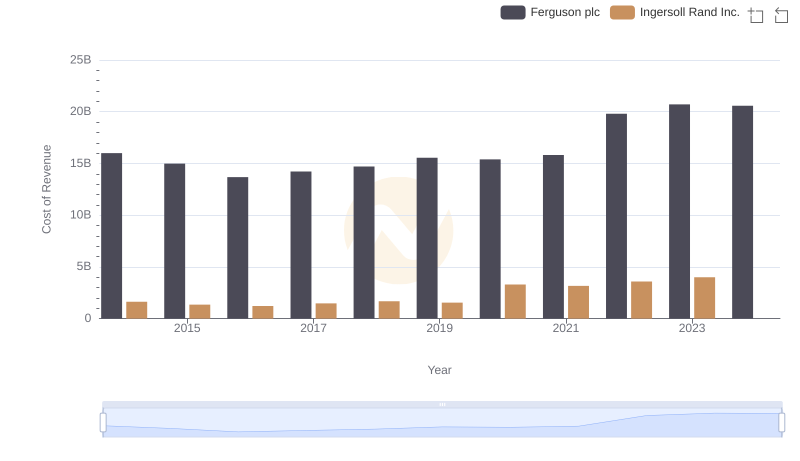

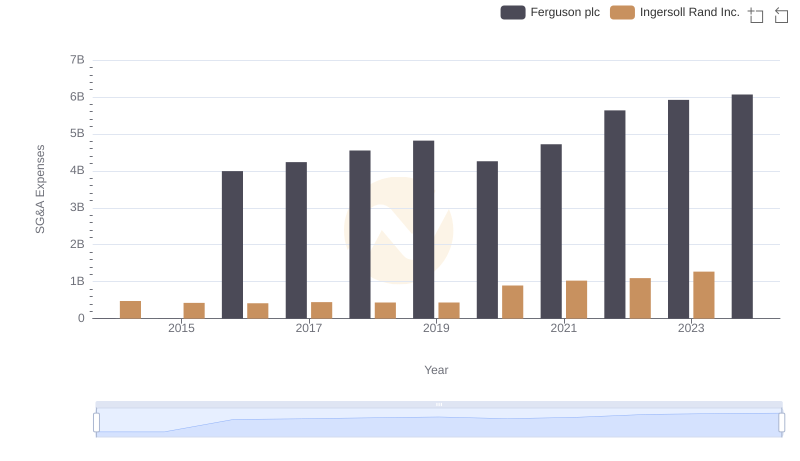

| __timestamp | Ferguson plc | Ingersoll Rand Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 22198928094 | 2570005000 |

| Thursday, January 1, 2015 | 20800698973 | 2126900000 |

| Friday, January 1, 2016 | 19066872795 | 1939436000 |

| Sunday, January 1, 2017 | 20009463224 | 2375400000 |

| Monday, January 1, 2018 | 20752000000 | 2689800000 |

| Tuesday, January 1, 2019 | 22010000000 | 2451900000 |

| Wednesday, January 1, 2020 | 21819000000 | 4910200000 |

| Friday, January 1, 2021 | 22792000000 | 5152400000 |

| Saturday, January 1, 2022 | 28566000000 | 5916300000 |

| Sunday, January 1, 2023 | 29734000000 | 6876100000 |

| Monday, January 1, 2024 | 29635000000 | 0 |

Unleashing the power of data

In the ever-evolving landscape of global industries, understanding revenue metrics is crucial for investors and stakeholders alike. This analysis focuses on two prominent companies: Ingersoll Rand Inc. and Ferguson plc, both of which have established themselves as leaders in their respective sectors. While Ferguson plc operates primarily in the plumbing and heating sector, Ingersoll Rand Inc. specializes in industrial equipment and solutions. This article delves into their revenue performance from 2014 to 2023, highlighting key trends and insights.

From 2014 to 2023, Ferguson plc has consistently outperformed Ingersoll Rand Inc. in terms of revenue generation. In 2014, Ferguson plc recorded approximately $22.2 billion in revenue, which marked the beginning of a robust growth trajectory. By 2023, this figure surged to around $29.7 billion, representing an impressive increase of approximately 34% over the decade. This growth can be attributed to Ferguson's strategic expansion into new markets and its strong foothold in the construction and renovation sectors.

In contrast, Ingersoll Rand Inc. started with a revenue of about $2.6 billion in 2014. Over the same period, its revenue grew to approximately $6.9 billion in 2023, showcasing a remarkable growth rate of around 165%. This increase is significant, yet it highlights the disparity between the two companies, as Ingersoll Rand's revenue remains substantially lower than Ferguson's. The data indicates that while Ingersoll Rand has made strides in increasing its revenue, it still operates on a much smaller scale compared to Ferguson.

Examining the year-on-year performance reveals interesting patterns. For instance, in 2020, Ingersoll Rand experienced a notable spike in revenue, reaching around $4.9 billion, which was a significant recovery from previous years. This increase can be linked to the company's strategic focus on innovation and efficiency in its product offerings. In contrast, Ferguson plc maintained steady growth during this period, with revenues hovering around $21.8 billion, demonstrating resilience amid global economic challenges.

Furthermore, the year 2022 marked a pivotal moment for both companies. Ferguson plc's revenue reached approximately $28.6 billion, while Ingersoll Rand's revenue climbed to about $5.9 billion. This trend underscores the growing demand for plumbing and HVAC solutions, which Ferguson capitalized on effectively.

As we look ahead, the outlook for both companies remains promising. Ferguson plc's continued investment in technology and sustainability initiatives positions it well for future growth. Meanwhile, Ingersoll Rand's focus on expanding its product lines and enhancing operational efficiency could lead to further revenue increases.

However, it's important to note that the data for 2024 is currently incomplete for Ingersoll Rand, which could impact future analyses. As such, stakeholders should remain vigilant and consider the broader market dynamics affecting both companies.

In summary, while Ferguson plc leads in overall revenue, Ingersoll Rand's rapid growth trajectory presents a compelling narrative of resilience and potential. Investors and analysts alike should keep a close eye on these two companies as they navigate the complexities of their respective markets.

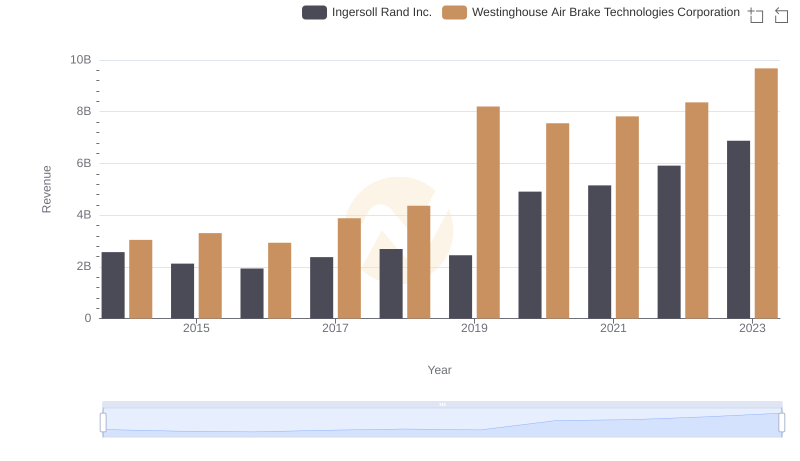

Revenue Insights: Ingersoll Rand Inc. and Westinghouse Air Brake Technologies Corporation Performance Compared

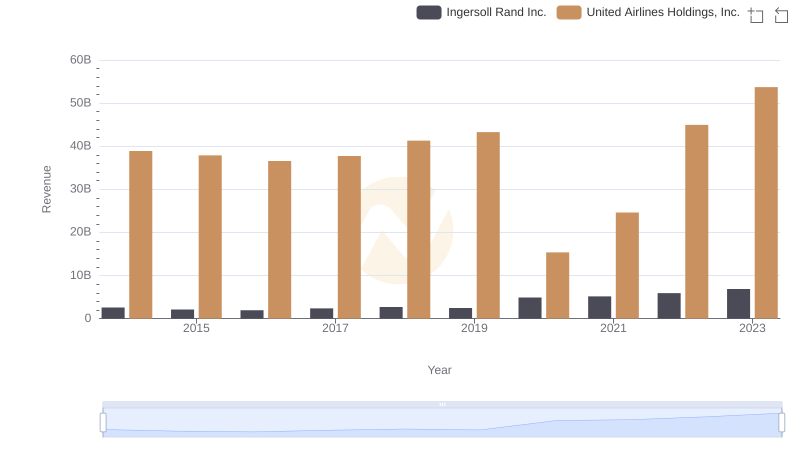

Ingersoll Rand Inc. or United Airlines Holdings, Inc.: Who Leads in Yearly Revenue?

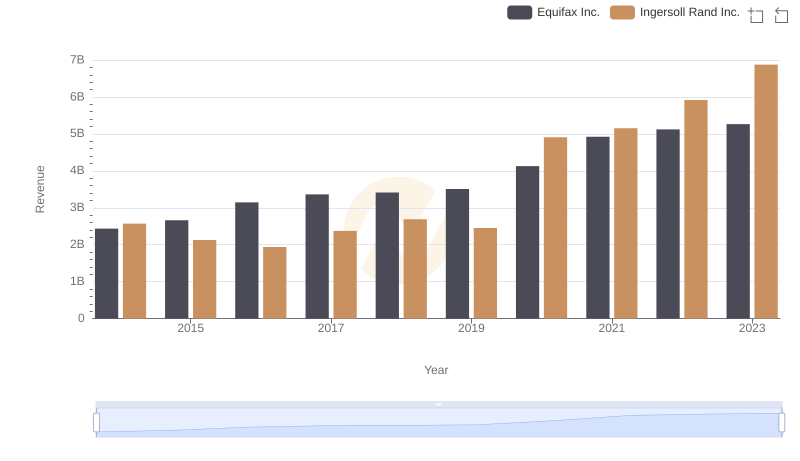

Ingersoll Rand Inc. vs Equifax Inc.: Examining Key Revenue Metrics

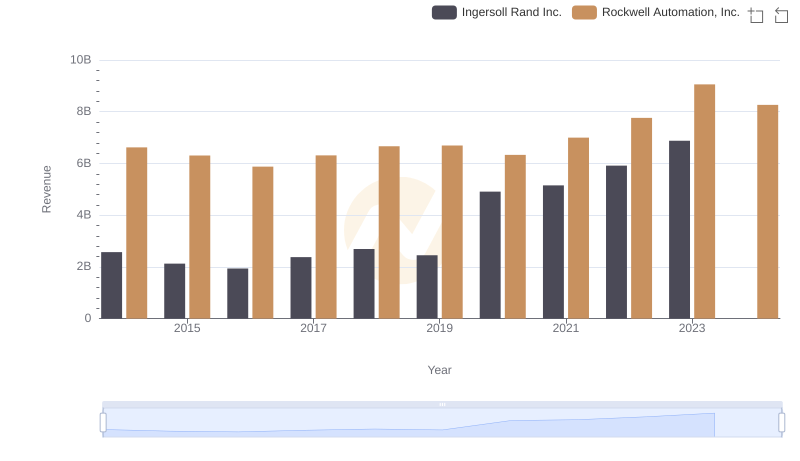

Breaking Down Revenue Trends: Ingersoll Rand Inc. vs Rockwell Automation, Inc.

Analyzing Cost of Revenue: Ingersoll Rand Inc. and Ferguson plc

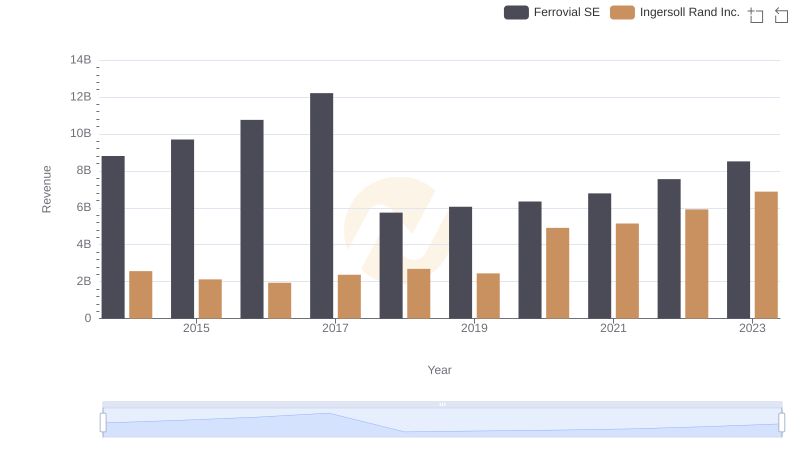

Comparing Revenue Performance: Ingersoll Rand Inc. or Ferrovial SE?

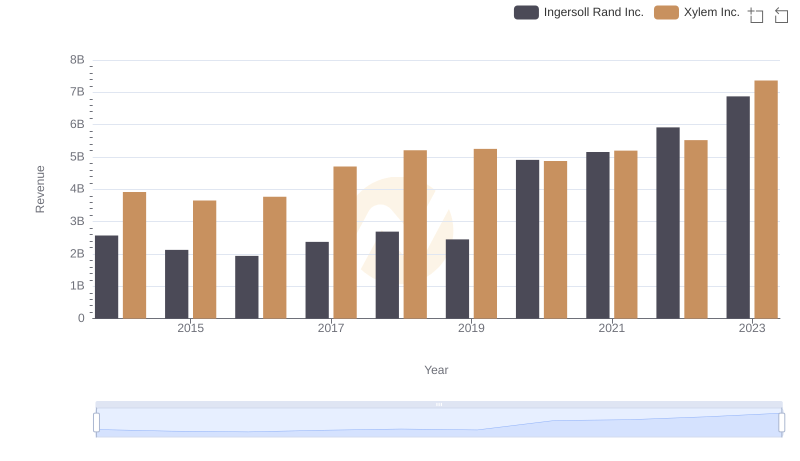

Revenue Insights: Ingersoll Rand Inc. and Xylem Inc. Performance Compared

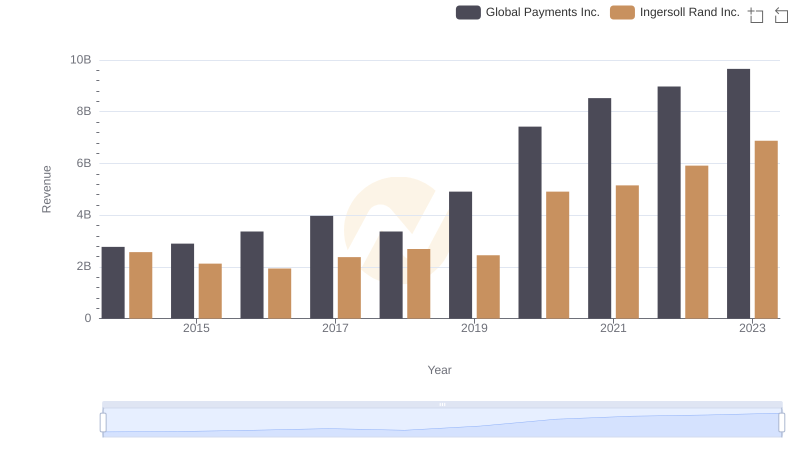

Ingersoll Rand Inc. and Global Payments Inc.: A Comprehensive Revenue Analysis

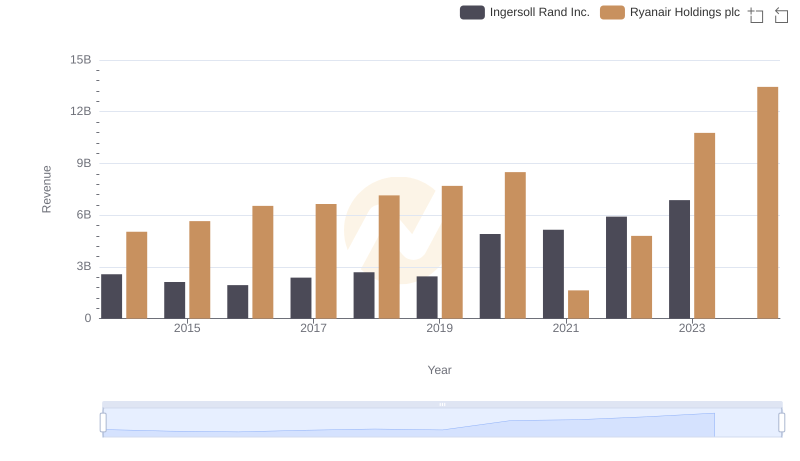

Comparing Revenue Performance: Ingersoll Rand Inc. or Ryanair Holdings plc?

Operational Costs Compared: SG&A Analysis of Ingersoll Rand Inc. and Ferguson plc