| __timestamp | Ingersoll Rand Inc. | Masco Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 476000000 | 1607000000 |

| Thursday, January 1, 2015 | 427000000 | 1339000000 |

| Friday, January 1, 2016 | 414339000 | 1403000000 |

| Sunday, January 1, 2017 | 446600000 | 1442000000 |

| Monday, January 1, 2018 | 434600000 | 1478000000 |

| Tuesday, January 1, 2019 | 436400000 | 1274000000 |

| Wednesday, January 1, 2020 | 894800000 | 1292000000 |

| Friday, January 1, 2021 | 1028000000 | 1413000000 |

| Saturday, January 1, 2022 | 1095800000 | 1390000000 |

| Sunday, January 1, 2023 | 1272700000 | 1481000000 |

| Monday, January 1, 2024 | 0 | 1468000000 |

Igniting the spark of knowledge

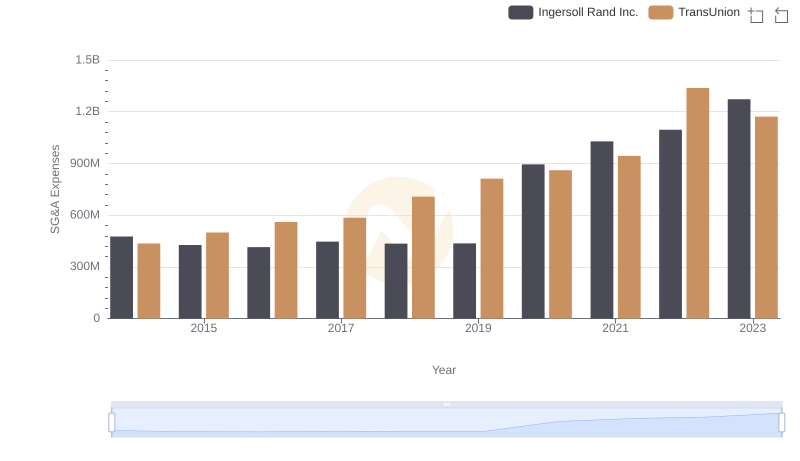

In the competitive landscape of industrial and home improvement sectors, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. From 2014 to 2023, Ingersoll Rand Inc. and Masco Corporation have shown distinct strategies in handling these costs. Ingersoll Rand Inc. has seen a significant increase in SG&A expenses, rising by approximately 167% over the decade. In contrast, Masco Corporation's expenses have remained relatively stable, with only a 7% increase. This suggests that while Ingersoll Rand Inc. is expanding its operations, Masco Corporation is maintaining a more consistent cost structure. The data highlights the importance of strategic financial management in sustaining growth and competitiveness. As businesses navigate economic fluctuations, understanding these trends can provide valuable insights into effective cost management strategies.

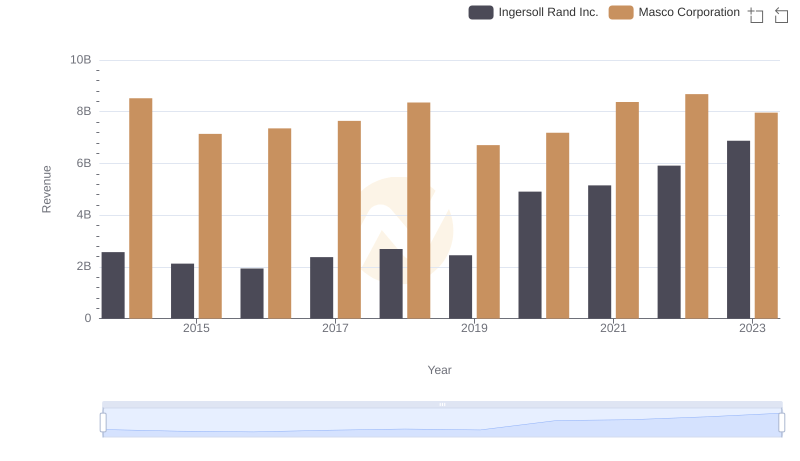

Revenue Insights: Ingersoll Rand Inc. and Masco Corporation Performance Compared

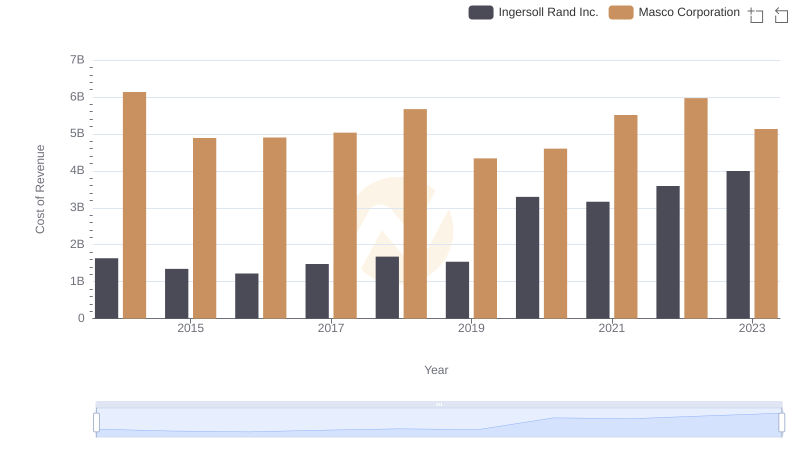

Cost of Revenue: Key Insights for Ingersoll Rand Inc. and Masco Corporation

Comparing SG&A Expenses: Ingersoll Rand Inc. vs TransUnion Trends and Insights

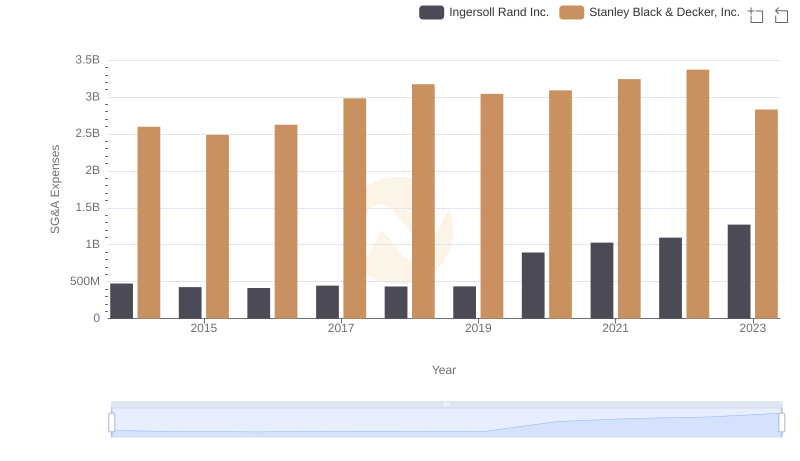

Who Optimizes SG&A Costs Better? Ingersoll Rand Inc. or Stanley Black & Decker, Inc.

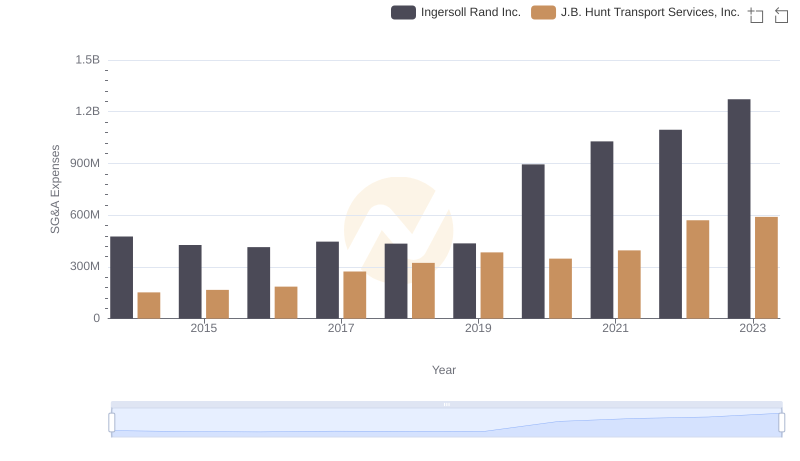

Ingersoll Rand Inc. or J.B. Hunt Transport Services, Inc.: Who Manages SG&A Costs Better?

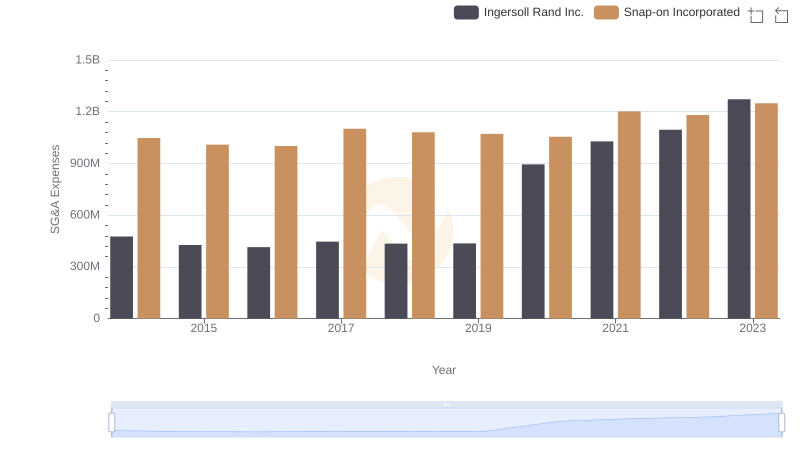

Cost Management Insights: SG&A Expenses for Ingersoll Rand Inc. and Snap-on Incorporated