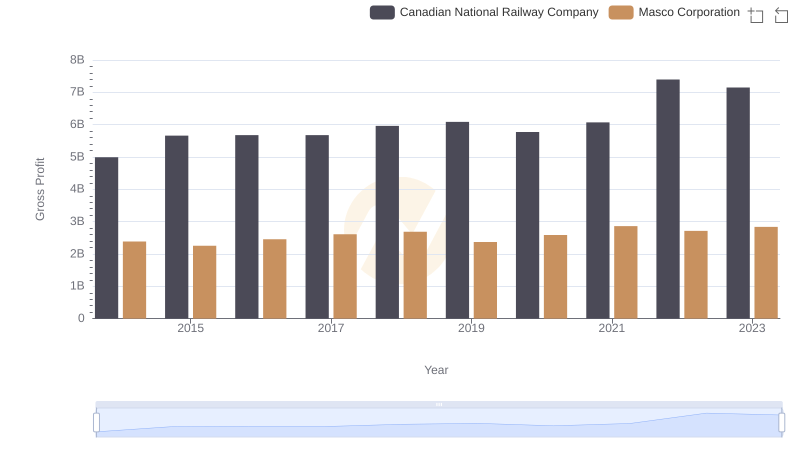

| __timestamp | Canadian National Railway Company | Snap-on Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 4992000000 | 1584300000 |

| Thursday, January 1, 2015 | 5660000000 | 1648300000 |

| Friday, January 1, 2016 | 5675000000 | 1709600000 |

| Sunday, January 1, 2017 | 5675000000 | 1824900000 |

| Monday, January 1, 2018 | 5962000000 | 1870000000 |

| Tuesday, January 1, 2019 | 6085000000 | 1844000000 |

| Wednesday, January 1, 2020 | 5771000000 | 1748500000 |

| Friday, January 1, 2021 | 6069000000 | 2110800000 |

| Saturday, January 1, 2022 | 7396000000 | 2181100000 |

| Sunday, January 1, 2023 | 7151000000 | 2619800000 |

| Monday, January 1, 2024 | 2377900000 |

Infusing magic into the data realm

In the ever-evolving landscape of North American industry, the Canadian National Railway Company and Snap-on Incorporated stand as titans in their respective fields. From 2014 to 2023, these companies have showcased remarkable growth in gross profit, reflecting their resilience and strategic prowess.

Canadian National Railway Company, a leader in the transportation sector, has seen its gross profit soar by approximately 43%, peaking in 2022. This growth underscores the company's ability to adapt and thrive amidst economic fluctuations. Meanwhile, Snap-on Incorporated, a stalwart in the manufacturing of tools and equipment, has experienced a robust 65% increase in gross profit over the same period, highlighting its innovative edge and market demand.

These trends not only illustrate the financial health of these companies but also offer insights into broader economic patterns, making them essential indicators for investors and industry analysts alike.

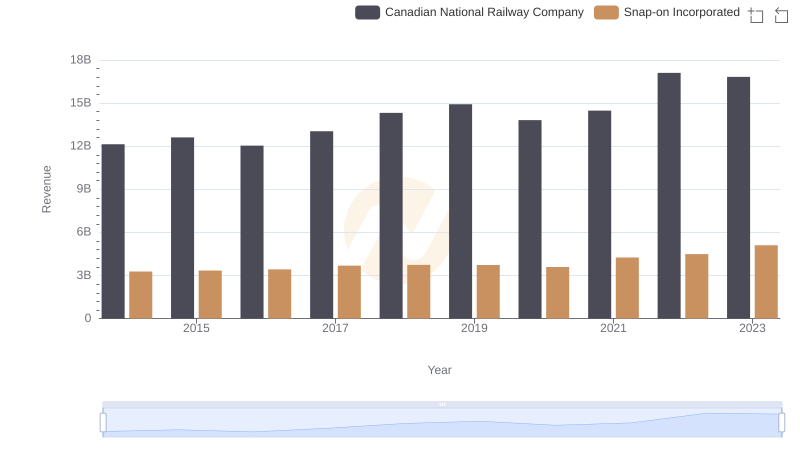

Who Generates More Revenue? Canadian National Railway Company or Snap-on Incorporated

Comparing Cost of Revenue Efficiency: Canadian National Railway Company vs Snap-on Incorporated

Canadian National Railway Company vs TransUnion: A Gross Profit Performance Breakdown

Gross Profit Analysis: Comparing Canadian National Railway Company and Masco Corporation

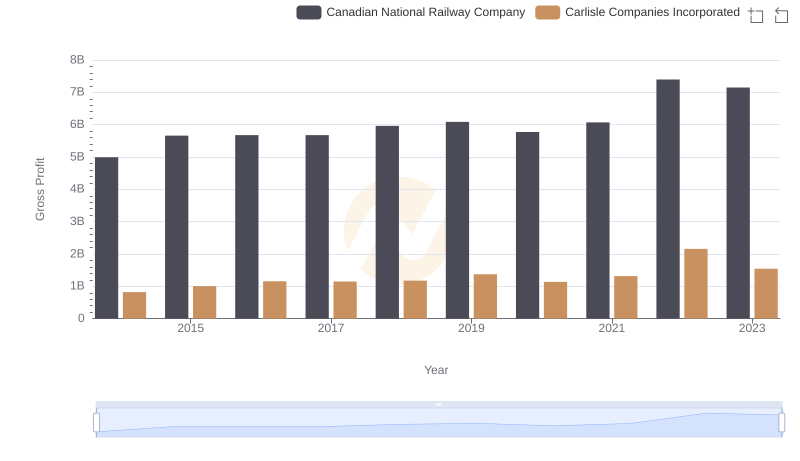

Gross Profit Analysis: Comparing Canadian National Railway Company and Carlisle Companies Incorporated

Gross Profit Comparison: Canadian National Railway Company and Stanley Black & Decker, Inc. Trends