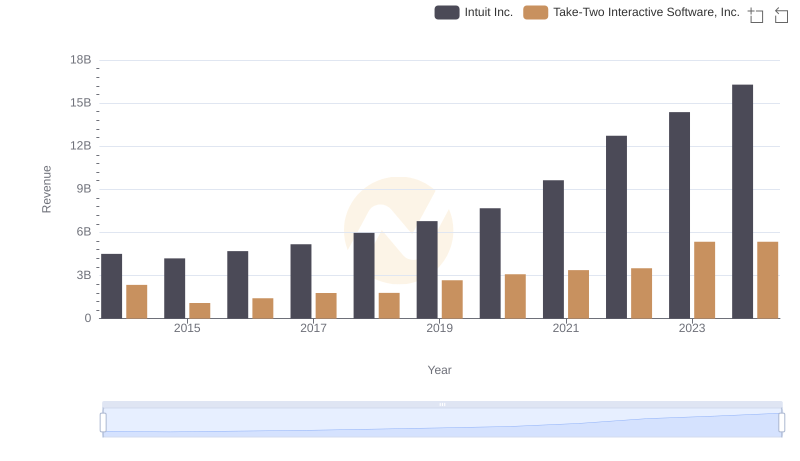

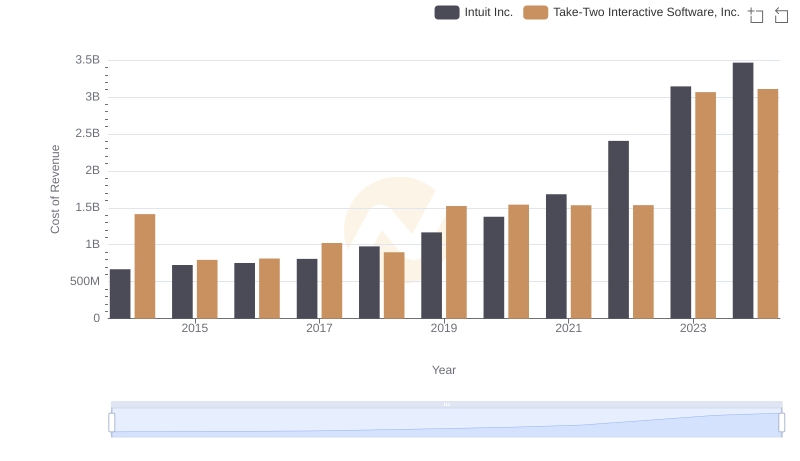

| __timestamp | Intuit Inc. | Take-Two Interactive Software, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 3838000000 | 936241000 |

| Thursday, January 1, 2015 | 3467000000 | 288071000 |

| Friday, January 1, 2016 | 3942000000 | 599825000 |

| Sunday, January 1, 2017 | 4368000000 | 756789000 |

| Monday, January 1, 2018 | 4987000000 | 894581000 |

| Tuesday, January 1, 2019 | 5617000000 | 1144750000 |

| Wednesday, January 1, 2020 | 6301000000 | 1546520000 |

| Friday, January 1, 2021 | 7950000000 | 1837687000 |

| Saturday, January 1, 2022 | 10320000000 | 1969399000 |

| Sunday, January 1, 2023 | 11225000000 | 2285300000 |

| Monday, January 1, 2024 | 12820000000 | 2241800000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of the tech industry, Intuit Inc. and Take-Two Interactive Software, Inc. have carved out significant niches. Over the past decade, Intuit has demonstrated a robust growth trajectory, with its gross profit surging by approximately 233% from 2014 to 2024. This impressive growth reflects Intuit's strategic innovations and market adaptability.

Conversely, Take-Two Interactive, a leader in the gaming industry, has seen its gross profit grow by about 140% over the same period. While not as rapid as Intuit's, this growth underscores Take-Two's resilience and its ability to captivate a global audience with its gaming franchises.

The data reveals a compelling narrative of two companies thriving in distinct sectors, each leveraging its strengths to achieve remarkable financial success. As we look to the future, both companies are poised to continue their upward trajectories, driven by innovation and consumer demand.

Intuit Inc. and Take-Two Interactive Software, Inc.: A Comprehensive Revenue Analysis

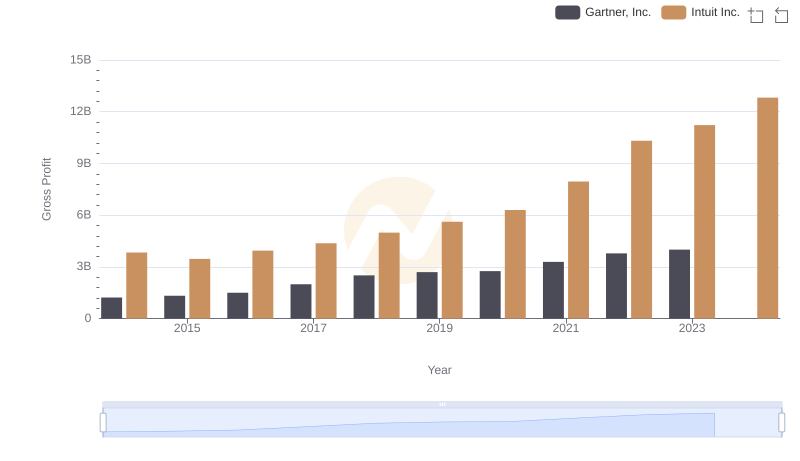

Who Generates Higher Gross Profit? Intuit Inc. or Gartner, Inc.

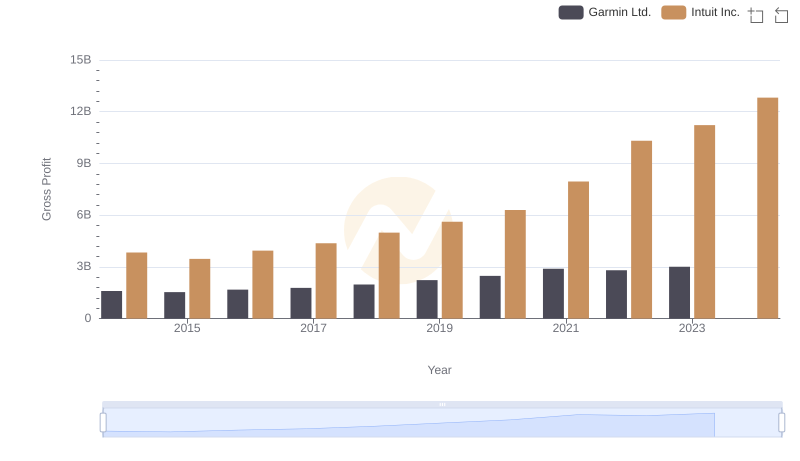

Intuit Inc. vs Garmin Ltd.: A Gross Profit Performance Breakdown

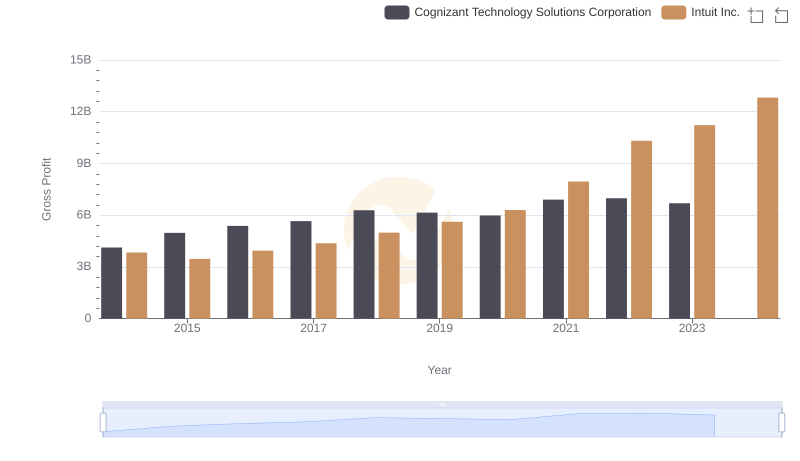

Gross Profit Analysis: Comparing Intuit Inc. and Cognizant Technology Solutions Corporation

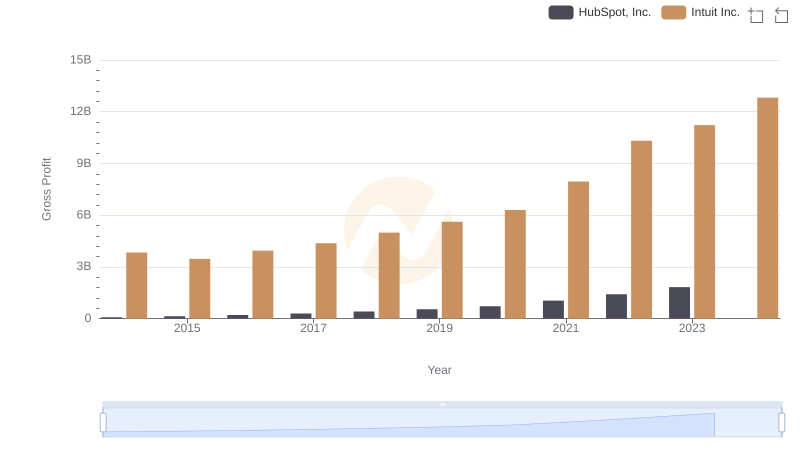

Gross Profit Analysis: Comparing Intuit Inc. and HubSpot, Inc.

Cost of Revenue: Key Insights for Intuit Inc. and Take-Two Interactive Software, Inc.

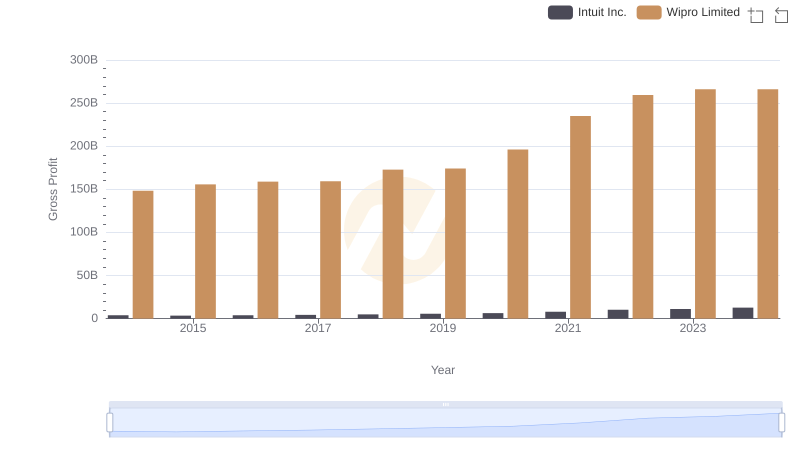

Gross Profit Trends Compared: Intuit Inc. vs Wipro Limited

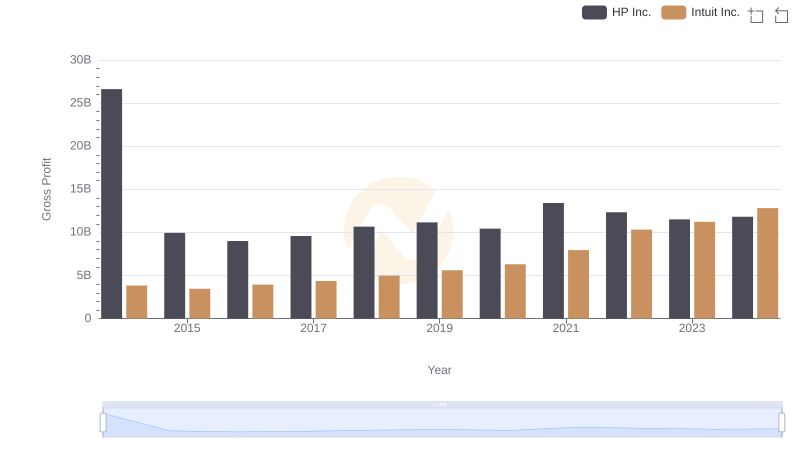

Gross Profit Comparison: Intuit Inc. and HP Inc. Trends

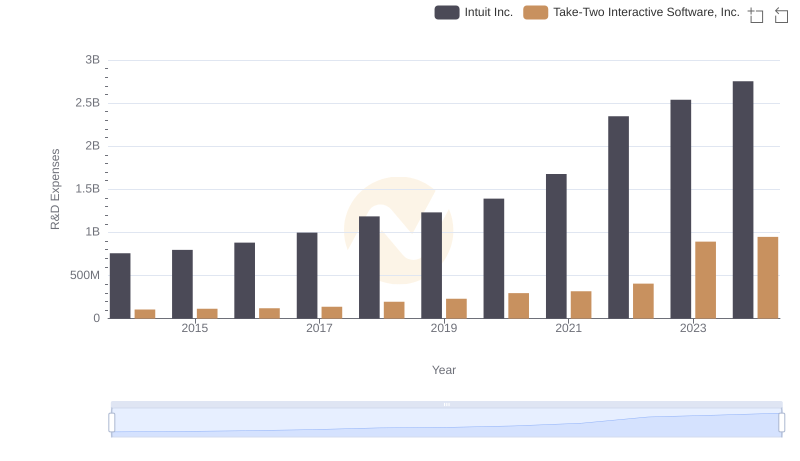

Analyzing R&D Budgets: Intuit Inc. vs Take-Two Interactive Software, Inc.

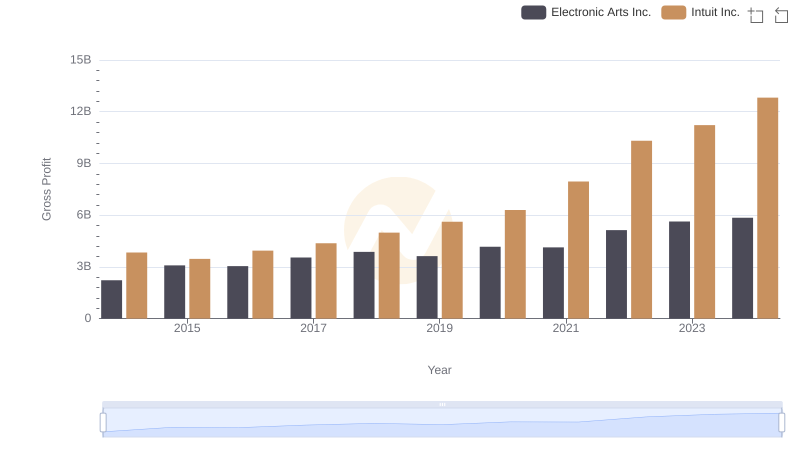

Who Generates Higher Gross Profit? Intuit Inc. or Electronic Arts Inc.

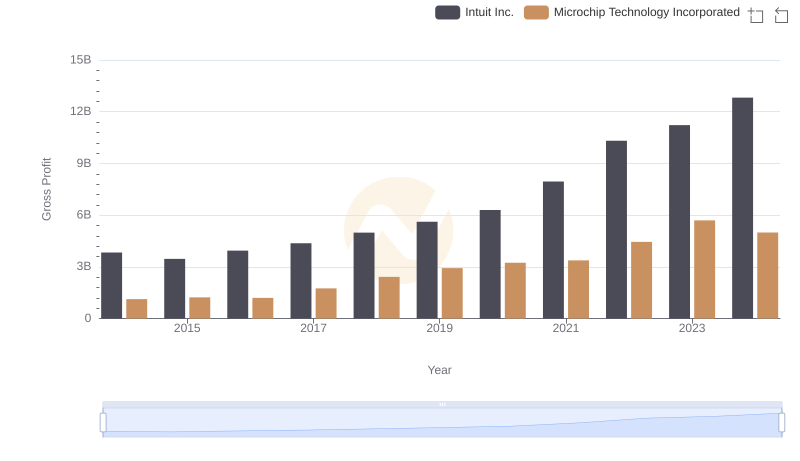

Gross Profit Analysis: Comparing Intuit Inc. and Microchip Technology Incorporated

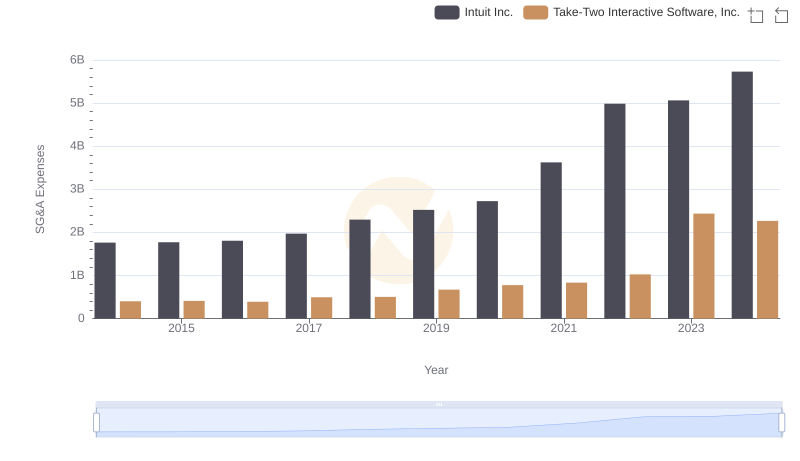

Comparing SG&A Expenses: Intuit Inc. vs Take-Two Interactive Software, Inc. Trends and Insights