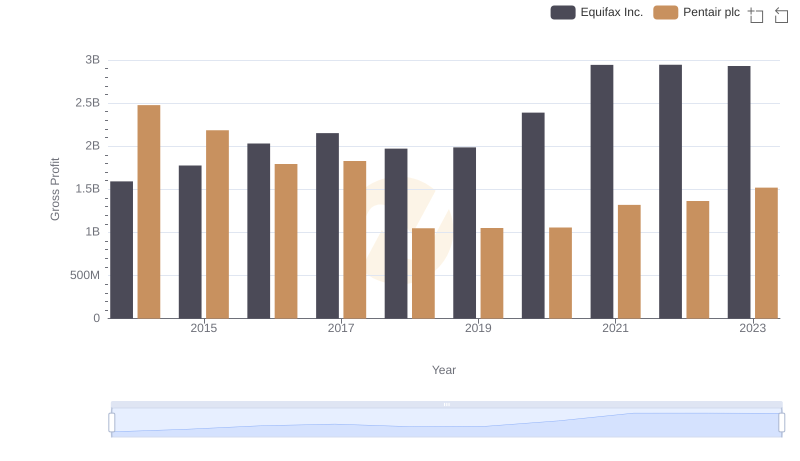

| __timestamp | Equifax Inc. | Pentair plc |

|---|---|---|

| Wednesday, January 1, 2014 | 844700000 | 4563000000 |

| Thursday, January 1, 2015 | 887400000 | 4263200000 |

| Friday, January 1, 2016 | 1113400000 | 3095900000 |

| Sunday, January 1, 2017 | 1210700000 | 3107400000 |

| Monday, January 1, 2018 | 1440400000 | 1917400000 |

| Tuesday, January 1, 2019 | 1521700000 | 1905700000 |

| Wednesday, January 1, 2020 | 1737400000 | 1960200000 |

| Friday, January 1, 2021 | 1980900000 | 2445600000 |

| Saturday, January 1, 2022 | 2177200000 | 2757200000 |

| Sunday, January 1, 2023 | 2335100000 | 2585300000 |

| Monday, January 1, 2024 | 0 | 2484000000 |

Data in motion

In the ever-evolving landscape of corporate finance, understanding the cost of revenue is crucial for assessing a company's efficiency and profitability. This analysis delves into the cost of revenue trends for Equifax Inc. and Pentair plc from 2014 to 2023. Over this period, Equifax Inc. has seen a steady increase in its cost of revenue, rising approximately 176% from 2014 to 2023. In contrast, Pentair plc experienced a significant decline of about 43% in the same timeframe, reflecting strategic shifts and operational efficiencies.

These trends highlight the diverse strategies employed by these companies in navigating their respective industries.

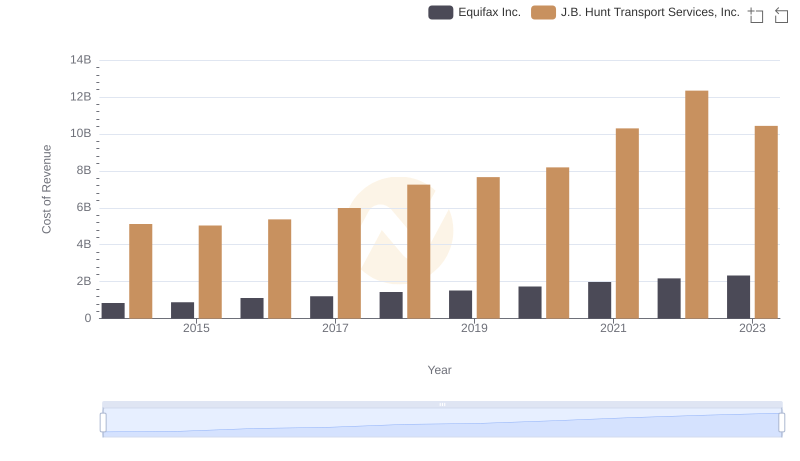

Cost of Revenue Trends: Equifax Inc. vs J.B. Hunt Transport Services, Inc.

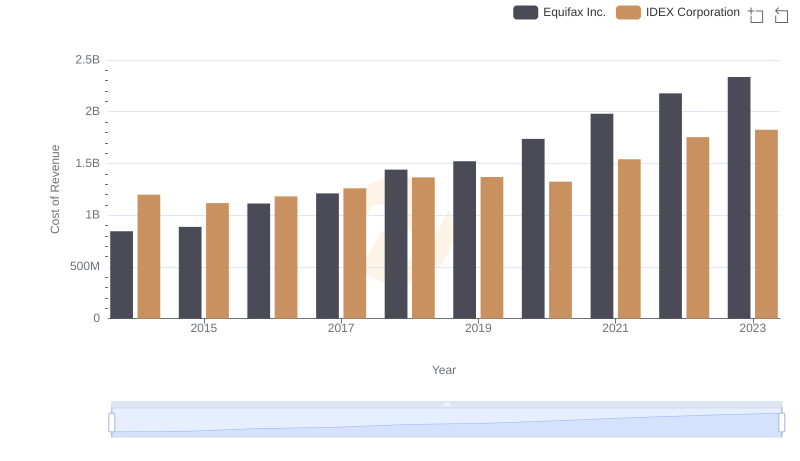

Cost Insights: Breaking Down Equifax Inc. and IDEX Corporation's Expenses

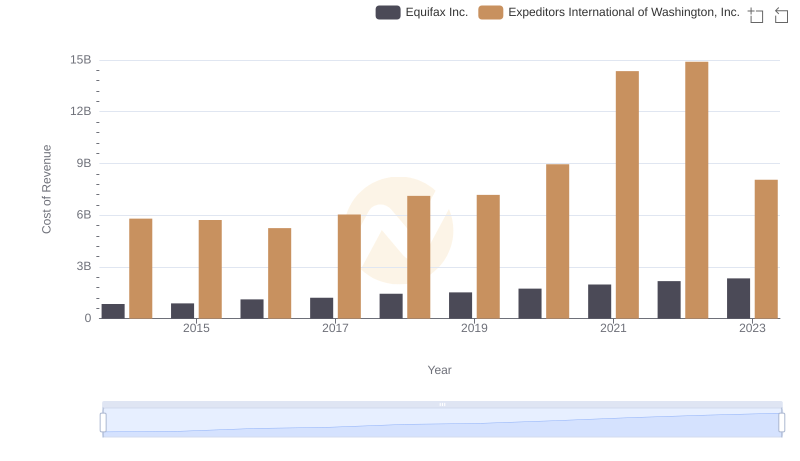

Cost of Revenue: Key Insights for Equifax Inc. and Expeditors International of Washington, Inc.

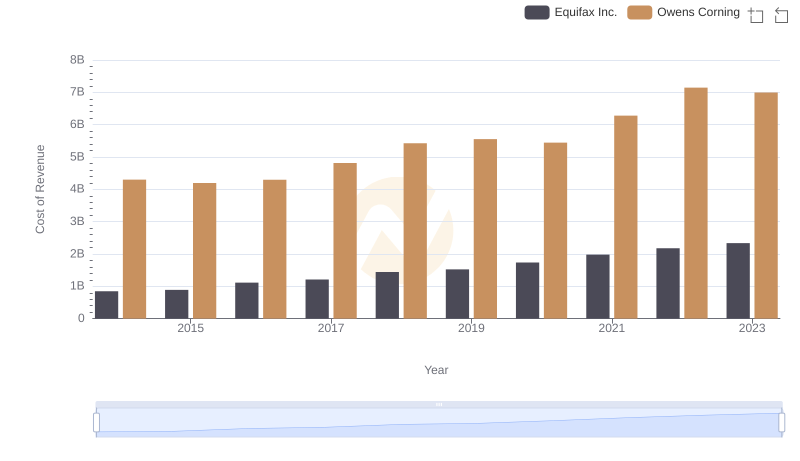

Cost of Revenue Trends: Equifax Inc. vs Owens Corning

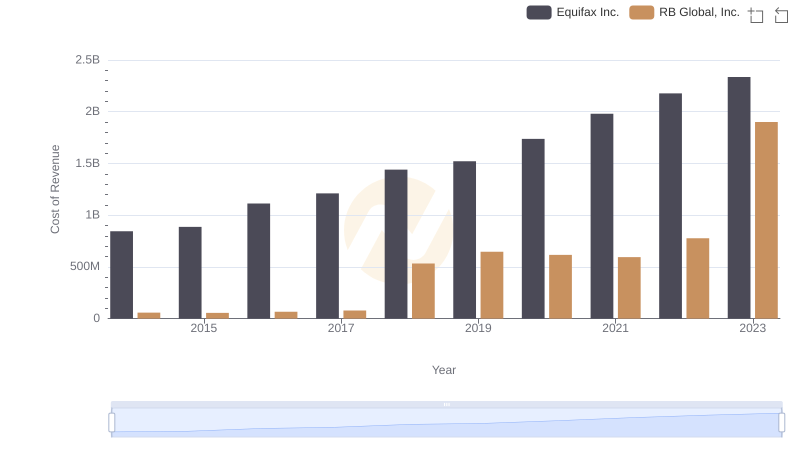

Cost Insights: Breaking Down Equifax Inc. and RB Global, Inc.'s Expenses

Key Insights on Gross Profit: Equifax Inc. vs Pentair plc