| __timestamp | Canadian National Railway Company | Snap-on Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 12134000000 | 3277700000 |

| Thursday, January 1, 2015 | 12611000000 | 3352800000 |

| Friday, January 1, 2016 | 12037000000 | 3430400000 |

| Sunday, January 1, 2017 | 13041000000 | 3686900000 |

| Monday, January 1, 2018 | 14321000000 | 3740700000 |

| Tuesday, January 1, 2019 | 14917000000 | 3730000000 |

| Wednesday, January 1, 2020 | 13819000000 | 3592500000 |

| Friday, January 1, 2021 | 14477000000 | 4252000000 |

| Saturday, January 1, 2022 | 17107000000 | 4492800000 |

| Sunday, January 1, 2023 | 16828000000 | 5108300000 |

| Monday, January 1, 2024 | 4707400000 |

In pursuit of knowledge

In the dynamic world of business, revenue generation is a key indicator of a company's success. Over the past decade, Canadian National Railway Company (CNR) and Snap-on Incorporated have been pivotal players in their respective industries. From 2014 to 2023, CNR consistently outperformed Snap-on in revenue, with CNR's revenue peaking at approximately $17.1 billion in 2022, a 41% increase from 2014. In contrast, Snap-on's revenue grew by 56% over the same period, reaching around $5.1 billion in 2023. This growth trajectory highlights Snap-on's robust expansion strategy, despite CNR's larger revenue base. The data underscores the resilience and adaptability of these companies in navigating economic challenges and seizing market opportunities. As we look to the future, the competition between these two giants will undoubtedly continue to shape their industries.

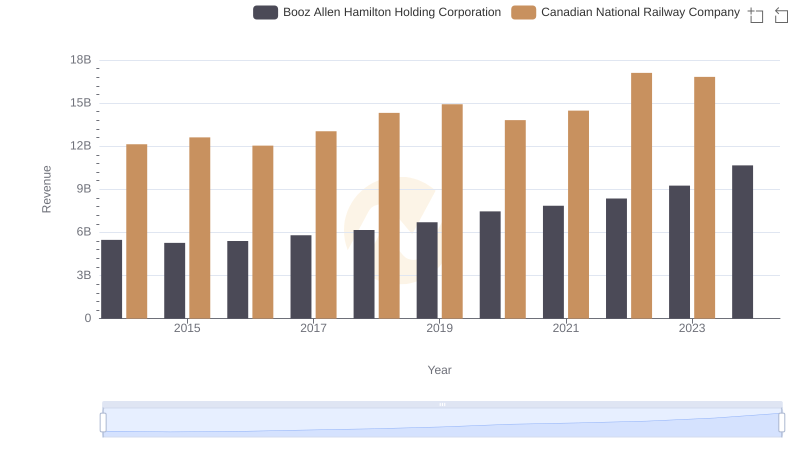

Revenue Showdown: Canadian National Railway Company vs Booz Allen Hamilton Holding Corporation

Revenue Showdown: Canadian National Railway Company vs Jacobs Engineering Group Inc.

Comparing Cost of Revenue Efficiency: Canadian National Railway Company vs Snap-on Incorporated

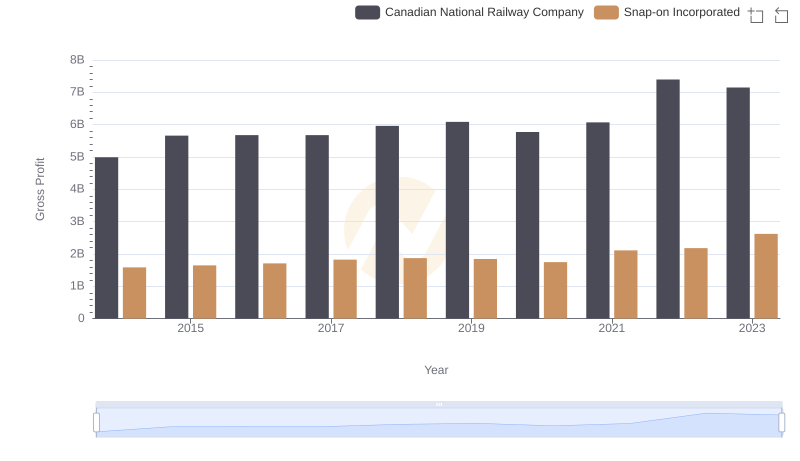

Gross Profit Trends Compared: Canadian National Railway Company vs Snap-on Incorporated