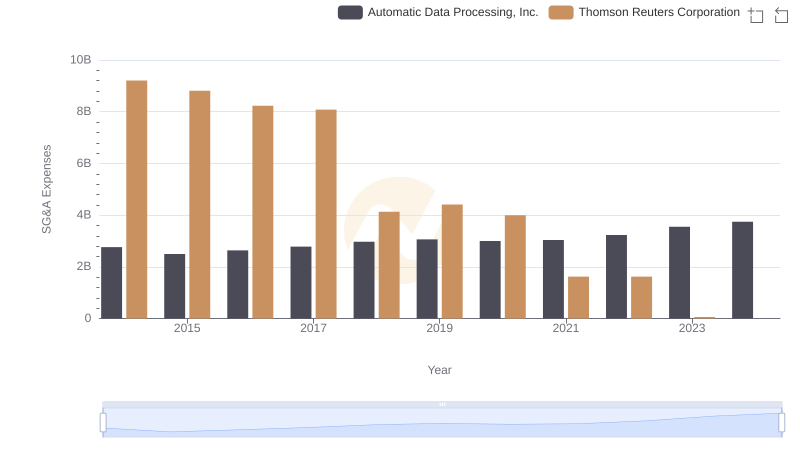

Breaking Down SG&A Expenses: Automatic Data Processing, Inc. vs Thomson Reuters Corporation

Cost Management Insights: SG&A Expenses for Automatic Data Processing, Inc. and Northrop Grumman Corporation

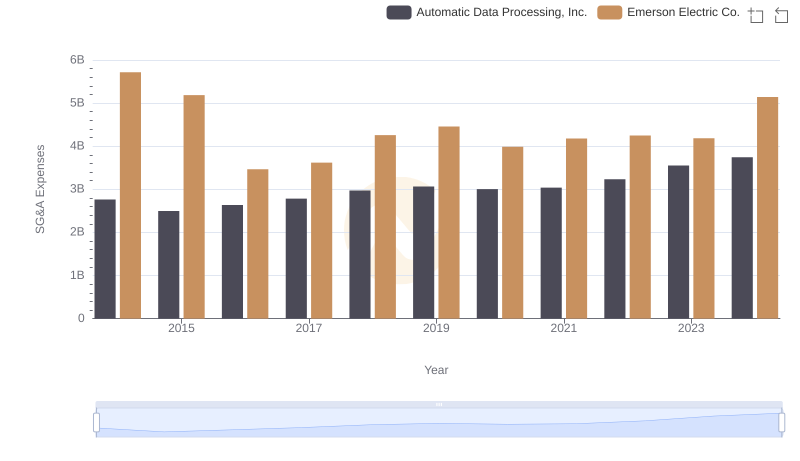

Comparing SG&A Expenses: Automatic Data Processing, Inc. vs Emerson Electric Co. Trends and Insights

A Professional Review of EBITDA: Automatic Data Processing, Inc. Compared to General Dynamics Corporation

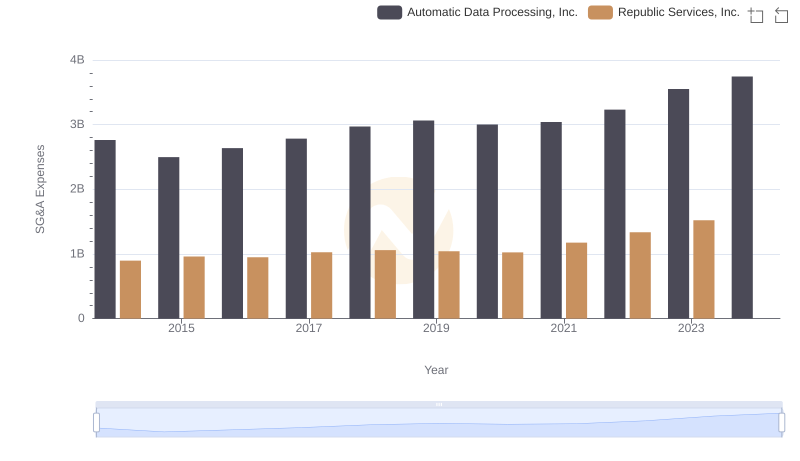

Automatic Data Processing, Inc. and Republic Services, Inc.: SG&A Spending Patterns Compared