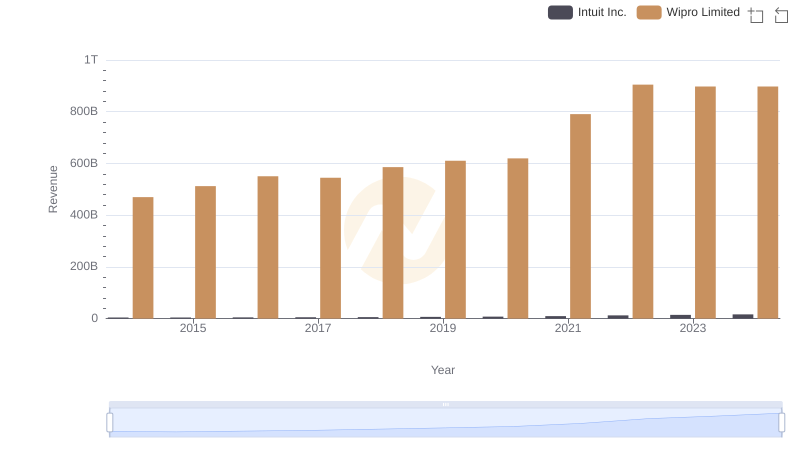

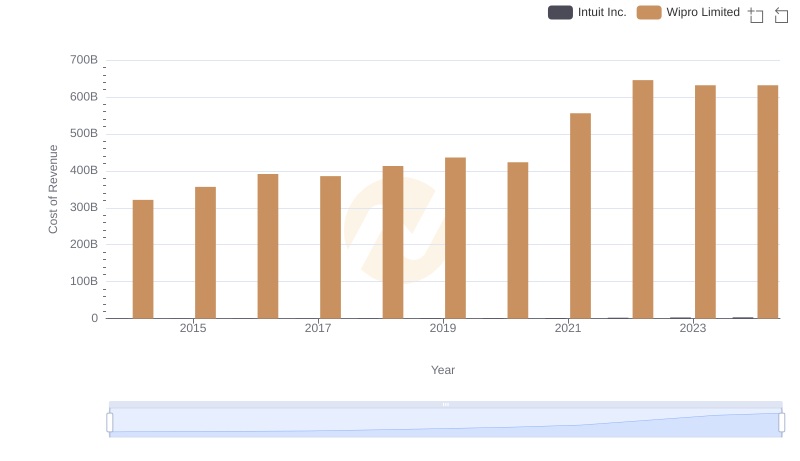

| __timestamp | Intuit Inc. | Wipro Limited |

|---|---|---|

| Wednesday, January 1, 2014 | 3838000000 | 148261000000 |

| Thursday, January 1, 2015 | 3467000000 | 155716000000 |

| Friday, January 1, 2016 | 3942000000 | 158858000000 |

| Sunday, January 1, 2017 | 4368000000 | 159296000000 |

| Monday, January 1, 2018 | 4987000000 | 172812000000 |

| Tuesday, January 1, 2019 | 5617000000 | 174147000000 |

| Wednesday, January 1, 2020 | 6301000000 | 196225000000 |

| Friday, January 1, 2021 | 7950000000 | 235062000000 |

| Saturday, January 1, 2022 | 10320000000 | 259430000000 |

| Sunday, January 1, 2023 | 11225000000 | 266106000000 |

| Monday, January 1, 2024 | 12820000000 | 266106000000 |

Cracking the code

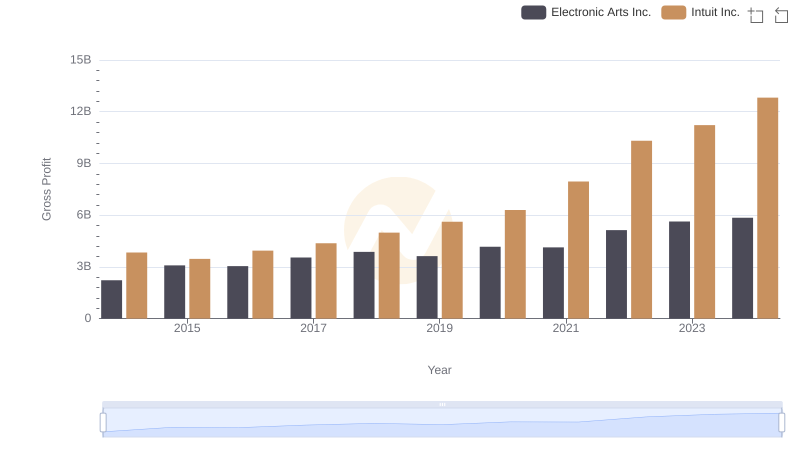

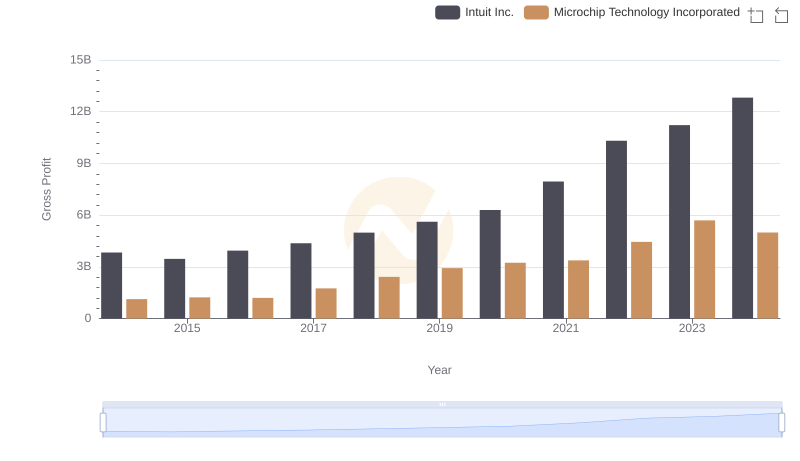

In the ever-evolving landscape of global business, understanding the financial health of industry giants is crucial. This analysis delves into the gross profit trends of Intuit Inc. and Wipro Limited from 2014 to 2024. Over this decade, Intuit Inc. has seen a remarkable growth of approximately 234%, with its gross profit rising from $3.8 billion in 2014 to an estimated $12.8 billion in 2024. Meanwhile, Wipro Limited, a leader in the IT services sector, has maintained a steady upward trajectory, with its gross profit increasing by about 80% from $148 billion to $266 billion in the same period.

This comparison highlights the dynamic nature of the tech industry, where both companies have capitalized on digital transformation trends. Intuit's aggressive growth strategy contrasts with Wipro's steady expansion, offering valuable insights into their respective market approaches.

Intuit Inc. or Wipro Limited: Who Leads in Yearly Revenue?

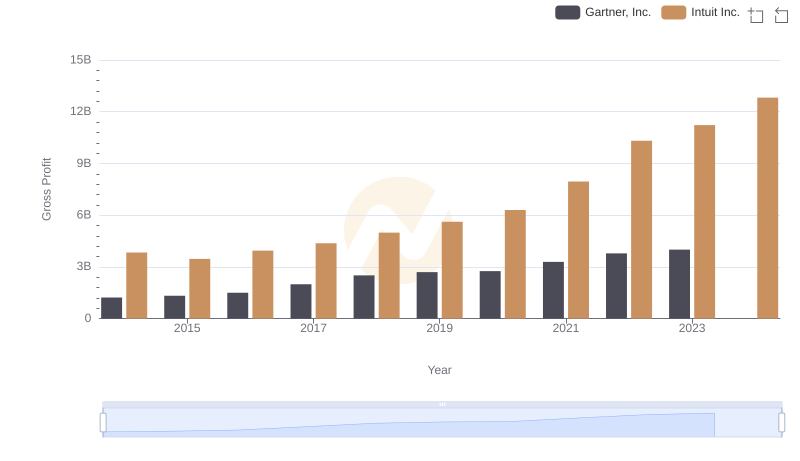

Who Generates Higher Gross Profit? Intuit Inc. or Gartner, Inc.

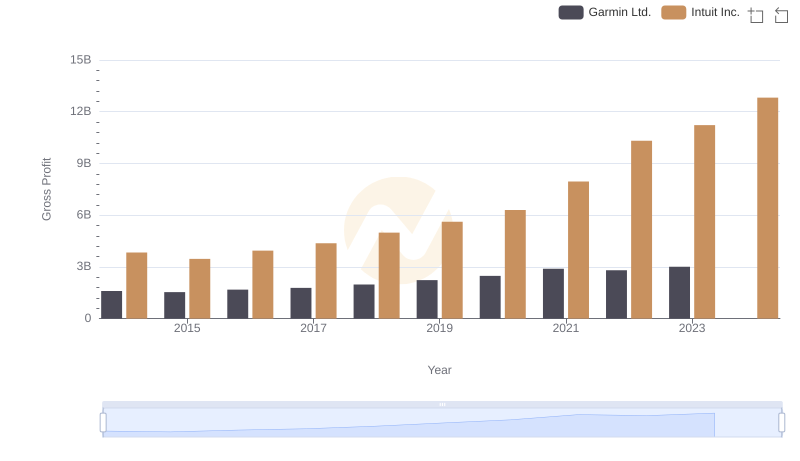

Intuit Inc. vs Garmin Ltd.: A Gross Profit Performance Breakdown

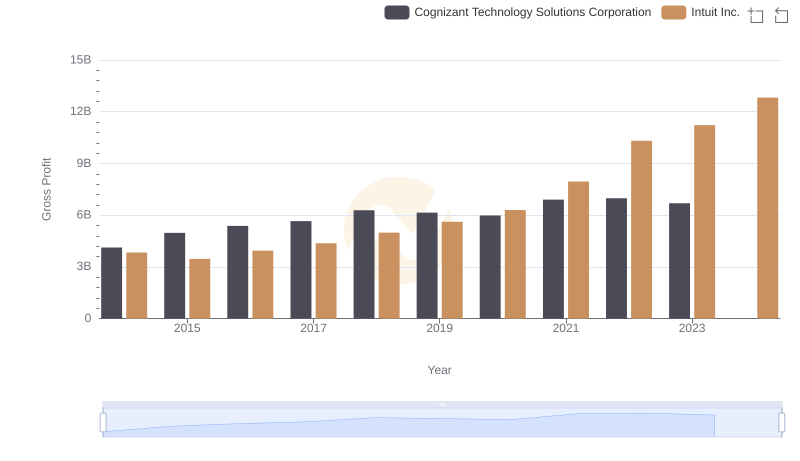

Gross Profit Analysis: Comparing Intuit Inc. and Cognizant Technology Solutions Corporation

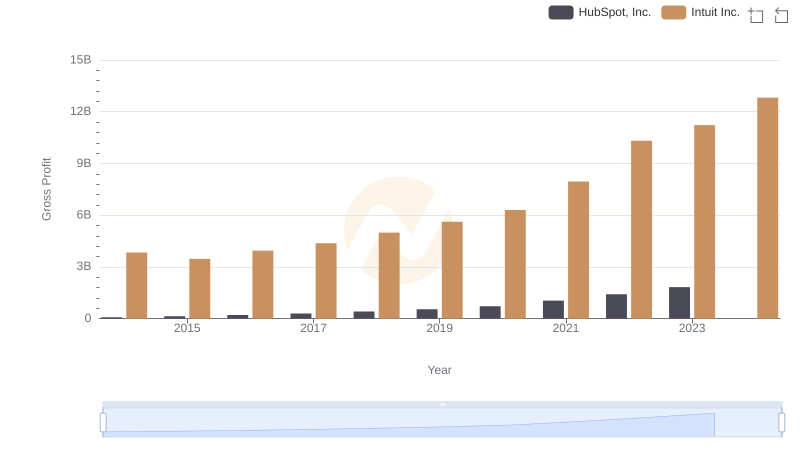

Gross Profit Analysis: Comparing Intuit Inc. and HubSpot, Inc.

Cost of Revenue: Key Insights for Intuit Inc. and Wipro Limited

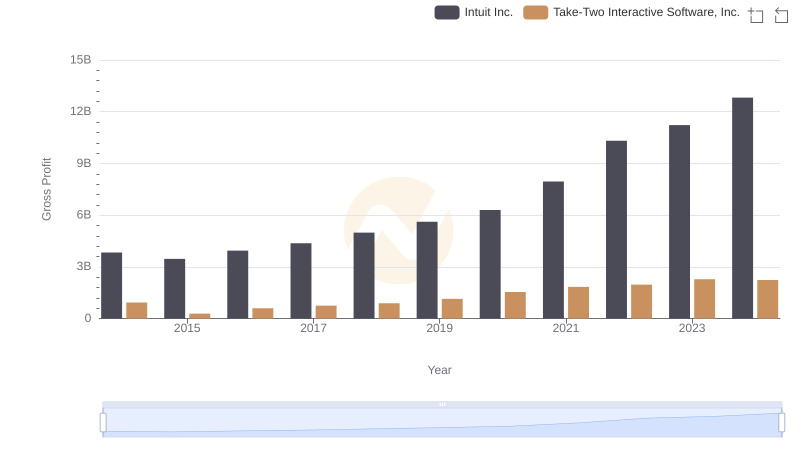

Intuit Inc. and Take-Two Interactive Software, Inc.: A Detailed Gross Profit Analysis

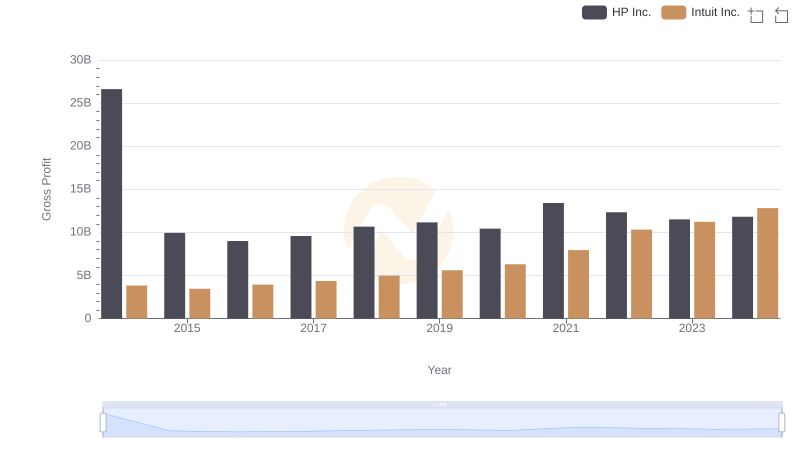

Gross Profit Comparison: Intuit Inc. and HP Inc. Trends

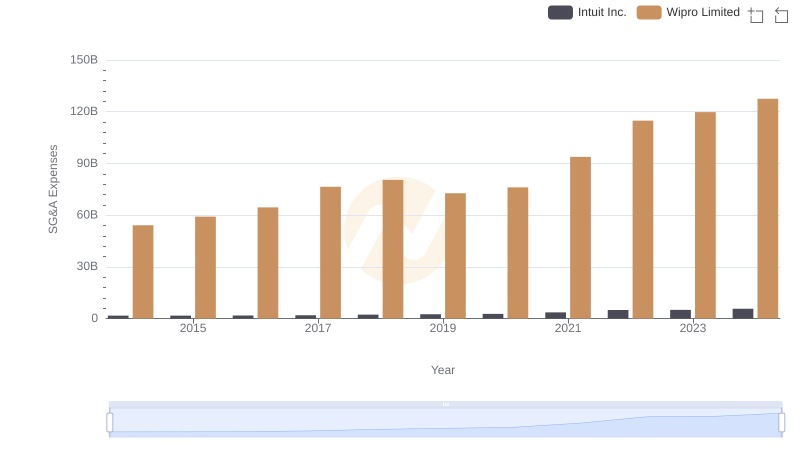

Breaking Down SG&A Expenses: Intuit Inc. vs Wipro Limited

Who Generates Higher Gross Profit? Intuit Inc. or Electronic Arts Inc.

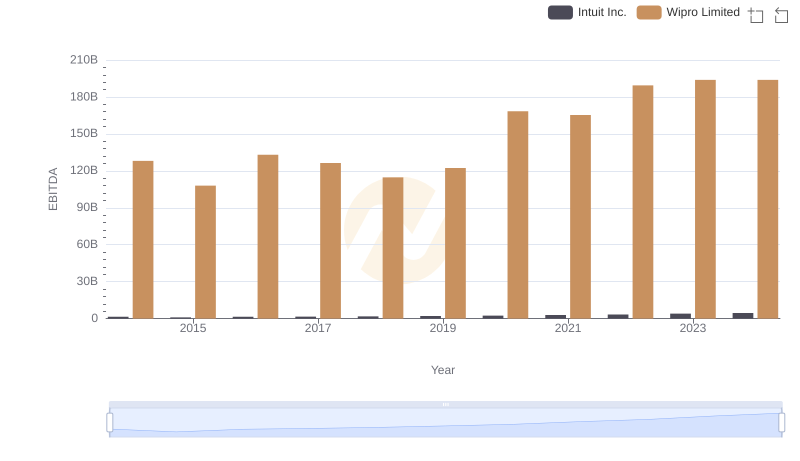

A Professional Review of EBITDA: Intuit Inc. Compared to Wipro Limited

Gross Profit Analysis: Comparing Intuit Inc. and Microchip Technology Incorporated