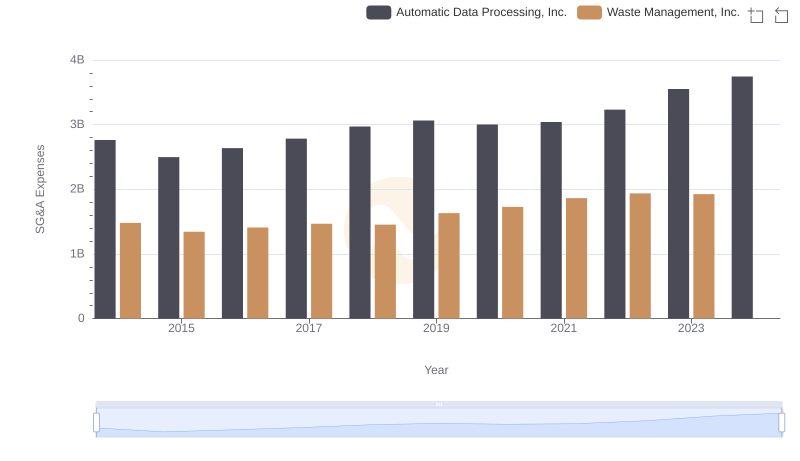

| __timestamp | Automatic Data Processing, Inc. | Cintas Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 2762400000 | 1302752000 |

| Thursday, January 1, 2015 | 2496900000 | 1224930000 |

| Friday, January 1, 2016 | 2637000000 | 1348122000 |

| Sunday, January 1, 2017 | 2783200000 | 1527380000 |

| Monday, January 1, 2018 | 2971500000 | 1916792000 |

| Tuesday, January 1, 2019 | 3064200000 | 1980644000 |

| Wednesday, January 1, 2020 | 3003000000 | 2071052000 |

| Friday, January 1, 2021 | 3040500000 | 1929159000 |

| Saturday, January 1, 2022 | 3233200000 | 2044876000 |

| Sunday, January 1, 2023 | 3551400000 | 2370704000 |

| Monday, January 1, 2024 | 3778900000 | 2617783000 |

Unleashing the power of data

In the competitive landscape of business operations, understanding the efficiency of Selling, General, and Administrative (SG&A) expenses is crucial. This analysis delves into the SG&A efficiency of Automatic Data Processing, Inc. (ADP) and Cintas Corporation over a decade, from 2014 to 2024.

ADP has consistently maintained higher SG&A expenses compared to Cintas, with a notable increase of approximately 36% from 2014 to 2024. In contrast, Cintas saw a 101% rise in the same period, indicating a more aggressive expansion or investment strategy.

In 2023, ADP's SG&A expenses surged to 3.55 billion, marking a significant leap from previous years, while Cintas reached 2.37 billion, reflecting its steady growth trajectory. This data highlights the strategic financial management and operational scaling of both companies, offering valuable insights for investors and industry analysts.

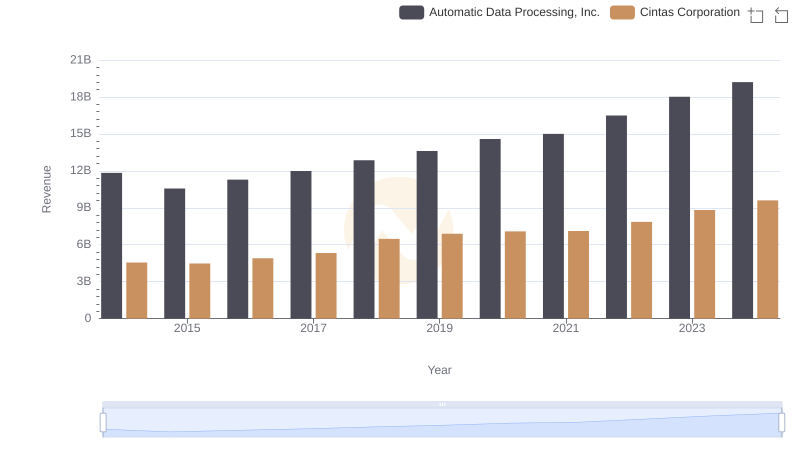

Automatic Data Processing, Inc. or Cintas Corporation: Who Leads in Yearly Revenue?

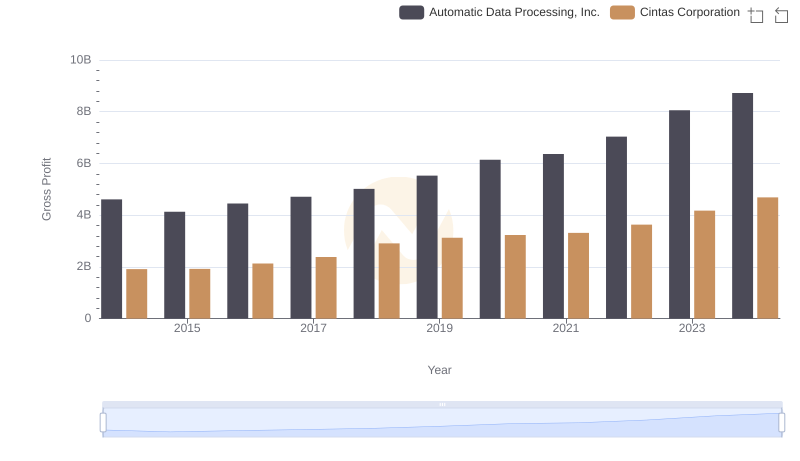

Gross Profit Comparison: Automatic Data Processing, Inc. and Cintas Corporation Trends

SG&A Efficiency Analysis: Comparing Automatic Data Processing, Inc. and Waste Management, Inc.

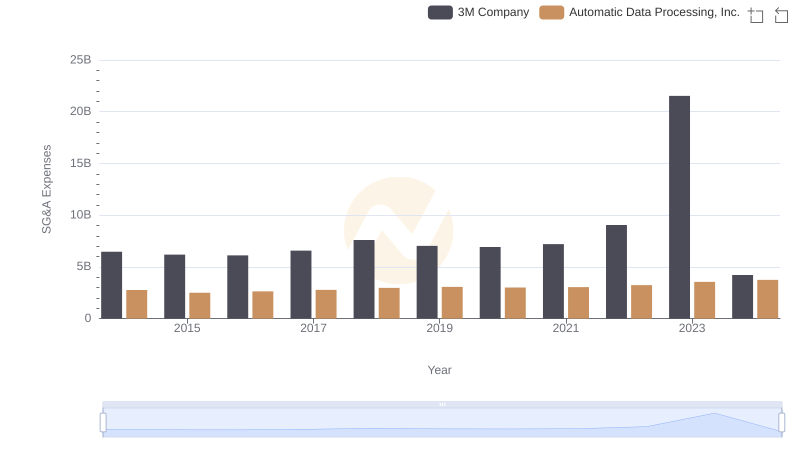

Automatic Data Processing, Inc. vs 3M Company: SG&A Expense Trends

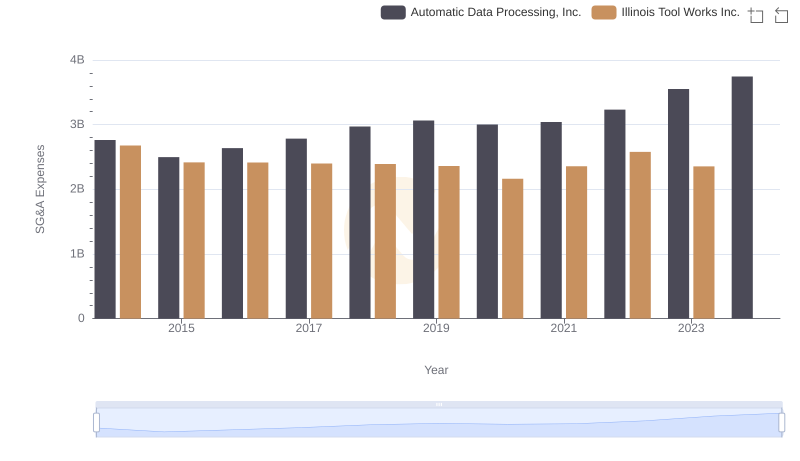

SG&A Efficiency Analysis: Comparing Automatic Data Processing, Inc. and Illinois Tool Works Inc.

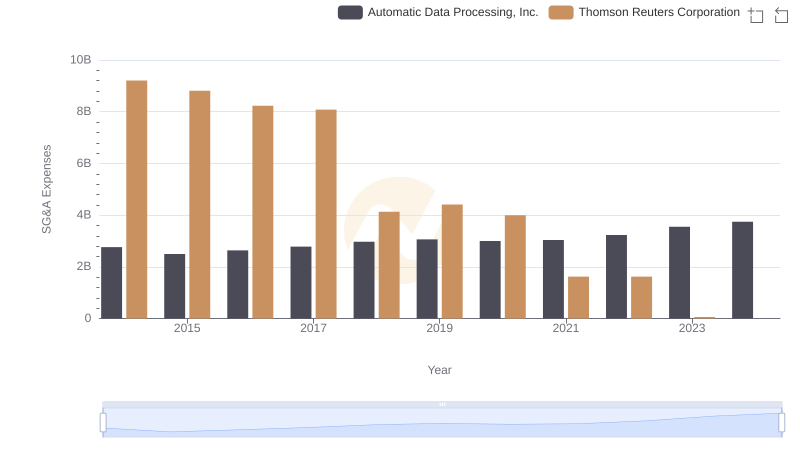

Breaking Down SG&A Expenses: Automatic Data Processing, Inc. vs Thomson Reuters Corporation

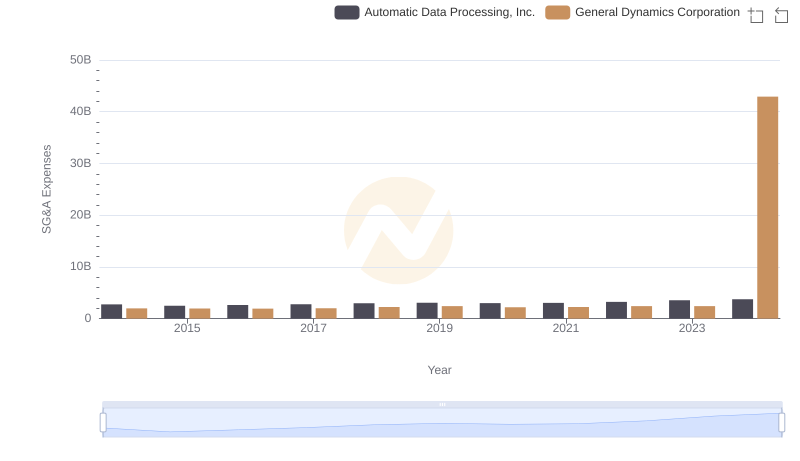

Automatic Data Processing, Inc. or General Dynamics Corporation: Who Manages SG&A Costs Better?

Cost Management Insights: SG&A Expenses for Automatic Data Processing, Inc. and Northrop Grumman Corporation

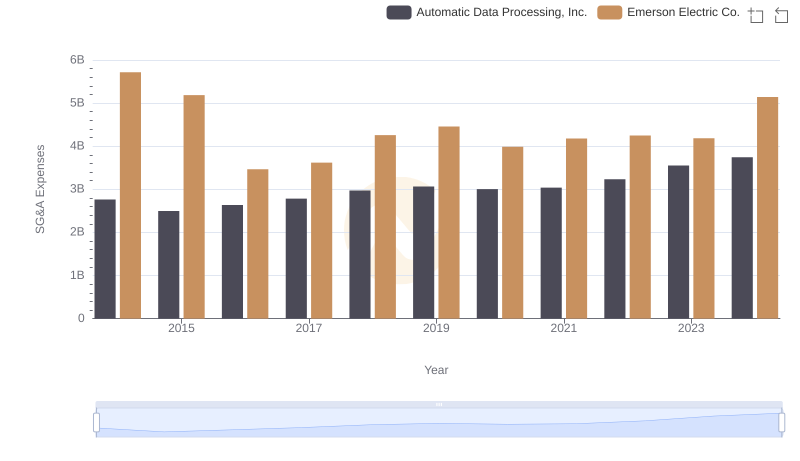

Comparing SG&A Expenses: Automatic Data Processing, Inc. vs Emerson Electric Co. Trends and Insights