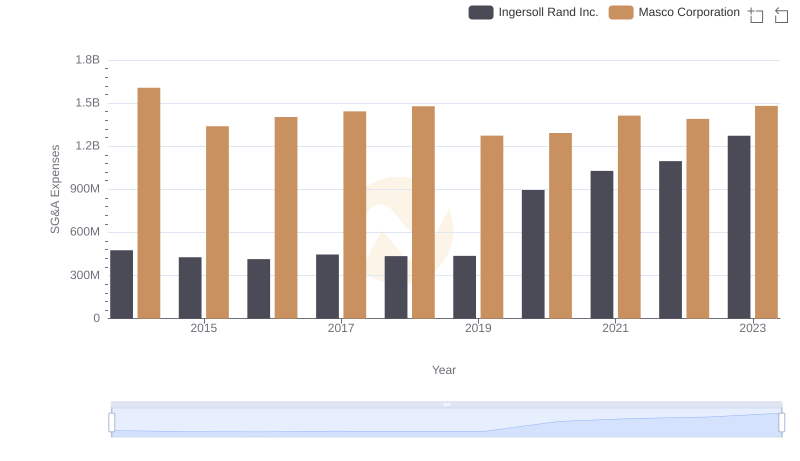

| __timestamp | Ingersoll Rand Inc. | Stanley Black & Decker, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 476000000 | 2595900000 |

| Thursday, January 1, 2015 | 427000000 | 2486400000 |

| Friday, January 1, 2016 | 414339000 | 2623900000 |

| Sunday, January 1, 2017 | 446600000 | 2980100000 |

| Monday, January 1, 2018 | 434600000 | 3171700000 |

| Tuesday, January 1, 2019 | 436400000 | 3041000000 |

| Wednesday, January 1, 2020 | 894800000 | 3089600000 |

| Friday, January 1, 2021 | 1028000000 | 3240400000 |

| Saturday, January 1, 2022 | 1095800000 | 3370000000 |

| Sunday, January 1, 2023 | 1272700000 | 2829300000 |

| Monday, January 1, 2024 | 0 | 3310500000 |

Infusing magic into the data realm

In the competitive landscape of industrial manufacturing, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Over the past decade, Ingersoll Rand Inc. and Stanley Black & Decker, Inc. have showcased contrasting strategies in this domain. From 2014 to 2023, Ingersoll Rand's SG&A expenses surged by approximately 167%, peaking in 2023. In contrast, Stanley Black & Decker maintained a relatively stable SG&A cost structure, with a modest increase of around 9% over the same period. Notably, in 2023, Ingersoll Rand's expenses reached 45% of Stanley Black & Decker's, up from 18% in 2014. This shift highlights Ingersoll Rand's aggressive expansion and investment in administrative capabilities. As these industry titans continue to evolve, their SG&A strategies will remain pivotal in shaping their financial health and competitive edge.

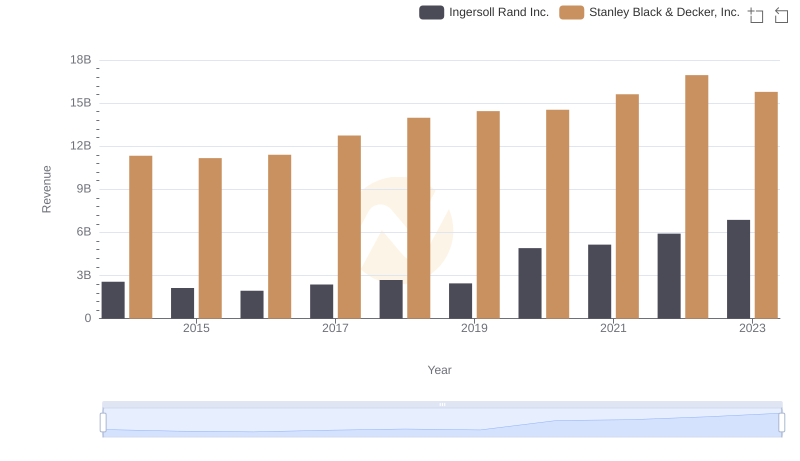

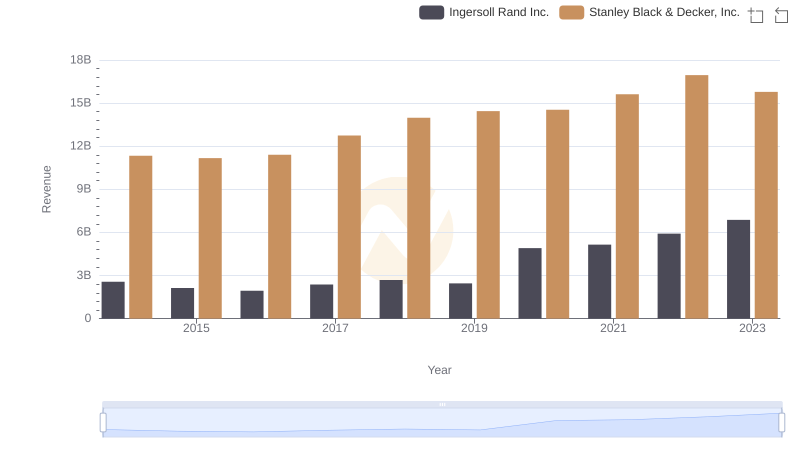

Ingersoll Rand Inc. and Stanley Black & Decker, Inc.: A Comprehensive Revenue Analysis

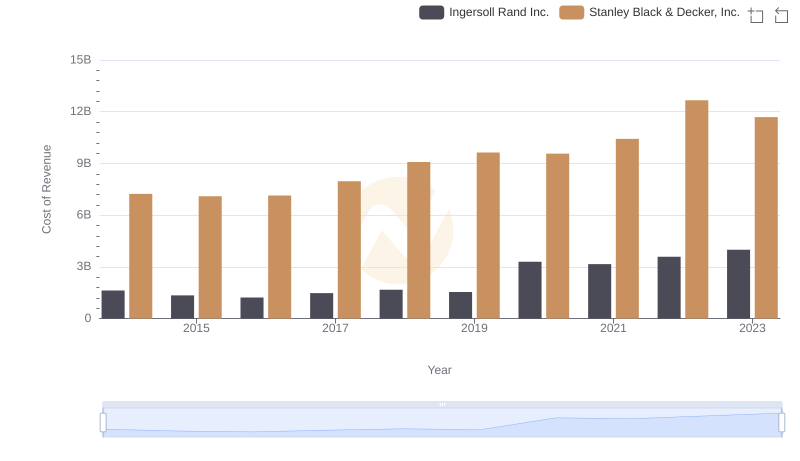

Cost of Revenue Trends: Ingersoll Rand Inc. vs Stanley Black & Decker, Inc.

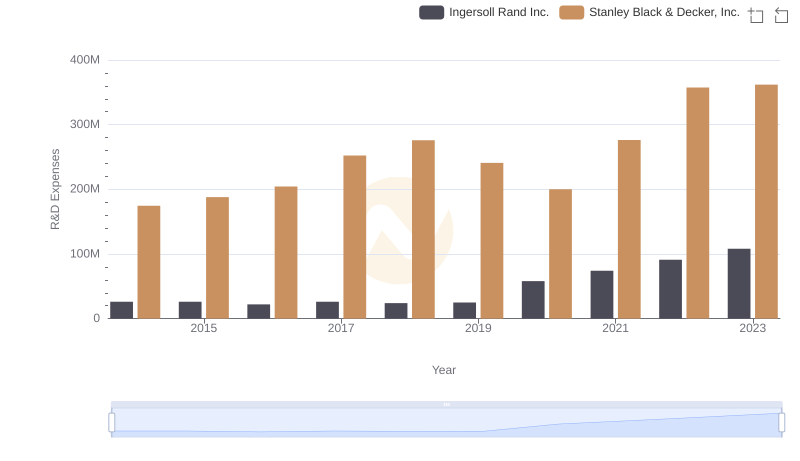

Ingersoll Rand Inc. or Stanley Black & Decker, Inc.: Who Invests More in Innovation?

Ingersoll Rand Inc. or Masco Corporation: Who Manages SG&A Costs Better?

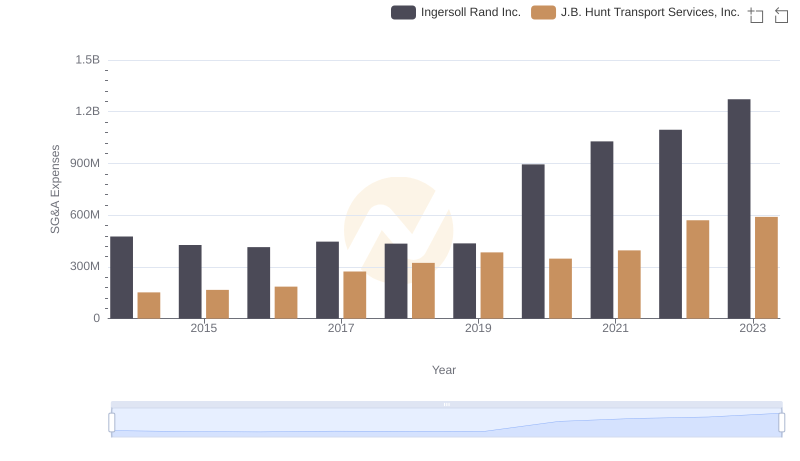

Ingersoll Rand Inc. or J.B. Hunt Transport Services, Inc.: Who Manages SG&A Costs Better?

Ingersoll Rand Inc. or Stanley Black & Decker, Inc.: Who Leads in Yearly Revenue?