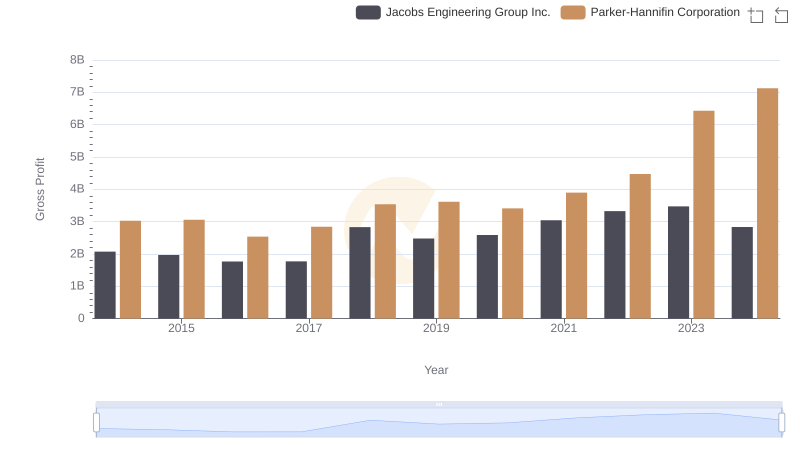

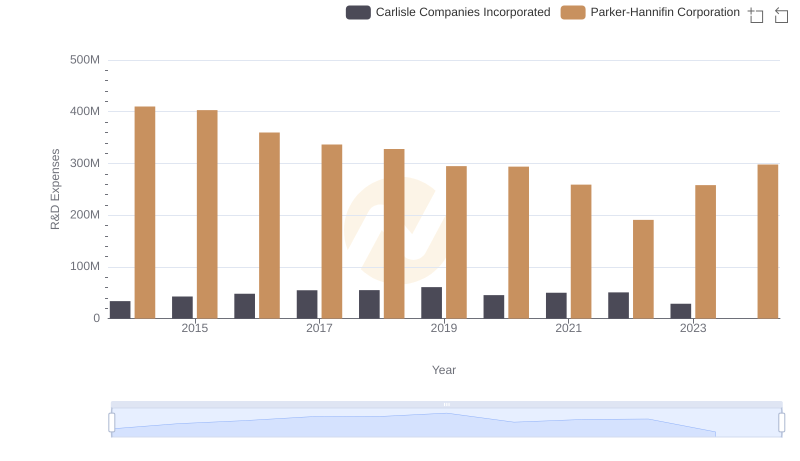

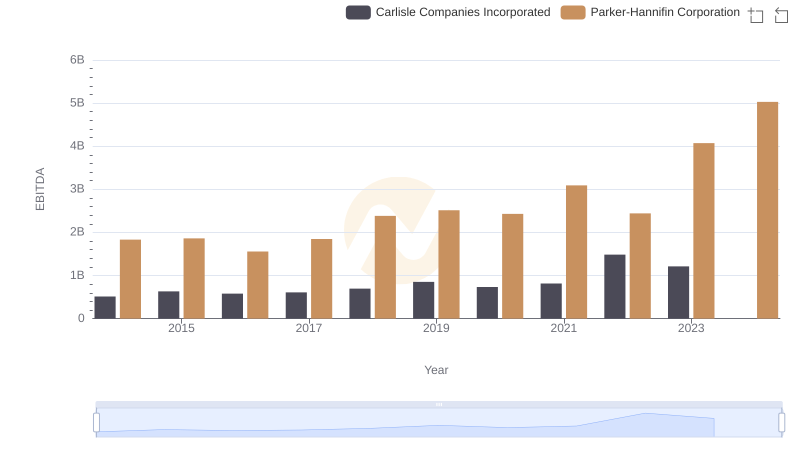

| __timestamp | Carlisle Companies Incorporated | Parker-Hannifin Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 819500000 | 3027744000 |

| Thursday, January 1, 2015 | 1006700000 | 3056499000 |

| Friday, January 1, 2016 | 1157300000 | 2537369000 |

| Sunday, January 1, 2017 | 1148000000 | 2840350000 |

| Monday, January 1, 2018 | 1174700000 | 3539551000 |

| Tuesday, January 1, 2019 | 1371700000 | 3616840000 |

| Wednesday, January 1, 2020 | 1137400000 | 3409002000 |

| Friday, January 1, 2021 | 1314700000 | 3897960000 |

| Saturday, January 1, 2022 | 2157400000 | 4474341000 |

| Sunday, January 1, 2023 | 1544000000 | 6429302000 |

| Monday, January 1, 2024 | 1887700000 | 7127790000 |

In pursuit of knowledge

In the competitive landscape of industrial manufacturing, Parker-Hannifin Corporation and Carlisle Companies Incorporated have showcased distinct trajectories in their gross profit trends over the past decade. From 2014 to 2023, Parker-Hannifin consistently outperformed Carlisle, with its gross profit peaking at approximately $6.4 billion in 2023, marking a staggering 112% increase from its 2014 figures. In contrast, Carlisle's gross profit saw a more modest growth, reaching its zenith in 2022 with a 163% increase from 2014, before dipping in 2023.

This divergence highlights Parker-Hannifin's robust growth strategy and market adaptability, while Carlisle's fluctuations suggest potential challenges or strategic shifts. The absence of data for Carlisle in 2024 further emphasizes the need for strategic clarity. As these industrial titans navigate the evolving market, their financial trajectories offer valuable insights into their operational resilience and strategic foresight.

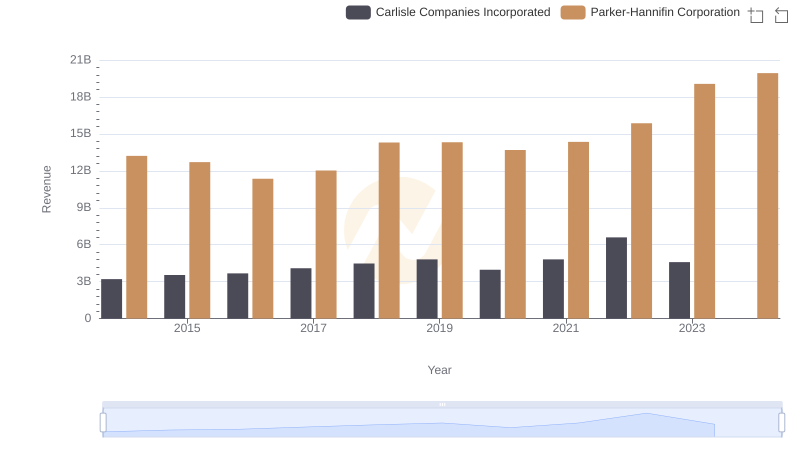

Parker-Hannifin Corporation vs Carlisle Companies Incorporated: Examining Key Revenue Metrics

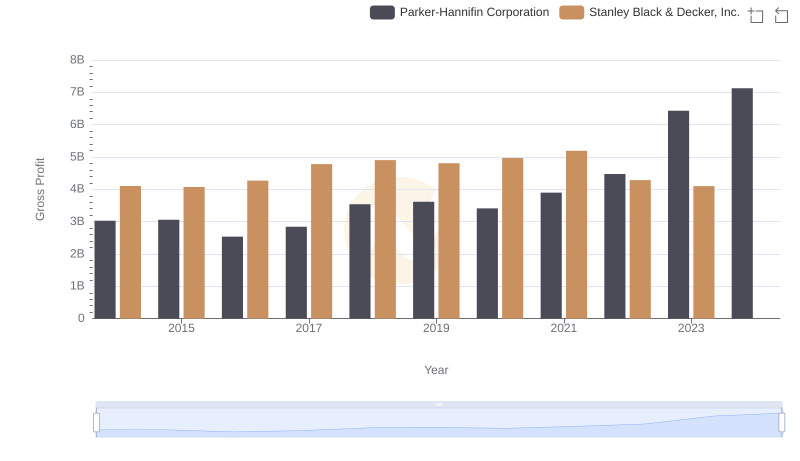

Parker-Hannifin Corporation and Stanley Black & Decker, Inc.: A Detailed Gross Profit Analysis

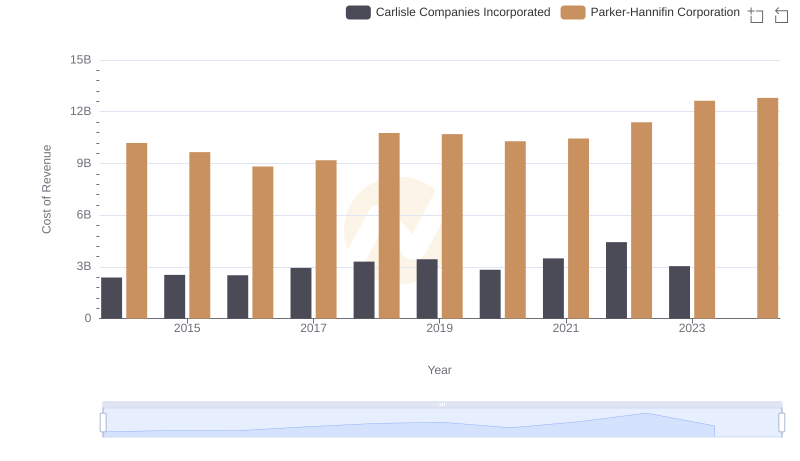

Comparing Cost of Revenue Efficiency: Parker-Hannifin Corporation vs Carlisle Companies Incorporated

Key Insights on Gross Profit: Parker-Hannifin Corporation vs Jacobs Engineering Group Inc.

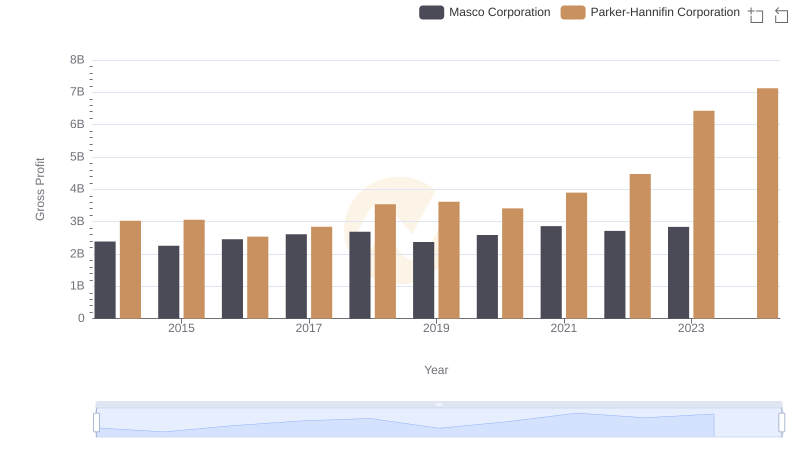

Who Generates Higher Gross Profit? Parker-Hannifin Corporation or Masco Corporation

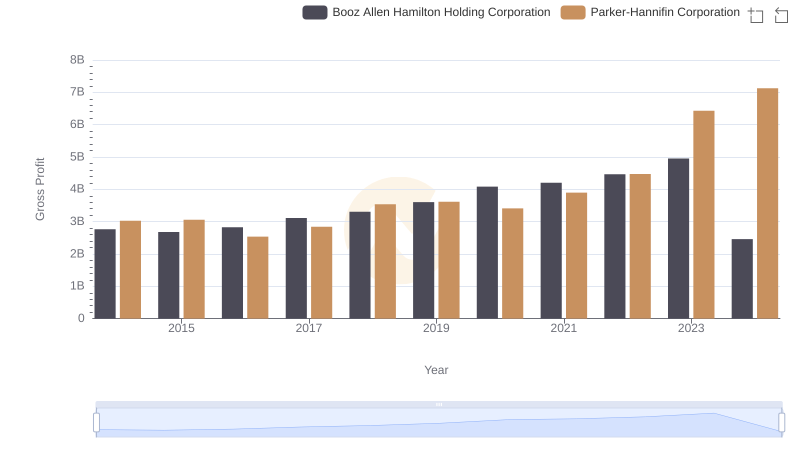

Key Insights on Gross Profit: Parker-Hannifin Corporation vs Booz Allen Hamilton Holding Corporation

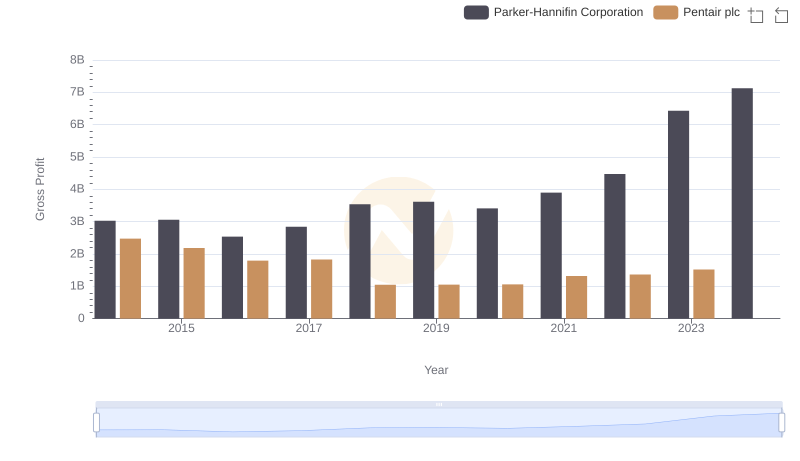

Parker-Hannifin Corporation vs Pentair plc: A Gross Profit Performance Breakdown

Research and Development: Comparing Key Metrics for Parker-Hannifin Corporation and Carlisle Companies Incorporated

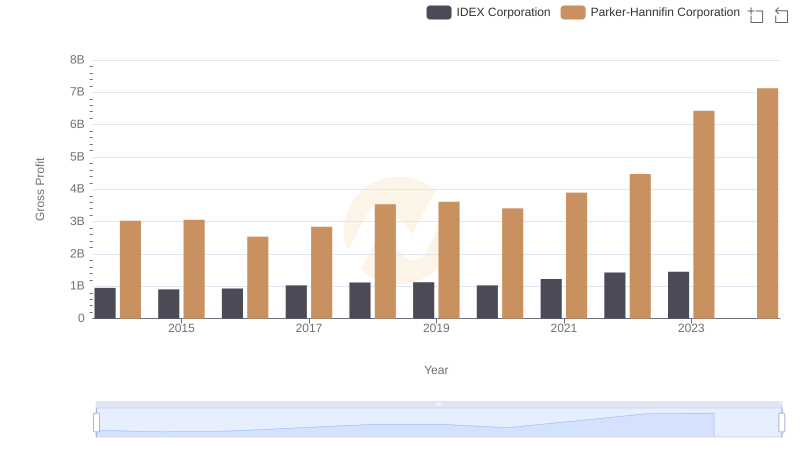

Gross Profit Analysis: Comparing Parker-Hannifin Corporation and IDEX Corporation

EBITDA Analysis: Evaluating Parker-Hannifin Corporation Against Carlisle Companies Incorporated