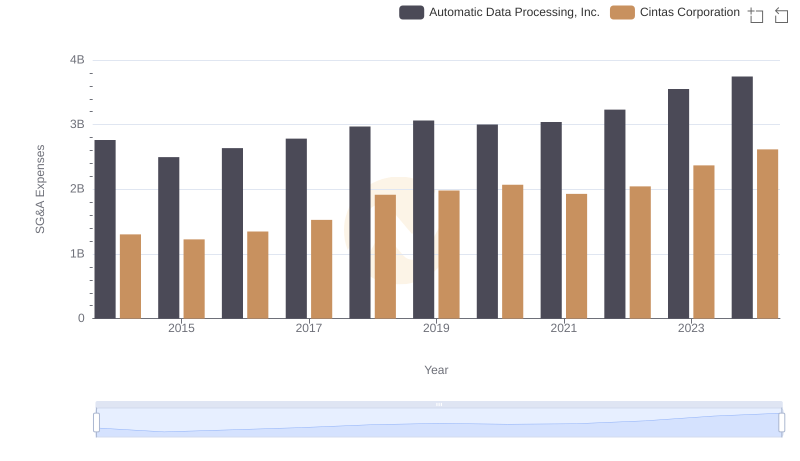

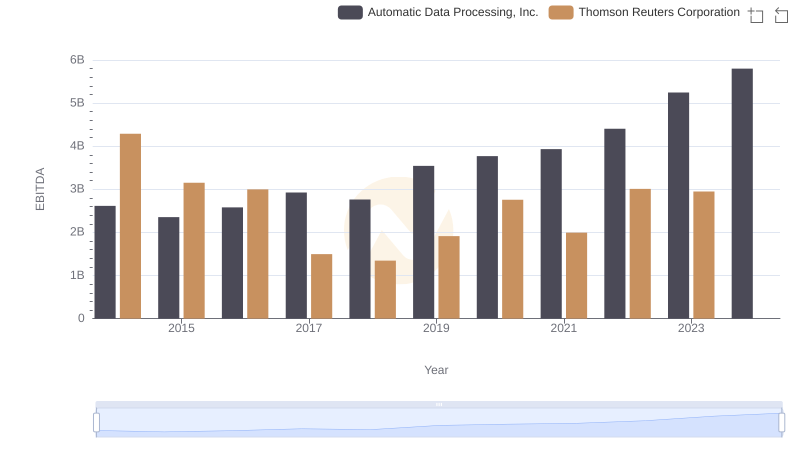

| __timestamp | Automatic Data Processing, Inc. | Thomson Reuters Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 2762400000 | 9209000000 |

| Thursday, January 1, 2015 | 2496900000 | 8810000000 |

| Friday, January 1, 2016 | 2637000000 | 8232000000 |

| Sunday, January 1, 2017 | 2783200000 | 8079000000 |

| Monday, January 1, 2018 | 2971500000 | 4131000000 |

| Tuesday, January 1, 2019 | 3064200000 | 4413000000 |

| Wednesday, January 1, 2020 | 3003000000 | 3999000000 |

| Friday, January 1, 2021 | 3040500000 | 1624000000 |

| Saturday, January 1, 2022 | 3233200000 | 1622000000 |

| Sunday, January 1, 2023 | 3551400000 | 64000000 |

| Monday, January 1, 2024 | 3778900000 |

Unlocking the unknown

In the ever-evolving landscape of corporate finance, understanding Selling, General, and Administrative (SG&A) expenses is crucial for evaluating a company's operational efficiency. Over the past decade, Automatic Data Processing, Inc. (ADP) and Thomson Reuters Corporation have showcased contrasting trends in their SG&A expenses.

From 2014 to 2023, ADP's SG&A expenses have steadily increased by approximately 36%, reflecting a consistent investment in operational capabilities. In contrast, Thomson Reuters experienced a dramatic 99% decrease in SG&A expenses, particularly noticeable from 2018 onwards. This sharp decline could indicate strategic cost-cutting measures or a shift in business focus.

Interestingly, the data for 2024 is incomplete for Thomson Reuters, suggesting a potential restructuring or reporting delay. These insights provide a window into the strategic priorities of these industry giants, offering valuable lessons for investors and analysts alike.

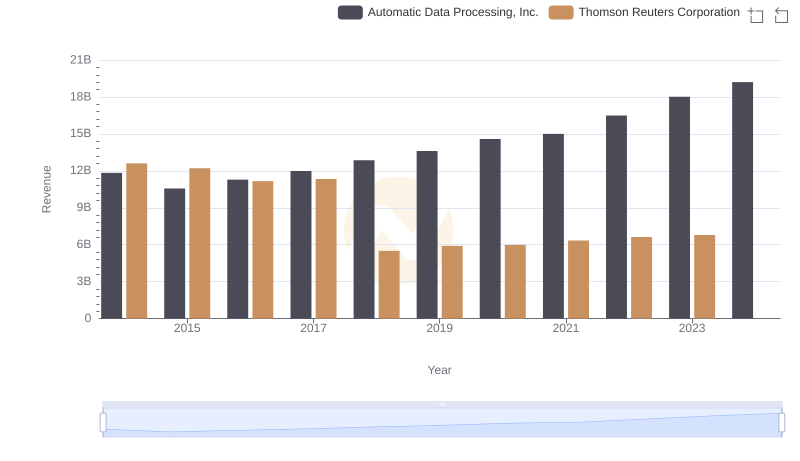

Automatic Data Processing, Inc. or Thomson Reuters Corporation: Who Leads in Yearly Revenue?

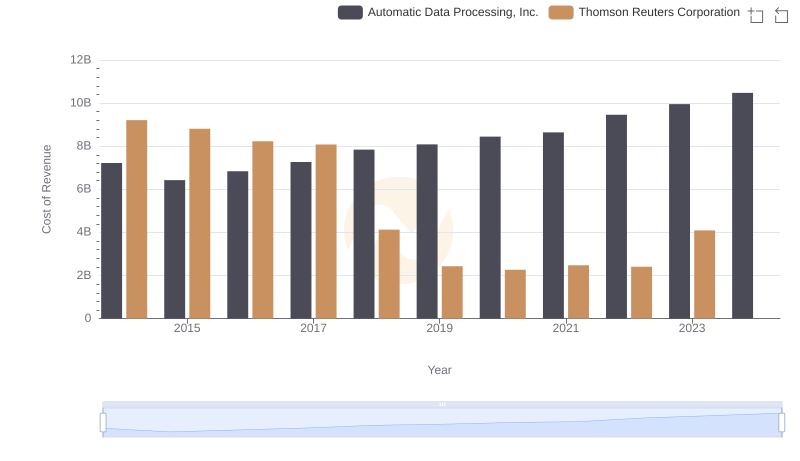

Cost of Revenue Comparison: Automatic Data Processing, Inc. vs Thomson Reuters Corporation

Gross Profit Analysis: Comparing Automatic Data Processing, Inc. and Thomson Reuters Corporation

SG&A Efficiency Analysis: Comparing Automatic Data Processing, Inc. and Cintas Corporation

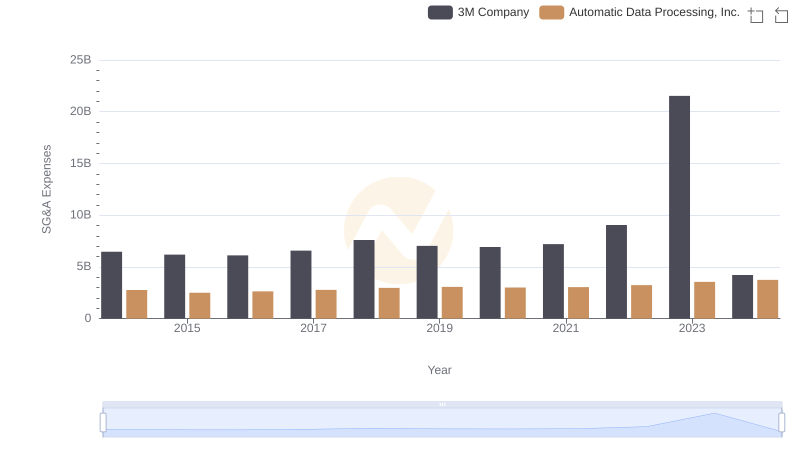

Automatic Data Processing, Inc. vs 3M Company: SG&A Expense Trends

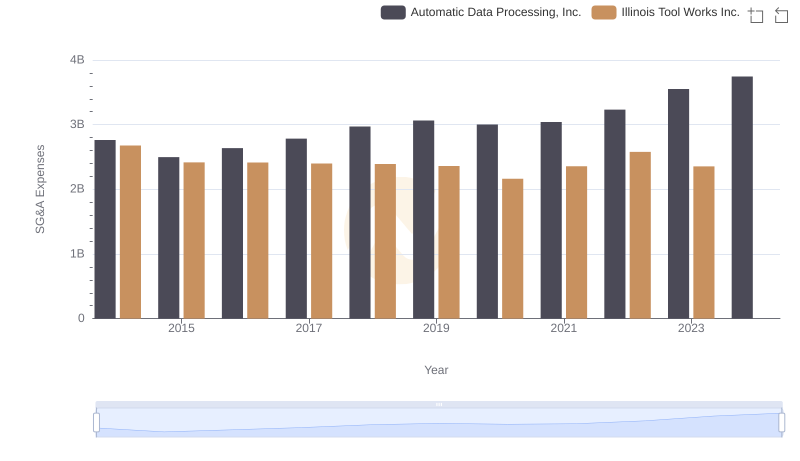

SG&A Efficiency Analysis: Comparing Automatic Data Processing, Inc. and Illinois Tool Works Inc.

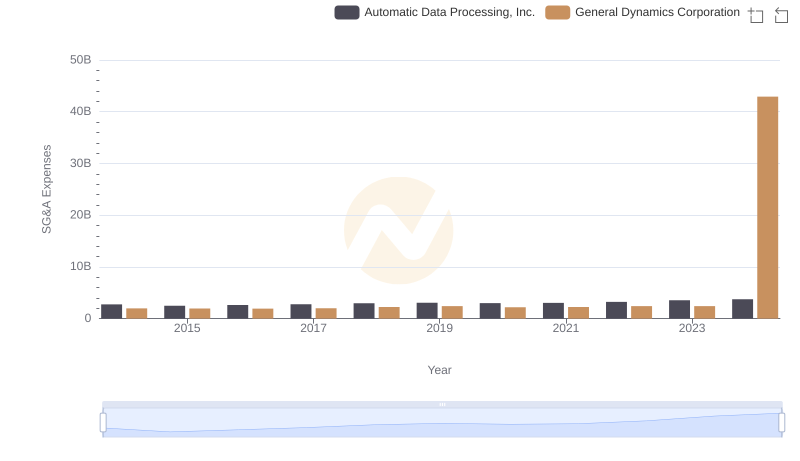

Automatic Data Processing, Inc. or General Dynamics Corporation: Who Manages SG&A Costs Better?

Cost Management Insights: SG&A Expenses for Automatic Data Processing, Inc. and Northrop Grumman Corporation

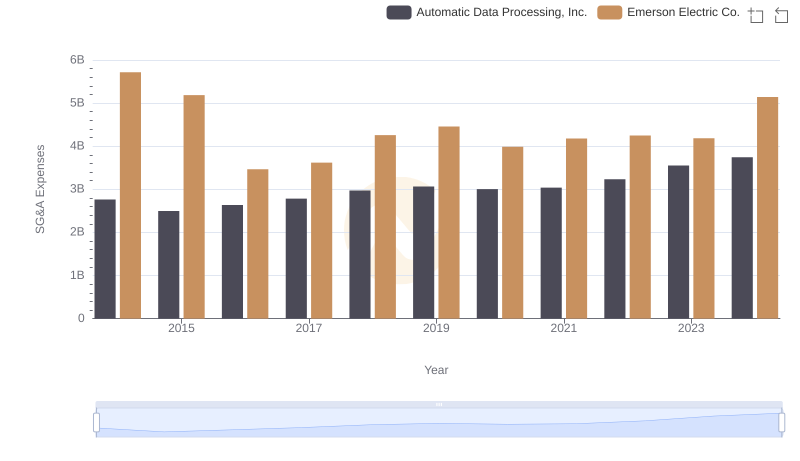

Comparing SG&A Expenses: Automatic Data Processing, Inc. vs Emerson Electric Co. Trends and Insights

EBITDA Analysis: Evaluating Automatic Data Processing, Inc. Against Thomson Reuters Corporation

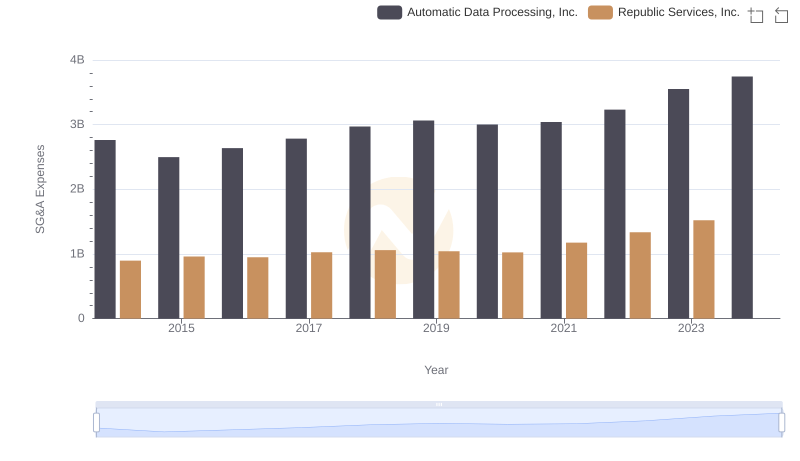

Automatic Data Processing, Inc. and Republic Services, Inc.: SG&A Spending Patterns Compared