| __timestamp | Canadian National Railway Company | TransUnion |

|---|---|---|

| Wednesday, January 1, 2014 | 4992000000 | 805600000 |

| Thursday, January 1, 2015 | 5660000000 | 975200000 |

| Friday, January 1, 2016 | 5675000000 | 1125800000 |

| Sunday, January 1, 2017 | 5675000000 | 1288100000 |

| Monday, January 1, 2018 | 5962000000 | 1527100000 |

| Tuesday, January 1, 2019 | 6085000000 | 1782000000 |

| Wednesday, January 1, 2020 | 5771000000 | 1796200000 |

| Friday, January 1, 2021 | 6069000000 | 1968600000 |

| Saturday, January 1, 2022 | 7396000000 | 2487000000 |

| Sunday, January 1, 2023 | 7151000000 | 2313900000 |

| Monday, January 1, 2024 | 4183800000 |

Cracking the code

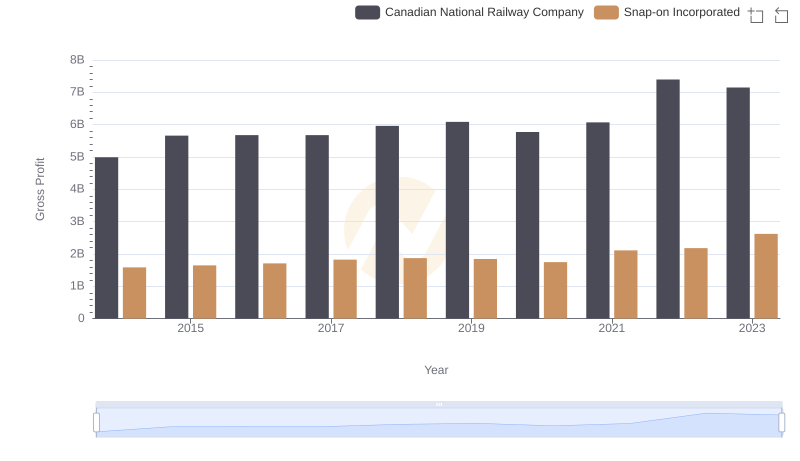

In the ever-evolving landscape of North American business, the Canadian National Railway Company (CNR) and TransUnion have showcased distinct trajectories in gross profit over the past decade. From 2014 to 2023, CNR consistently outperformed TransUnion, with its gross profit peaking at approximately $7.4 billion in 2022, marking a 48% increase from 2014. Meanwhile, TransUnion's growth, though more modest, saw a significant 209% rise, reaching around $2.5 billion in the same year.

This performance highlights CNR's robust position in the transportation sector, benefiting from its expansive rail network across Canada and the U.S. In contrast, TransUnion's steady climb reflects its strategic expansion in the credit reporting industry. As we look to the future, these trends underscore the resilience and adaptability of these industry giants in navigating economic shifts.

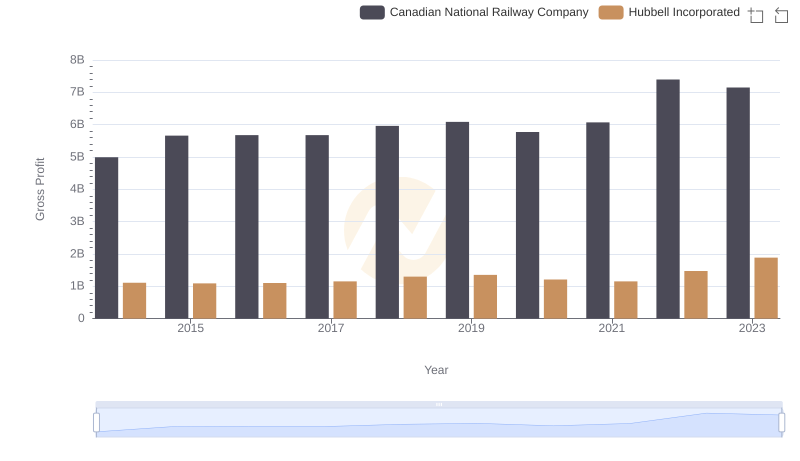

Who Generates Higher Gross Profit? Canadian National Railway Company or Hubbell Incorporated

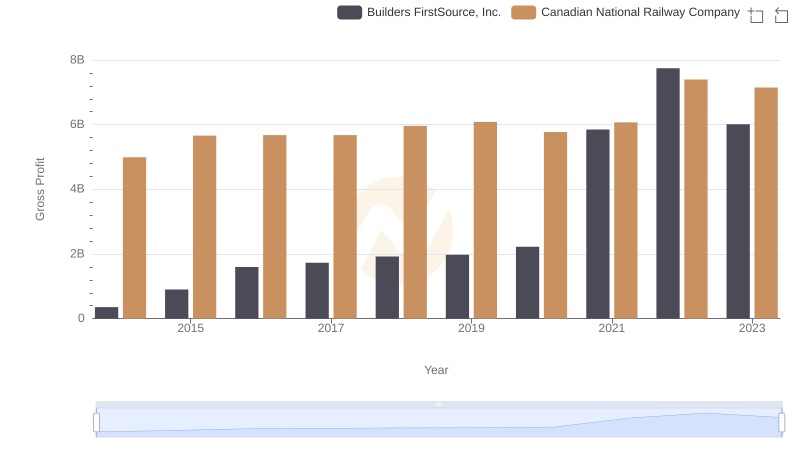

Who Generates Higher Gross Profit? Canadian National Railway Company or Builders FirstSource, Inc.

Canadian National Railway Company vs Watsco, Inc.: A Gross Profit Performance Breakdown

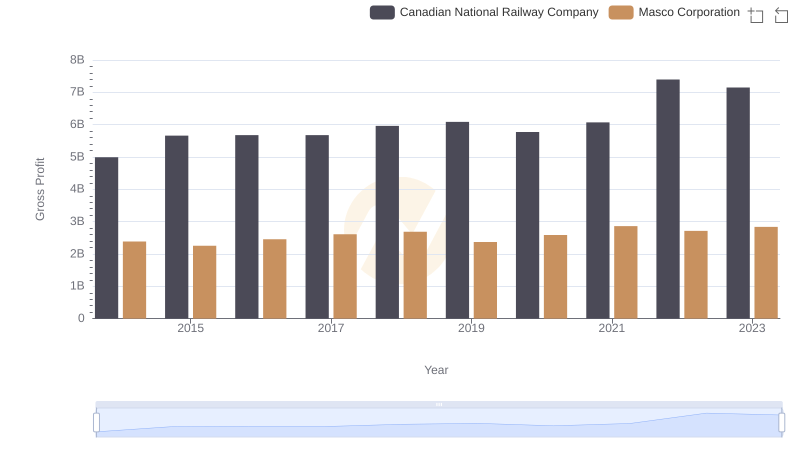

Gross Profit Analysis: Comparing Canadian National Railway Company and Masco Corporation

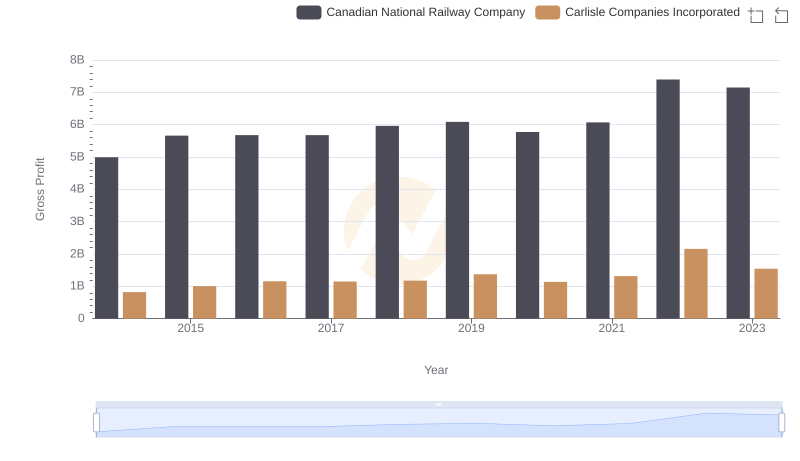

Gross Profit Analysis: Comparing Canadian National Railway Company and Carlisle Companies Incorporated

Gross Profit Comparison: Canadian National Railway Company and Stanley Black & Decker, Inc. Trends

Gross Profit Trends Compared: Canadian National Railway Company vs Snap-on Incorporated