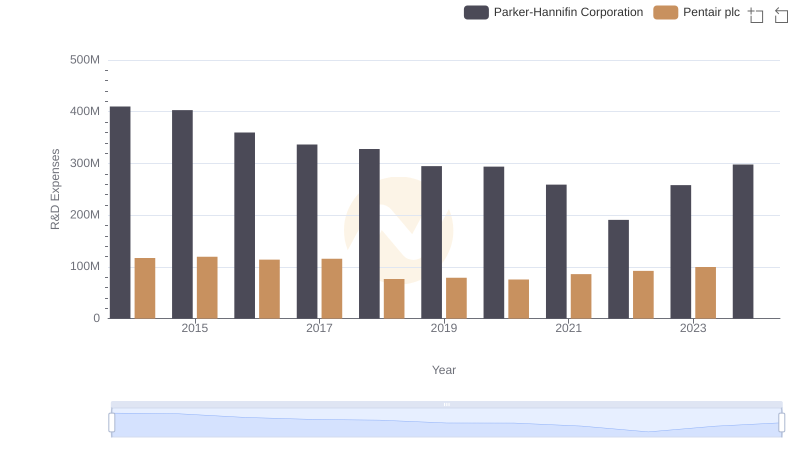

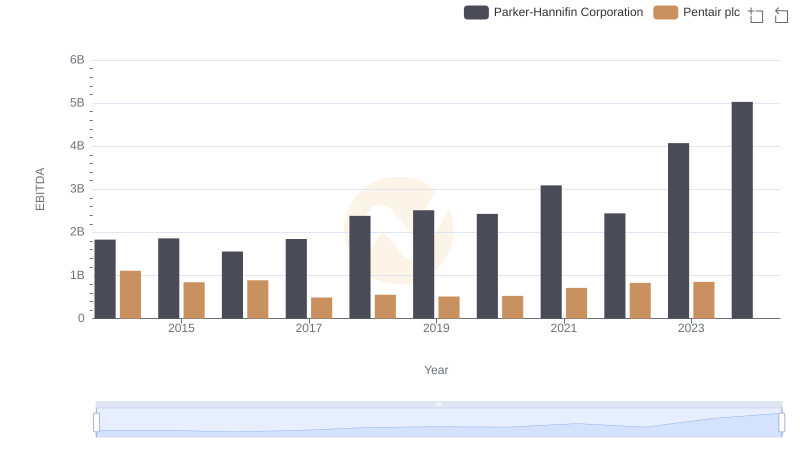

| __timestamp | Parker-Hannifin Corporation | Pentair plc |

|---|---|---|

| Wednesday, January 1, 2014 | 3027744000 | 2476000000 |

| Thursday, January 1, 2015 | 3056499000 | 2185800000 |

| Friday, January 1, 2016 | 2537369000 | 1794100000 |

| Sunday, January 1, 2017 | 2840350000 | 1829100000 |

| Monday, January 1, 2018 | 3539551000 | 1047700000 |

| Tuesday, January 1, 2019 | 3616840000 | 1051500000 |

| Wednesday, January 1, 2020 | 3409002000 | 1057600000 |

| Friday, January 1, 2021 | 3897960000 | 1319200000 |

| Saturday, January 1, 2022 | 4474341000 | 1364600000 |

| Sunday, January 1, 2023 | 6429302000 | 1519200000 |

| Monday, January 1, 2024 | 7127790000 | 1598800000 |

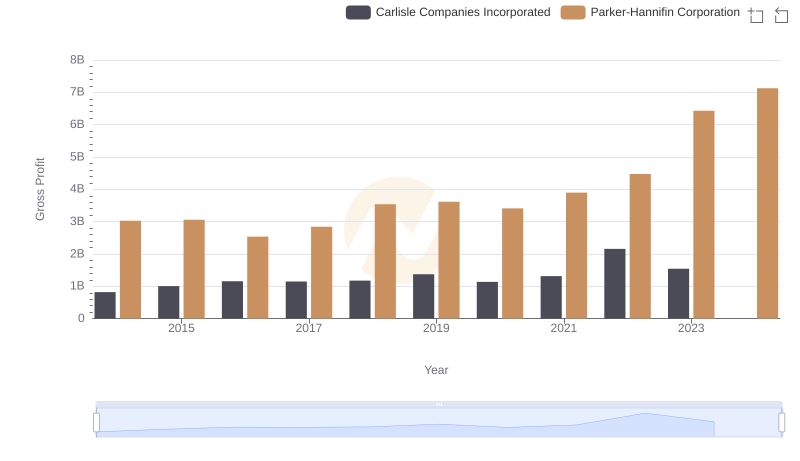

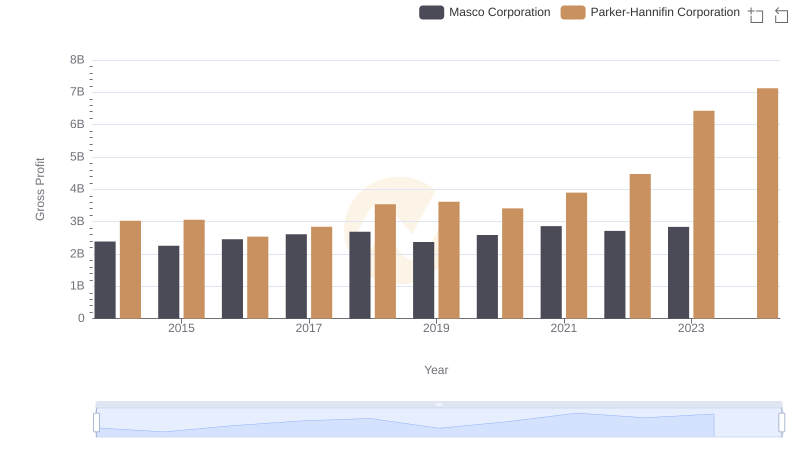

Unveiling the hidden dimensions of data

In the competitive landscape of industrial manufacturing, Parker-Hannifin Corporation and Pentair plc have long been stalwarts. Over the past decade, Parker-Hannifin has demonstrated a robust growth trajectory in gross profit, surging by approximately 135% from 2014 to 2023. This impressive growth is highlighted by a significant leap in 2023, where gross profit reached a peak, marking a 44% increase from the previous year.

Conversely, Pentair plc has faced a more challenging path. Despite a steady performance, their gross profit has seen a decline of about 39% from 2014 to 2023. The data for 2024 remains incomplete, leaving room for speculation on Pentair's future performance.

This analysis underscores the dynamic shifts within the industry, where Parker-Hannifin's strategic initiatives have clearly paid off, while Pentair navigates through a period of transformation.

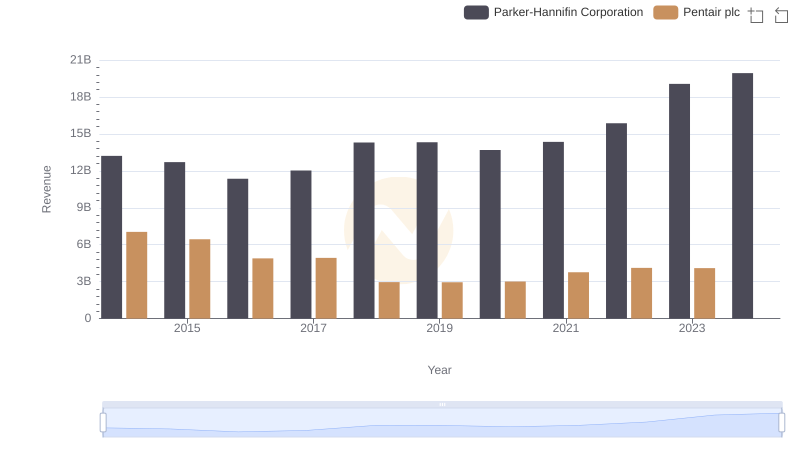

Annual Revenue Comparison: Parker-Hannifin Corporation vs Pentair plc

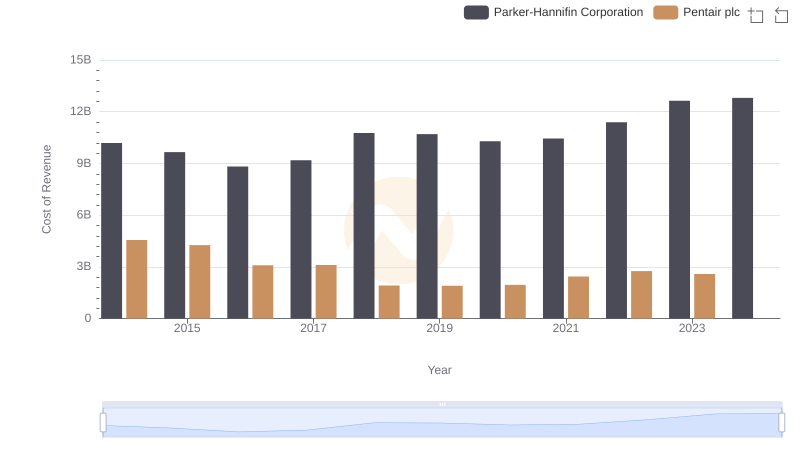

Cost Insights: Breaking Down Parker-Hannifin Corporation and Pentair plc's Expenses

Gross Profit Trends Compared: Parker-Hannifin Corporation vs Carlisle Companies Incorporated

Who Generates Higher Gross Profit? Parker-Hannifin Corporation or Masco Corporation

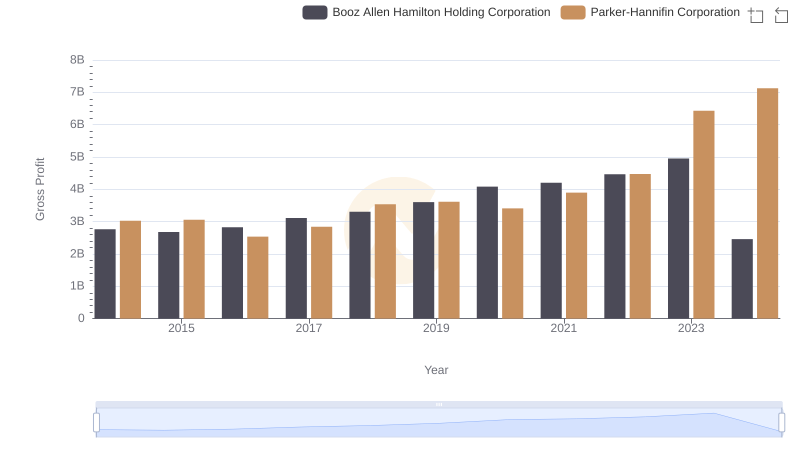

Key Insights on Gross Profit: Parker-Hannifin Corporation vs Booz Allen Hamilton Holding Corporation

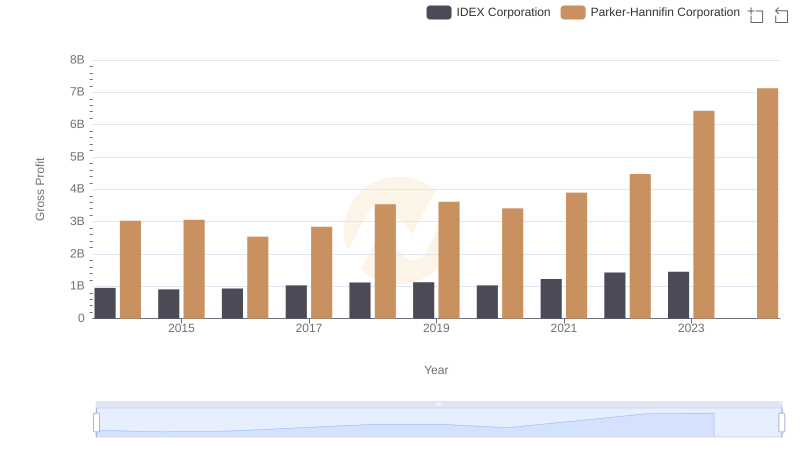

Gross Profit Analysis: Comparing Parker-Hannifin Corporation and IDEX Corporation

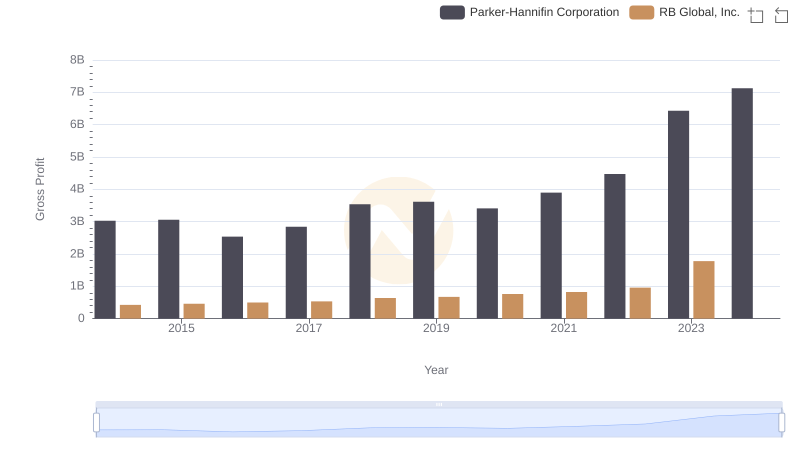

Who Generates Higher Gross Profit? Parker-Hannifin Corporation or RB Global, Inc.

R&D Spending Showdown: Parker-Hannifin Corporation vs Pentair plc

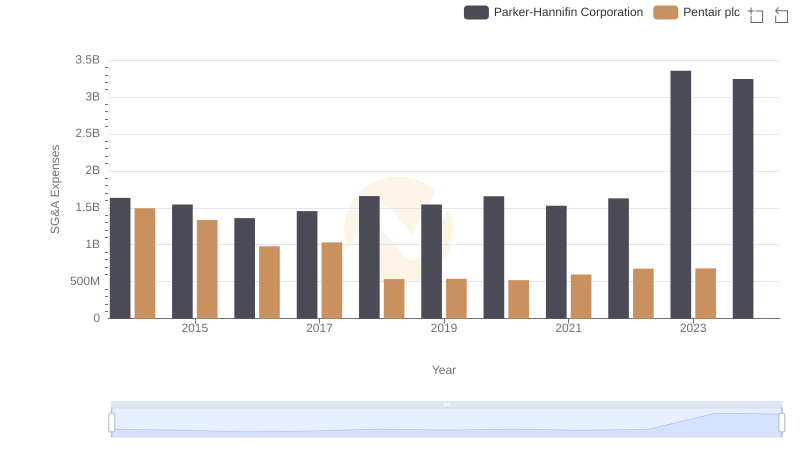

Who Optimizes SG&A Costs Better? Parker-Hannifin Corporation or Pentair plc

EBITDA Metrics Evaluated: Parker-Hannifin Corporation vs Pentair plc